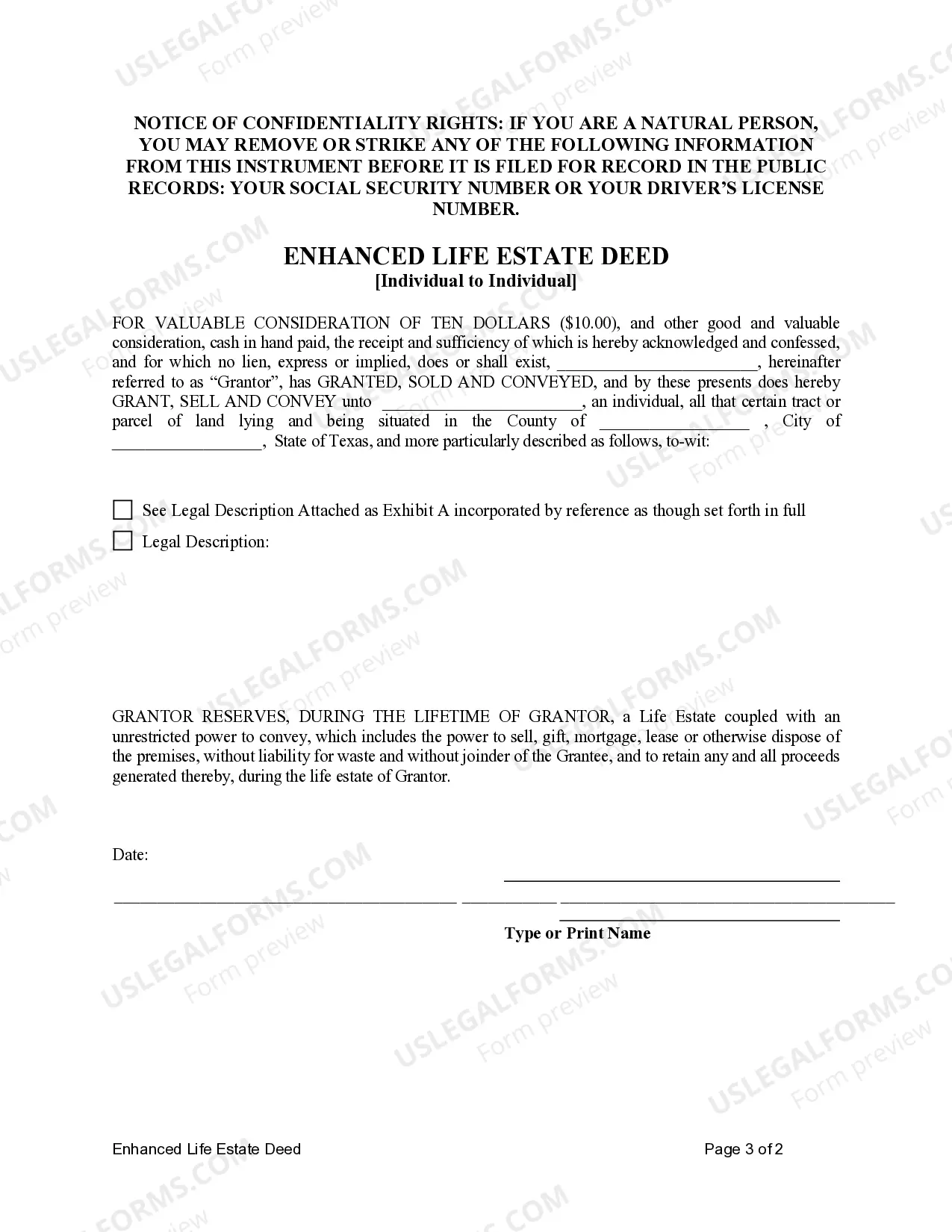

This form is an Enhanced Life Estate Deed, also known as a Lady Bird Deed, where the Grantor is an Individual and the Grantee is an Individual. Grantor conveys and warrants the described property to the Grantee subject to a reserved enhanced life estate in Grantor. Further, the Grantor reserves the right to mortgage, sell, burden, and otherwise use the property and retain all profits without interference from Grantee during the course of the life estate. This deed complies with all state statutory laws.

The Bexar Texas Enhanced Life Estate Deed, commonly known as Lady Bird Deed, is a specialized type of property transfer document that allows an individual (granter) to retain control of their property during their lifetime while designating a beneficiary (grantee) who will inherit the property automatically upon the granter's death, avoiding the need for probate. This unique estate planning tool provides several advantages for individuals in Bexar County, Texas, and has gained popularity due to its flexibility and benefits. Here is a detailed description of the Bexar Texas Enhanced Life Estate Deed Vladimirir— - Individual to Individual, along with some related types: 1. Bexar Texas Enhanced Life Estate Deed Vladimirir— - Individual to Individual: This type of Lady Bird Deed is executed between an individual property owner and another individual who will become the beneficiary. It allows the granter to retain full control and ownership of the property during their lifetime, including the ability to sell, mortgage, or even revoke the deed. The granter can also make changes to the beneficiary designation at any time without the beneficiary's consent. Key features and benefits of Bexar Texas Enhanced Life Estate Deed Vladimirir— - Individual to Individual— - The granter retains the right to live in or use the property, receive income generated by it, or even sell it during their lifetime. — The property automatically passes to the beneficiary upon the granter's death, bypassing the need for probate. — It provides a seamless transfer of property without the expenses and delays associated with probate court. — The beneficiary receives a stepped-up tax basis, potentially reducing capital gains taxes if they choose to sell the property. 2. Bexar Texas Enhanced Life Estate Deed Vladimirir— - Joint Tenancy with the Right of Survivorship: This variation of the Lady Bird Deed is executed between co-owners or spouses. It creates a joint tenancy with the right of survivorship, where each owner has an equal share of the property. Upon the death of one owner, their share automatically passes to the surviving owner(s) outside of probate. 3. Bexar Texas Enhanced Life Estate Deed Vladimirir— - Individual to Trust: In this scenario, the granter transfers the property to a trust instead of an individual beneficiary. The granter retains control over the property during their lifetime as the trustee, and upon their death, the trust-owned property is distributed to the trust beneficiaries without probate. Overall, the Bexar Texas Enhanced Life Estate Deed Vladimirir— - Individual to Individual is a powerful tool that allows property owners in Bexar County, Texas, to efficiently transfer property while maintaining control during their lifetime. Seeking legal advice when considering this type of deed is crucial to ensure compliance with state laws and to better understand its implications on estate planning.The Bexar Texas Enhanced Life Estate Deed, commonly known as Lady Bird Deed, is a specialized type of property transfer document that allows an individual (granter) to retain control of their property during their lifetime while designating a beneficiary (grantee) who will inherit the property automatically upon the granter's death, avoiding the need for probate. This unique estate planning tool provides several advantages for individuals in Bexar County, Texas, and has gained popularity due to its flexibility and benefits. Here is a detailed description of the Bexar Texas Enhanced Life Estate Deed Vladimirir— - Individual to Individual, along with some related types: 1. Bexar Texas Enhanced Life Estate Deed Vladimirir— - Individual to Individual: This type of Lady Bird Deed is executed between an individual property owner and another individual who will become the beneficiary. It allows the granter to retain full control and ownership of the property during their lifetime, including the ability to sell, mortgage, or even revoke the deed. The granter can also make changes to the beneficiary designation at any time without the beneficiary's consent. Key features and benefits of Bexar Texas Enhanced Life Estate Deed Vladimirir— - Individual to Individual— - The granter retains the right to live in or use the property, receive income generated by it, or even sell it during their lifetime. — The property automatically passes to the beneficiary upon the granter's death, bypassing the need for probate. — It provides a seamless transfer of property without the expenses and delays associated with probate court. — The beneficiary receives a stepped-up tax basis, potentially reducing capital gains taxes if they choose to sell the property. 2. Bexar Texas Enhanced Life Estate Deed Vladimirir— - Joint Tenancy with the Right of Survivorship: This variation of the Lady Bird Deed is executed between co-owners or spouses. It creates a joint tenancy with the right of survivorship, where each owner has an equal share of the property. Upon the death of one owner, their share automatically passes to the surviving owner(s) outside of probate. 3. Bexar Texas Enhanced Life Estate Deed Vladimirir— - Individual to Trust: In this scenario, the granter transfers the property to a trust instead of an individual beneficiary. The granter retains control over the property during their lifetime as the trustee, and upon their death, the trust-owned property is distributed to the trust beneficiaries without probate. Overall, the Bexar Texas Enhanced Life Estate Deed Vladimirir— - Individual to Individual is a powerful tool that allows property owners in Bexar County, Texas, to efficiently transfer property while maintaining control during their lifetime. Seeking legal advice when considering this type of deed is crucial to ensure compliance with state laws and to better understand its implications on estate planning.