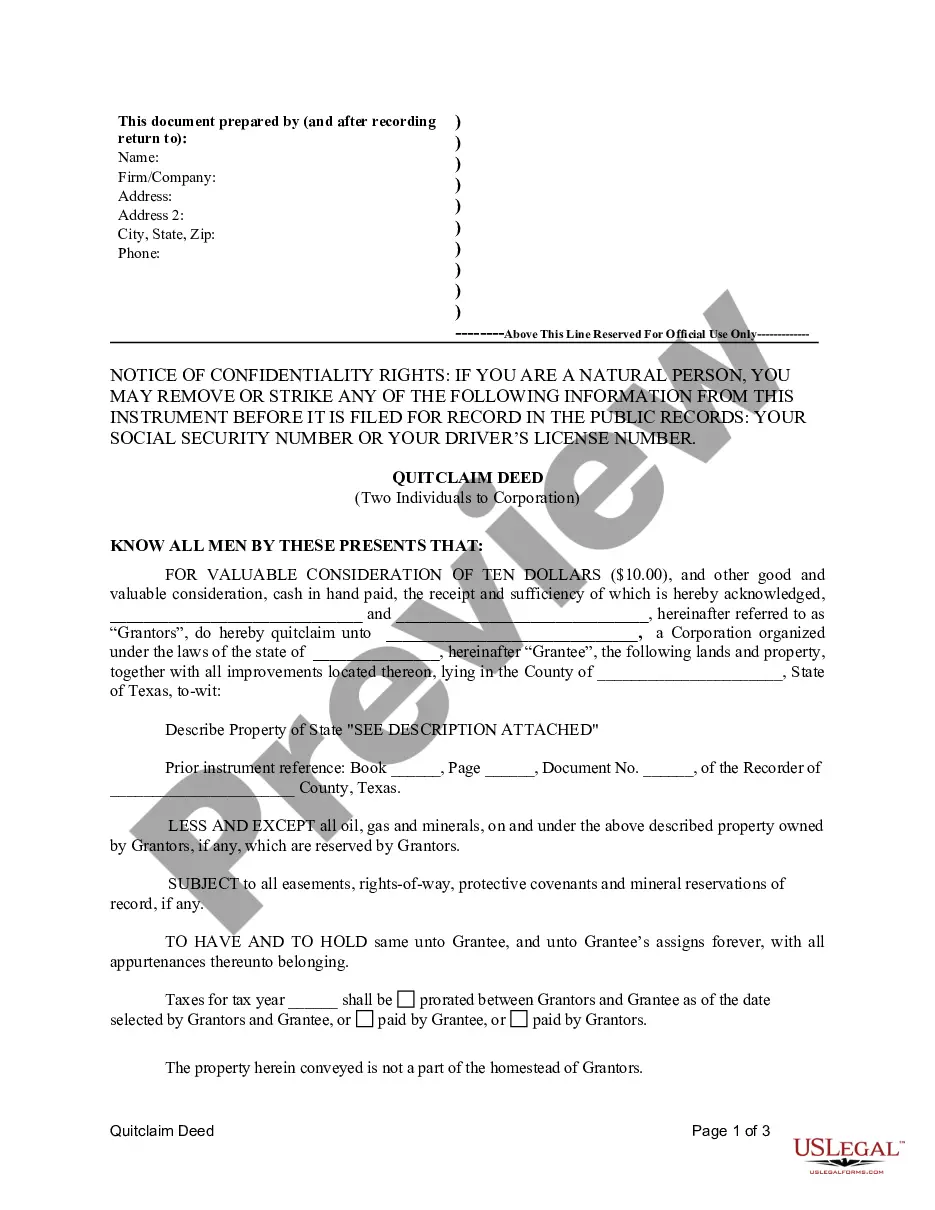

This Quitclaim Deed by Two Individuals to Corporation form is a Quitclaim Deed where the Grantors are two individuals and the Grantee is a corporation. Grantors convey quitclaim the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Fort Worth Texas Quitclaim Deed by Two Individuals to Corporation is a legal document that transfers the ownership of a property from two individuals to a corporation using a quitclaim deed method. This type of deed is commonly used when the two individuals want to transfer the ownership rights of the property to a corporation in which they have interests. The quitclaim deed is a legal instrument used to transfer the interest or claim of the individuals (known as granters) in the property to the corporation (known as the grantee) without any warranties or guarantees regarding the property's title. This means that the granters do not guarantee that they have clear ownership, and they are simply transferring whatever rights they have in the property to the corporation. The Fort Worth Texas Quitclaim Deed by Two Individuals to Corporation typically contains specific information, including the names and addresses of the granters and the corporation, a legal description of the property being transferred, and any relevant restrictions or encumbrances on the property. It may also include a statement of consideration, stating whether money or some other form of payment has been exchanged for the transfer of the property. There may be different types of Fort Worth Texas Quitclaim Deed by Two Individuals to Corporation, based on the specific circumstances or agreements between the granters and the corporation. Some variations to consider may include: 1. Voluntary Transfer: This type of quitclaim deed is executed willingly by the two individuals, without any outside pressure or legal obligation. It is a straightforward transfer of ownership rights to the corporation. 2. Divorce Settlement: In cases of divorce or separation, a quitclaim deed may be used to transfer one spouse's interest in a property to a corporation that might be held jointly by the other spouse or to settle financial obligations. 3. Estate Planning: In scenarios where individuals wish to transfer real estate assets to a corporation for estate planning purposes, a Fort Worth Texas Quitclaim Deed by Two Individuals to Corporation can be used. The transfer can help with asset protection, tax planning, or transitioning ownership to the next generation. It is important to note that while a quitclaim deed transfers the granters' interest in the property, it does not guarantee the property's title or provide any warranties. Therefore, it is advisable for all parties involved to seek legal counsel and conduct a thorough title search before executing a quitclaim deed. This will help ensure a smooth transfer of ownership and protect the interests of all parties involved.A Fort Worth Texas Quitclaim Deed by Two Individuals to Corporation is a legal document that transfers the ownership of a property from two individuals to a corporation using a quitclaim deed method. This type of deed is commonly used when the two individuals want to transfer the ownership rights of the property to a corporation in which they have interests. The quitclaim deed is a legal instrument used to transfer the interest or claim of the individuals (known as granters) in the property to the corporation (known as the grantee) without any warranties or guarantees regarding the property's title. This means that the granters do not guarantee that they have clear ownership, and they are simply transferring whatever rights they have in the property to the corporation. The Fort Worth Texas Quitclaim Deed by Two Individuals to Corporation typically contains specific information, including the names and addresses of the granters and the corporation, a legal description of the property being transferred, and any relevant restrictions or encumbrances on the property. It may also include a statement of consideration, stating whether money or some other form of payment has been exchanged for the transfer of the property. There may be different types of Fort Worth Texas Quitclaim Deed by Two Individuals to Corporation, based on the specific circumstances or agreements between the granters and the corporation. Some variations to consider may include: 1. Voluntary Transfer: This type of quitclaim deed is executed willingly by the two individuals, without any outside pressure or legal obligation. It is a straightforward transfer of ownership rights to the corporation. 2. Divorce Settlement: In cases of divorce or separation, a quitclaim deed may be used to transfer one spouse's interest in a property to a corporation that might be held jointly by the other spouse or to settle financial obligations. 3. Estate Planning: In scenarios where individuals wish to transfer real estate assets to a corporation for estate planning purposes, a Fort Worth Texas Quitclaim Deed by Two Individuals to Corporation can be used. The transfer can help with asset protection, tax planning, or transitioning ownership to the next generation. It is important to note that while a quitclaim deed transfers the granters' interest in the property, it does not guarantee the property's title or provide any warranties. Therefore, it is advisable for all parties involved to seek legal counsel and conduct a thorough title search before executing a quitclaim deed. This will help ensure a smooth transfer of ownership and protect the interests of all parties involved.