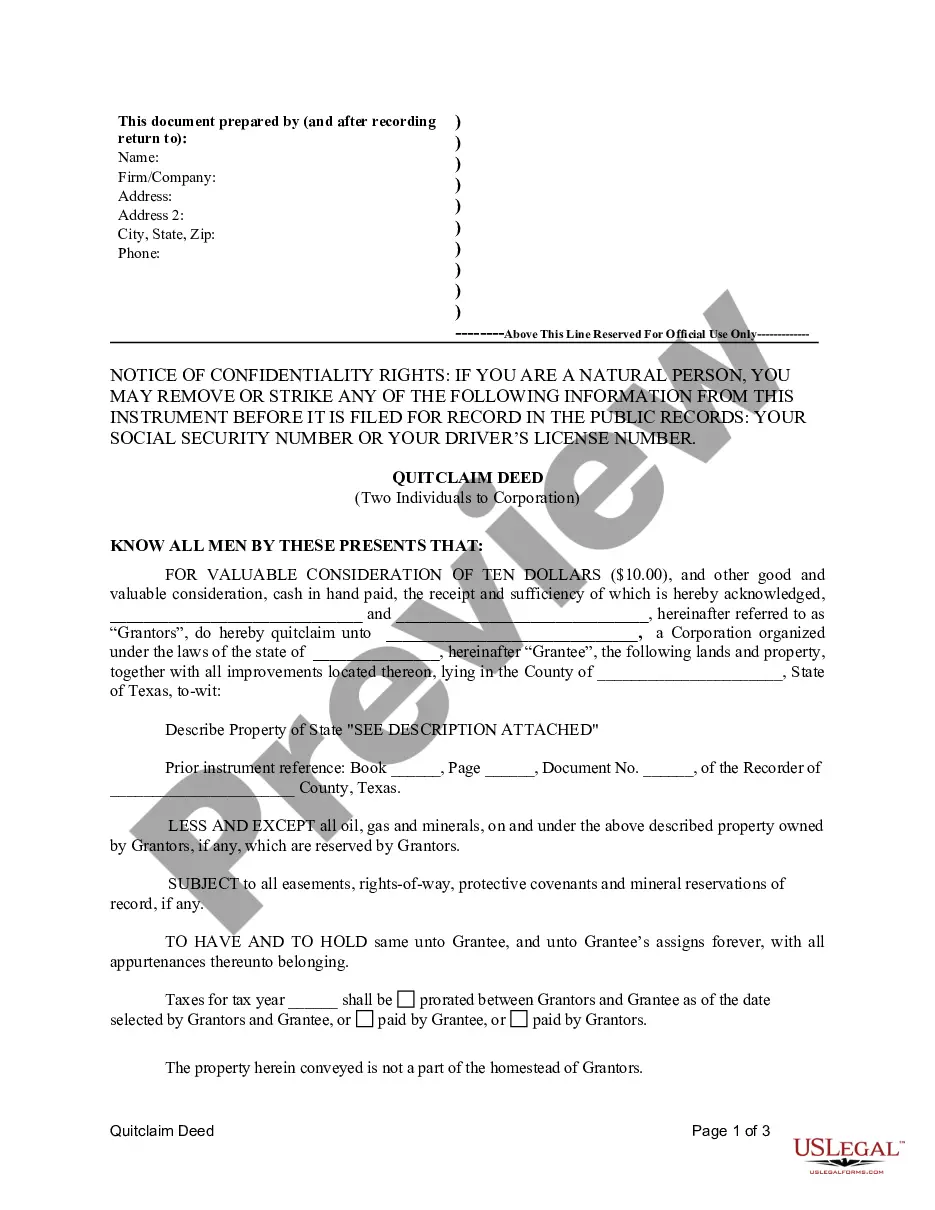

This Quitclaim Deed by Two Individuals to Corporation form is a Quitclaim Deed where the Grantors are two individuals and the Grantee is a corporation. Grantors convey quitclaim the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Killeen Texas Quitclaim Deed by Two Individuals to Corporation is a legally binding document that transfers ownership of real estate property from two individuals to a corporation. This type of deed is commonly used when individuals decide to transfer their property to a corporation for various reasons, such as asset protection, tax benefits, or business operations. The Killeen Texas Quitclaim Deed by Two Individuals to Corporation enables seamless and transparent property transfers while protecting the interests of all parties involved. This document outlines the details of the transfer, including the names of the two individuals transferring the property, the corporation's name, and the property's legal description. By executing a quitclaim deed, the two individuals are essentially relinquishing their ownership rights, if any, on the property and transferring them to the corporation. However, it's important to note that a quitclaim deed does not guarantee that the transferring individuals have full ownership or that the property is free from any liens or encumbrances. Therefore, it is vital for both parties involved to conduct thorough due diligence and legal research. Different types of Killeen Texas Quitclaim Deed by Two Individuals to Corporation can include: 1. General Killeen Texas Quitclaim Deed by Two Individuals to Corporation: This is the most common type of quitclaim deed, which transfers ownership of the property to the corporation without any specific conditions or limitations. 2. Special Killeen Texas Quitclaim Deed by Two Individuals to Corporation: This type of quitclaim deed includes specific conditions or limitations on the transfer, such as restrictions on the use of the property or certain rights reserved by the individuals transferring the property. 3. Tax-Free Killeen Texas Quitclaim Deed by Two Individuals to Corporation: This type of quitclaim deed is often used for tax planning purposes, allowing the individuals to transfer the property to the corporation without triggering tax consequences. In certain cases, this can be achieved by meeting specific requirements and qualifications. It is crucial to consult with a qualified attorney or real estate professional to ensure that the Killeen Texas Quitclaim Deed by Two Individuals to Corporation complies with all applicable laws and regulations, protects the interests of all parties involved, and accurately reflects the transfer of ownership. This will help prevent any issues or disputes in the future and provide a smooth transition of property ownership from individuals to the corporation.A Killeen Texas Quitclaim Deed by Two Individuals to Corporation is a legally binding document that transfers ownership of real estate property from two individuals to a corporation. This type of deed is commonly used when individuals decide to transfer their property to a corporation for various reasons, such as asset protection, tax benefits, or business operations. The Killeen Texas Quitclaim Deed by Two Individuals to Corporation enables seamless and transparent property transfers while protecting the interests of all parties involved. This document outlines the details of the transfer, including the names of the two individuals transferring the property, the corporation's name, and the property's legal description. By executing a quitclaim deed, the two individuals are essentially relinquishing their ownership rights, if any, on the property and transferring them to the corporation. However, it's important to note that a quitclaim deed does not guarantee that the transferring individuals have full ownership or that the property is free from any liens or encumbrances. Therefore, it is vital for both parties involved to conduct thorough due diligence and legal research. Different types of Killeen Texas Quitclaim Deed by Two Individuals to Corporation can include: 1. General Killeen Texas Quitclaim Deed by Two Individuals to Corporation: This is the most common type of quitclaim deed, which transfers ownership of the property to the corporation without any specific conditions or limitations. 2. Special Killeen Texas Quitclaim Deed by Two Individuals to Corporation: This type of quitclaim deed includes specific conditions or limitations on the transfer, such as restrictions on the use of the property or certain rights reserved by the individuals transferring the property. 3. Tax-Free Killeen Texas Quitclaim Deed by Two Individuals to Corporation: This type of quitclaim deed is often used for tax planning purposes, allowing the individuals to transfer the property to the corporation without triggering tax consequences. In certain cases, this can be achieved by meeting specific requirements and qualifications. It is crucial to consult with a qualified attorney or real estate professional to ensure that the Killeen Texas Quitclaim Deed by Two Individuals to Corporation complies with all applicable laws and regulations, protects the interests of all parties involved, and accurately reflects the transfer of ownership. This will help prevent any issues or disputes in the future and provide a smooth transition of property ownership from individuals to the corporation.