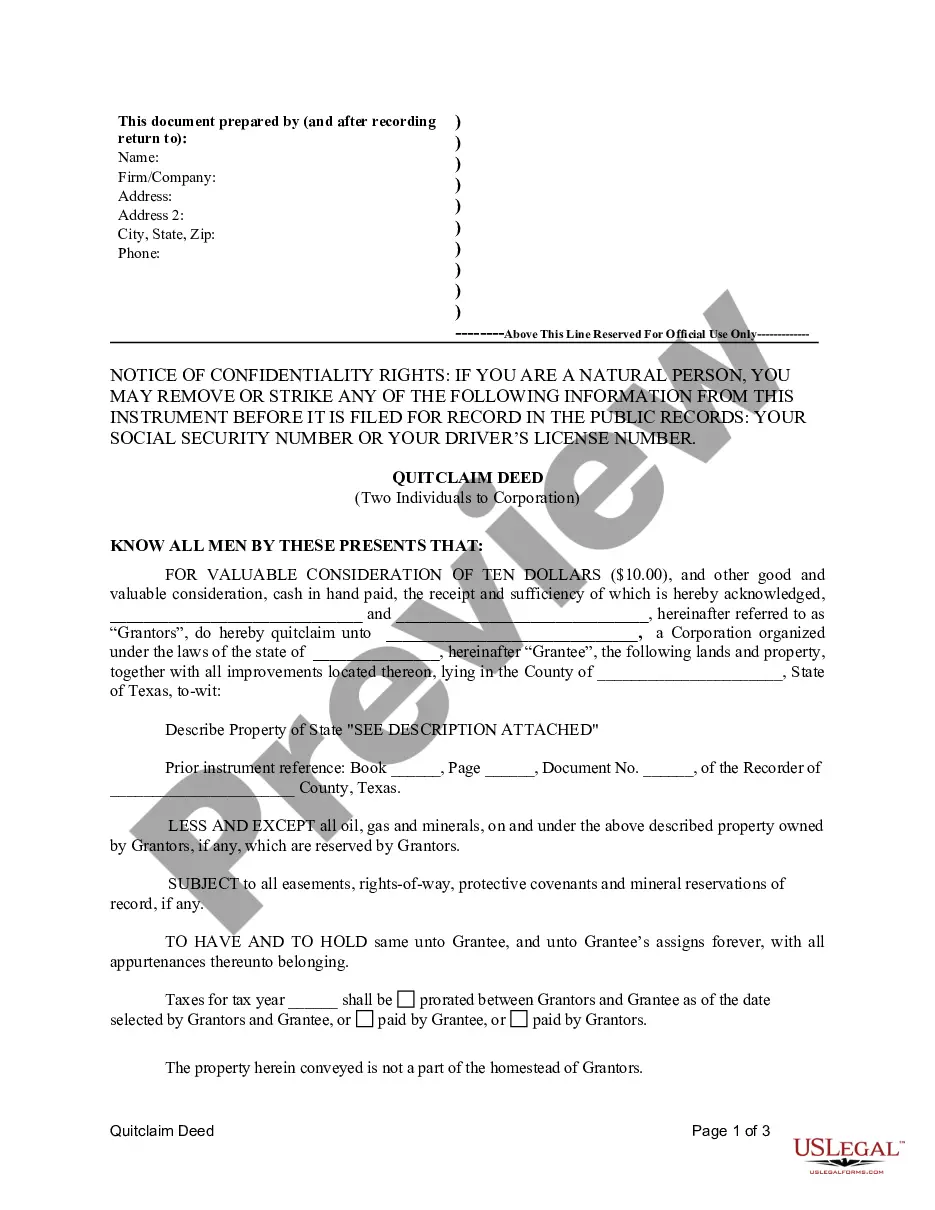

This Quitclaim Deed by Two Individuals to Corporation form is a Quitclaim Deed where the Grantors are two individuals and the Grantee is a corporation. Grantors convey quitclaim the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Round Rock Texas Quitclaim Deed by Two Individuals to Corporation is a legal document that transfers ownership of a property from two individuals to a corporation using a quitclaim deed method. This type of transaction can occur for various reasons, such as when two individuals decide to sell or donate a property they co-own to a corporation they have established. The Round Rock Texas Quitclaim Deed by Two Individuals to Corporation serves as a legally binding contract that facilitates the transfer of ownership rights and interests in a property. It guarantees that the two individuals, known as granters or sellers, fully relinquish their rights to the property and transfer them to the corporation, referred to as the grantee or buyer. One common scenario where a Round Rock Texas Quitclaim Deed by Two Individuals to Corporation is utilized is when business partners or co-founders of a corporation want to transfer a property they jointly own to the corporate entity. This ensures that the property becomes an asset of the corporation, providing certain benefits and protections, such as liability protection and the ability to use the property for business purposes. It's important to note that there can be variations of Round Rock Texas Quitclaim Deed by Two Individuals to Corporation, depending on the specific circumstances and intentions of the involved parties. For example, if the corporation is being newly formed solely for the purpose of acquiring the property, it may be referred to as a "Newly Formed Round Rock Texas Quitclaim Deed by Two Individuals to Corporation." This type of deed emphasizes that the property is being transferred to a new entity specifically created for this purpose. Another possible variation could include the addition of specific conditions or restrictions to the transfer. In such cases, the deed might be referred to as a "Round Rock Texas Quitclaim Deed by Two Individuals to Corporation with Conditions" or "Round Rock Texas Quitclaim Deed by Two Individuals to Corporation with Restrictions." These conditions or restrictions can range from ensuring the property is used for specific purposes, defining rights of use, or establishing any limitations imposed on the corporation regarding the property. In conclusion, a Round Rock Texas Quitclaim Deed by Two Individuals to Corporation is a legal instrument used for the transfer of property ownership from two individuals to a corporation. This type of deed can have variations depending on the circumstances, such as a newly formed corporation or the inclusion of specific conditions or restrictions. It is crucial to undertake such transactions with the guidance of legal professionals to ensure accuracy and compliance with relevant laws and regulations.A Round Rock Texas Quitclaim Deed by Two Individuals to Corporation is a legal document that transfers ownership of a property from two individuals to a corporation using a quitclaim deed method. This type of transaction can occur for various reasons, such as when two individuals decide to sell or donate a property they co-own to a corporation they have established. The Round Rock Texas Quitclaim Deed by Two Individuals to Corporation serves as a legally binding contract that facilitates the transfer of ownership rights and interests in a property. It guarantees that the two individuals, known as granters or sellers, fully relinquish their rights to the property and transfer them to the corporation, referred to as the grantee or buyer. One common scenario where a Round Rock Texas Quitclaim Deed by Two Individuals to Corporation is utilized is when business partners or co-founders of a corporation want to transfer a property they jointly own to the corporate entity. This ensures that the property becomes an asset of the corporation, providing certain benefits and protections, such as liability protection and the ability to use the property for business purposes. It's important to note that there can be variations of Round Rock Texas Quitclaim Deed by Two Individuals to Corporation, depending on the specific circumstances and intentions of the involved parties. For example, if the corporation is being newly formed solely for the purpose of acquiring the property, it may be referred to as a "Newly Formed Round Rock Texas Quitclaim Deed by Two Individuals to Corporation." This type of deed emphasizes that the property is being transferred to a new entity specifically created for this purpose. Another possible variation could include the addition of specific conditions or restrictions to the transfer. In such cases, the deed might be referred to as a "Round Rock Texas Quitclaim Deed by Two Individuals to Corporation with Conditions" or "Round Rock Texas Quitclaim Deed by Two Individuals to Corporation with Restrictions." These conditions or restrictions can range from ensuring the property is used for specific purposes, defining rights of use, or establishing any limitations imposed on the corporation regarding the property. In conclusion, a Round Rock Texas Quitclaim Deed by Two Individuals to Corporation is a legal instrument used for the transfer of property ownership from two individuals to a corporation. This type of deed can have variations depending on the circumstances, such as a newly formed corporation or the inclusion of specific conditions or restrictions. It is crucial to undertake such transactions with the guidance of legal professionals to ensure accuracy and compliance with relevant laws and regulations.