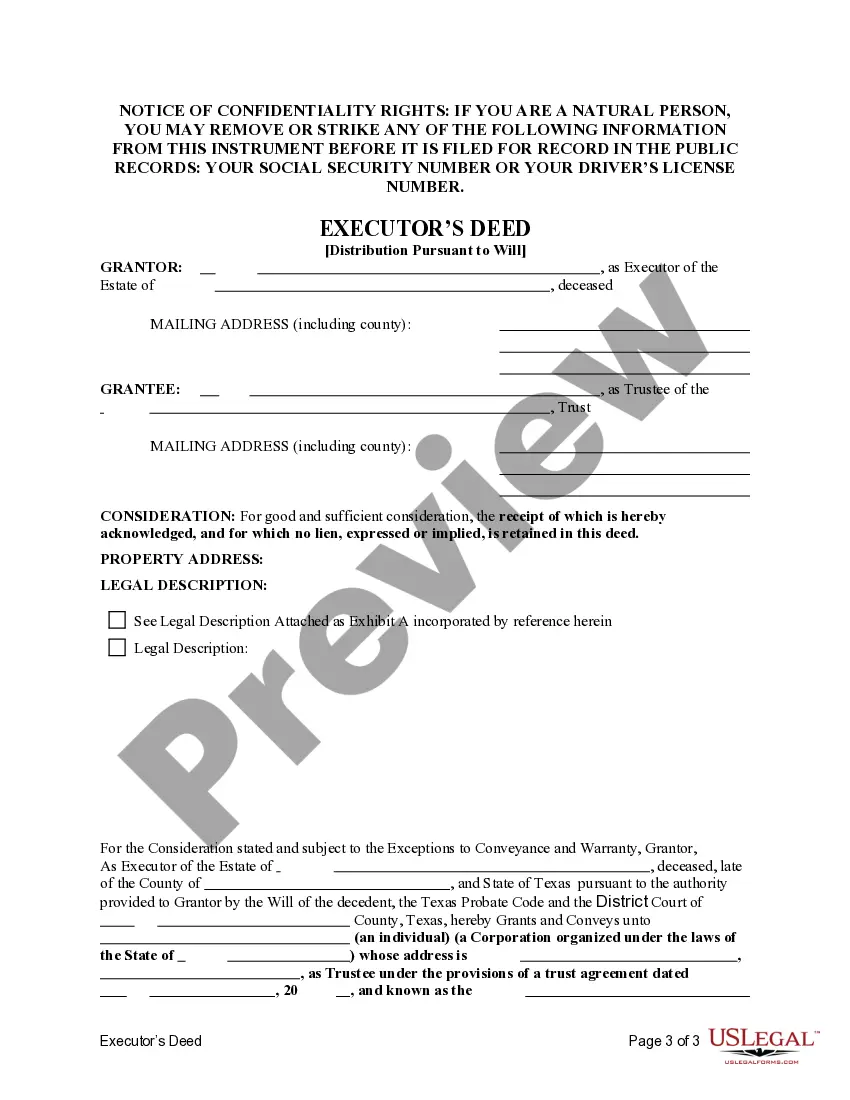

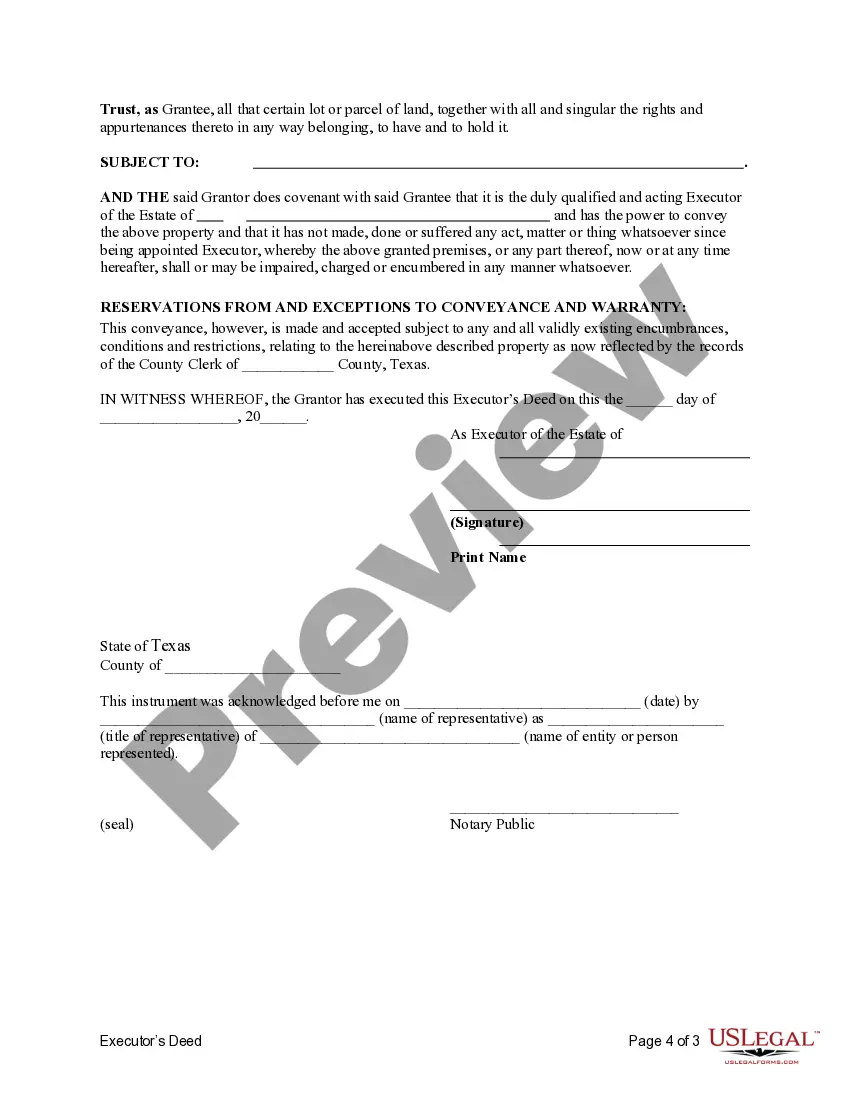

This form is an Executor's Deed where the Grantor is the executor of an estate and the Grantee is a Trust disgnated by will to receive the property. Grantor conveys and grants the described property to the Grantee. The Grantor warrants the title only as to events and acts while the property is held by the Executor. This deed complies with all state statutory laws.

A McKinney Texas Executor's Deed of Distribution to a Trust is a legal document that allows the executor of an estate in McKinney, Texas, to transfer assets from the estate to a trust. This type of deed is often used when the deceased person had established a trust during their lifetime, and the assets need to be distributed according to the terms of that trust. There are different types of McKinney Texas Executor's Deed of Distribution to a Trust, depending on the specific circumstances and requirements of the estate. Some common types include: 1. Testamentary Trust Executor's Deed: This type of deed is used when the trust was established in the decedent's will. The executor follows the instructions outlined in the will to distribute assets to the trust beneficiaries. 2. Revocable Living Trust Executor's Deed: This type of deed is utilized when the decedent created a revocable living trust during their lifetime. The executor transfers assets from the estate to the trust, ensuring they are managed and distributed according to the trust's provisions. 3. Irrevocable Trust Executor's Deed: In cases where the decedent established an irrevocable trust, the executor uses this type of deed to transfer assets to the trust beneficiaries. Unlike revocable trusts, the terms of an irrevocable trust cannot be modified or revoked after the granter's death. The process of executing a Deed of Distribution to a Trust involves careful adherence to legal requirements and the specific provisions of the trust document. The executor should obtain the necessary legal advice and, if needed, seek court approval before transferring assets to the trust. To initiate the process, the executor will typically gather the required documentation, such as the death certificate, will, trust agreement, and any other relevant estate planning documents. They will then collaborate with an attorney experienced in estate administration and trust matters to draft the Executor's Deed of Distribution to a Trust. Once the deed is prepared, it needs to be executed, signed, and notarized by the executor. The deed should specify the property or assets being transferred, the named beneficiaries of the trust, and any applicable conditions or restrictions. After executing the deed, the executor must file it with the appropriate county clerk's office in McKinney, Texas, alongside other required probate documents. This filing ensures the transfer of ownership is legally recognized and protects the rights of the beneficiaries. In summary, a McKinney Texas Executor's Deed of Distribution to a Trust is a crucial legal instrument used by executors to transfer assets from an estate to a trust according to the terms outlined by the decedent. It helps streamline the distribution process and ensures that the deceased person's wishes are followed while protecting the rights and interests of the trust beneficiaries.A McKinney Texas Executor's Deed of Distribution to a Trust is a legal document that allows the executor of an estate in McKinney, Texas, to transfer assets from the estate to a trust. This type of deed is often used when the deceased person had established a trust during their lifetime, and the assets need to be distributed according to the terms of that trust. There are different types of McKinney Texas Executor's Deed of Distribution to a Trust, depending on the specific circumstances and requirements of the estate. Some common types include: 1. Testamentary Trust Executor's Deed: This type of deed is used when the trust was established in the decedent's will. The executor follows the instructions outlined in the will to distribute assets to the trust beneficiaries. 2. Revocable Living Trust Executor's Deed: This type of deed is utilized when the decedent created a revocable living trust during their lifetime. The executor transfers assets from the estate to the trust, ensuring they are managed and distributed according to the trust's provisions. 3. Irrevocable Trust Executor's Deed: In cases where the decedent established an irrevocable trust, the executor uses this type of deed to transfer assets to the trust beneficiaries. Unlike revocable trusts, the terms of an irrevocable trust cannot be modified or revoked after the granter's death. The process of executing a Deed of Distribution to a Trust involves careful adherence to legal requirements and the specific provisions of the trust document. The executor should obtain the necessary legal advice and, if needed, seek court approval before transferring assets to the trust. To initiate the process, the executor will typically gather the required documentation, such as the death certificate, will, trust agreement, and any other relevant estate planning documents. They will then collaborate with an attorney experienced in estate administration and trust matters to draft the Executor's Deed of Distribution to a Trust. Once the deed is prepared, it needs to be executed, signed, and notarized by the executor. The deed should specify the property or assets being transferred, the named beneficiaries of the trust, and any applicable conditions or restrictions. After executing the deed, the executor must file it with the appropriate county clerk's office in McKinney, Texas, alongside other required probate documents. This filing ensures the transfer of ownership is legally recognized and protects the rights of the beneficiaries. In summary, a McKinney Texas Executor's Deed of Distribution to a Trust is a crucial legal instrument used by executors to transfer assets from an estate to a trust according to the terms outlined by the decedent. It helps streamline the distribution process and ensures that the deceased person's wishes are followed while protecting the rights and interests of the trust beneficiaries.