This Quitclaim Deed From an Individual To a Corporation form is a Quitclaim Deed where the grantor is an individual and the grantee is a corporation. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

Austin Texas Quitclaim Deed from Individual to Corporation

Description

How to fill out Texas Quitclaim Deed From Individual To Corporation?

If you are searching for a legitimate document, it’s incredibly challenging to select a more user-friendly platform than the US Legal Forms site – possibly the largest collections available online.

Here you can acquire a vast array of document samples tailored for both business and personal use, categorized by type, region, or keywords.

With the premium search feature, locating the latest Austin Texas Quitclaim Deed from Individual to Corporation is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Retrieve the document. Choose the format and store it on your device.

- Moreover, the accuracy of each document is validated by a team of experienced attorneys who regularly review the templates on our platform and refresh them in line with the most current state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Austin Texas Quitclaim Deed from Individual to Corporation is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply follow the instructions provided below.

- Ensure you have selected the form you desire. Review its description and utilize the Preview feature to inspect its content. If it doesn’t fulfill your needs, utilize the Search bar at the top of the page to locate the required document.

- Confirm your choice. Select the Buy now button. Then, pick your desired pricing plan and provide your details to create an account.

Form popularity

FAQ

Here are eight steps on how to transfer property title to an LLC: Contact Your Lender.Form an LLC.Obtain a Tax ID Number and Open an LLC Bank Account.Obtain a Form for a Deed.Fill out the Warranty or Quitclaim Deed Form.Sign the Deed to Transfer Property to the LLC.Record the Deed.Change Your Lease.

The transfer process can take up to 3 months. There are different phases involved in the transfer of a property. These phases are: Instruction: a conveyancer receives the instruction to transfer the property.

Average Title transfer service fee is ?20,000 for properties within Metro Manila and ?30,000 for properties outside of Metro Manila.

SB 885 provides that four years after recording a quitclaim deed, a subsequent purchaser or creditor for value without actual notice of other unrecorded claims on the property has good faith protection.

The county will charge a filing fee of about $30 to $40. Once the Gift Deed has been signed, notarized, and filed, ownership of the property passes to the new owner. The transfer is the same as any other deed.

There are several types of deeds people use to transfer property in Texas. While all of these deeds are valid in Texas, this doesn't mean real estate attorneys favor them. In fact, while quitclaim deeds are valid, they're not often used in Texas because they're barely considered deeds at all.

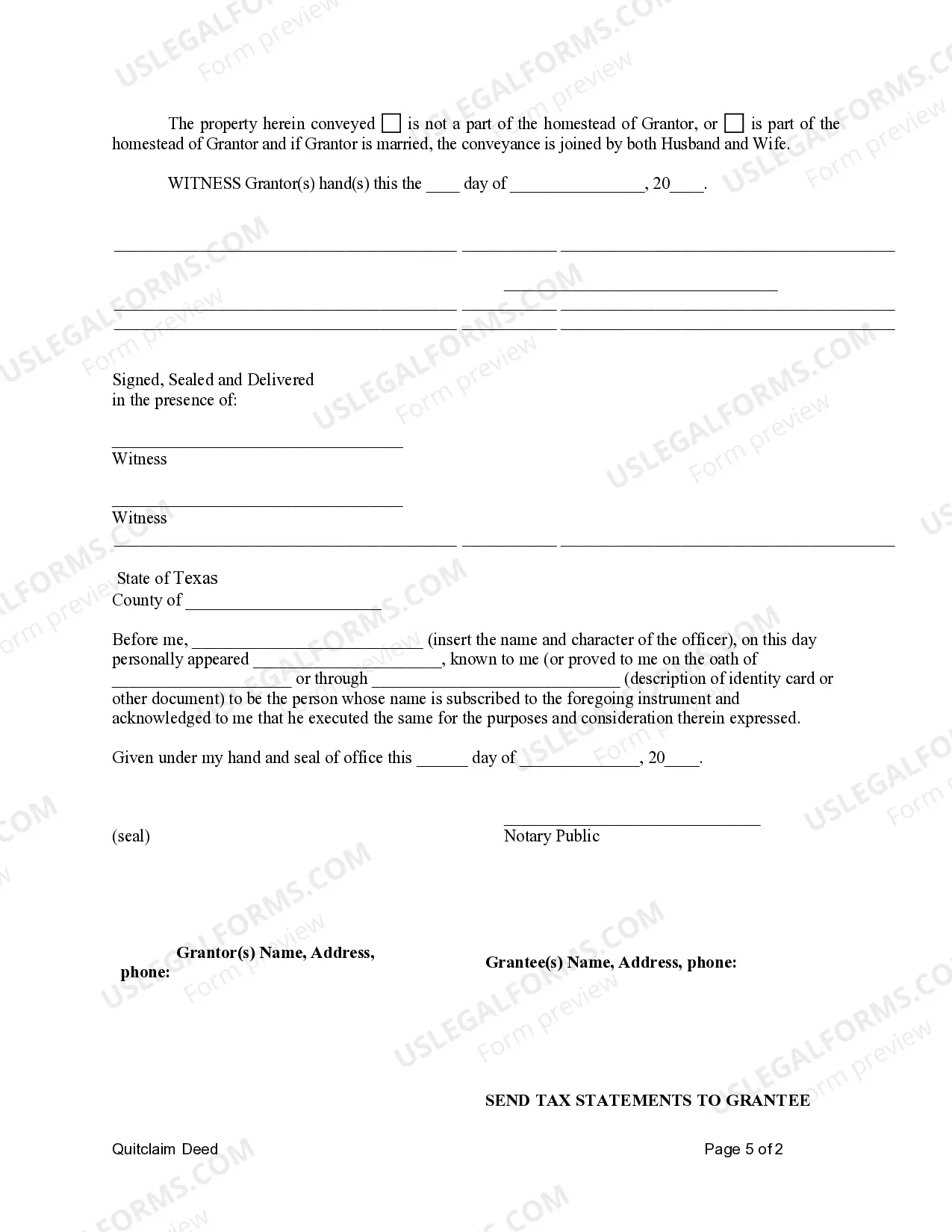

Code Section 13.002. Signing - According to Texas Law (Section 11.002(c)), a quitclaim deed must be signed by the Grantor, along with two signing witnesses, or it may be notarized by a Notary Public. Recording - Once the document has been witnessed or notarized, it must be filed with the County Clerk's Office.

How to Transfer Texas Real Estate Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor).Create a new deed.Sign and notarize the deed.File the documents in the county land records.

All property deeds ? $195 Any Property Deed needed to transfer real estate in Texas. Prepared by an attorney licensed in the state of Texas.