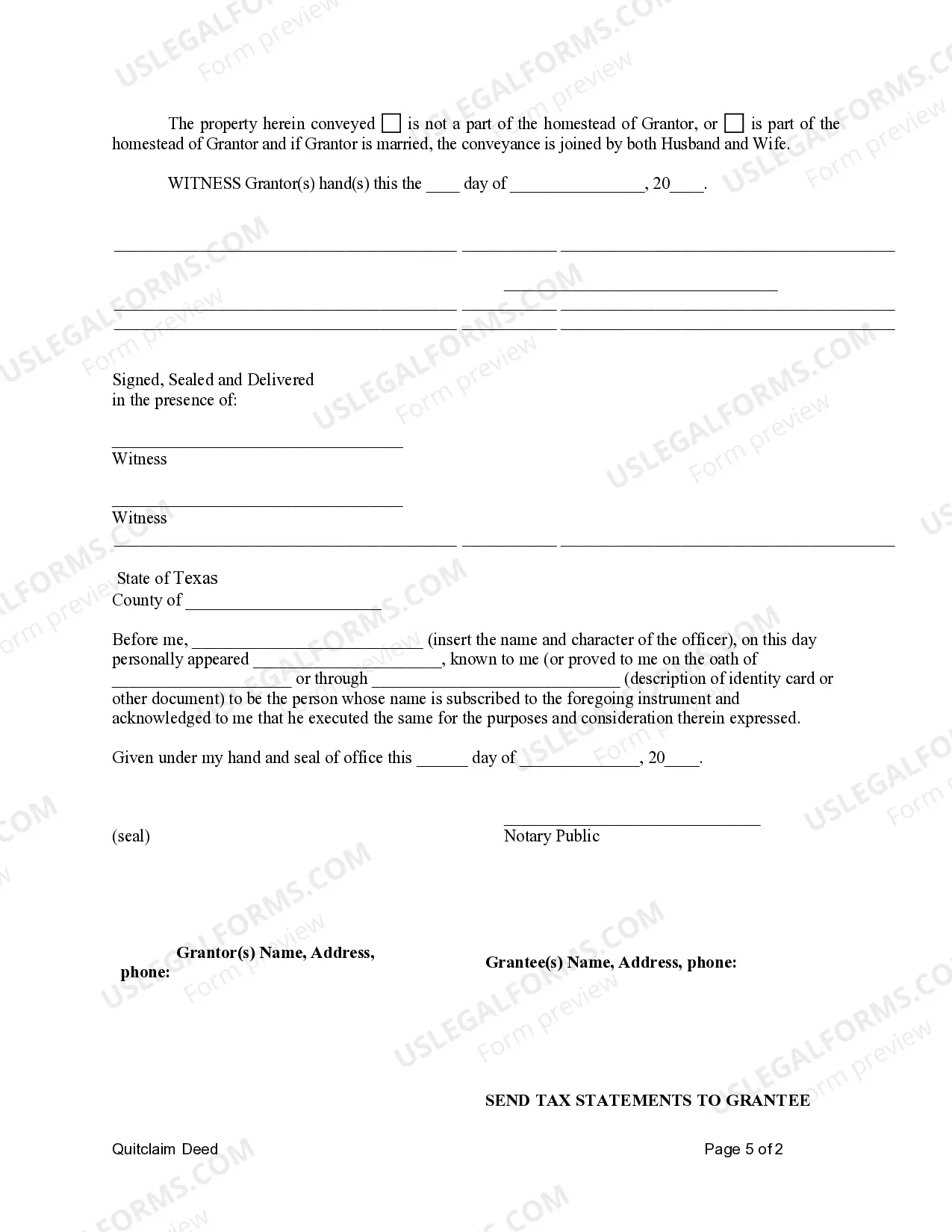

This Quitclaim Deed From an Individual To a Corporation form is a Quitclaim Deed where the grantor is an individual and the grantee is a corporation. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

A McKinney Texas Quitclaim Deed from Individual to Corporation is a legal document used to transfer ownership of real estate from an individual to a corporation in the city of McKinney, Texas. This type of deed is commonly utilized when an individual wishes to transfer or convey their property rights to a corporation, whether it be for business purposes, tax benefits, or liability protection. A quitclaim deed is a legal instrument that offers no guarantee or warranty of the property's title and only transfers the interest or claim that the individual possesses at the time of the transfer. It does not guarantee that the property is free from any liens, encumbrances, or other claims. By executing a quitclaim deed from an individual to a corporation, the individual essentially relinquishes their ownership rights, if any, to the property and transfers them to the corporation. The corporation then becomes the new legal owner of the property, assuming any responsibilities, claims, or benefits associated with it. Different types of McKinney Texas Quitclaim Deed from Individual to Corporation may include: 1. General Quitclaim Deed: This is the most common type of quitclaim deed, where the individual conveys their entire interest in the property to the corporation without any specific limitations or conditions. 2. Limited Quitclaim Deed: In some cases, the individual may choose to transfer only a part or specific interest in the property to the corporation through a limited quitclaim deed. This may involve transferring a specific percentage of ownership, a specified portion of the property, or particular rights associated with the property. 3. Conditioned Quitclaim Deed: With a conditioned quitclaim deed, the transfer is subject to certain conditions, terms, or restrictions. These conditions could include requirements such as the corporation assuming specific liabilities or obligations associated with the property, fulfilling certain contractual obligations, or meeting certain performance standards. 4. Reverse Quitclaim Deed: This type of quitclaim deed is less common but may be used when a corporation wishes to transfer property rights back to an individual. It allows the corporation to relinquish its ownership in favor of an individual. It is important to note that executing a quitclaim deed should be done with careful consideration and consultation with legal professionals experienced in real estate and corporate law. Both the individual transferring the property and the corporation receiving it should seek legal advice to ensure the transaction is properly documented and in compliance with all applicable laws.A McKinney Texas Quitclaim Deed from Individual to Corporation is a legal document used to transfer ownership of real estate from an individual to a corporation in the city of McKinney, Texas. This type of deed is commonly utilized when an individual wishes to transfer or convey their property rights to a corporation, whether it be for business purposes, tax benefits, or liability protection. A quitclaim deed is a legal instrument that offers no guarantee or warranty of the property's title and only transfers the interest or claim that the individual possesses at the time of the transfer. It does not guarantee that the property is free from any liens, encumbrances, or other claims. By executing a quitclaim deed from an individual to a corporation, the individual essentially relinquishes their ownership rights, if any, to the property and transfers them to the corporation. The corporation then becomes the new legal owner of the property, assuming any responsibilities, claims, or benefits associated with it. Different types of McKinney Texas Quitclaim Deed from Individual to Corporation may include: 1. General Quitclaim Deed: This is the most common type of quitclaim deed, where the individual conveys their entire interest in the property to the corporation without any specific limitations or conditions. 2. Limited Quitclaim Deed: In some cases, the individual may choose to transfer only a part or specific interest in the property to the corporation through a limited quitclaim deed. This may involve transferring a specific percentage of ownership, a specified portion of the property, or particular rights associated with the property. 3. Conditioned Quitclaim Deed: With a conditioned quitclaim deed, the transfer is subject to certain conditions, terms, or restrictions. These conditions could include requirements such as the corporation assuming specific liabilities or obligations associated with the property, fulfilling certain contractual obligations, or meeting certain performance standards. 4. Reverse Quitclaim Deed: This type of quitclaim deed is less common but may be used when a corporation wishes to transfer property rights back to an individual. It allows the corporation to relinquish its ownership in favor of an individual. It is important to note that executing a quitclaim deed should be done with careful consideration and consultation with legal professionals experienced in real estate and corporate law. Both the individual transferring the property and the corporation receiving it should seek legal advice to ensure the transaction is properly documented and in compliance with all applicable laws.