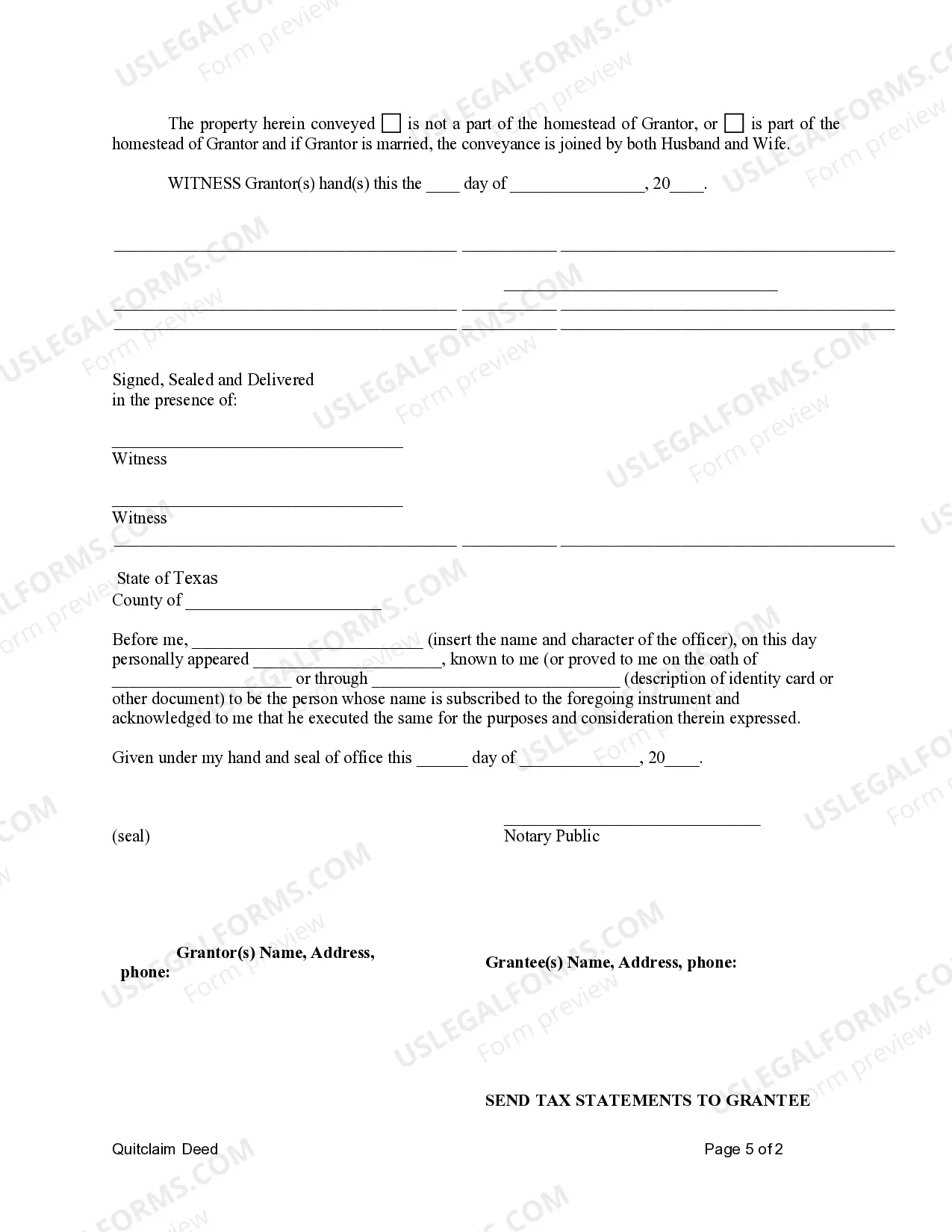

This Quitclaim Deed From an Individual To a Corporation form is a Quitclaim Deed where the grantor is an individual and the grantee is a corporation. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

A Round Rock Texas Quitclaim Deed from Individual to Corporation is a legal document that transfers ownership of a property from an individual to a corporation through the use of a quitclaim deed. This type of deed is commonly used when an individual wishes to transfer their personal property to a corporation they own or are affiliated with. The Round Rock Texas Quitclaim Deed is a binding agreement that includes specific information, such as the names and addresses of both the individual granting the property (granter) and the corporation receiving the property (grantee). It also includes a comprehensive legal description of the property being transferred, which includes information such as the address, lot number, and any relevant survey or plat information. This type of deed is different from other transfer methods, such as warranty deeds, in that it does not guarantee that the property being transferred is free from any encumbrances or claims, except those specified in the deed itself. The granter only transfers whatever interest they may have in the property, without making any warranties or guarantees about the ownership. There can be variations of Round Rock Texas Quitclaim Deeds from Individual to Corporation, depending on the specific circumstances of the transfer. For instance, there may be cases where the transfer is made to a subsidiary or affiliated corporation, rather than the main corporation. In such situations, the deed may include additional clauses or conditions to reflect the unique relationship between the individual and the subsidiary corporation. Furthermore, the terms and conditions of the transfer can also vary, such as whether it is a full transfer or a partial transfer of ownership rights. In some cases, the individual may retain a partial interest in the property, while transferring the majority of it to the corporation. These details would be specified in the deed, along with any specific rights or restrictions associated with the transfer. In conclusion, a Round Rock Texas Quitclaim Deed from Individual to Corporation is a legal document used to transfer ownership of a property from an individual to a corporation. It is important to carefully review and understand the terms and conditions specified in the deed before executing it. Consulting with a qualified real estate attorney is highly recommended ensuring a smooth and legally valid transfer of property.A Round Rock Texas Quitclaim Deed from Individual to Corporation is a legal document that transfers ownership of a property from an individual to a corporation through the use of a quitclaim deed. This type of deed is commonly used when an individual wishes to transfer their personal property to a corporation they own or are affiliated with. The Round Rock Texas Quitclaim Deed is a binding agreement that includes specific information, such as the names and addresses of both the individual granting the property (granter) and the corporation receiving the property (grantee). It also includes a comprehensive legal description of the property being transferred, which includes information such as the address, lot number, and any relevant survey or plat information. This type of deed is different from other transfer methods, such as warranty deeds, in that it does not guarantee that the property being transferred is free from any encumbrances or claims, except those specified in the deed itself. The granter only transfers whatever interest they may have in the property, without making any warranties or guarantees about the ownership. There can be variations of Round Rock Texas Quitclaim Deeds from Individual to Corporation, depending on the specific circumstances of the transfer. For instance, there may be cases where the transfer is made to a subsidiary or affiliated corporation, rather than the main corporation. In such situations, the deed may include additional clauses or conditions to reflect the unique relationship between the individual and the subsidiary corporation. Furthermore, the terms and conditions of the transfer can also vary, such as whether it is a full transfer or a partial transfer of ownership rights. In some cases, the individual may retain a partial interest in the property, while transferring the majority of it to the corporation. These details would be specified in the deed, along with any specific rights or restrictions associated with the transfer. In conclusion, a Round Rock Texas Quitclaim Deed from Individual to Corporation is a legal document used to transfer ownership of a property from an individual to a corporation. It is important to carefully review and understand the terms and conditions specified in the deed before executing it. Consulting with a qualified real estate attorney is highly recommended ensuring a smooth and legally valid transfer of property.