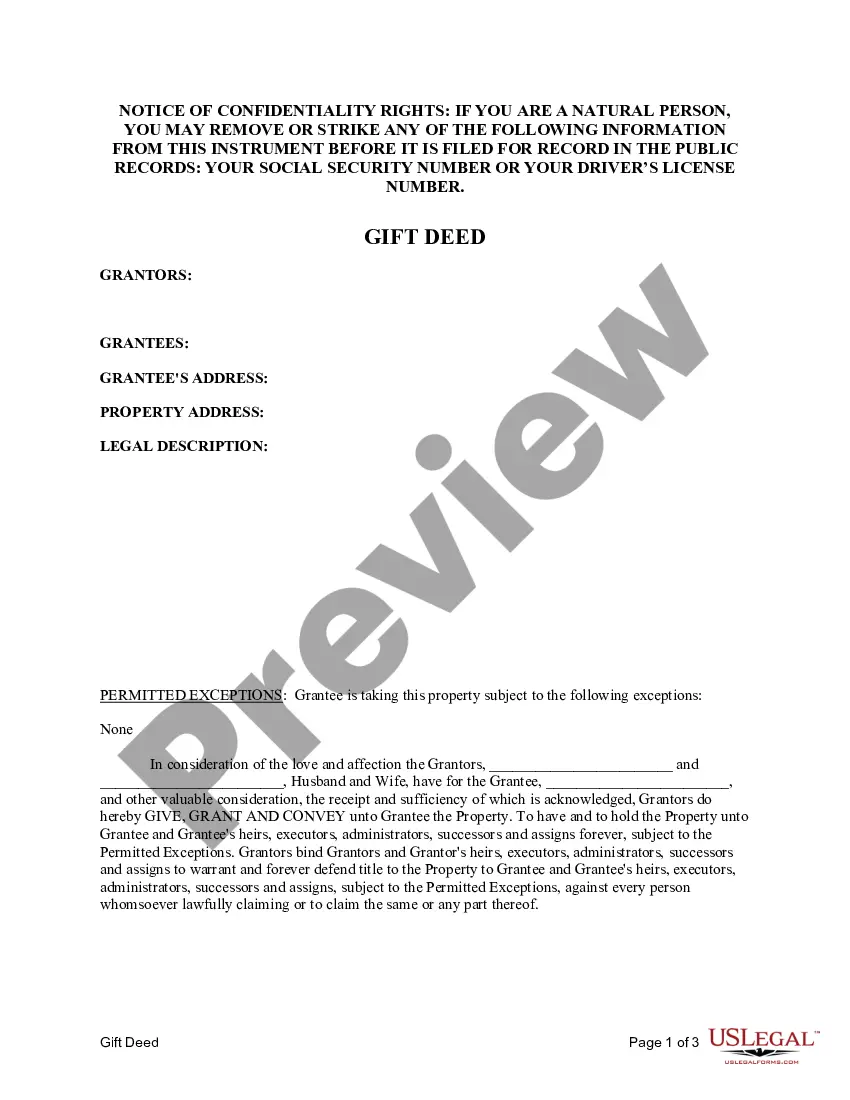

This form is a Gift Deed where the Grantors are Husband and Wife and the Grantee is an Individual. Grantors convey and warrant the described property to the Grantee. This deed complies with all state statutory laws.

A Bexar Texas Gift Deed — Husband and Wife to an Individual is a legal document used to transfer real property as a gift from a married couple to an individual, usually without any monetary compensation. This type of deed allows spouses to jointly gift their property to another person, often a family member, friend, or beneficiary, thereby transferring ownership rights of the property. The purpose of a Gift Deed is to transfer ownership without any exchange of money or other value, expressing the donors' intention to give the property as a gift. It is important to note that this type of deed is irrevocable, meaning that once the gift is made, the donors cannot take it back or change their minds. It also eliminates any future claims or ownership interest in the gifted property. Various types of Bexar Texas Gift Deeds include: 1. Bexar Texas Gift Deed — Husband and Wife to an Individual with Full Ownership: This type of gift deed transfers complete ownership of the property to the individual receiving the gift. The recipient becomes the sole owner and assumes all responsibilities and liabilities associated with the property. 2. Bexar Texas Gift Deed — Husband and Wife to an Individual with Retained Life Estate: With this type of gift deed, the donors transfer the ownership to an individual while retaining a life estate. The donors continue to possess and enjoy the property until their death, after which the recipient gains full ownership. 3. Bexar Texas Gift Deed — Husband and Wife to an Individual with Joint Tenancy with Rights of Survivorship: This specific gift deed establishes joint tenancy between the donors and the individual receiving the property. In the event of the donors' death, the recipient automatically becomes the sole owner of the property. 4. Bexar Texas Gift Deed — Husband and Wife to an Individual with Tenancy in Common: This type of gift deed grants the individual receiving the gift a concurrent ownership interest as a tenant in common with the donors. Each party holds a distinct share in the property, and in the event of the donors' death, their share passes through their estate, rather than transferring to the recipient. 5. Bexar Texas Gift Deed — Husband and Wife to an Individual with Specific Conditions: This gift deed may include various conditions or restrictions set forth by the donors. These conditions could involve the use or future transfer of the property, ensuring it aligns with the donors' specific wishes. In conclusion, a Bexar Texas Gift Deed — Husband and Wife to an Individual is a legal instrument used to gift real property from a married couple to an individual recipient. The type of gift deed chosen depends on the donors' intentions and preferences, which may include full ownership transfer, retained life estate, joint tenancy with rights of survivorship, tenancy in common, or specific conditions.A Bexar Texas Gift Deed — Husband and Wife to an Individual is a legal document used to transfer real property as a gift from a married couple to an individual, usually without any monetary compensation. This type of deed allows spouses to jointly gift their property to another person, often a family member, friend, or beneficiary, thereby transferring ownership rights of the property. The purpose of a Gift Deed is to transfer ownership without any exchange of money or other value, expressing the donors' intention to give the property as a gift. It is important to note that this type of deed is irrevocable, meaning that once the gift is made, the donors cannot take it back or change their minds. It also eliminates any future claims or ownership interest in the gifted property. Various types of Bexar Texas Gift Deeds include: 1. Bexar Texas Gift Deed — Husband and Wife to an Individual with Full Ownership: This type of gift deed transfers complete ownership of the property to the individual receiving the gift. The recipient becomes the sole owner and assumes all responsibilities and liabilities associated with the property. 2. Bexar Texas Gift Deed — Husband and Wife to an Individual with Retained Life Estate: With this type of gift deed, the donors transfer the ownership to an individual while retaining a life estate. The donors continue to possess and enjoy the property until their death, after which the recipient gains full ownership. 3. Bexar Texas Gift Deed — Husband and Wife to an Individual with Joint Tenancy with Rights of Survivorship: This specific gift deed establishes joint tenancy between the donors and the individual receiving the property. In the event of the donors' death, the recipient automatically becomes the sole owner of the property. 4. Bexar Texas Gift Deed — Husband and Wife to an Individual with Tenancy in Common: This type of gift deed grants the individual receiving the gift a concurrent ownership interest as a tenant in common with the donors. Each party holds a distinct share in the property, and in the event of the donors' death, their share passes through their estate, rather than transferring to the recipient. 5. Bexar Texas Gift Deed — Husband and Wife to an Individual with Specific Conditions: This gift deed may include various conditions or restrictions set forth by the donors. These conditions could involve the use or future transfer of the property, ensuring it aligns with the donors' specific wishes. In conclusion, a Bexar Texas Gift Deed — Husband and Wife to an Individual is a legal instrument used to gift real property from a married couple to an individual recipient. The type of gift deed chosen depends on the donors' intentions and preferences, which may include full ownership transfer, retained life estate, joint tenancy with rights of survivorship, tenancy in common, or specific conditions.