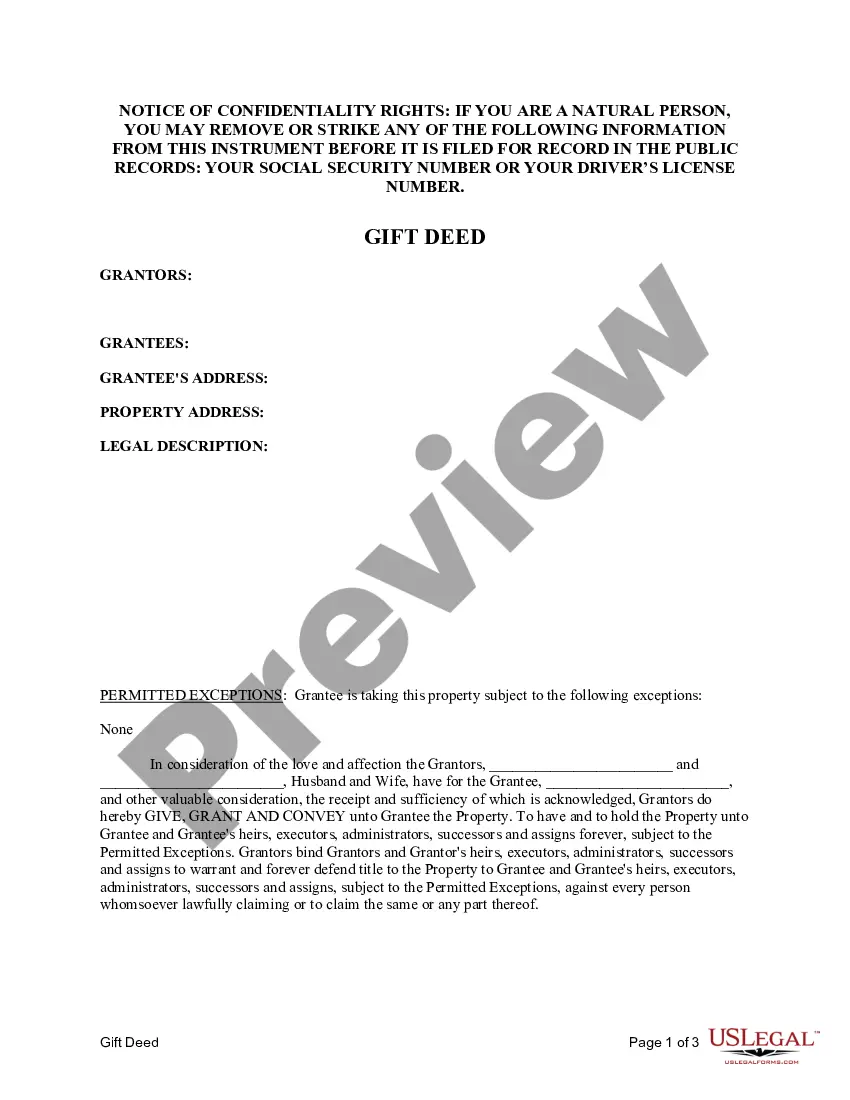

This form is a Gift Deed where the Grantors are Husband and Wife and the Grantee is an Individual. Grantors convey and warrant the described property to the Grantee. This deed complies with all state statutory laws.

A Dallas Texas Gift Deed — Husband and Wife to an Individual is a legal document used to transfer ownership of a property from a married couple to an individual as a gift. This type of deed is commonly used when a couple wants to gift a property to a family member, friend, or acquaintance. The purpose of a gift deed is to legally transfer the property without any monetary exchange. It is important to note that once the gift deed is signed and recorded, the recipient becomes the sole owner of the property. There are various types of Dallas Texas Gift Deeds — Husband and Wife to an Individual, depending on specific circumstances and requirements: 1. General Gift Deed: This is the most common type of gift deed where the couple transfers ownership of the property to the individual without any conditions or limitations. 2. Conditional Gift Deed: In this type of gift deed, certain conditions or restrictions may be imposed by the couple. For example, they may require the individual to maintain the property or use it for specific purposes. 3. Lifetime Gift Deed: This type of gift deed is executed during the lifetime of the couple. They transfer ownership of the property to the individual, but retain the right to live in the property until their death. 4. Future Interest Gift Deed: Unlike a general gift deed, this type of deed grants the individual the future interest in the property, meaning they will gain ownership of the property upon the death of the couple. 5. Revocable Gift Deed: This gift deed allows the couple to revoke or cancel the deed at any time before it is fully executed, usually to accommodate changing circumstances or unforeseen events. In order to execute a Dallas Texas Gift Deed — Husband and Wife to an Individual, it is crucial to consult with an experienced real estate attorney to navigate the legal process. Additionally, it is important to research and comply with all local, state, and federal laws regarding gift deeds, including any applicable taxes or regulations. By following the proper procedures, this type of deed can serve as an excellent way for a couple to transfer property ownership as a generous gift.A Dallas Texas Gift Deed — Husband and Wife to an Individual is a legal document used to transfer ownership of a property from a married couple to an individual as a gift. This type of deed is commonly used when a couple wants to gift a property to a family member, friend, or acquaintance. The purpose of a gift deed is to legally transfer the property without any monetary exchange. It is important to note that once the gift deed is signed and recorded, the recipient becomes the sole owner of the property. There are various types of Dallas Texas Gift Deeds — Husband and Wife to an Individual, depending on specific circumstances and requirements: 1. General Gift Deed: This is the most common type of gift deed where the couple transfers ownership of the property to the individual without any conditions or limitations. 2. Conditional Gift Deed: In this type of gift deed, certain conditions or restrictions may be imposed by the couple. For example, they may require the individual to maintain the property or use it for specific purposes. 3. Lifetime Gift Deed: This type of gift deed is executed during the lifetime of the couple. They transfer ownership of the property to the individual, but retain the right to live in the property until their death. 4. Future Interest Gift Deed: Unlike a general gift deed, this type of deed grants the individual the future interest in the property, meaning they will gain ownership of the property upon the death of the couple. 5. Revocable Gift Deed: This gift deed allows the couple to revoke or cancel the deed at any time before it is fully executed, usually to accommodate changing circumstances or unforeseen events. In order to execute a Dallas Texas Gift Deed — Husband and Wife to an Individual, it is crucial to consult with an experienced real estate attorney to navigate the legal process. Additionally, it is important to research and comply with all local, state, and federal laws regarding gift deeds, including any applicable taxes or regulations. By following the proper procedures, this type of deed can serve as an excellent way for a couple to transfer property ownership as a generous gift.