This form is a Gift Deed where the Grantors are Husband and Wife and the Grantee is an Individual. Grantors convey and warrant the described property to the Grantee. This deed complies with all state statutory laws.

Harris Texas Gift Deed - Husband and Wife to an Individual

Description

How to fill out Texas Gift Deed - Husband And Wife To An Individual?

Utilize the US Legal Forms and gain immediate access to any form template you require.

Our advantageous platform, boasting a vast selection of documents, simplifies the process of locating and obtaining nearly any document sample you may need.

You can download, complete, and sign the Harris Texas Gift Deed - Husband and Wife to an Individual in mere minutes instead of spending hours online searching for an appropriate template.

Using our catalog is a fantastic method to enhance the security of your document submissions.

If you have not yet created an account, follow the instructions outlined below.

Locate the template you need. Ensure it is the form you were looking for: verify its title and description, and use the Preview feature if available. Otherwise, use the Search bar to find the necessary document.

- Our knowledgeable attorneys routinely review all documents to ensure that the templates are suitable for specific jurisdictions and in compliance with recent laws and regulations.

- How do you acquire the Harris Texas Gift Deed - Husband and Wife to an Individual.

- If you possess a subscription, simply Log In to your account.

- The Download option will be activated for all documents you view.

- In addition, you can find all previously saved documents in the My documents section.

Form popularity

FAQ

While it is not legally required to hire a lawyer to transfer a deed in Texas, seeking legal help can provide valuable guidance, especially with a Harris Texas Gift Deed - Husband and Wife to an Individual. A lawyer can help you navigate any complexities and ensure compliance with state laws. Alternatively, platforms like US Legal Forms offer resources and templates that simplify the deed transfer process, making it easier for you to complete the necessary documentation accurately.

To transfer property title to a family member in Texas, you can use a Harris Texas Gift Deed - Husband and Wife to an Individual to formalize the process. This deed allows you to convey ownership without monetary exchange, which simplifies the transfer. However, ensure you properly execute and record the deed with the county clerk's office to establish legal ownership. Professional assistance from legal services or platforms like US Legal Forms can streamline the process and ensure you meet all requirements.

When you gift property using a Harris Texas Gift Deed - Husband and Wife to an Individual, you may encounter certain tax implications. Generally, gifts may not incur income tax for the giver, but the recipient could be responsible for capital gains tax if they sell the property later. It's important to consider annual gift tax exclusions and exemptions which may apply. Consulting a tax professional can help clarify these implications and ensure you understand your responsibilities.

The three essential requirements for a gift of personal property include a clear intention to give, delivery of the property, and acceptance by the recipient. Utilizing a Harris Texas Gift Deed - Husband and Wife to an Individual can help formalize these elements in a property context. Ensure all parties understand their rights and responsibilities.

Gifting property to a family member in Texas can be done using a Harris Texas Gift Deed - Husband and Wife to an Individual. This allows you to transfer ownership without the complications of a sale. After preparing the necessary documentation, you should file the deed with the county to ensure everything is official.

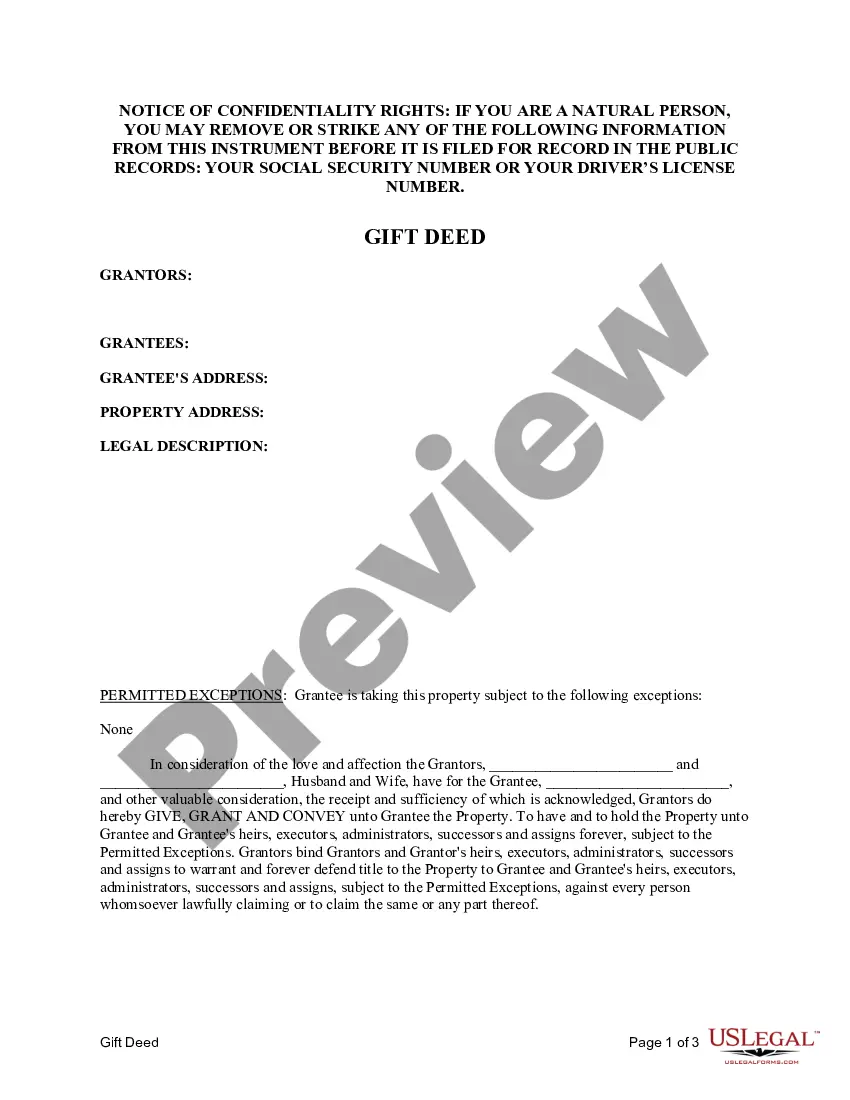

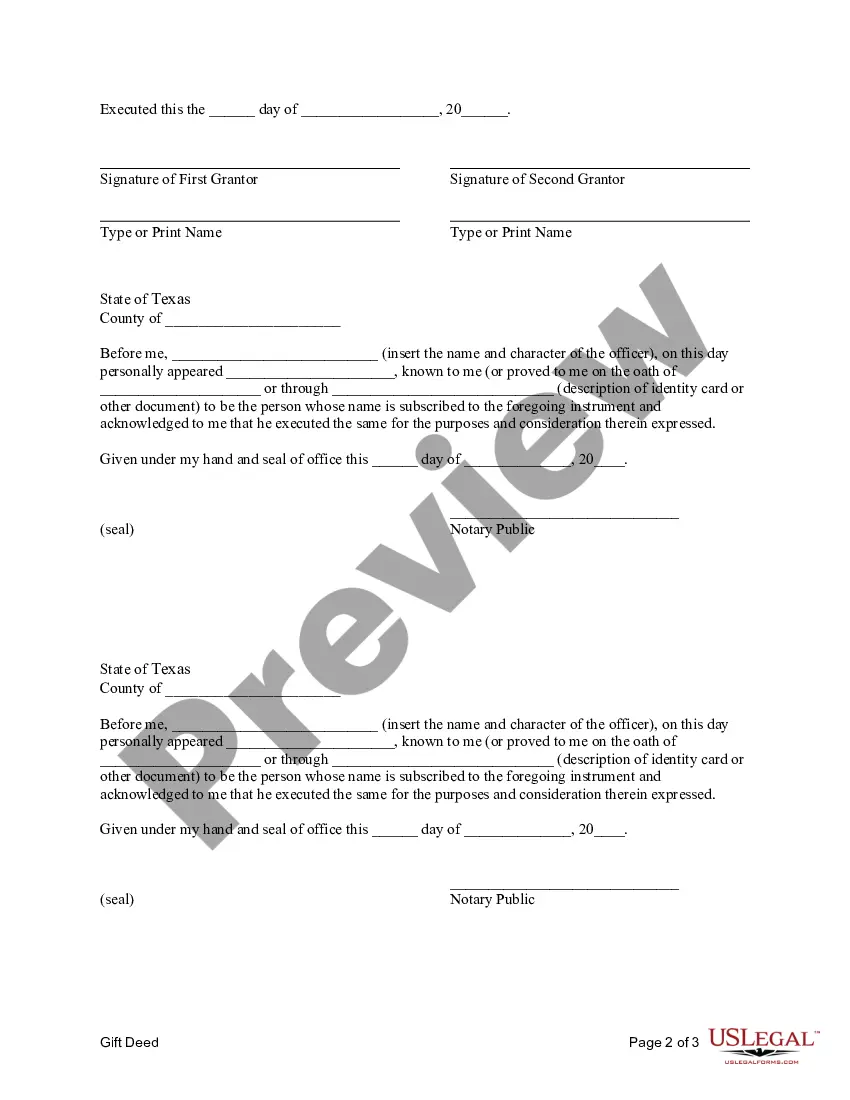

To write a gift deed in Texas, you need to include specific details like the names of the giver and receiver, property description, and the intention to give the property as a gift. A Harris Texas Gift Deed - Husband and Wife to an Individual outlines these elements effectively. Make sure to have the deed signed and notarized to make it valid.

Yes, it is generally advisable for both spouses to be on the house title in Texas. Doing so provides legal protection and ensures both parties have an equal claim to the property. If you plan to add a spouse to the title, remember that using a Harris Texas Gift Deed - Husband and Wife to an Individual can simplify the process.

To transfer property to a family member quickly and effectively in Texas, consider using a Harris Texas Gift Deed - Husband and Wife to an Individual. This deed allows you to transfer ownership without the lengthy processes of traditional sales. Make sure to prepare the deed properly, sign, and notarize it before filing it with the county.

The best way to transfer property title between family members is often through a Harris Texas Gift Deed - Husband and Wife to an Individual. This method effectively facilitates the transfer without needing to involve a sale, thus minimizing potential taxes. Ensure that all necessary documentation is prepared and filed correctly to protect everyone’s interests.

To add your spouse to your house deed in Texas, you will need to prepare a new deed, commonly known as a Harris Texas Gift Deed - Husband and Wife to an Individual. This deed must include both names and be properly signed and notarized. Once completed, you should file the new deed with the county clerk's office to ensure the change is officially recorded.