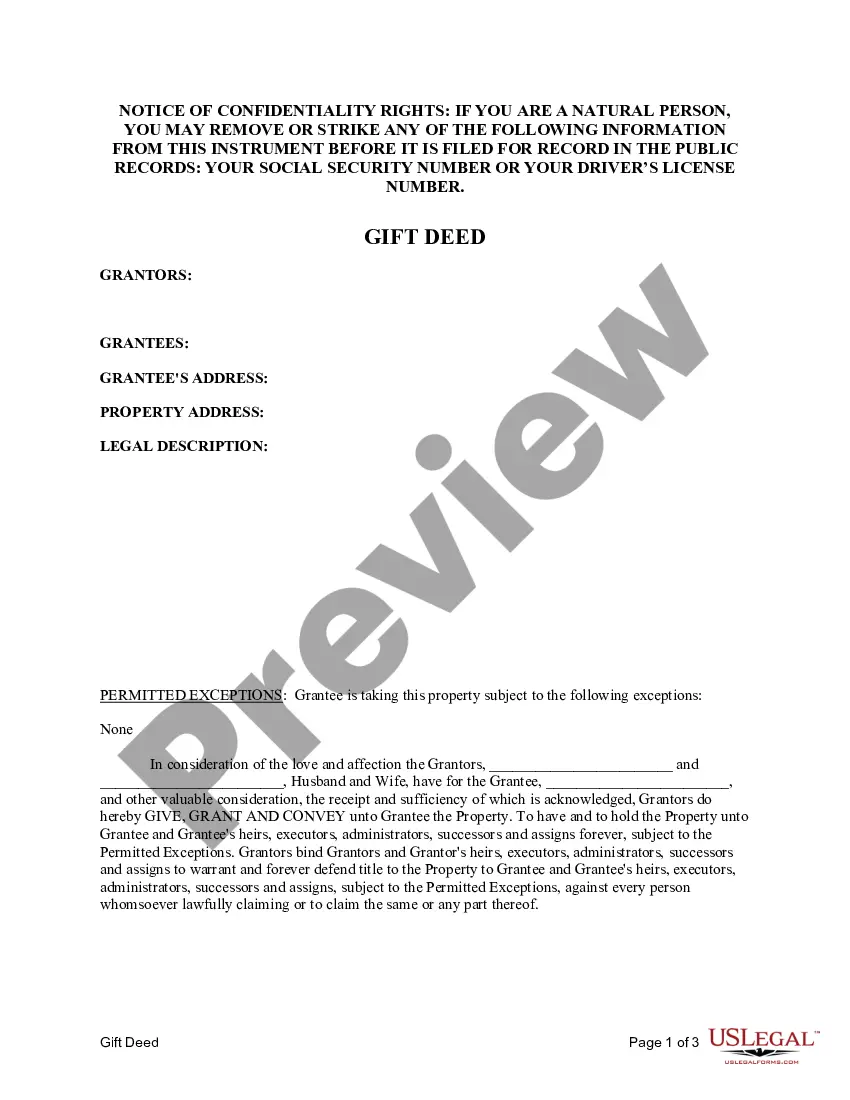

This form is a Gift Deed where the Grantors are Husband and Wife and the Grantee is an Individual. Grantors convey and warrant the described property to the Grantee. This deed complies with all state statutory laws.

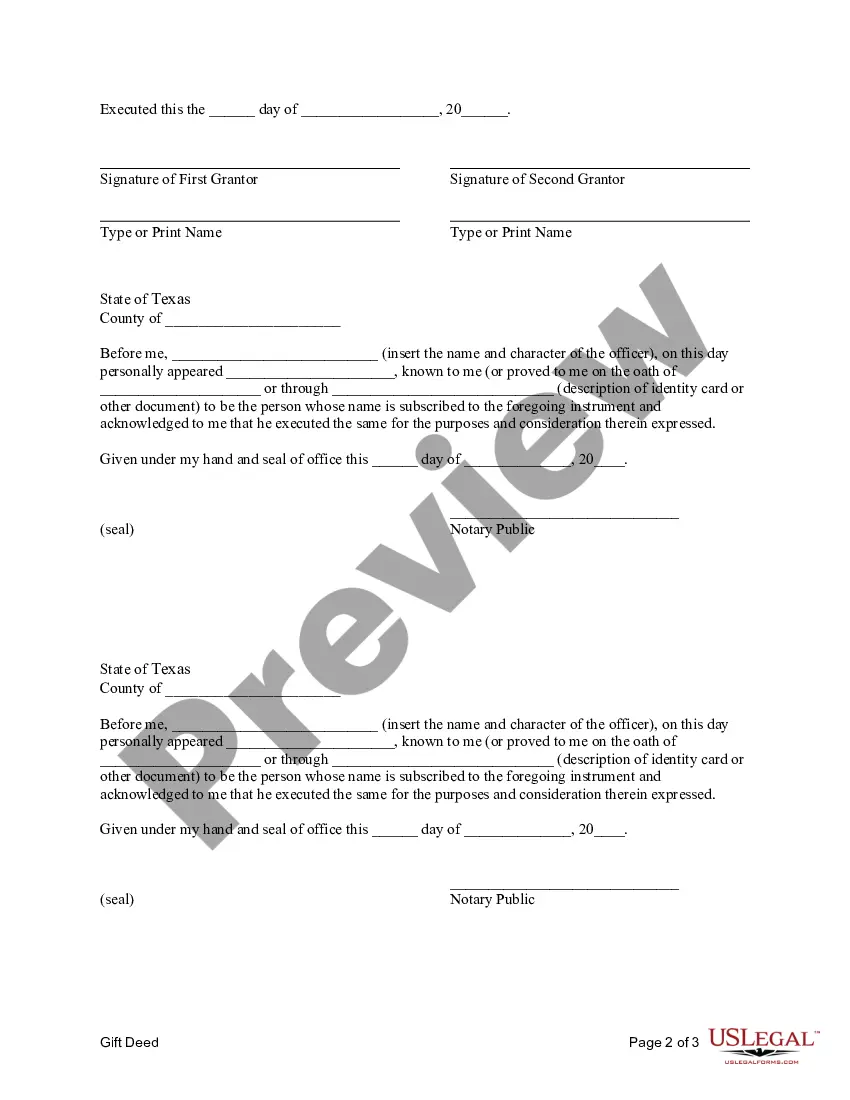

Title: Irving Texas Gift Deed — Husband and Wife to an Individual: A Comprehensive Overview Introduction: The Irving Texas Gift Deed — Husband and Wife to an Individual is a legal document that enables a married couple to transfer ownership of real estate or personal property as a gift to an individual recipient. This type of transfer typically occurs without any exchange of monetary consideration. This article will provide a detailed description of the Irving Texas Gift Deed — Husband and Wife to an Individual, its purpose, requirements, and any additional types related to it. Key Points: 1. Purpose and Importance: The purpose of an Irving Texas Gift Deed — Husband and Wife to an Individual is to legally transfer the ownership of property (real estate or personal) between a married couple and an individual recipient. This allows the couple to gift their property, often to a family member or loved one, without the need for compensation. 2. Execution and Legal Requirements: To ensure the validity of the Irving Texas Gift Deed — Husband and Wife to an Individual, certain legal requirements must be met: — The gift must be willingly and voluntarily given by the husband and wife. — The document must be in writing, signed, and notarized by both spouses. — A complete and accurate description of the gifted property, including addresses and legal descriptions, must be included. — The deed should clearly state the intent to gift the property without any consideration. — The gift should be delivered to the individual, indicating an immediate transfer of ownership. 3. Different Types of Irving Texas Gift Deed — Husband and Wife to an Individual: Although the basic concept remains the same, variations of the gift deed may include: — Residential Property Gift Deed: This pertains to the transfer of residential property owned by the husband and wife to a specific individual. — Commercial Property Gift Deed: Involves gifting commercial property owned by the husband and wife to an individual, often for personal or business purposes. — Personal Property Gift Deed: A transfer of personal belongings such as vehicles, art collections, or jewelry, from the husband and wife to an individual. 4. Tax Implications: It's crucial to note that gift deeds may have tax implications. In some cases, a gift may trigger gift tax liability for the donor. It is advisable to consult a tax attorney or professional for guidance to understand any potential tax consequences associated with the Irving Texas Gift Deed — Husband and Wife to an Individual. Conclusion: The Irving Texas Gift Deed — Husband and Wife to an Individual serves as a legally binding document to transfer property ownership from a married couple to an individual recipient solely as a gift. Understanding the purpose, legal requirements, and potential tax implications is essential for a successful transfer. Any variations, such as residential or commercial property gift deeds, cater to specific situations. Seeking professional advice before drafting or executing the deed is strongly recommended ensuring compliance with relevant laws and regulations.Title: Irving Texas Gift Deed — Husband and Wife to an Individual: A Comprehensive Overview Introduction: The Irving Texas Gift Deed — Husband and Wife to an Individual is a legal document that enables a married couple to transfer ownership of real estate or personal property as a gift to an individual recipient. This type of transfer typically occurs without any exchange of monetary consideration. This article will provide a detailed description of the Irving Texas Gift Deed — Husband and Wife to an Individual, its purpose, requirements, and any additional types related to it. Key Points: 1. Purpose and Importance: The purpose of an Irving Texas Gift Deed — Husband and Wife to an Individual is to legally transfer the ownership of property (real estate or personal) between a married couple and an individual recipient. This allows the couple to gift their property, often to a family member or loved one, without the need for compensation. 2. Execution and Legal Requirements: To ensure the validity of the Irving Texas Gift Deed — Husband and Wife to an Individual, certain legal requirements must be met: — The gift must be willingly and voluntarily given by the husband and wife. — The document must be in writing, signed, and notarized by both spouses. — A complete and accurate description of the gifted property, including addresses and legal descriptions, must be included. — The deed should clearly state the intent to gift the property without any consideration. — The gift should be delivered to the individual, indicating an immediate transfer of ownership. 3. Different Types of Irving Texas Gift Deed — Husband and Wife to an Individual: Although the basic concept remains the same, variations of the gift deed may include: — Residential Property Gift Deed: This pertains to the transfer of residential property owned by the husband and wife to a specific individual. — Commercial Property Gift Deed: Involves gifting commercial property owned by the husband and wife to an individual, often for personal or business purposes. — Personal Property Gift Deed: A transfer of personal belongings such as vehicles, art collections, or jewelry, from the husband and wife to an individual. 4. Tax Implications: It's crucial to note that gift deeds may have tax implications. In some cases, a gift may trigger gift tax liability for the donor. It is advisable to consult a tax attorney or professional for guidance to understand any potential tax consequences associated with the Irving Texas Gift Deed — Husband and Wife to an Individual. Conclusion: The Irving Texas Gift Deed — Husband and Wife to an Individual serves as a legally binding document to transfer property ownership from a married couple to an individual recipient solely as a gift. Understanding the purpose, legal requirements, and potential tax implications is essential for a successful transfer. Any variations, such as residential or commercial property gift deeds, cater to specific situations. Seeking professional advice before drafting or executing the deed is strongly recommended ensuring compliance with relevant laws and regulations.