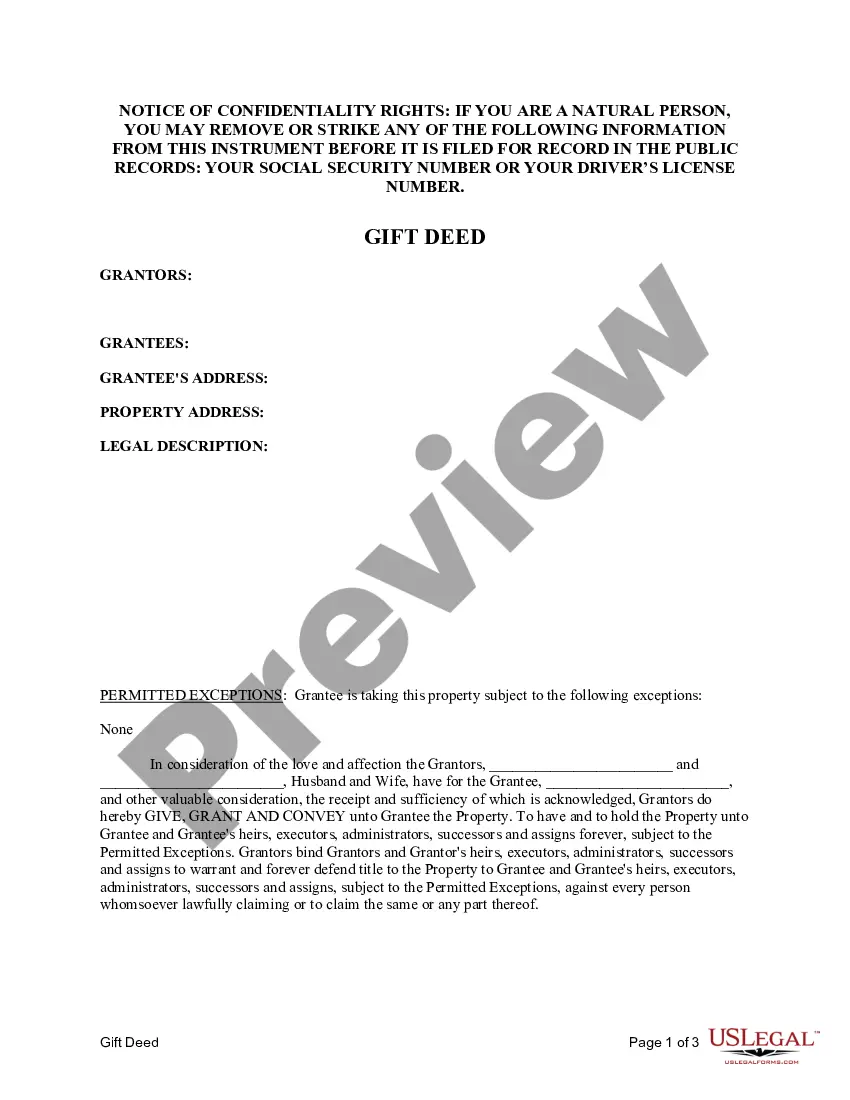

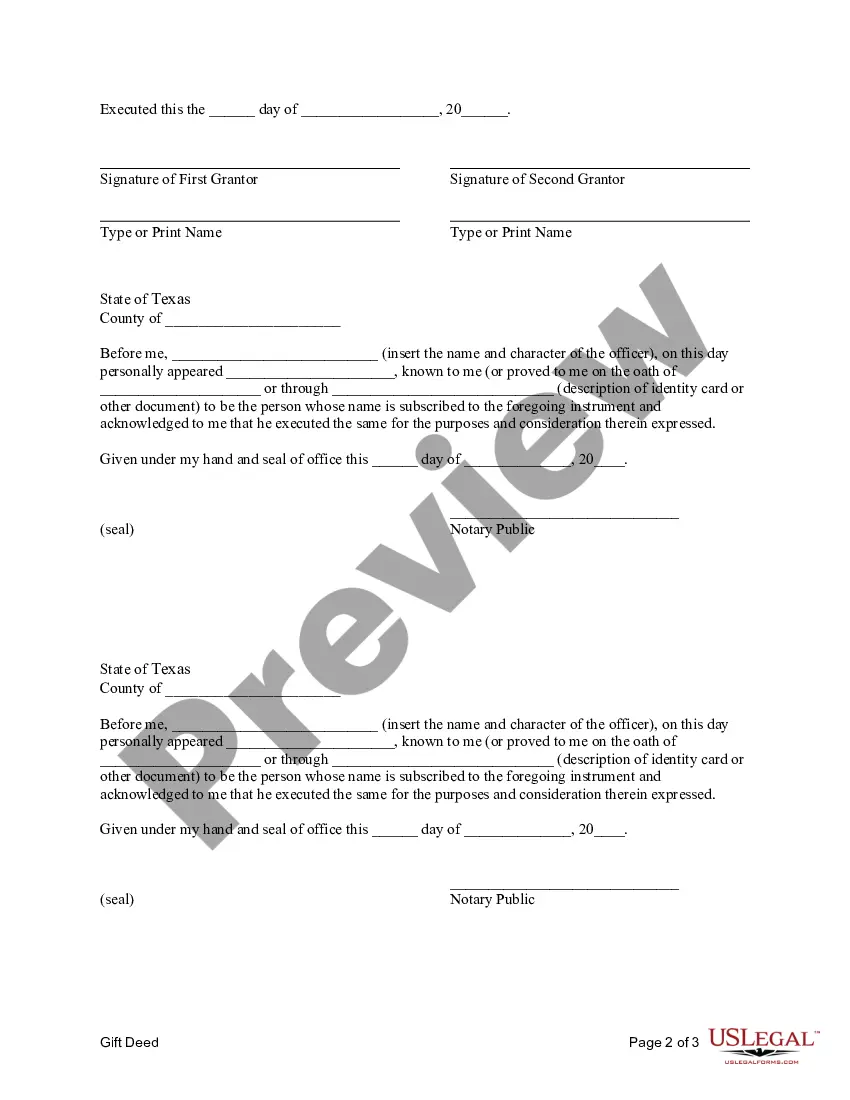

This form is a Gift Deed where the Grantors are Husband and Wife and the Grantee is an Individual. Grantors convey and warrant the described property to the Grantee. This deed complies with all state statutory laws.

A Sugar Land Texas Gift Deed — Husband and Wife to an Individual is a legal document that allows a married couple to transfer ownership of a property or real estate to an individual as a gift. This type of deed is commonly used to ensure a smooth and legal transfer of property rights, typically without any consideration or monetary compensation involved. In Sugar Land, Texas, there are different types of Gift Deeds that can be used to transfer property from a husband and wife to an individual. Some of these types include: 1. General Gift Deed: This type of deed transfers the property as a gift without any specific conditions or restrictions. It is a straightforward method of transferring ownership rights. 2. Specific Gift Deed: This deed is used when there are specific conditions attached to the gift. For example, the property may come with certain restrictions or limitations that the done (individual receiving the gift) must adhere to. 3. Reserving Life Estate: In this type of Gift Deed, the husband and wife transfer the property to an individual, but retain the right to use and live on the property for the duration of their lives. After their passing, the individual becomes the sole owner. 4. Joint Tenancy with Right of Survivorship: This type of Gift Deed establishes joint ownership of the property between the husband, wife, and the individual receiving the gift. Should one party pass away, the surviving owner(s) automatically inherit the deceased's share of the property. 5. Tenants in Common: This type of Gift Deed allows the husband, wife, and the individual to each hold a distinct, separate share of the property. The shares can be divided unequally, and the owners have the right to transfer or sell their portion. When preparing a Sugar Land Texas Gift Deed — Husband and Wife to an Individual, it is essential to consult with a real estate attorney or legal professional to ensure compliance with state and local laws. The deed should clearly state the names of the husband, wife, and the individual receiving the gift, a legal description of the property, and any specific conditions or restrictions, if applicable. Properly drafting and recording the deed is crucial to establish and protect the new owner's legal rights and ownership of the property.A Sugar Land Texas Gift Deed — Husband and Wife to an Individual is a legal document that allows a married couple to transfer ownership of a property or real estate to an individual as a gift. This type of deed is commonly used to ensure a smooth and legal transfer of property rights, typically without any consideration or monetary compensation involved. In Sugar Land, Texas, there are different types of Gift Deeds that can be used to transfer property from a husband and wife to an individual. Some of these types include: 1. General Gift Deed: This type of deed transfers the property as a gift without any specific conditions or restrictions. It is a straightforward method of transferring ownership rights. 2. Specific Gift Deed: This deed is used when there are specific conditions attached to the gift. For example, the property may come with certain restrictions or limitations that the done (individual receiving the gift) must adhere to. 3. Reserving Life Estate: In this type of Gift Deed, the husband and wife transfer the property to an individual, but retain the right to use and live on the property for the duration of their lives. After their passing, the individual becomes the sole owner. 4. Joint Tenancy with Right of Survivorship: This type of Gift Deed establishes joint ownership of the property between the husband, wife, and the individual receiving the gift. Should one party pass away, the surviving owner(s) automatically inherit the deceased's share of the property. 5. Tenants in Common: This type of Gift Deed allows the husband, wife, and the individual to each hold a distinct, separate share of the property. The shares can be divided unequally, and the owners have the right to transfer or sell their portion. When preparing a Sugar Land Texas Gift Deed — Husband and Wife to an Individual, it is essential to consult with a real estate attorney or legal professional to ensure compliance with state and local laws. The deed should clearly state the names of the husband, wife, and the individual receiving the gift, a legal description of the property, and any specific conditions or restrictions, if applicable. Properly drafting and recording the deed is crucial to establish and protect the new owner's legal rights and ownership of the property.