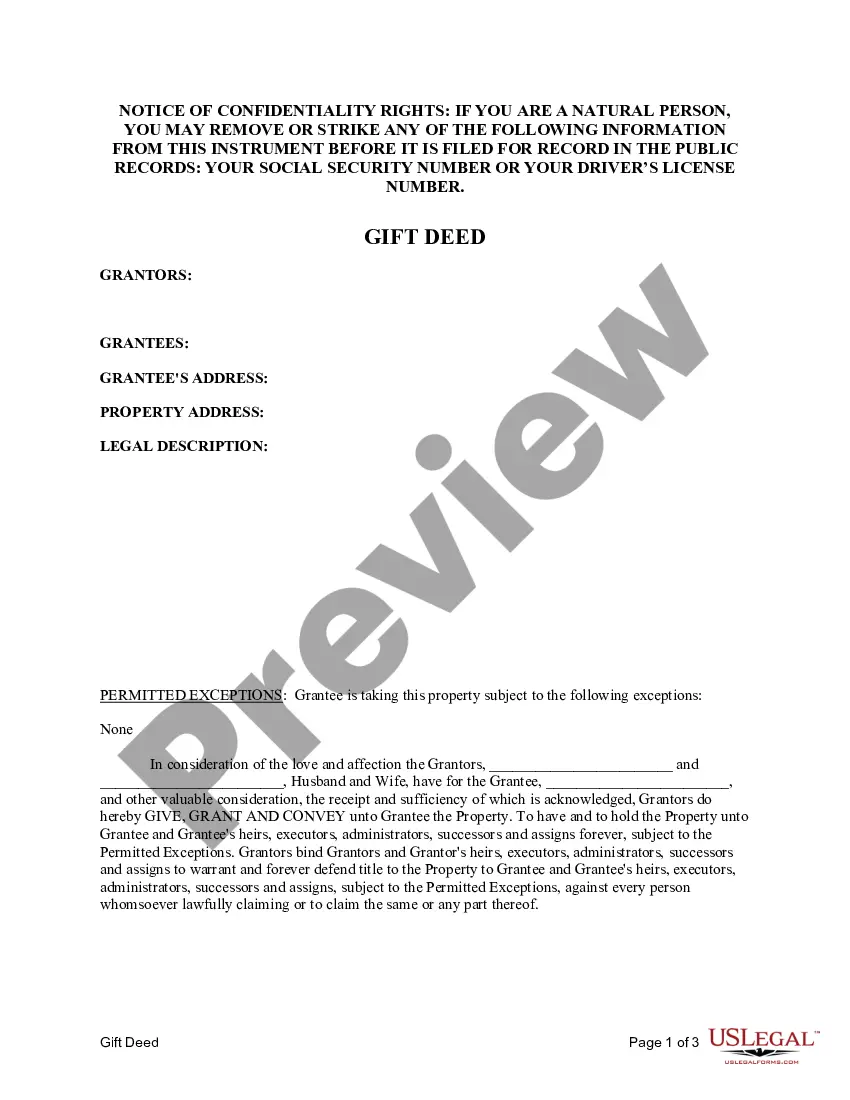

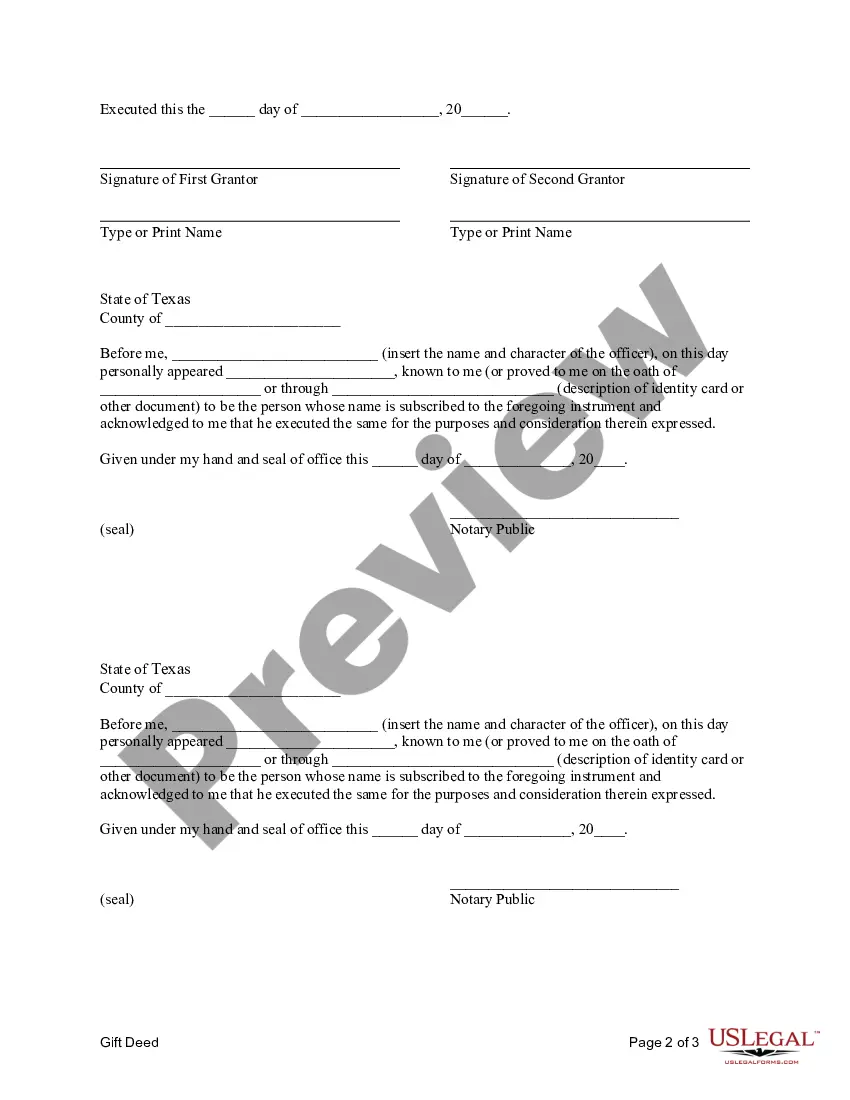

This form is a Gift Deed where the Grantors are Husband and Wife and the Grantee is an Individual. Grantors convey and warrant the described property to the Grantee. This deed complies with all state statutory laws.

A Tarrant Texas Gift Deed — Husband and Wife to an Individual is a legal document that allows a married couple to transfer ownership of real estate property as a gift to an individual recipient. This type of deed commonly used in Tarrant County, Texas, ensures that the transfer of property is properly documented and legally binding. Keywords: Tarrant Texas, gift deed, husband and wife, individual, transfer ownership, real estate property, legal document, Tarrant County, Texas, properly documented, legally binding. There are several types of Tarrant Texas Gift Deed — Husband and Wife to an Individual, each catering to specific situations and needs: 1. Irrevocable Gift Deed: This type of gift deed assures that the couple cannot revoke or take back the transfer of the property once the deed is recorded. It provides a permanent transfer of ownership to the individual recipient. 2. Joint Gift Deed with Right of Survivorship: In this scenario, the husband and wife become joint owners with the individual recipient, and upon the death of one spouse, the surviving spouse and the recipient will continue owning the property. 3. Gift Deed with Reserved Life Estates: This type allows the couple to gift the property to an individual while retaining certain rights, such as the right to live in or use the property until their death, after which the ownership is completely transferred to the individual. 4. Conditional Gift Deed: This gift deed is designed to include specific conditions that the individual recipient must fulfill to retain ownership of the property. Failure to meet these conditions can result in the property reverting to the husband and wife or being transferred to another party. 5. Gift Deed with Mortgage Assumption: In some cases, the couple may gift the property to an individual along with the responsibility of assuming any existing mortgage or other financial obligations related to the property. It is essential to consult with a qualified real estate attorney or legal professional specializing in property transfer in Tarrant County, Texas, to ensure that the selected gift deed type accurately reflects the couple's intentions and complies with the local regulations and laws.A Tarrant Texas Gift Deed — Husband and Wife to an Individual is a legal document that allows a married couple to transfer ownership of real estate property as a gift to an individual recipient. This type of deed commonly used in Tarrant County, Texas, ensures that the transfer of property is properly documented and legally binding. Keywords: Tarrant Texas, gift deed, husband and wife, individual, transfer ownership, real estate property, legal document, Tarrant County, Texas, properly documented, legally binding. There are several types of Tarrant Texas Gift Deed — Husband and Wife to an Individual, each catering to specific situations and needs: 1. Irrevocable Gift Deed: This type of gift deed assures that the couple cannot revoke or take back the transfer of the property once the deed is recorded. It provides a permanent transfer of ownership to the individual recipient. 2. Joint Gift Deed with Right of Survivorship: In this scenario, the husband and wife become joint owners with the individual recipient, and upon the death of one spouse, the surviving spouse and the recipient will continue owning the property. 3. Gift Deed with Reserved Life Estates: This type allows the couple to gift the property to an individual while retaining certain rights, such as the right to live in or use the property until their death, after which the ownership is completely transferred to the individual. 4. Conditional Gift Deed: This gift deed is designed to include specific conditions that the individual recipient must fulfill to retain ownership of the property. Failure to meet these conditions can result in the property reverting to the husband and wife or being transferred to another party. 5. Gift Deed with Mortgage Assumption: In some cases, the couple may gift the property to an individual along with the responsibility of assuming any existing mortgage or other financial obligations related to the property. It is essential to consult with a qualified real estate attorney or legal professional specializing in property transfer in Tarrant County, Texas, to ensure that the selected gift deed type accurately reflects the couple's intentions and complies with the local regulations and laws.