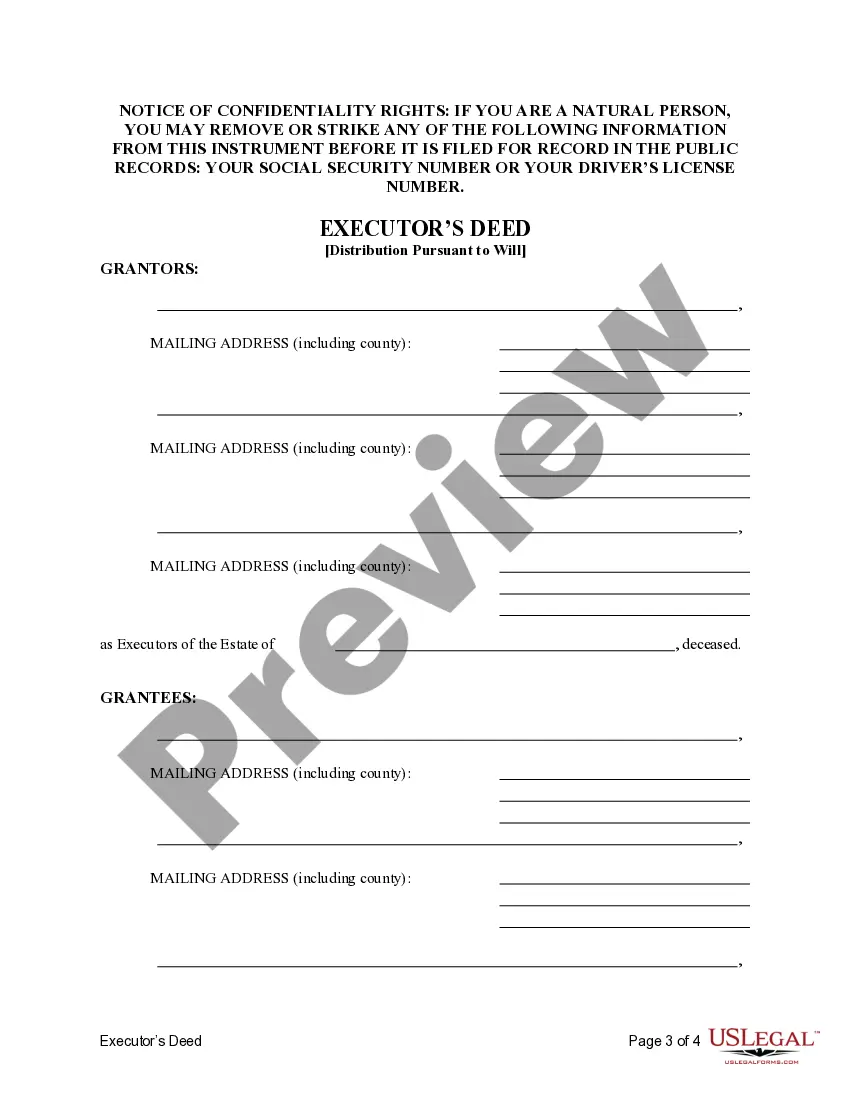

This form is an Executor's Deed where the Grantors are the executors of an estate and the Grantees are the beneficiaries of the estate. Grantors convey the described property to the Grantees. The Grantors warrants the title only as to events and acts while the property is held by the Executors. This deed complies with all state statutory laws.

Dallas Texas Executor's Deed - Three Executors to Five Beneficiaries Pursuant to Terms of Will

Description

How to fill out Texas Executor's Deed - Three Executors To Five Beneficiaries Pursuant To Terms Of Will?

Finding validated templates that are pertinent to your regional regulations can be challenging unless you utilize the US Legal Forms library.

It is an online repository of over 85,000 legal forms catering to both personal and business requirements as well as various real-life scenarios.

All the documents are appropriately classified by usage areas and jurisdiction domains, making the search for the Dallas Texas Executor's Deed - Three Executors to Five Beneficiaries Following the Terms of Will as straightforward as 1-2-3.

Maintaining documents orderly and compliant with legal standards is crucial. Leverage the US Legal Forms library to consistently have essential document templates readily available!

- Ensure you check the Preview mode and document description.

- Confirm that you have selected the correct one that fits your needs and fully aligns with your local jurisdiction criteria.

- If required, search for an alternative template.

- Upon discovering any discrepancies, utilize the Search tab above to locate the appropriate one. If it meets your needs, proceed to the following step.

- Select the document for purchase.

Form popularity

FAQ

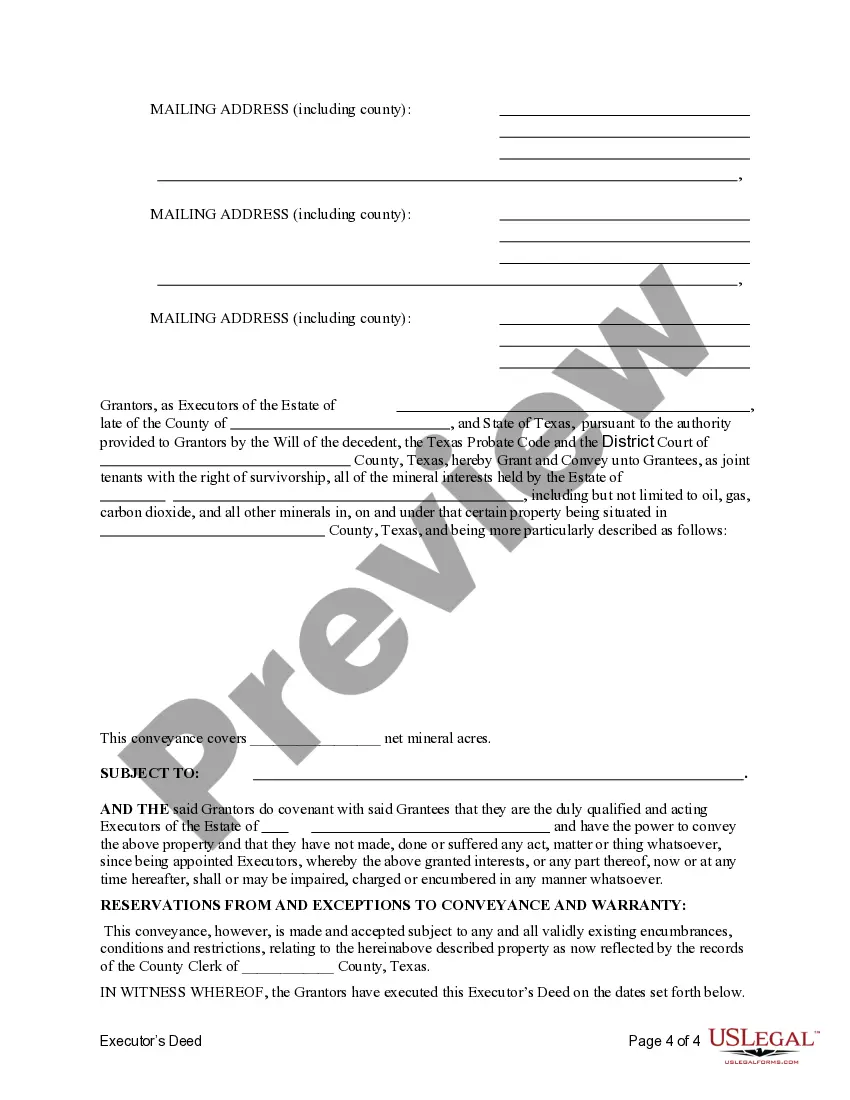

The Will must give the executor the power to sell property; Letters Testamentary must be issued; and. The estate Inventory and Appraisal has been filed with the court.

Where there are multiple executors, they can act on their own (severally) or as a group (jointly). However, the act of one of them is deemed in law to be an act of all of them. This means that even if the other executors disagree with the action/decision of another, the action/decision is still binding.

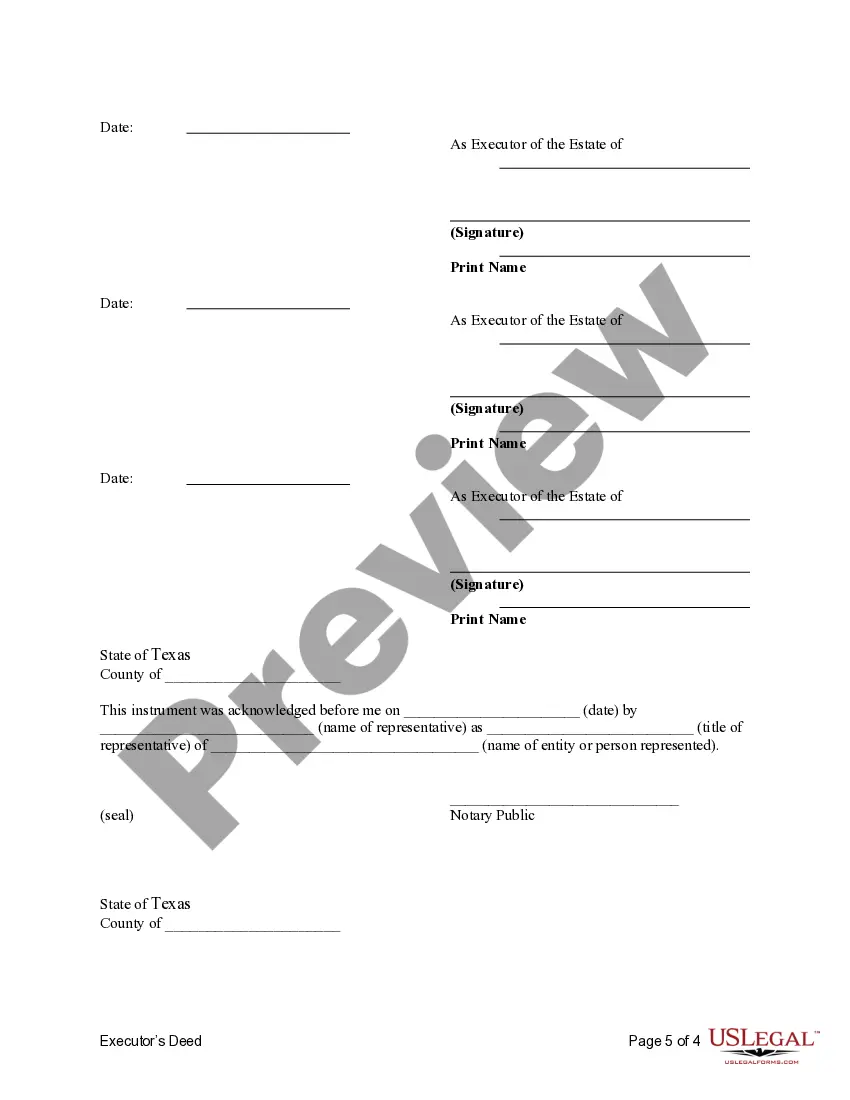

The executor is the person named in the Last Will and Testament to handle the affairs of the estate. When more than one person is appointed as executor the are referred to as co-executors.

What Are Executor Duties in Texas? Locate and notify all beneficiaries of the will; Give notice to the decedent's creditors; Identify and collect all the decedent's assets; Take steps to maintain and protect the assets; Pay all the decedent's debts; Bring a wrongful death suit, if appropriate, if family members do not;

Under Texas law, you can be removed as the executor of an estate for flagrant misconduct, mismanagement, or theft of the estate's assets. If enough evidence exists to believe you have stolen money or property under your control, you can be removed.

The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

People usually designate one person to serve as the executor of their will, but it is also possible to designate two or more co-executors. Most lawyers advise that one executor is best, as it avoids potential disputes, but there are situations where it may make sense to appoint co-executors.

Your will can name two or more co-executors. You can provide that your co-executors must act together or that each may act independently of the others. If you designate three or more co-executors, you can allow action to be taken by a majority vote.

If the will names more than four executors then some of those people must either choose to renounce their right to apply, or choose to reserve their right to apply. The reservation is made by signing a document known as a 'power reserved' letter.

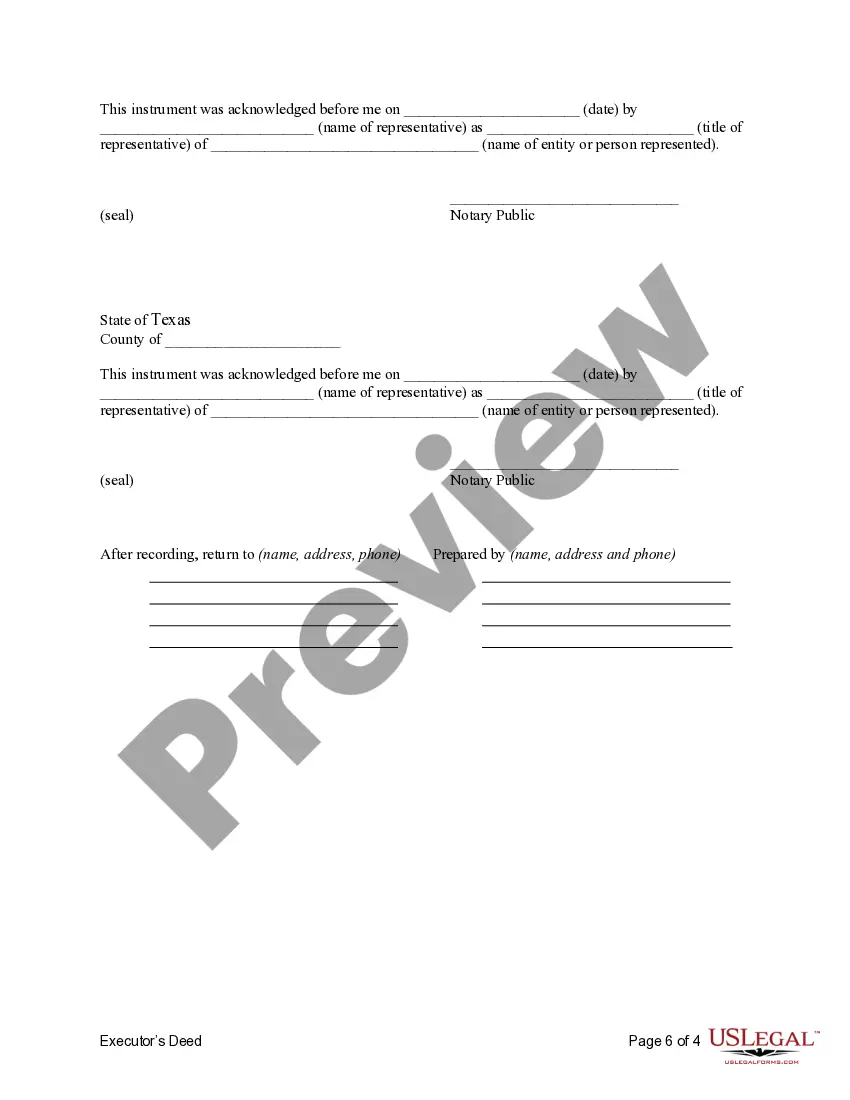

An Executor's Deed in Texas is used to transfer real property from the estate of a deceased property owner to the heir or heirs designated in their Will. It is signed by a court appointed Executor, who is the person named in a will to execute the terms of a Will.