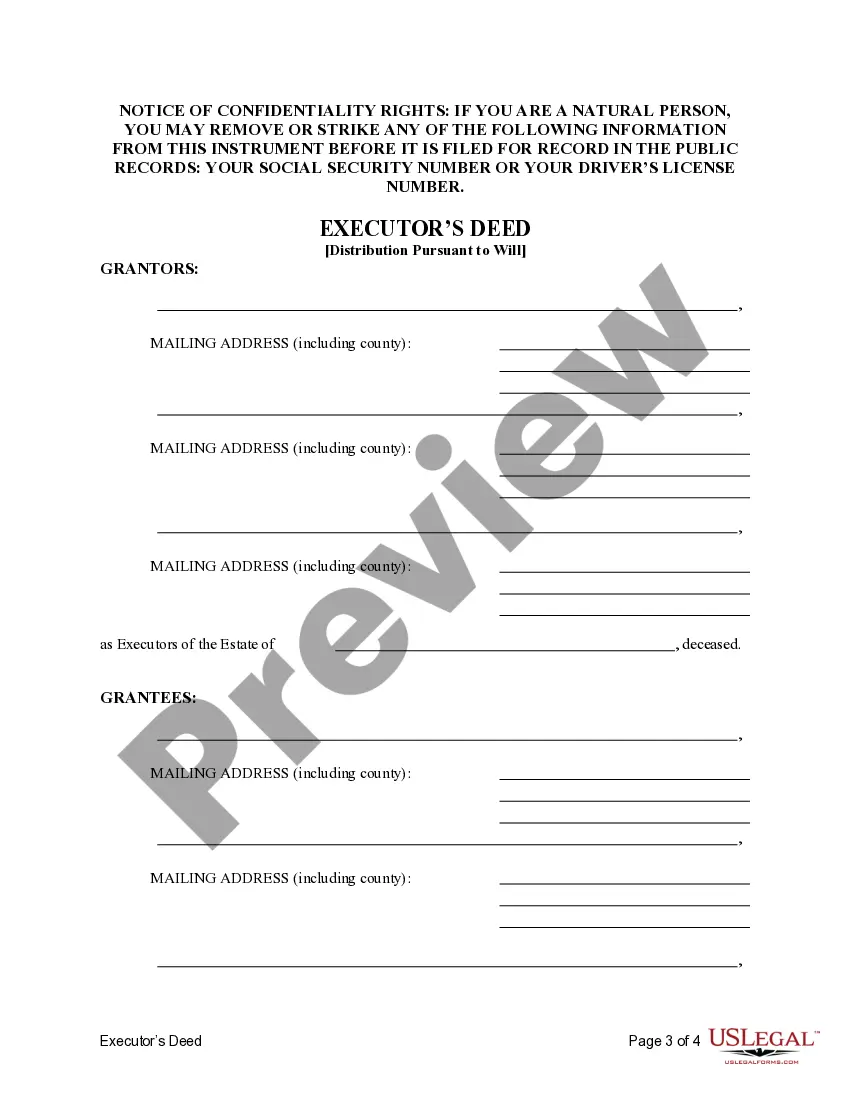

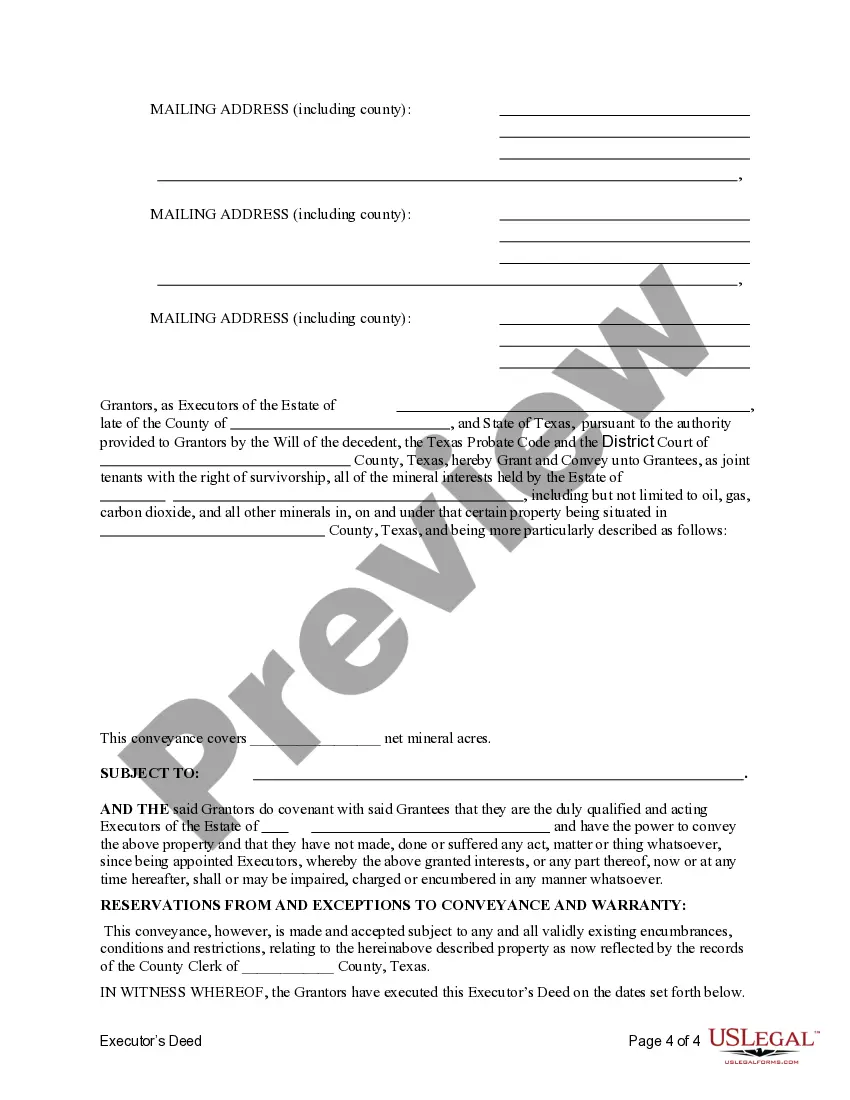

This form is an Executor's Deed where the Grantors are the executors of an estate and the Grantees are the beneficiaries of the estate. Grantors convey the described property to the Grantees. The Grantors warrants the title only as to events and acts while the property is held by the Executors. This deed complies with all state statutory laws.

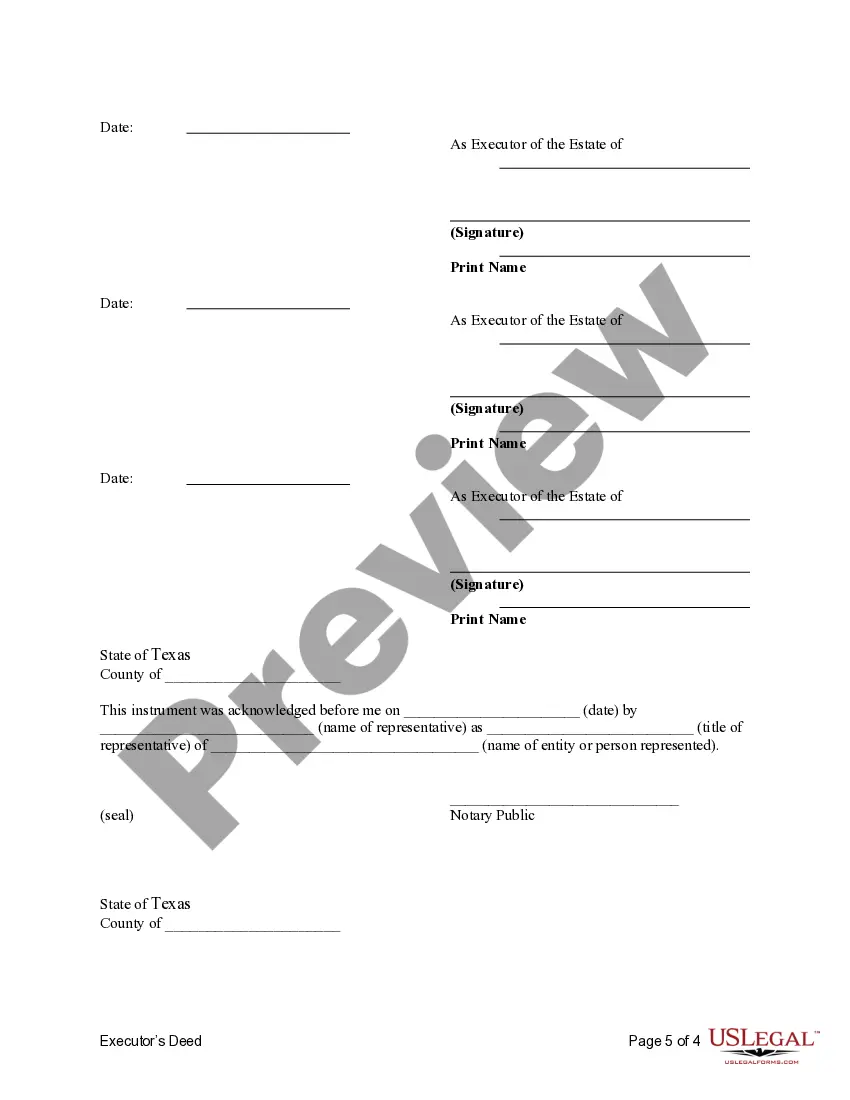

Keywords: Harris Texas, Executor's Deed, Three Executors, Five Beneficiaries, Pursuant to Terms of Will, Types. Title: Understanding the Harris Texas Executor's Deed — Three Executors to Five Beneficiaries Pursuant to Terms of Will Introduction: In Harris County, Texas, the Executor's Deed — Three Executors to Five Beneficiaries Pursuant to Terms of Will plays a crucial role in the efficient transfer of assets and inheritance. This detailed description aims to provide a comprehensive understanding of this legal document, its significance, and any variations that may exist. 1. Executor's Deed Defined: The Executor's Deed is a legally binding document that establishes the transfer of property from an estate's executor(s) to the designated beneficiaries. In the case of the Harris Texas Executor's Deed — Three Executors to Five Beneficiaries Pursuant to Terms of Will, it specifically caters to situations where three executors are involved in distributing assets among five beneficiaries, adhering to the specifications outlined in the deceased individual's will. 2. Importance of the Executor's Deed: The Executor's Deed holds immense importance, as it serves as evidence of rightful property transfer, protecting the rights of both executors and beneficiaries. This document ensures that the transfer process abides by the deceased person's intentions as expressed in their will, thereby preventing any disputes or conflicts among involved parties. 3. Key Elements of the Executor's Deed: a. Executors' Information: The deed should clearly state the names and contact details of the three executors assigned to administer the estate. b. Beneficiaries' Information: The names and contact information of the five beneficiaries entitled to receive the assets must be accurately specified. c. Terms of the Will: Details regarding the distribution of assets stated in the will, such as specific property allocation or alternative beneficiaries if necessary, should be documented. d. Legal Description of Property: A complete and accurate description of the property being transferred is a vital component of the deed. e. Signatures and Notarization: All executors, beneficiaries, and witnesses involved should sign the document in the presence of a notary public to validate its authenticity. Types of Harris Texas Executor's Deed — Three Executors to Five Beneficiaries Pursuant to Terms of Will: 1. Voluntary Executor's Deed: If all parties involved mutually agree on the distribution of assets, this type of deed is executed voluntarily, expediting the transfer process. 2. Court-Ordered Executor's Deed: In situations where disputes or conflicts arise among the involved parties, the court may intervene to issue an executor's deed, ensuring a fair distribution of assets according to the will's terms. 3. Special Circumstances Executor's Deed: This type of deed is utilized when unique circumstances, such as tax complications, creditor claims, or legal challenges, require specific provisions for the transfer of assets to five beneficiaries by three executors. Conclusion: The Harris Texas Executor's Deed — Three Executors to Five Beneficiaries Pursuant to Terms of Will is a legally significant document that facilitates the transfer of assets according to the deceased's intentions. By understanding its elements and different types, executors and beneficiaries can ensure a smooth and proper allocation of properties, minimizing potential conflicts and preserving the deceased person's wishes.Keywords: Harris Texas, Executor's Deed, Three Executors, Five Beneficiaries, Pursuant to Terms of Will, Types. Title: Understanding the Harris Texas Executor's Deed — Three Executors to Five Beneficiaries Pursuant to Terms of Will Introduction: In Harris County, Texas, the Executor's Deed — Three Executors to Five Beneficiaries Pursuant to Terms of Will plays a crucial role in the efficient transfer of assets and inheritance. This detailed description aims to provide a comprehensive understanding of this legal document, its significance, and any variations that may exist. 1. Executor's Deed Defined: The Executor's Deed is a legally binding document that establishes the transfer of property from an estate's executor(s) to the designated beneficiaries. In the case of the Harris Texas Executor's Deed — Three Executors to Five Beneficiaries Pursuant to Terms of Will, it specifically caters to situations where three executors are involved in distributing assets among five beneficiaries, adhering to the specifications outlined in the deceased individual's will. 2. Importance of the Executor's Deed: The Executor's Deed holds immense importance, as it serves as evidence of rightful property transfer, protecting the rights of both executors and beneficiaries. This document ensures that the transfer process abides by the deceased person's intentions as expressed in their will, thereby preventing any disputes or conflicts among involved parties. 3. Key Elements of the Executor's Deed: a. Executors' Information: The deed should clearly state the names and contact details of the three executors assigned to administer the estate. b. Beneficiaries' Information: The names and contact information of the five beneficiaries entitled to receive the assets must be accurately specified. c. Terms of the Will: Details regarding the distribution of assets stated in the will, such as specific property allocation or alternative beneficiaries if necessary, should be documented. d. Legal Description of Property: A complete and accurate description of the property being transferred is a vital component of the deed. e. Signatures and Notarization: All executors, beneficiaries, and witnesses involved should sign the document in the presence of a notary public to validate its authenticity. Types of Harris Texas Executor's Deed — Three Executors to Five Beneficiaries Pursuant to Terms of Will: 1. Voluntary Executor's Deed: If all parties involved mutually agree on the distribution of assets, this type of deed is executed voluntarily, expediting the transfer process. 2. Court-Ordered Executor's Deed: In situations where disputes or conflicts arise among the involved parties, the court may intervene to issue an executor's deed, ensuring a fair distribution of assets according to the will's terms. 3. Special Circumstances Executor's Deed: This type of deed is utilized when unique circumstances, such as tax complications, creditor claims, or legal challenges, require specific provisions for the transfer of assets to five beneficiaries by three executors. Conclusion: The Harris Texas Executor's Deed — Three Executors to Five Beneficiaries Pursuant to Terms of Will is a legally significant document that facilitates the transfer of assets according to the deceased's intentions. By understanding its elements and different types, executors and beneficiaries can ensure a smooth and proper allocation of properties, minimizing potential conflicts and preserving the deceased person's wishes.