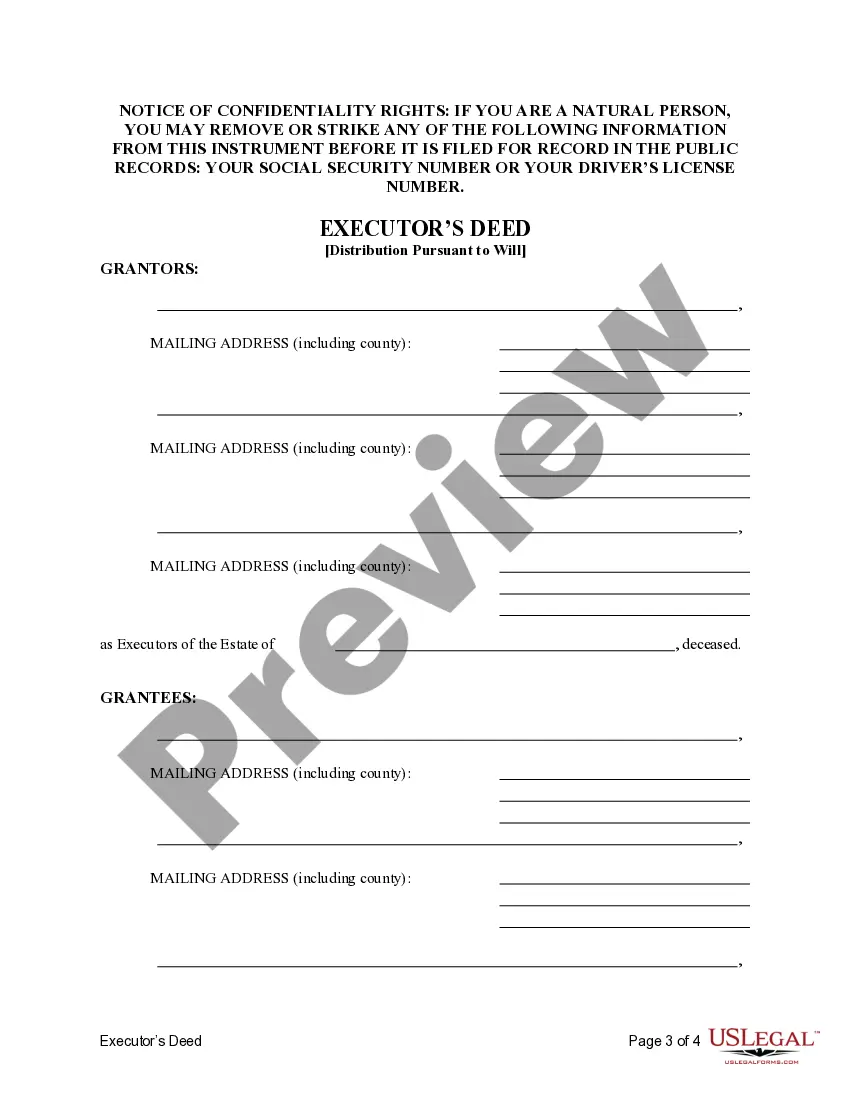

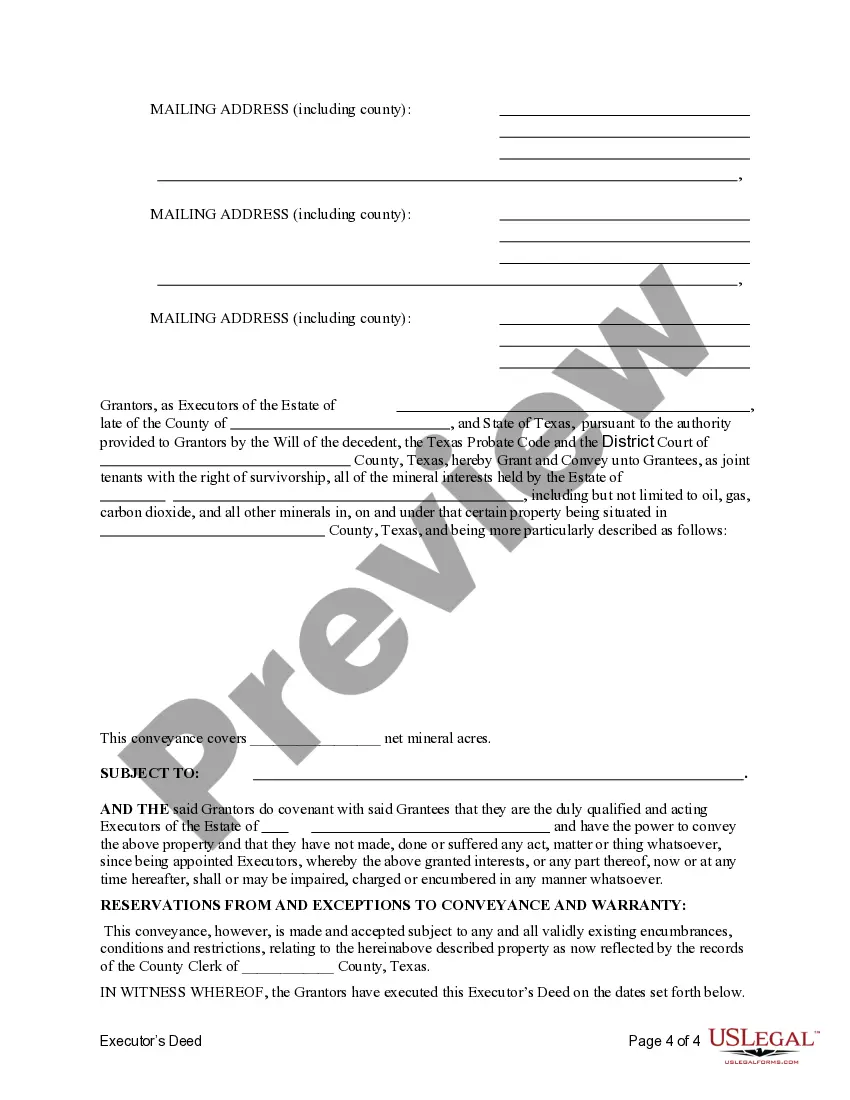

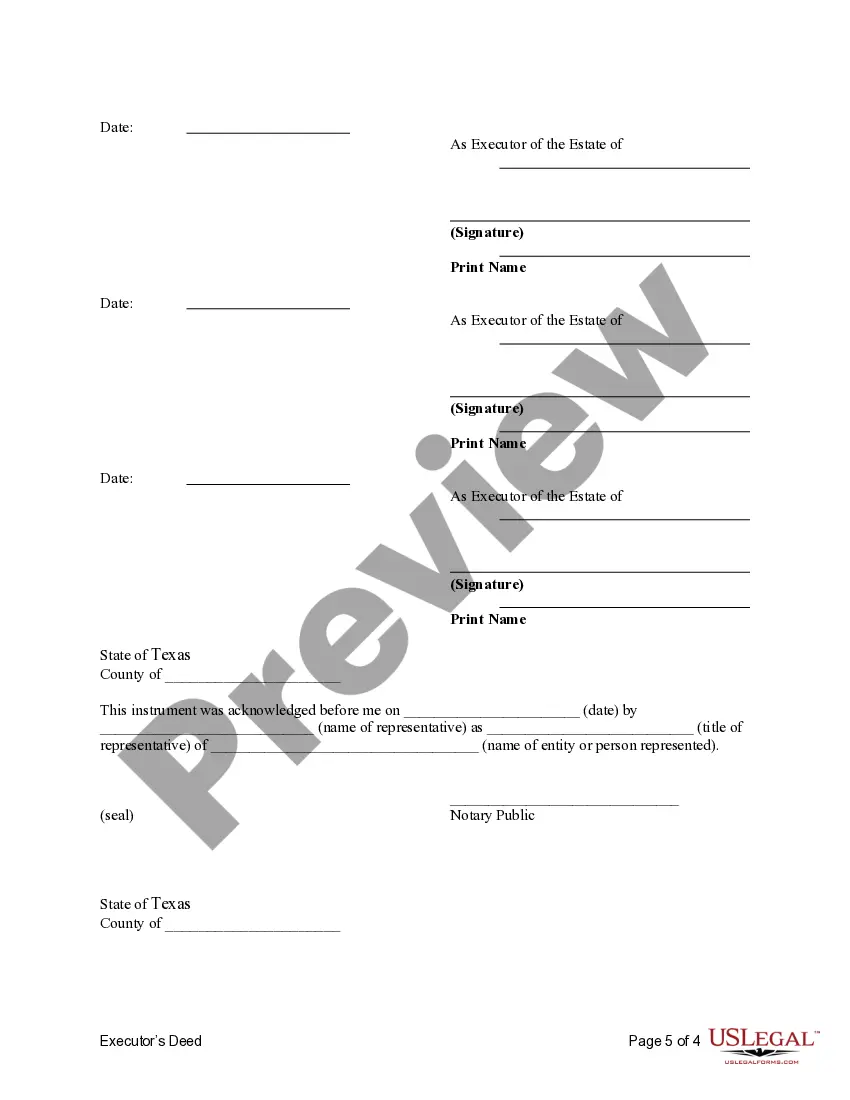

This form is an Executor's Deed where the Grantors are the executors of an estate and the Grantees are the beneficiaries of the estate. Grantors convey the described property to the Grantees. The Grantors warrants the title only as to events and acts while the property is held by the Executors. This deed complies with all state statutory laws.

The Houston Texas Executor's Deed — Three Executors to Five Beneficiaries Pursuant to Terms of Will is a legal document used in the state of Texas to transfer real estate property from three executors to five beneficiaries, in accordance with the terms specified in a will. This type of deed is utilized when a deceased person has designated three individuals as executors of their estate in their will, and there are five beneficiaries named who are entitled to receive ownership or interest in a particular property. The purpose of this deed is to facilitate the smooth transfer of property from the deceased person's estate to the beneficiaries. The Houston Texas Executor's Deed must adhere to the specific requirements set forth in the state's laws to ensure its validity and enforceability. It should include necessary details such as the names and addresses of the executors and beneficiaries involved, a clear description of the property being transferred, and references to the specific terms outlined in the deceased person's will. There may be variations or subtypes of the Houston Texas Executor's Deed depending on the specific circumstances or additional provisions in the will. For instance, if the will designates different numbers of executors or beneficiaries, the deed would be titled accordingly (e.g., Houston Texas Executor's Deed — Two Executors to Three Beneficiaries Pursuant to Terms of Will). Furthermore, the terms of the will may outline specific conditions or restrictions on the transfer of the property, which would then need to be stated and adhered to in the deed. It is important to engage the services of a qualified attorney familiar with estate and real estate laws in Texas when preparing the Houston Texas Executor's Deed. This ensures that the deed is accurately drafted, legally sound, and in compliance with all relevant regulations. Additionally, legal guidance can help to address any potential complexities or challenges that may arise during the transfer process, minimizing potential disputes among executors or beneficiaries. By utilizing the Houston Texas Executor's Deed — Three Executors to Five Beneficiaries Pursuant to Terms of Will, individuals involved can smoothly and lawfully transfer property from an estate to its rightful beneficiaries, allowing for the efficient distribution of assets in accordance with the deceased person's wishes.