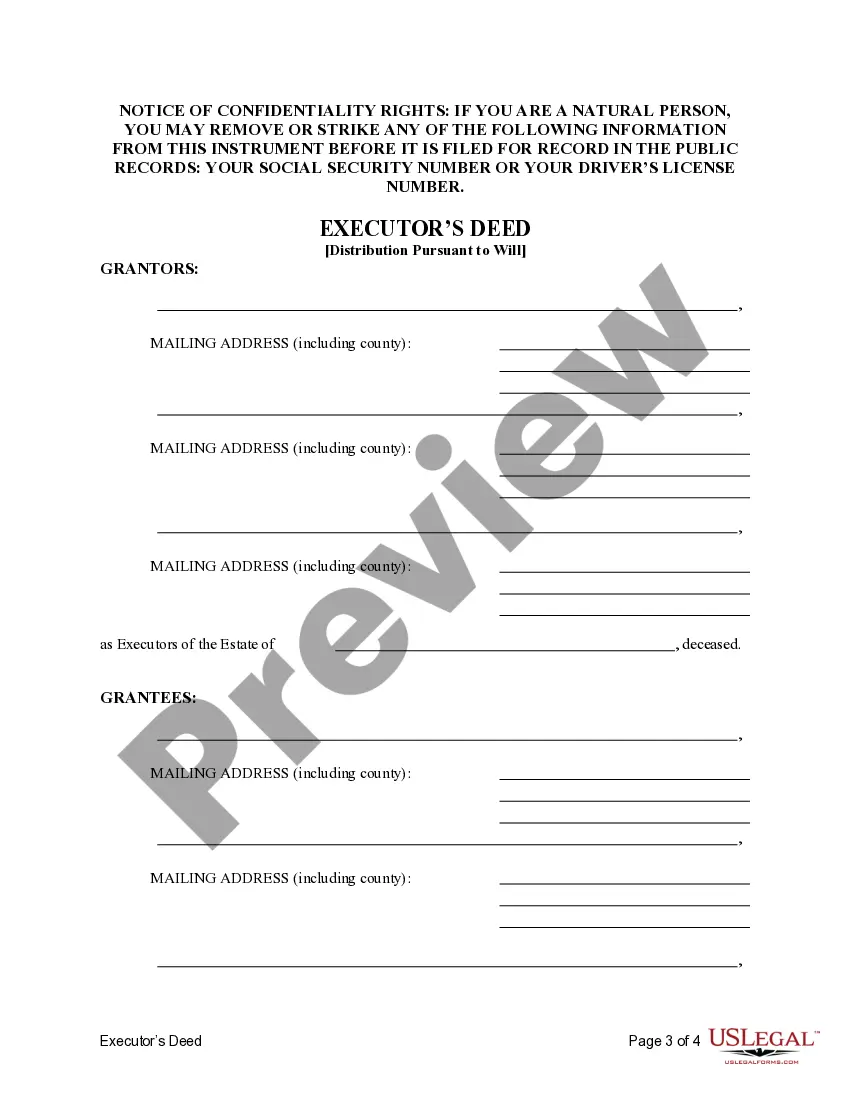

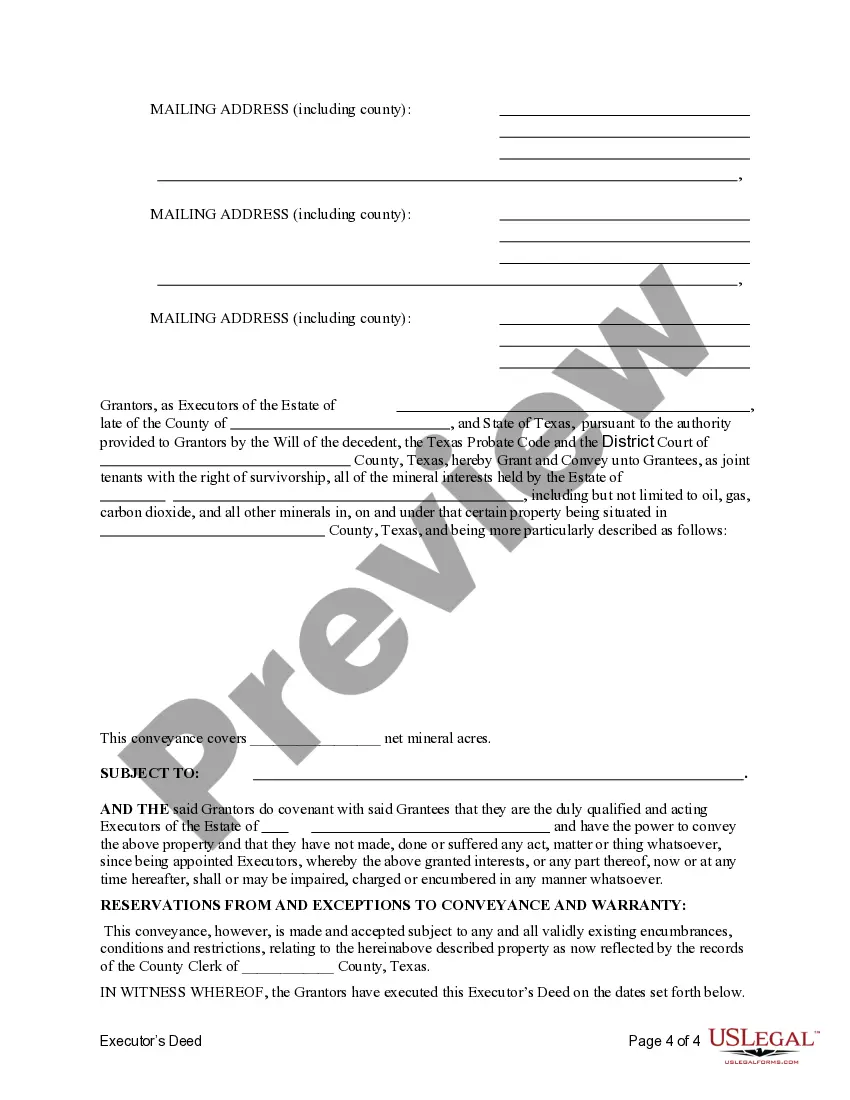

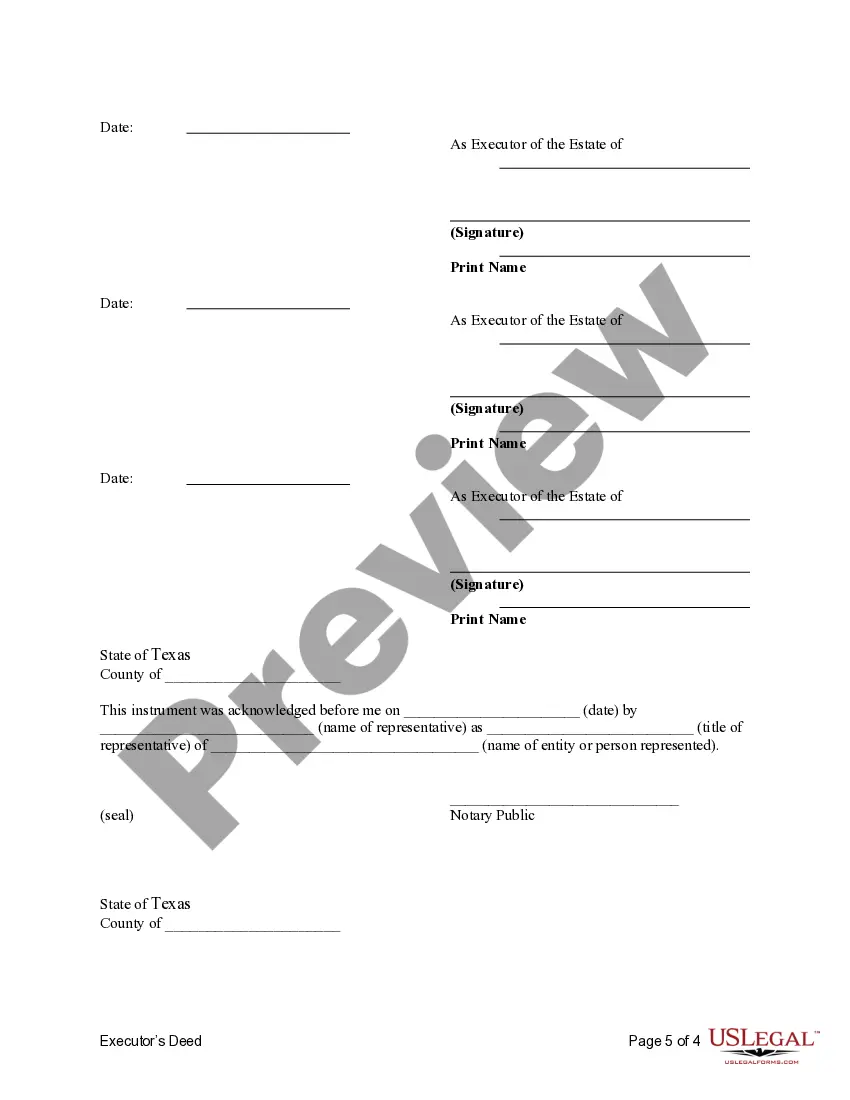

This form is an Executor's Deed where the Grantors are the executors of an estate and the Grantees are the beneficiaries of the estate. Grantors convey the described property to the Grantees. The Grantors warrants the title only as to events and acts while the property is held by the Executors. This deed complies with all state statutory laws.

A McKinney Texas Executor's Deed — Three Executors to Five Beneficiaries Pursuant to Terms of Will is a legal document that transfers property ownership from the deceased person's estate to multiple beneficiaries according to the stipulations outlined in their will. This type of deed is specific to McKinney, Texas, and involves three appointed executors overseeing the distribution of assets to five beneficiaries. In the case of multiple executors, each executor would work together to fulfill the deceased person's wishes as per the will. The executor's duty is to manage the legal and financial affairs of the deceased, including filing taxes, paying debts, and ultimately distributing the estate to the designated beneficiaries. The McKinney Texas Executor's Deed — Three Executors to Five Beneficiaries Pursuant to Terms of Will helps ensure that the transfer of property ownership occurs smoothly and in accordance with the deceased person's expressed wishes. The deed serves as proof of transfer and provides legal protection to all parties involved. Different types of McKinney Texas Executor's Deeds may exist depending on the specific circumstances outlined in the will. These may include Executor's Deed with Specific Bequests, Executor's Deed with Residuary Bequests, Executor's Deed with Contingent Bequests, or Executor's Deed with Trust Provisions, among others. In summary, a McKinney Texas Executor's Deed — Three Executors to Five Beneficiaries Pursuant to Terms of Will enables the transfer of ownership of a deceased person's assets to multiple beneficiaries as outlined in their will. It ensures the proper distribution of assets and protects the rights of both executors and beneficiaries.