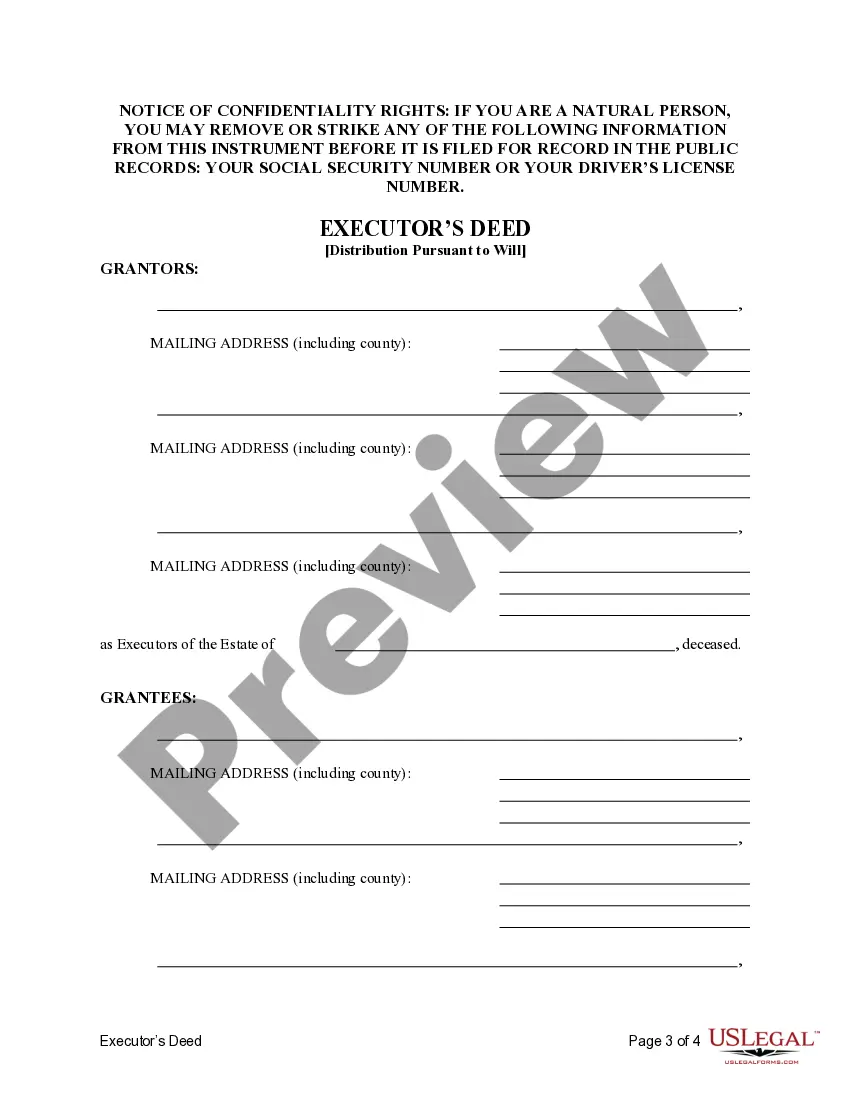

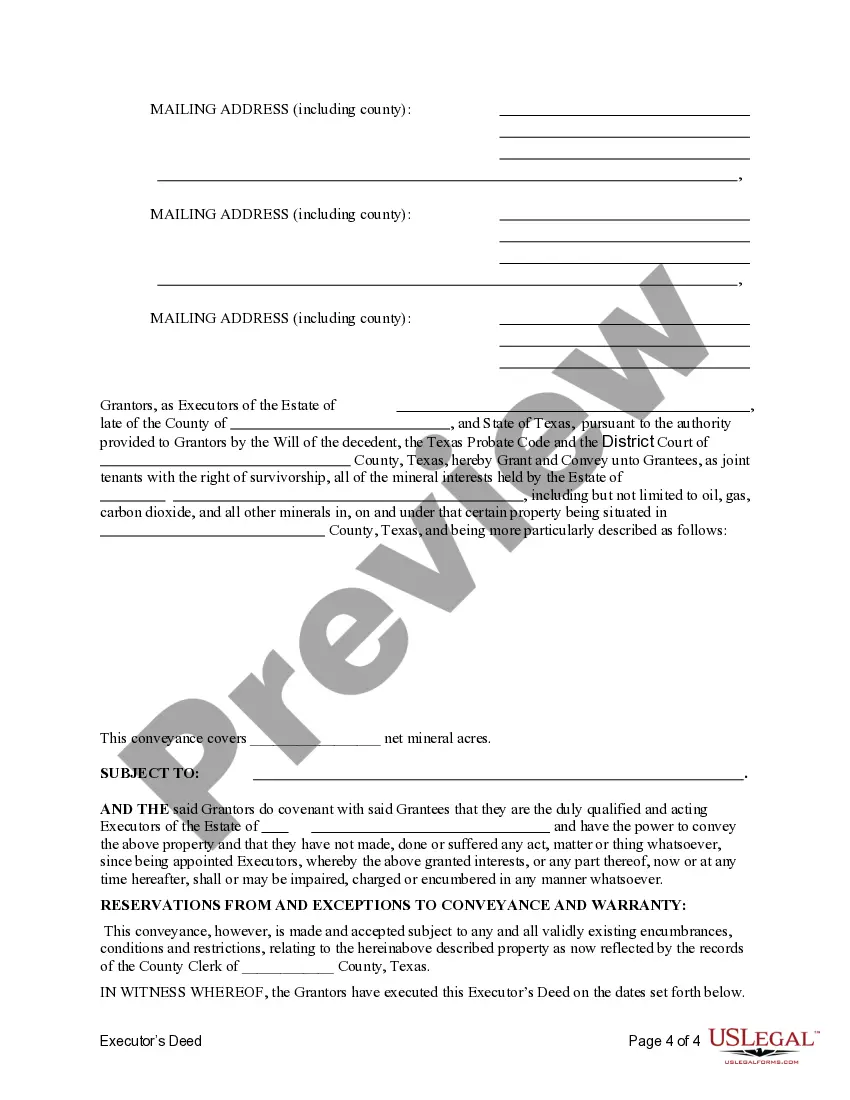

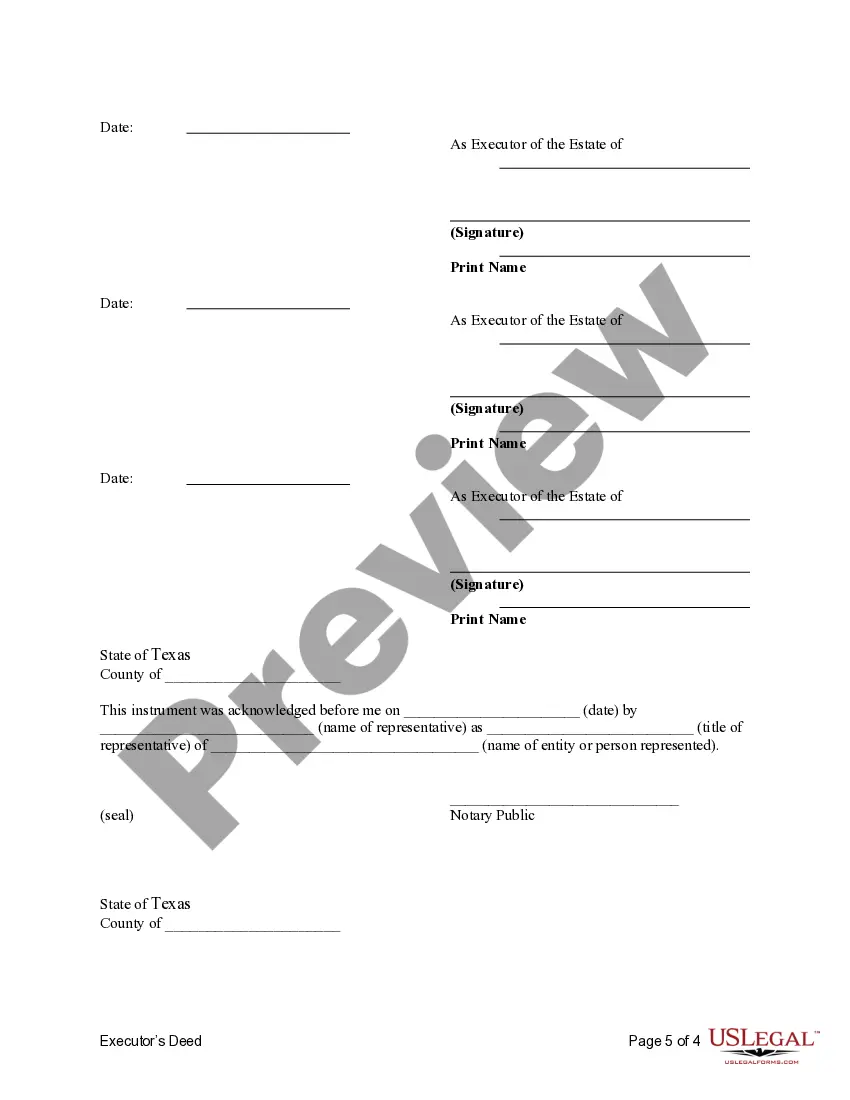

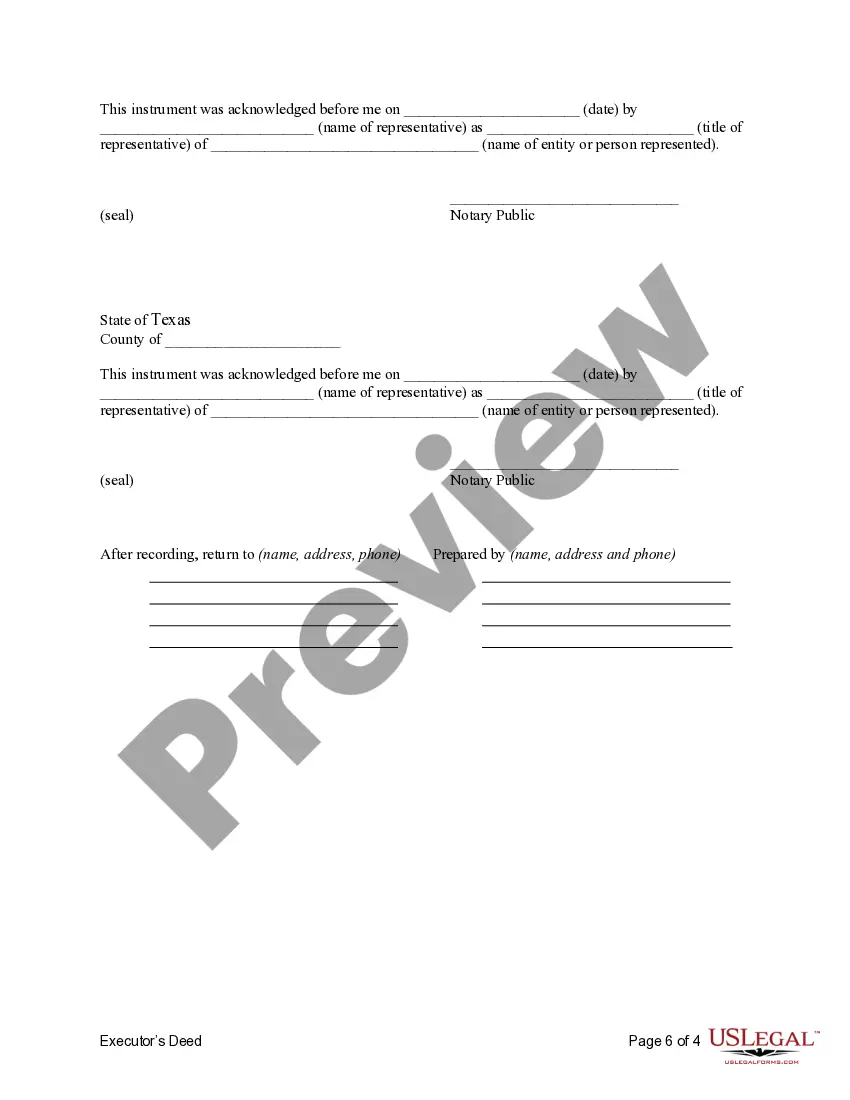

This form is an Executor's Deed where the Grantors are the executors of an estate and the Grantees are the beneficiaries of the estate. Grantors convey the described property to the Grantees. The Grantors warrants the title only as to events and acts while the property is held by the Executors. This deed complies with all state statutory laws.

Sugar Land Texas Executor's Deed — Three Executors to Five Beneficiaries Pursuant to Terms of Will In Sugar Land, Texas, the Executor's Deed plays a crucial role in transferring property ownership following the terms outlined in a deceased individual's will. When three executors are involved in the execution of the will, the distribution of assets to five beneficiaries may require the utilization of a specific type of Executor's Deed. The Executor's Deed serves as a legal document that authorizes the transfer of property from the deceased person's estate to the designated beneficiaries. This deed is tailored to the specific circumstances outlined in the will, which may include three executors working together to ensure the beneficiaries' rights are upheld. The Executor's Deed is executed in compliance with the Texas probate laws and reflects the intent of the deceased individual as expressed in their will. It is essential to follow the precise instructions and provisions stated in the will to ensure a smooth execution of the estate's distribution. The sugar Land Texas Executor's Deed — Three Executors to Five Beneficiaries Pursuant to the Terms of Will may have variations depending on the specific requirements outlined in the will. Some possible variations or additional categories may include: 1. Executor's Deed — Joint Tenancy: If the will specifies a joint tenancy arrangement among the three executors, who is an after the will's execution, act as tenants-in-common in transferring the property to the five beneficiaries. 2. Executor's Deed — Trust Agreement: If the deceased person's estate is held within a trust, the Executor's Deed may be executed in accordance with the terms specified within the trust agreement, with three executors working together to distribute the property to the five beneficiaries as outlined. 3. Executor's Deed — Life Estates: In situations where the will establishes life estate rights, the Executor's Deed may ensure the smooth transfer of property to the five beneficiaries under the guidance of the three executors, considering the specific conditions and terms of the will. 4. Executor's Deed — Power of Sale: If the will grants the three executors the power of sale, the Executor's Deed may facilitate the transfer of property ownership to the five beneficiaries as per the terms specified in the will, with the option to sell the property if necessary. It is important to consult with an experienced attorney or legal professional in Sugar Land, Texas, to ensure that the Executor's Deed is properly drafted and executed in compliance with the deceased person's will and relevant probate laws. The involvement of three executors and the distribution of assets to five beneficiaries make the process more complex, necessitating professional guidance to achieve a successful transfer of property ownership.