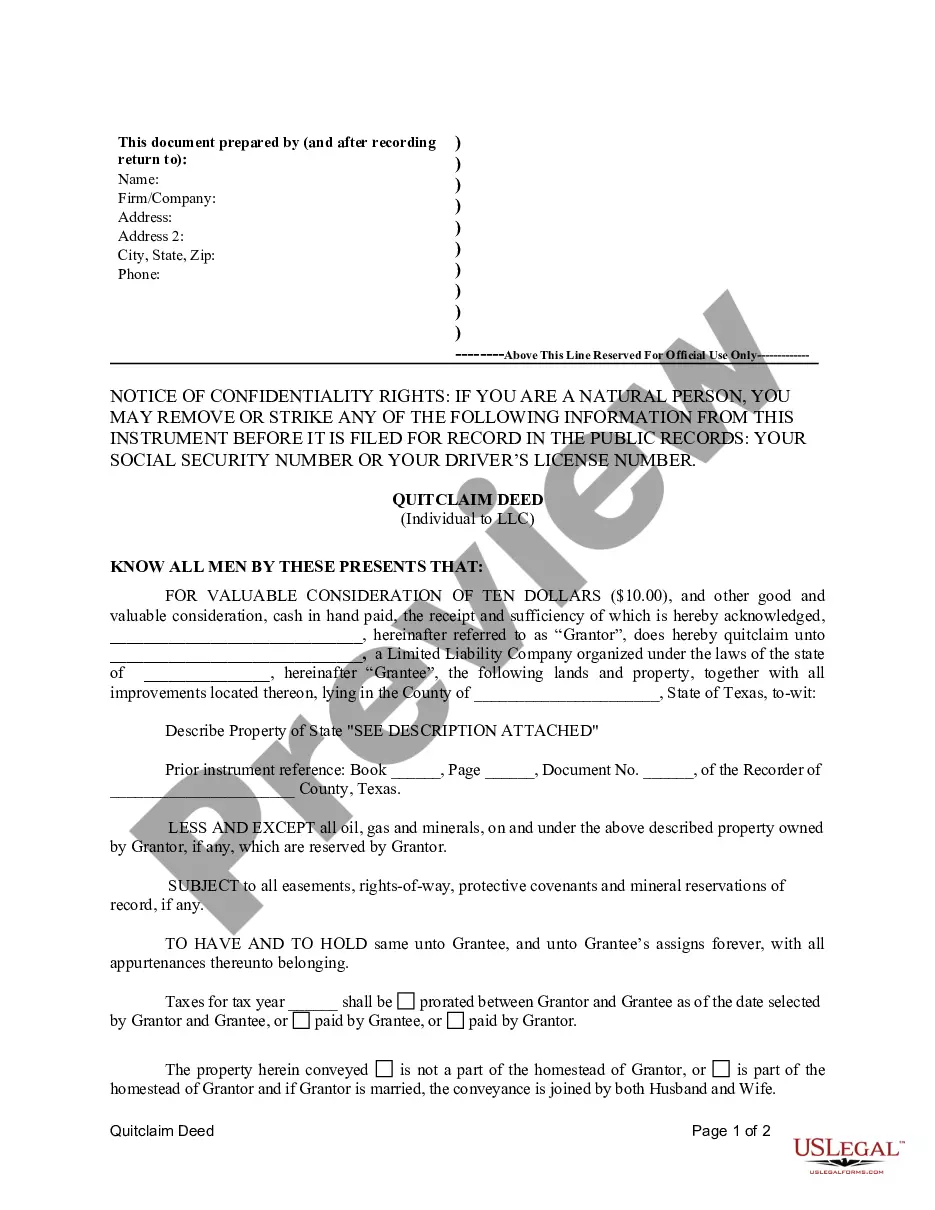

This Quitclaim Deed from Individual to LLC form is a Quitclaim Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

A Collin Texas Quitclaim Deed from Individual to LLC is a legal document that allows an individual (the granter) to transfer their ownership interest in a property to a limited liability company (LLC) (the grantee) in Collin County, Texas. This type of deed is often used when an individual wants to transfer ownership of a property they own personally to an LLC that they have formed. A Collin Texas Quitclaim Deed from Individual to LLC serves as evidence of the transfer of ownership rights, title, and interest from the individual to the LLC. The granter relinquishes any claims or rights they have on the property, transferring them to the LLC. This deed does not provide any warranties or guarantees regarding the property's title or any encumbrances it may have. Different types of Collin Texas Quitclaim Deeds from Individual to LLC include: 1. Straightforward Individual to LLC Quitclaim Deed: This is the most common type where an individual transfers full ownership of a property to their newly formed LLC. It outlines the granter's intent to transfer all their rights and interest in the property to the LLC with no specific limitations. 2. Partial Interest Individual to LLC Quitclaim Deed: In this case, the individual transfers only a portion or percentage of their ownership interest in the property to the LLC. This can be useful when multiple individuals want to become partners or co-owners of the LLC, with each contributing a portion of their property interest. 3. Encumbrance Individual to LLC Quitclaim Deed: This type of quitclaim deed allows the individual to transfer the property to the LLC while also transferring specific encumbrances or debts associated with the property. The LLC accepts these encumbrances as part of the transfer, taking responsibility for them. 4. Affidavit of Title Individual to LLC Quitclaim Deed: This type of quitclaim deed is often used when the individual wants to guarantee that they hold a clear and marketable title to the property. By signing an Affidavit of Title, the granter affirms that they are the sole owner of the property and that there are no existing claims or liens against it. 5. Special Use Individual to LLC Quitclaim Deed: This deed is used when the individual wants to transfer the property ownership to an LLC for a specific purpose, such as for rental or commercial use. The deed may include specific restrictions or conditions related to the property's future use by the LLC. Overall, a Collin Texas Quitclaim Deed from Individual to LLC facilitates the legal transfer of property ownership from an individual to an LLC in Collin County, Texas. It is crucial to consult with a real estate attorney or professional to ensure the proper execution and recording of the deed to protect the interests of all parties involved.