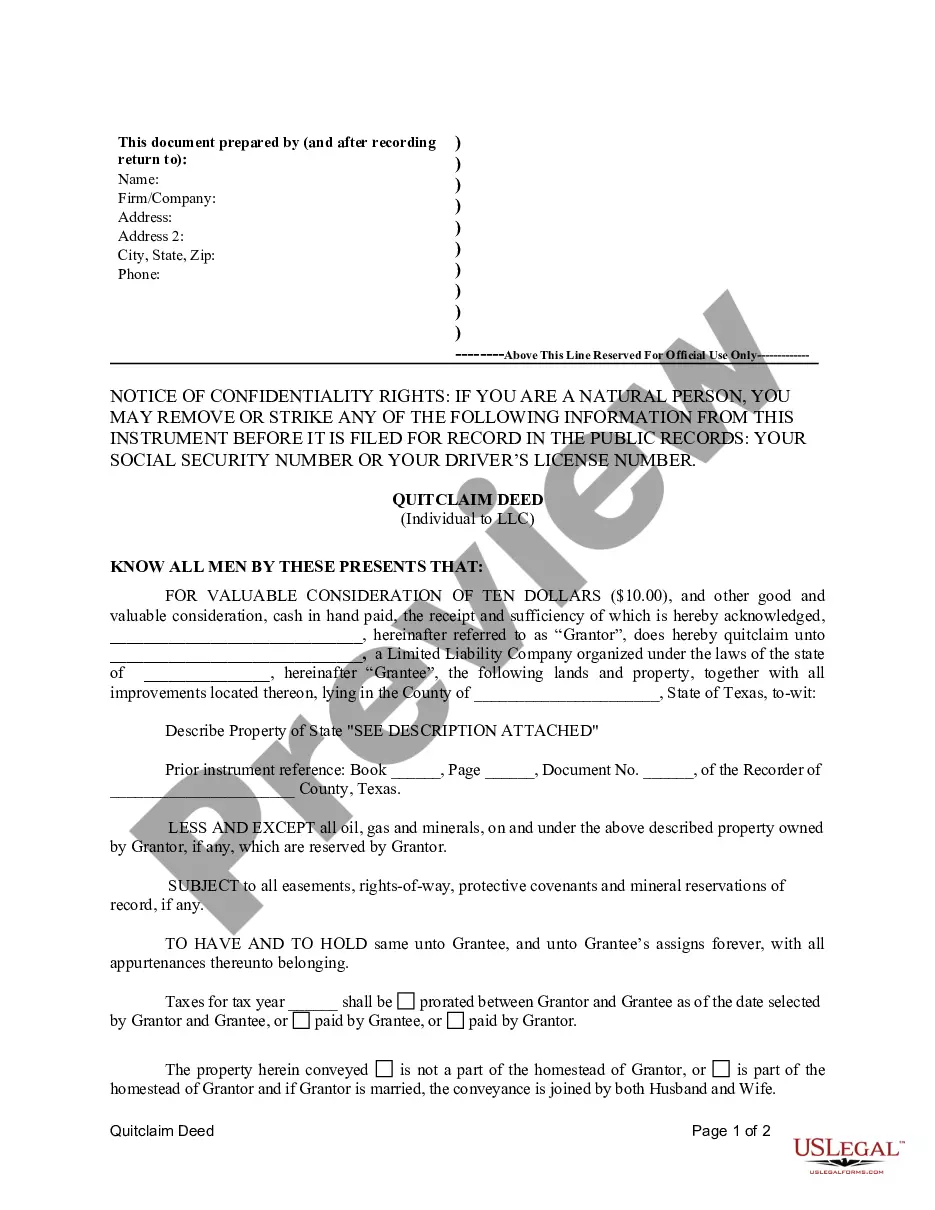

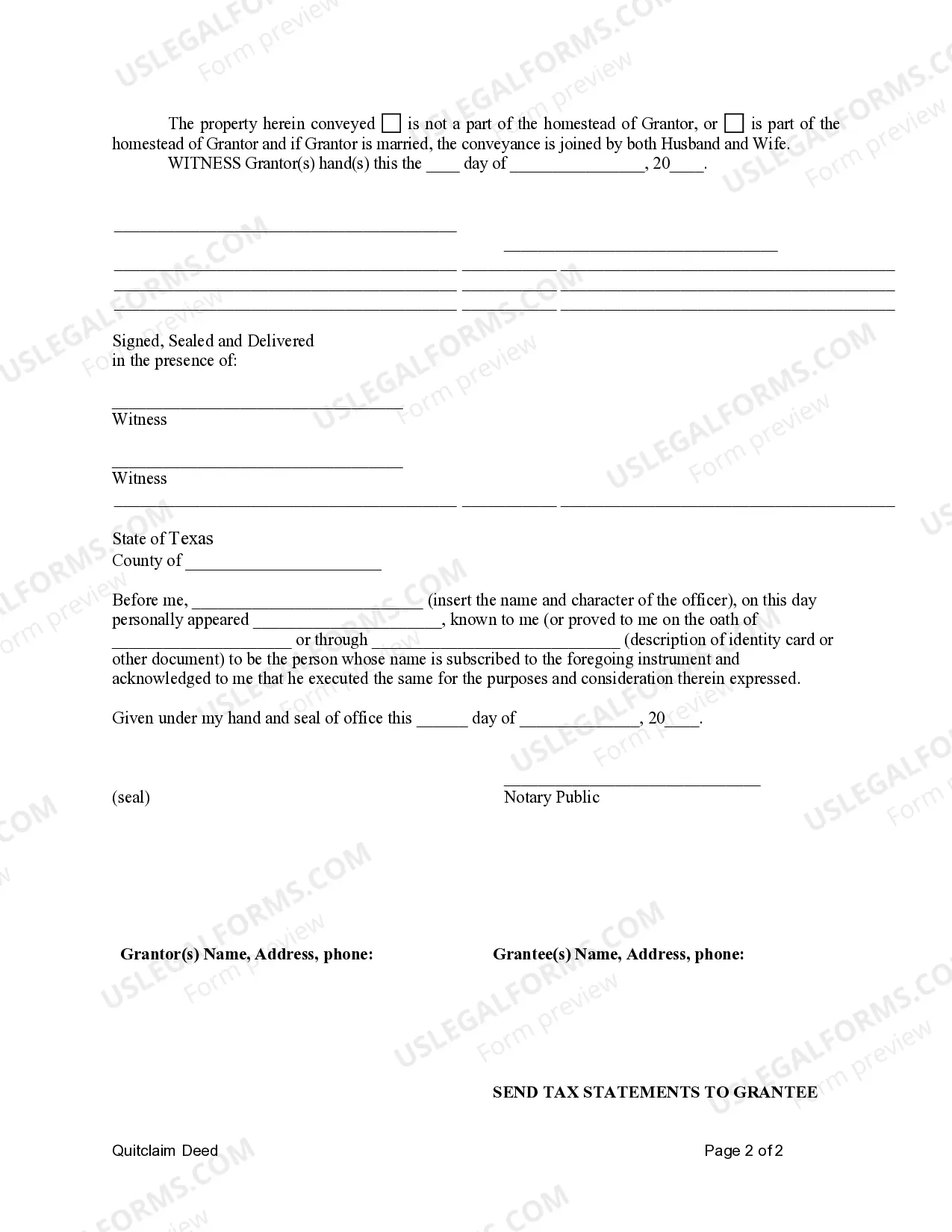

This Quitclaim Deed from Individual to LLC form is a Quitclaim Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

A Frisco Texas quitclaim deed from an Individual to an LLC is a legal document used to transfer ownership of a property located in Frisco, Texas, from an individual to a Limited Liability Company (LLC). This type of deed is commonly used when an individual wishes to transfer their property to an LLC they are establishing or already a part of. It is crucial to note that a quitclaim deed does not provide any warranties or guarantees about the property's title status, but it simply transfers whatever interest the granter (individual) has in the property to the grantee (LLC). Keywords: Frisco Texas, quitclaim deed, Individual, LLC, transfer ownership, property, Limited Liability Company, legal document, title status, granter, grantee. Different types of Frisco Texas Quitclaim Deeds from Individual to LLC: 1. Frisco Texas Quitclaim Deed for Real Estate Transfer from Individual to LLC: This type of quitclaim deed is used when an individual wants to transfer ownership of a real estate property, such as a residential home or commercial building, located in Frisco, Texas, to an LLC. The deed documents the transfer of ownership rights and interests, without making any warranties or guarantees about the property's title status. 2. Frisco Texas Quitclaim Deed for Land Transfer from Individual to LLC: This quitclaim deed is specifically designed for transferring the ownership of undeveloped land located in Frisco, Texas, from an individual to an LLC. It allows the individual to convey their interest in the land to the LLC, facilitating future development or investment plans. 3. Frisco Texas Quitclaim Deed for Investment Property Transfer from Individual to LLC: This type of quitclaim deed is used when an individual wants to transfer ownership of an investment property, such as a rental property or commercial property, located in Frisco, Texas, to an LLC. It enables the individual to transfer their ownership interests in the property to the LLC, allowing for easy management, tax advantages, and liability protection. 4. Frisco Texas Quitclaim Deed with Reservation of Rights from Individual to LLC: In certain cases, an individual may wish to transfer ownership of a property to an LLC using a quitclaim deed but also retain certain rights or interests in the property. This type of quitclaim deed, known as a quitclaim deed with a reservation of rights, is utilized for such transactions in Frisco, Texas. The individual may reserve specific rights, such as access to certain areas of the property or mineral rights, while transferring the remaining ownership to the LLC. These types of Frisco Texas quitclaim deeds from an Individual to an LLC provide a legal means to transfer property ownership, allowing individuals to leverage the benefits and protections offered by LCS for their real estate or investment interests. It is recommended to consult with a qualified real estate attorney or title company for guidance and assistance in executing such transactions.A Frisco Texas quitclaim deed from an Individual to an LLC is a legal document used to transfer ownership of a property located in Frisco, Texas, from an individual to a Limited Liability Company (LLC). This type of deed is commonly used when an individual wishes to transfer their property to an LLC they are establishing or already a part of. It is crucial to note that a quitclaim deed does not provide any warranties or guarantees about the property's title status, but it simply transfers whatever interest the granter (individual) has in the property to the grantee (LLC). Keywords: Frisco Texas, quitclaim deed, Individual, LLC, transfer ownership, property, Limited Liability Company, legal document, title status, granter, grantee. Different types of Frisco Texas Quitclaim Deeds from Individual to LLC: 1. Frisco Texas Quitclaim Deed for Real Estate Transfer from Individual to LLC: This type of quitclaim deed is used when an individual wants to transfer ownership of a real estate property, such as a residential home or commercial building, located in Frisco, Texas, to an LLC. The deed documents the transfer of ownership rights and interests, without making any warranties or guarantees about the property's title status. 2. Frisco Texas Quitclaim Deed for Land Transfer from Individual to LLC: This quitclaim deed is specifically designed for transferring the ownership of undeveloped land located in Frisco, Texas, from an individual to an LLC. It allows the individual to convey their interest in the land to the LLC, facilitating future development or investment plans. 3. Frisco Texas Quitclaim Deed for Investment Property Transfer from Individual to LLC: This type of quitclaim deed is used when an individual wants to transfer ownership of an investment property, such as a rental property or commercial property, located in Frisco, Texas, to an LLC. It enables the individual to transfer their ownership interests in the property to the LLC, allowing for easy management, tax advantages, and liability protection. 4. Frisco Texas Quitclaim Deed with Reservation of Rights from Individual to LLC: In certain cases, an individual may wish to transfer ownership of a property to an LLC using a quitclaim deed but also retain certain rights or interests in the property. This type of quitclaim deed, known as a quitclaim deed with a reservation of rights, is utilized for such transactions in Frisco, Texas. The individual may reserve specific rights, such as access to certain areas of the property or mineral rights, while transferring the remaining ownership to the LLC. These types of Frisco Texas quitclaim deeds from an Individual to an LLC provide a legal means to transfer property ownership, allowing individuals to leverage the benefits and protections offered by LCS for their real estate or investment interests. It is recommended to consult with a qualified real estate attorney or title company for guidance and assistance in executing such transactions.