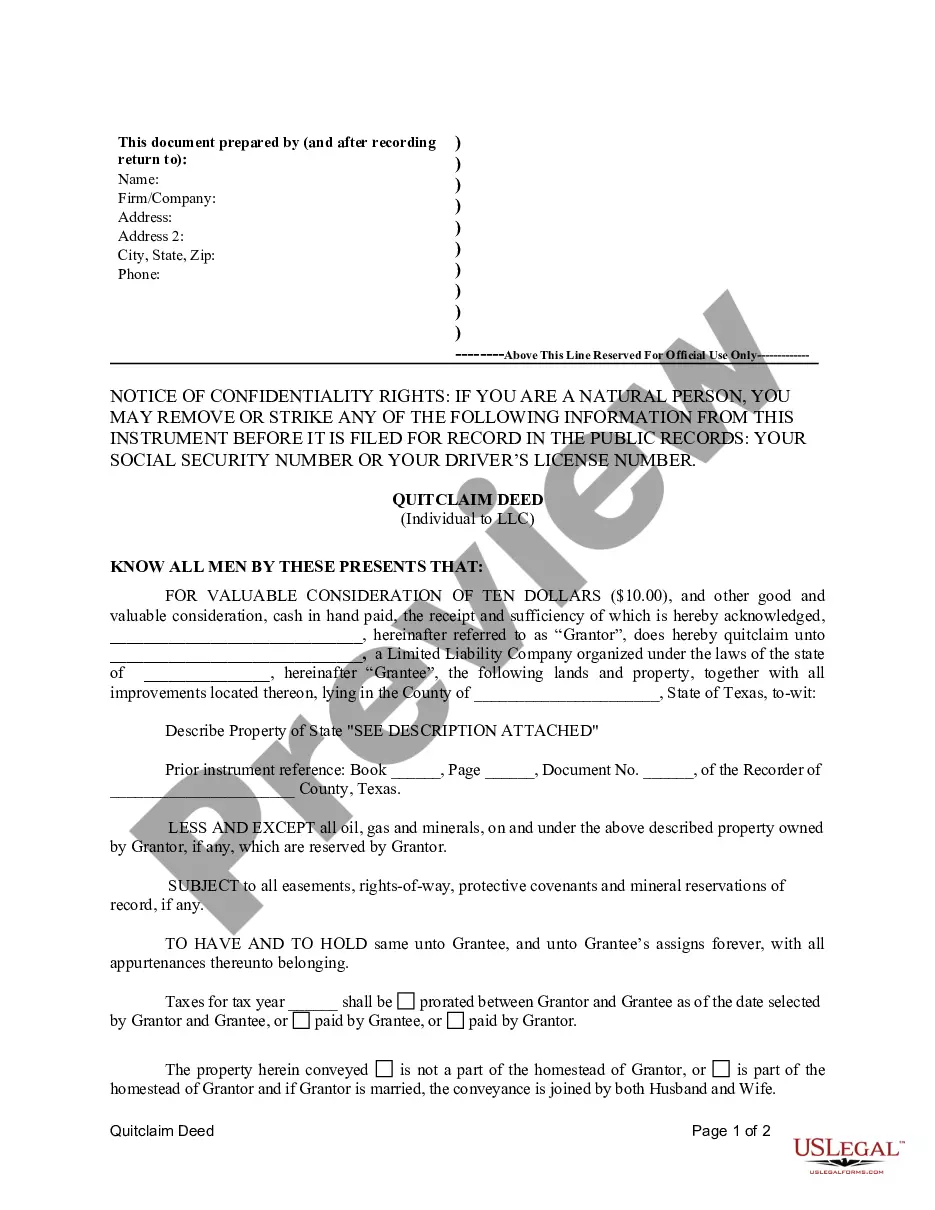

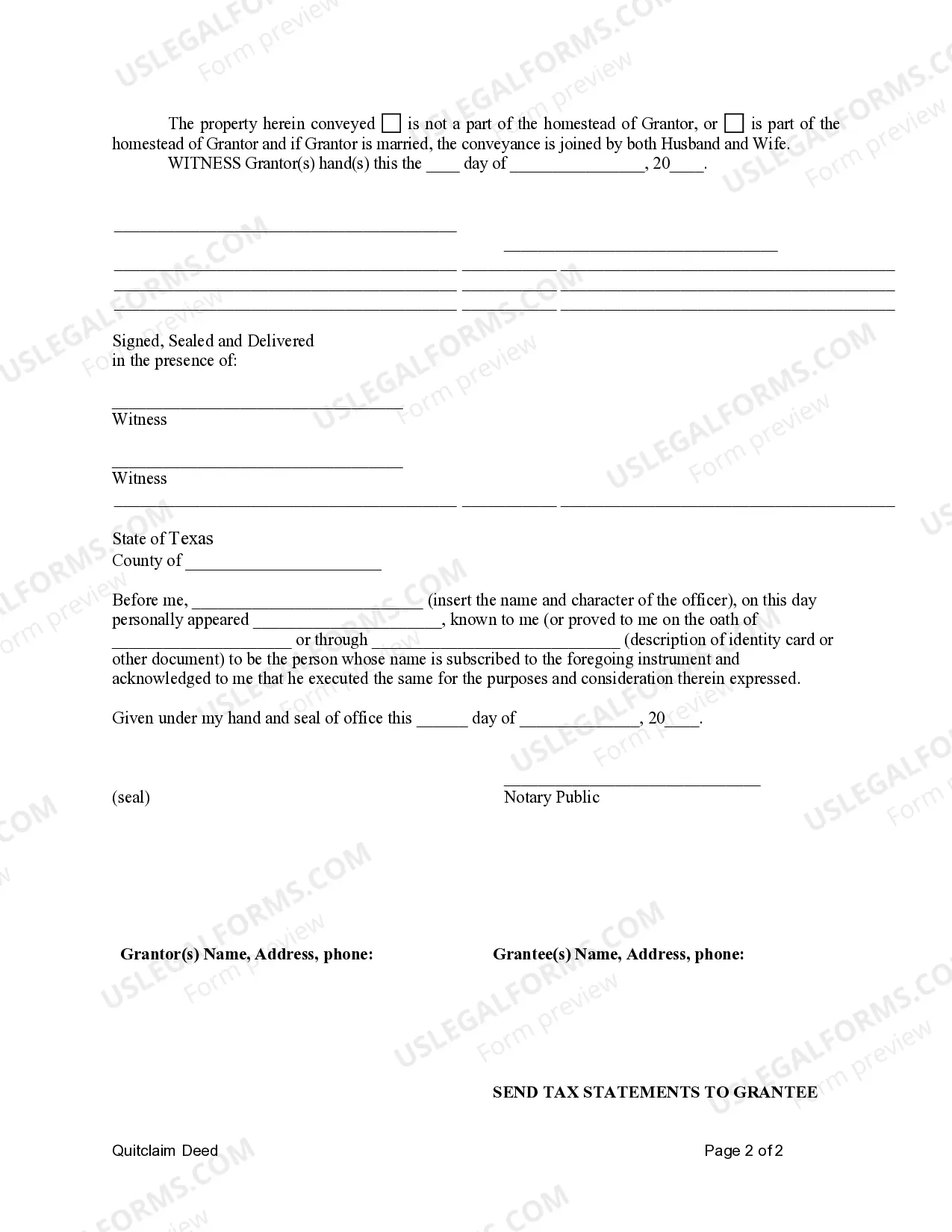

This Quitclaim Deed from Individual to LLC form is a Quitclaim Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

A quitclaim deed is a legal document used to transfer ownership of real estate property from an individual to a limited liability company (LLC) in Pearland, Texas. This type of transfer occurs when an individual wants to change the ownership structure of a property they own by transferring it into an LLC. There are different types of Pearland Texas Quitclaim Deeds from Individual to LLC, including: 1. Voluntary Transfer: This type of quitclaim deed is a result of a voluntary decision made by the individual owner to transfer the property to an LLC. It is usually used when the owner wants to protect their personal assets or for estate planning purposes. 2. Business Restructuring: Sometimes, an individual may choose to transfer their property to an LLC to restructure their business holdings. This can involve consolidation of assets or forming a new LLC for tax or liability purposes. 3. Partnership Conversion: An individual who is a partner in a partnership may transfer their interest in a property to an LLC. This type of quitclaim deed facilitates the conversion of a partnership interest into an ownership interest in an LLC. 4. Asset Protection: Transferring a property to an LLC through a quitclaim deed can provide asset protection for the owner. By separating personal assets from business assets, the individual limits their personal liability and protects their personal wealth from any legal claims against the LLC. 5. Estate Planning: A quitclaim deed from an individual to an LLC can be utilized as part of estate planning strategies. By transferring the property to the LLC, the individual can ensure a smooth transfer of ownership to their heirs or beneficiaries upon their death, avoiding potential probate proceedings. It is important to consult with a qualified attorney experienced in real estate law and business formations to draft and execute a Pearland Texas Quitclaim Deed properly. This legal professional will guide both parties involved and ensure compliance with state laws and regulations. Additionally, it is crucial to conduct a thorough due diligence process to assess any existing liens, encumbrances, or title issues before transferring the property.