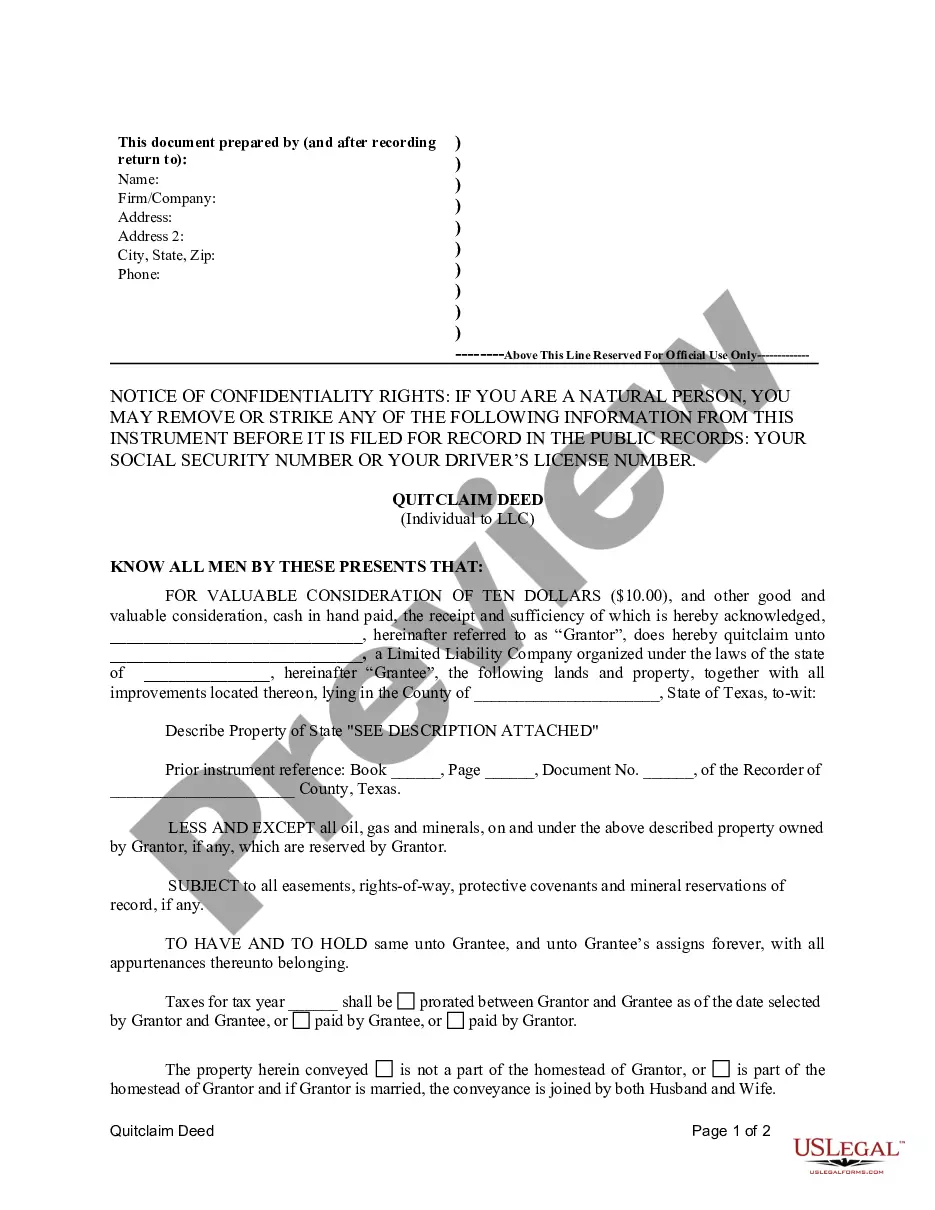

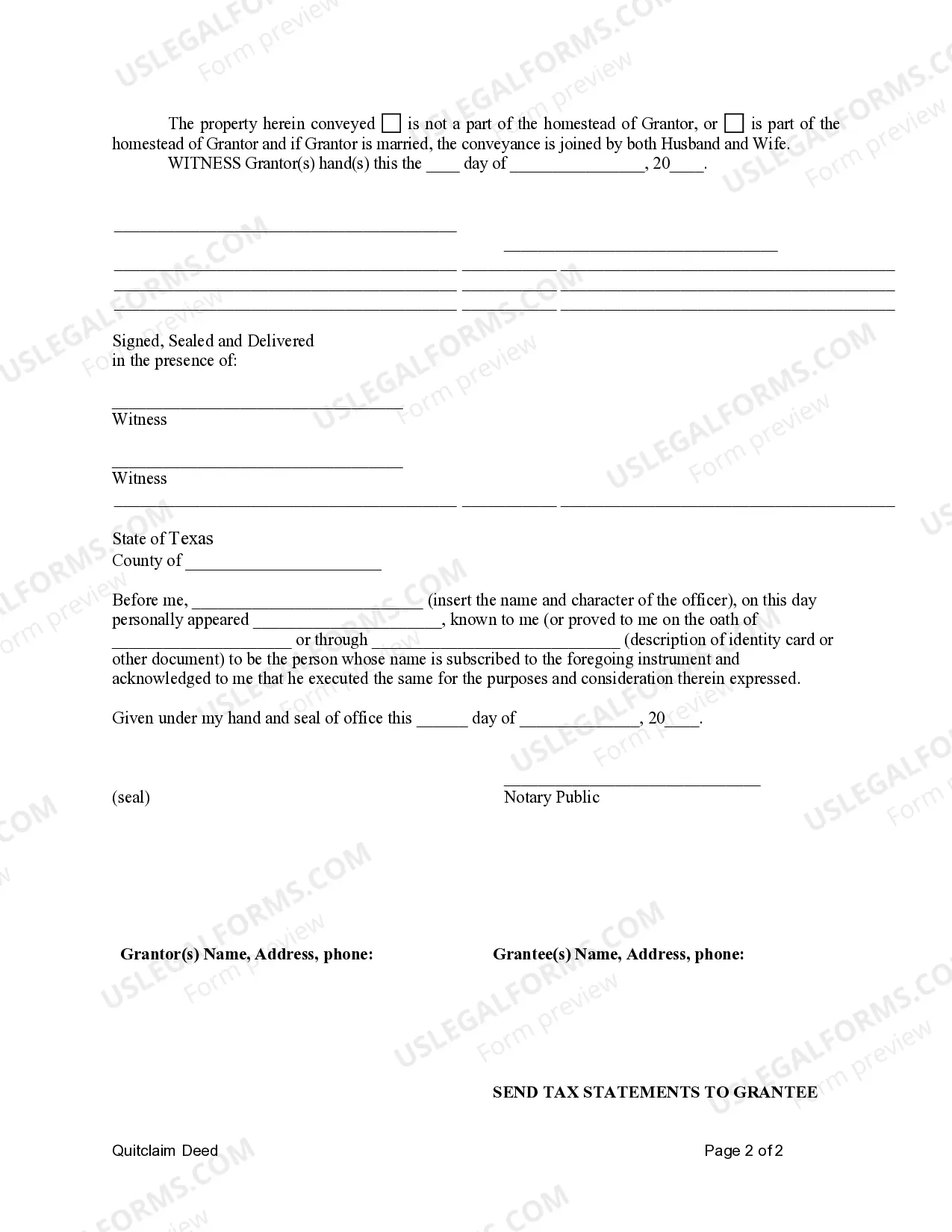

This Quitclaim Deed from Individual to LLC form is a Quitclaim Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

A Round Rock Texas Quitclaim Deed from an Individual to an LLC is a legally binding document that transfers ownership of a property from an individual to a limited liability company (LLC) in Round Rock, Texas. This type of deed is commonly used in real estate transactions when an individual wants to transfer their property rights to an LLC they either own or want to create. The Round Rock Texas Quitclaim Deed from Individual to LLC ensures a seamless and transparent transfer of ownership, providing protection for both parties involved. It is important to note that a quitclaim deed only transfers the property interest that the individual possesses at the time of the transfer, without providing any guarantees or warranties. There are different types of Round Rock Texas Quitclaim Deeds from Individual to LLC, categorized based on specific scenarios or circumstances. These include: 1. Voluntary Transfer Quitclaim Deed: This type of deed is used when an individual willingly transfers ownership of a property to their LLC. It can be a strategic decision made for various reasons, such as asset protection, estate planning, or business restructuring. 2. Divorce or Dissolution Quitclaim Deed: In cases of divorce or dissolution, a Quitclaim Deed is commonly utilized to transfer a property from one spouse to an LLC owned by either party or both jointly. This allows for a clean separation of assets and liabilities. 3. Estate Planning Quitclaim Deed: Individuals who wish to include their property in their estate planning often opt for this type of Quitclaim Deed. It allows for a smooth transfer of ownership to an LLC designated as a trust or a family-owned entity, ensuring a well-structured succession plan. 4. Asset Protection Quitclaim Deed: When individuals seek to protect their personal assets from potential risks or liabilities associated with their property, they may choose to transfer ownership to an LLC. This type of Quitclaim Deed safeguards the individual's personal assets by placing the property under the company's ownership and liability protection. 5. Business Investment Quitclaim Deed: Entrepreneurs and investors may transfer ownership of a property to an LLC as part of their business investment strategy. This allows for better control, tax benefits, and the ability to separate personal and business assets. It is important to consult with a qualified attorney or real estate professional experienced in Round Rock, Texas real estate transactions when considering a Round Rock Texas Quitclaim Deed from an Individual to an LLC. They can provide guidance, ensure legal compliance, and assist in drafting and executing the deed accurately.A Round Rock Texas Quitclaim Deed from an Individual to an LLC is a legally binding document that transfers ownership of a property from an individual to a limited liability company (LLC) in Round Rock, Texas. This type of deed is commonly used in real estate transactions when an individual wants to transfer their property rights to an LLC they either own or want to create. The Round Rock Texas Quitclaim Deed from Individual to LLC ensures a seamless and transparent transfer of ownership, providing protection for both parties involved. It is important to note that a quitclaim deed only transfers the property interest that the individual possesses at the time of the transfer, without providing any guarantees or warranties. There are different types of Round Rock Texas Quitclaim Deeds from Individual to LLC, categorized based on specific scenarios or circumstances. These include: 1. Voluntary Transfer Quitclaim Deed: This type of deed is used when an individual willingly transfers ownership of a property to their LLC. It can be a strategic decision made for various reasons, such as asset protection, estate planning, or business restructuring. 2. Divorce or Dissolution Quitclaim Deed: In cases of divorce or dissolution, a Quitclaim Deed is commonly utilized to transfer a property from one spouse to an LLC owned by either party or both jointly. This allows for a clean separation of assets and liabilities. 3. Estate Planning Quitclaim Deed: Individuals who wish to include their property in their estate planning often opt for this type of Quitclaim Deed. It allows for a smooth transfer of ownership to an LLC designated as a trust or a family-owned entity, ensuring a well-structured succession plan. 4. Asset Protection Quitclaim Deed: When individuals seek to protect their personal assets from potential risks or liabilities associated with their property, they may choose to transfer ownership to an LLC. This type of Quitclaim Deed safeguards the individual's personal assets by placing the property under the company's ownership and liability protection. 5. Business Investment Quitclaim Deed: Entrepreneurs and investors may transfer ownership of a property to an LLC as part of their business investment strategy. This allows for better control, tax benefits, and the ability to separate personal and business assets. It is important to consult with a qualified attorney or real estate professional experienced in Round Rock, Texas real estate transactions when considering a Round Rock Texas Quitclaim Deed from an Individual to an LLC. They can provide guidance, ensure legal compliance, and assist in drafting and executing the deed accurately.