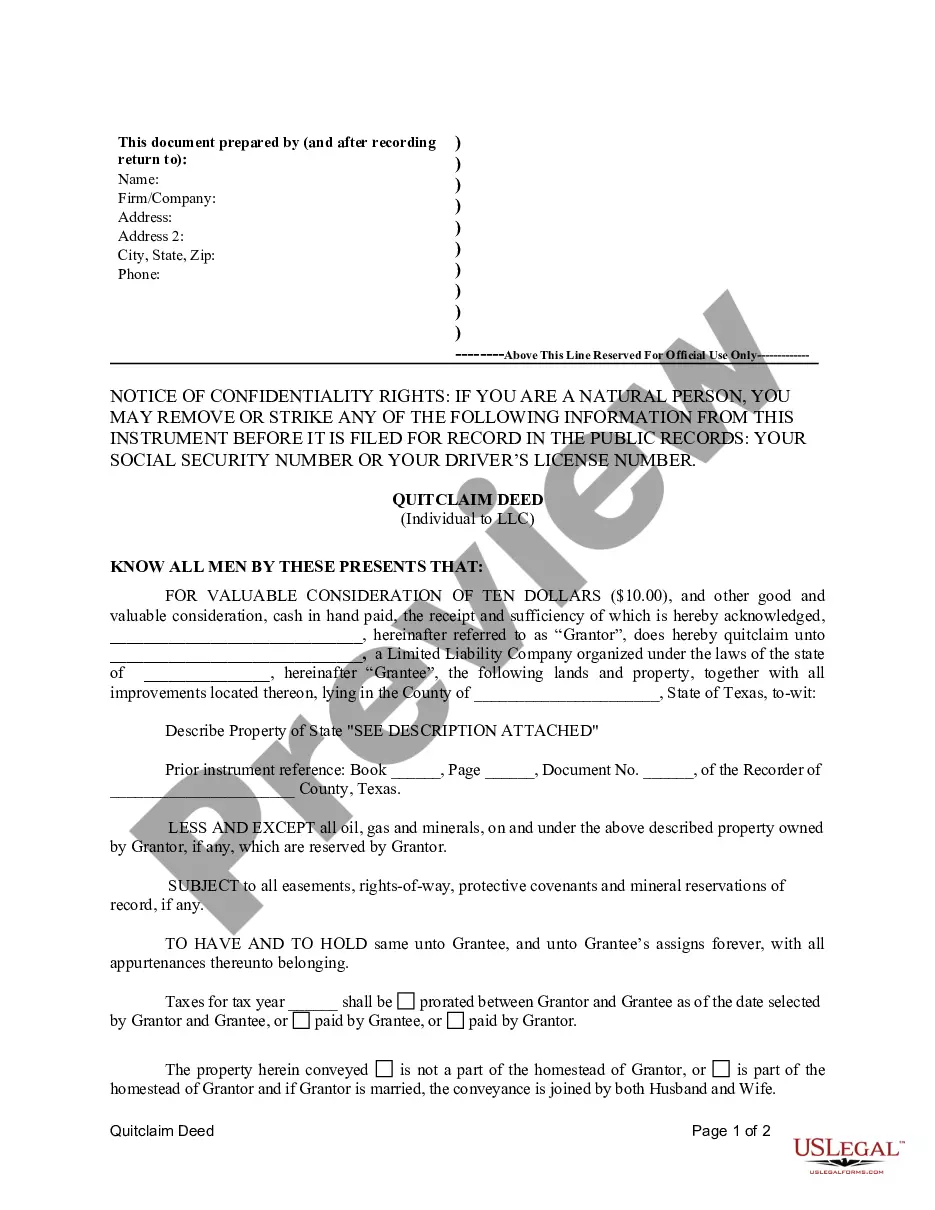

This Quitclaim Deed from Individual to LLC form is a Quitclaim Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

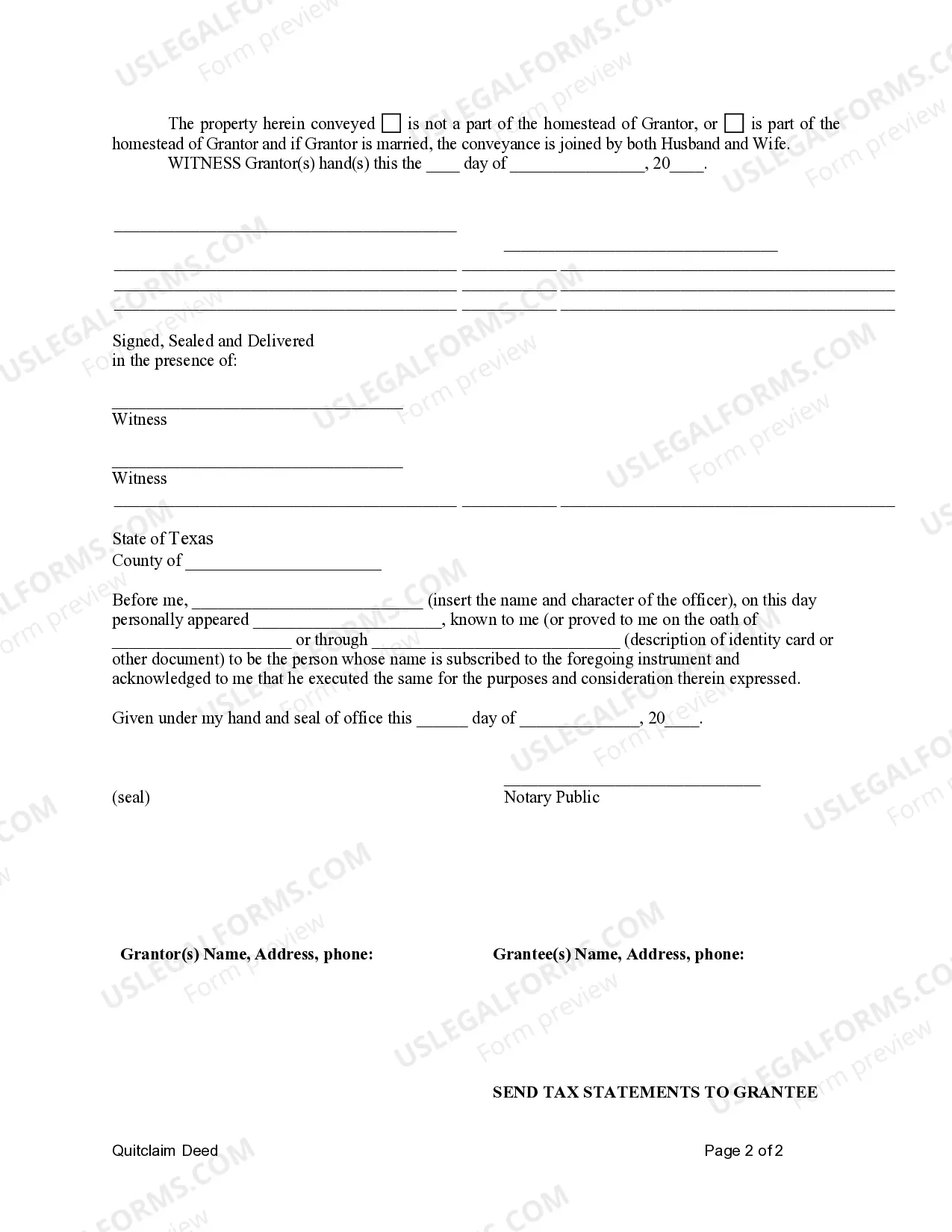

A Sugar Land Texas Quitclaim Deed from an Individual to an LLC is a legal document that transfers ownership of a property from an individual to a limited liability company (LLC) in the city of Sugar Land, Texas. This type of deed ensures a clear and recorded transfer of property rights without making any guarantees to the receiving party about the title's validity or the absence of liens. The main purpose of executing a Quitclaim Deed in Sugar Land, Texas, is to transfer property ownership from an individual to an LLC. This transaction is commonly used when individuals want to transfer property into a business entity, protect personal assets, or restructure ownership. It is important to note that the use of a Quitclaim Deed does not necessarily imply that the LLC is purchasing the property or assuming any existing debts or obligations. When obtaining a Sugar Land Texas Quitclaim Deed from Individual to LLC, it is crucial to consider various factors to ensure a seamless transfer: 1. Consult an Attorney: Before proceeding with the Quitclaim Deed, it is advisable to consult an experienced real estate attorney who specializes in Sugar Land, Texas, property transactions. They can provide valuable guidance on legal requirements, tax implications, and potential issues. 2. Verify Property Title: The individual transferring the property (granter) should provide the necessary information to verify their ownership and ascertain any encumbrances, including liens, mortgages, or claims. 3. Prepare the Deed: The Quitclaim Deed document must include accurate and specific information, such as the legal description of the property, the exact names of the granter and the LLC, and the intended purpose of the transfer. 4. Notarization and Recording: Both the granter and the LLC representative need to sign the Quitclaim Deed in the presence of a notary public. Once executed, the deed should be submitted for recording at the Fort Bend County Clerk's Office or relevant jurisdiction. Different types of Sugar Land Texas Quitclaim Deeds from Individual to LLC may exist depending on specific requirements or circumstances: 1. Personal Asset Protection: This type of Quitclaim Deed is commonly used by individuals aiming to shield personal assets from business risks or liabilities. 2. Business Restructuring: In cases where existing property ownership needs to be transferred from an individual to an LLC as part of a broader business restructuring plan, a Quitclaim Deed facilitates the legal process. 3. Estate Planning: Individuals engaged in estate planning may use a Quitclaim Deed to transfer property to an LLC for better management, succession planning, or tax purposes. 4. Investment Property Transfer: When an individual wants to transfer ownership of an investment property to an LLC entity, a Quitclaim Deed ensures a transparent transfer of rights. Overall, executing a Sugar Land Texas Quitclaim Deed from Individual to LLC requires careful consideration, legal assistance, and compliance with relevant regulations to ensure a smooth and legally supported property ownership transfer.