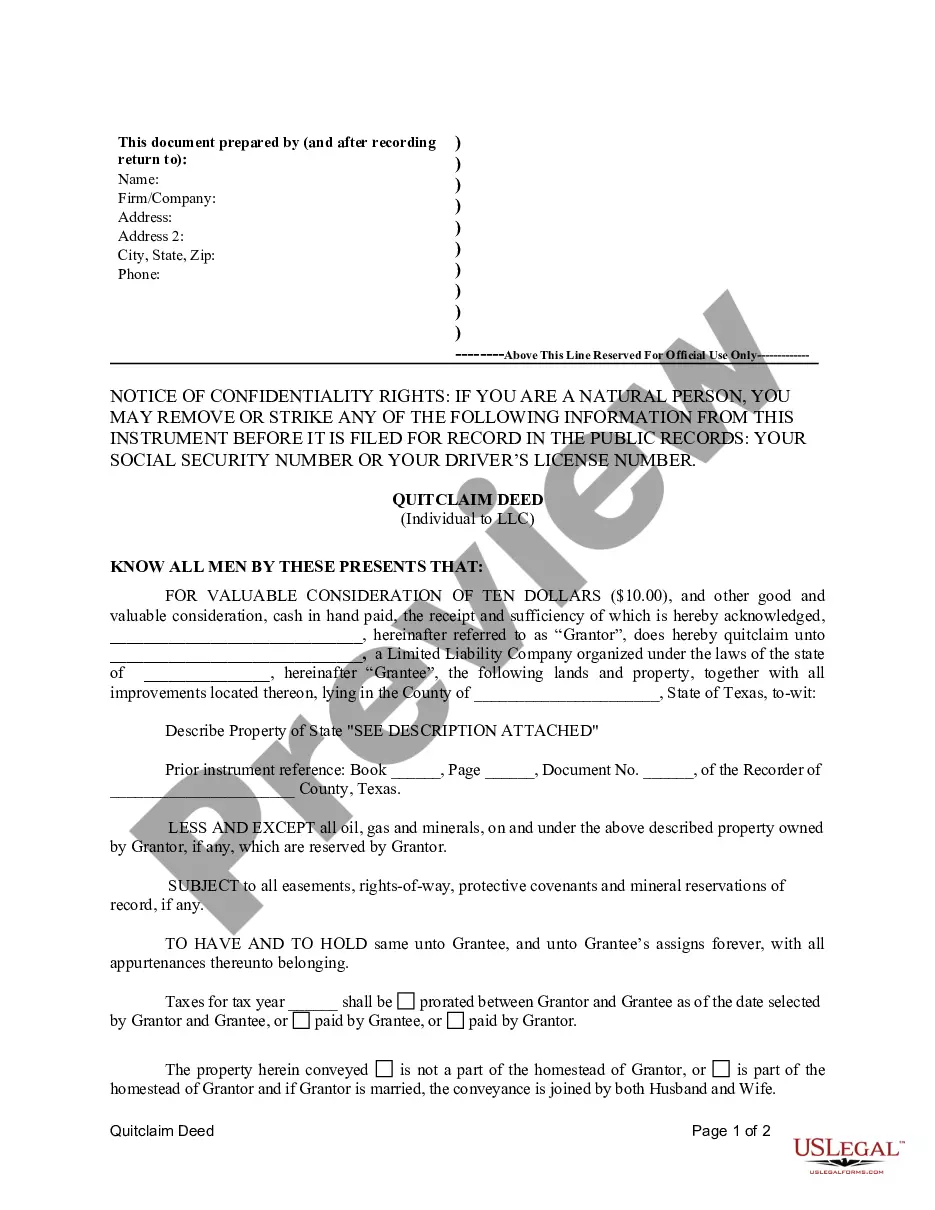

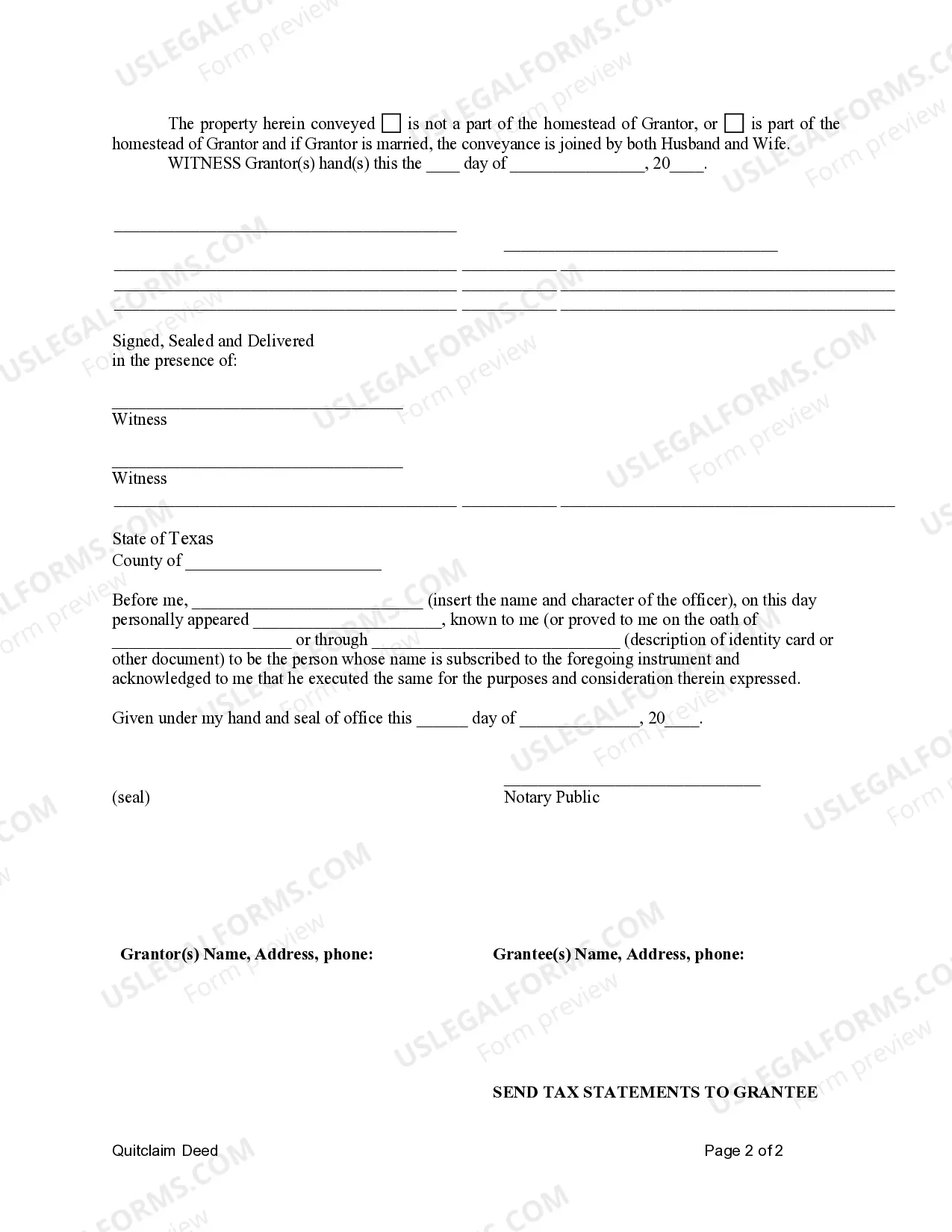

This Quitclaim Deed from Individual to LLC form is a Quitclaim Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

A Travis Texas Quitclaim Deed from an individual to an LLC is a legal document used to transfer ownership of real property from an individual to a limited liability company (LLC) located within the Travis County, Texas jurisdiction. This type of deed is commonly used when a property owner wants to transfer ownership of their property to an LLC for liability protection or business purposes. The Travis Texas Quitclaim Deed from Individual to LLC is specifically designed for properties situated within Travis County, Texas. This county includes the city of Austin, the state capital, and is known for its growing real estate market and business-friendly environment. By utilizing a Quitclaim Deed, the individual, also referred to as the granter, conveys their interest in the real estate to the LLC, known as the grantee. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the granter has clear title to the property being transferred. It simply releases any interest the granter may have in the property, whatever that interest may be. There may be variations of this type of deed based on specific circumstances or contingencies. These additional types of Travis Texas Quitclaim Deeds from Individual to LLC might include: 1. Trustee-to-LLC Quitclaim Deed: This type of deed is used when the individual granter holds the property in a trust, and the trustee is transferring ownership to the LLC. 2. Joint Tenancy-to-LLC Quitclaim Deed: If the property is currently owned by the individual granter and another individual as joint tenants, this deed is used to transfer the granter's share to the LLC. 3. Marital Property-to-LLC Quitclaim Deed: When married individuals jointly own a property, this deed is used to transfer one spouse's interest to the LLC. 4. Inherited Property-to-LLC Quitclaim Deed: If an individual has inherited property and wishes to transfer ownership to an LLC, this type of deed is used to effect the transfer. 5. Partnership-to-LLC Quitclaim Deed: If a partnership owns the property, and the individual granter wants to transfer their interest to an LLC, this deed facilitates the transfer. When utilizing a Travis Texas Quitclaim Deed from an individual to an LLC, it is crucial to consult with a qualified Texas real estate attorney to ensure all legal requirements are met. This will help to avoid any future complications or disputes regarding the property transfer and maintain a clear chain of title.A Travis Texas Quitclaim Deed from an individual to an LLC is a legal document used to transfer ownership of real property from an individual to a limited liability company (LLC) located within the Travis County, Texas jurisdiction. This type of deed is commonly used when a property owner wants to transfer ownership of their property to an LLC for liability protection or business purposes. The Travis Texas Quitclaim Deed from Individual to LLC is specifically designed for properties situated within Travis County, Texas. This county includes the city of Austin, the state capital, and is known for its growing real estate market and business-friendly environment. By utilizing a Quitclaim Deed, the individual, also referred to as the granter, conveys their interest in the real estate to the LLC, known as the grantee. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the granter has clear title to the property being transferred. It simply releases any interest the granter may have in the property, whatever that interest may be. There may be variations of this type of deed based on specific circumstances or contingencies. These additional types of Travis Texas Quitclaim Deeds from Individual to LLC might include: 1. Trustee-to-LLC Quitclaim Deed: This type of deed is used when the individual granter holds the property in a trust, and the trustee is transferring ownership to the LLC. 2. Joint Tenancy-to-LLC Quitclaim Deed: If the property is currently owned by the individual granter and another individual as joint tenants, this deed is used to transfer the granter's share to the LLC. 3. Marital Property-to-LLC Quitclaim Deed: When married individuals jointly own a property, this deed is used to transfer one spouse's interest to the LLC. 4. Inherited Property-to-LLC Quitclaim Deed: If an individual has inherited property and wishes to transfer ownership to an LLC, this type of deed is used to effect the transfer. 5. Partnership-to-LLC Quitclaim Deed: If a partnership owns the property, and the individual granter wants to transfer their interest to an LLC, this deed facilitates the transfer. When utilizing a Travis Texas Quitclaim Deed from an individual to an LLC, it is crucial to consult with a qualified Texas real estate attorney to ensure all legal requirements are met. This will help to avoid any future complications or disputes regarding the property transfer and maintain a clear chain of title.