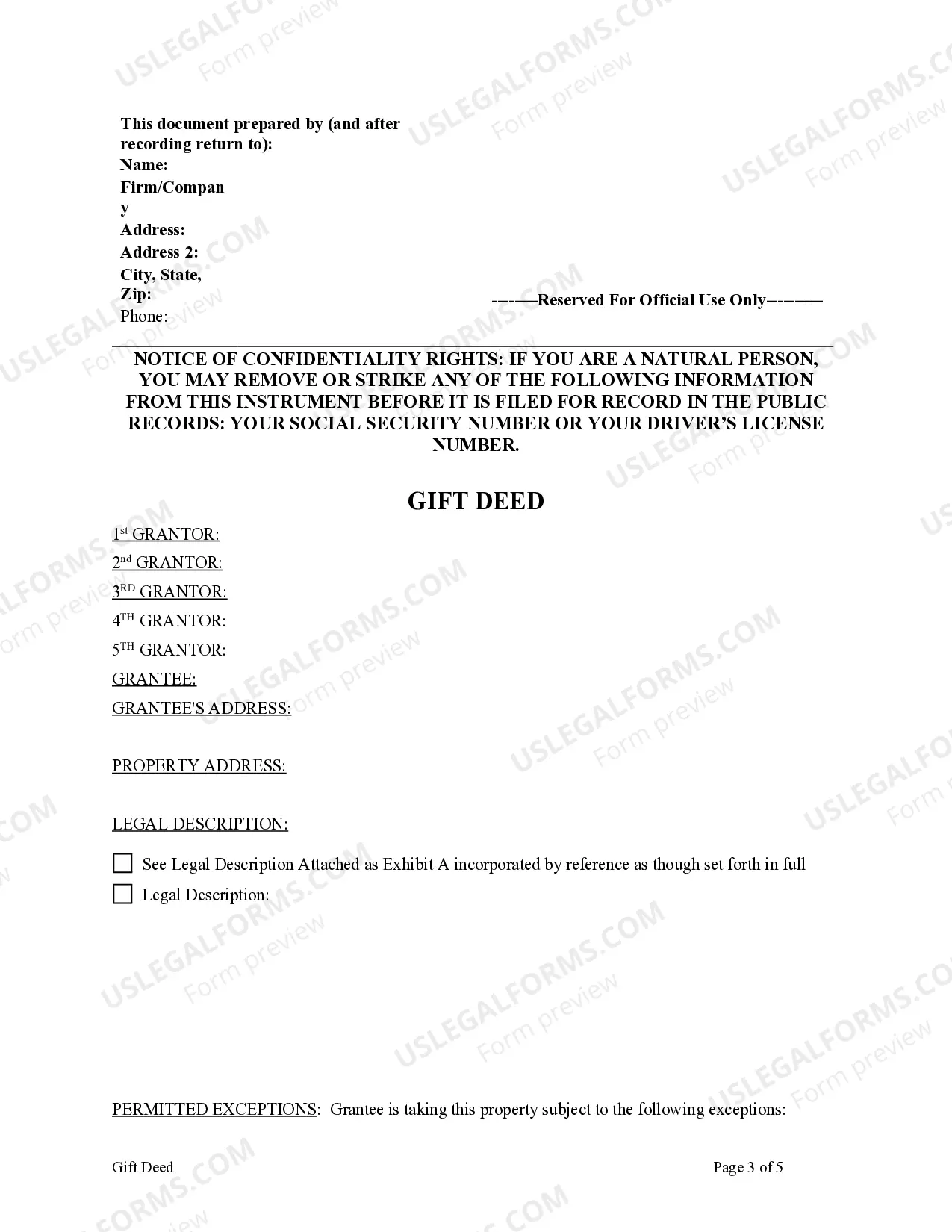

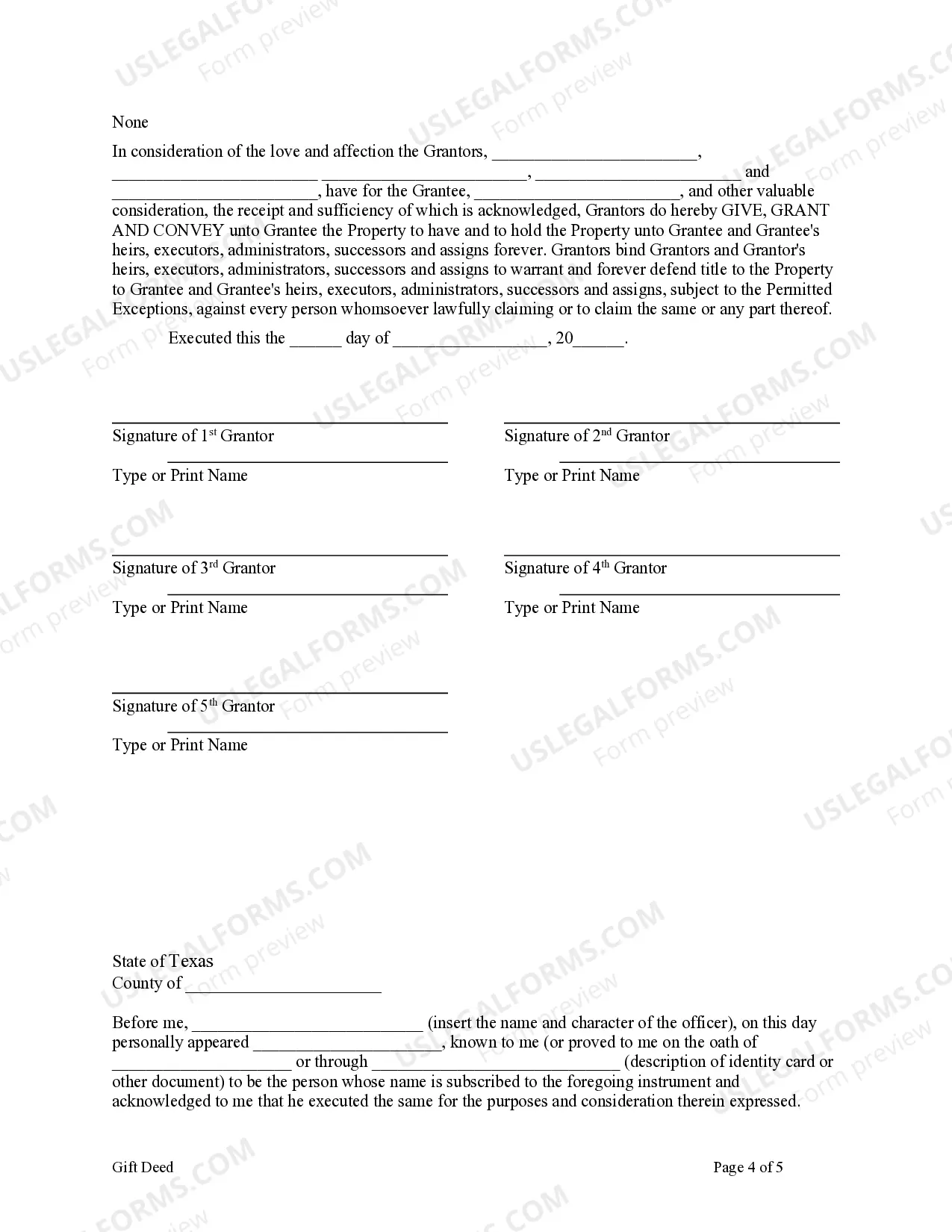

This form is a Gift Deed where the Grantors are five individuals and the Grantee is an individual. Grantors grant and convey the described property to Grantee. This deed complies with all state statutory laws.

A McKinney Texas Gift Deed from Five Granters to One Grantee is a legal document used to transfer ownership of a property without any consideration or payment involved. This type of deed is commonly used when individuals or families wish to gift their property to another person or entity, such as a family member, friend, or charitable organization. The gift deed serves as evidence of the transfer of ownership and ensures that the recipient (grantee) becomes the legal owner of the property, free from any claims or encumbrances against it. It is essential to follow the specific guidelines and legal requirements of McKinney Texas when preparing and executing this document. Different types of McKinney Texas Gift Deeds from Five Granters to One Grantee may include: 1. Simple Gift Deed: This is the most basic form of gift deed, without any additional conditions or restrictions imposed on the grantee. It transfers the property title from the five granters to the one grantee, usually involving the typical elements of a valid deed such as the property description, identification of the granters and grantee, and their signatures. 2. Reserved Life Estate Gift Deed: In this type of gift deed, the granter retains a life estate while gifting the remainder interest to the grantee. This means that the granter retains the right to occupy or use the property until their death, after which the grantee assumes full ownership. Certain legal formalities must be followed to create a valid reserved life estate gift deed. 3. Joint Tenancy with Right of Survivorship Gift Deed: This gift deed grants the property ownership to the grantee(s) as joint tenants, with the right of survivorship. This means that if one joint tenant passes away, their share automatically transfers to the surviving joint tenant(s) without going through probate. This arrangement allows for seamless transfer of title and avoidance of potential complications in case of death. It is important to consult with an experienced legal professional to understand the specific requirements, implications, and potential tax implications associated with McKinney Texas Gift Deed from Five Granters to One Grantee. This ensures compliance with local laws and safeguards the interests of all parties involved in the property transfer.A McKinney Texas Gift Deed from Five Granters to One Grantee is a legal document used to transfer ownership of a property without any consideration or payment involved. This type of deed is commonly used when individuals or families wish to gift their property to another person or entity, such as a family member, friend, or charitable organization. The gift deed serves as evidence of the transfer of ownership and ensures that the recipient (grantee) becomes the legal owner of the property, free from any claims or encumbrances against it. It is essential to follow the specific guidelines and legal requirements of McKinney Texas when preparing and executing this document. Different types of McKinney Texas Gift Deeds from Five Granters to One Grantee may include: 1. Simple Gift Deed: This is the most basic form of gift deed, without any additional conditions or restrictions imposed on the grantee. It transfers the property title from the five granters to the one grantee, usually involving the typical elements of a valid deed such as the property description, identification of the granters and grantee, and their signatures. 2. Reserved Life Estate Gift Deed: In this type of gift deed, the granter retains a life estate while gifting the remainder interest to the grantee. This means that the granter retains the right to occupy or use the property until their death, after which the grantee assumes full ownership. Certain legal formalities must be followed to create a valid reserved life estate gift deed. 3. Joint Tenancy with Right of Survivorship Gift Deed: This gift deed grants the property ownership to the grantee(s) as joint tenants, with the right of survivorship. This means that if one joint tenant passes away, their share automatically transfers to the surviving joint tenant(s) without going through probate. This arrangement allows for seamless transfer of title and avoidance of potential complications in case of death. It is important to consult with an experienced legal professional to understand the specific requirements, implications, and potential tax implications associated with McKinney Texas Gift Deed from Five Granters to One Grantee. This ensures compliance with local laws and safeguards the interests of all parties involved in the property transfer.