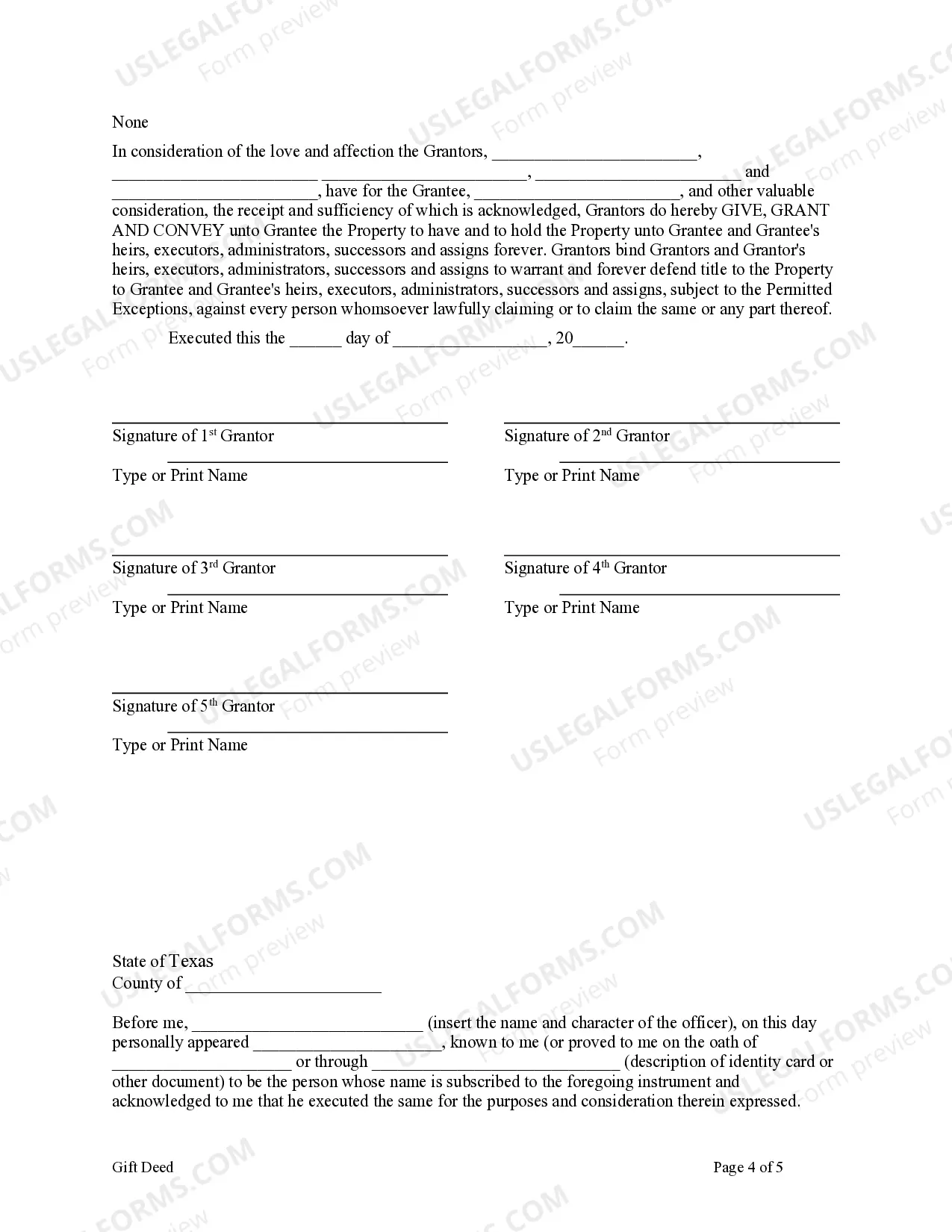

This form is a Gift Deed where the Grantors are five individuals and the Grantee is an individual. Grantors grant and convey the described property to Grantee. This deed complies with all state statutory laws.

A San Antonio Texas Gift Deed from Five Granters to One Grantee is a legal document that is used to transfer ownership of a property from multiple individuals (referred to as granters) to a single person or entity (known as the grantee) as a gift. This type of gift deed is commonly used in real estate transactions in San Antonio, Texas. The gift deed serves as evidence of the transfer of the property's ownership rights without any monetary exchange. It indicates that the granters are gifting their respective shares or interests in the property to the grantee without the expectation of receiving anything in return. As a result, the grantee becomes the sole owner of the property, assuming all rights and responsibilities associated with it. This type of gift deed is particularly relevant for situations where multiple individuals jointly own a property and wish to gift it to a single person or entity. It can be used to transfer residential, commercial, or vacant land properties. Additionally, it can be employed in cases such as gifting property to family members, transferring property to a trust, or donating property to a charitable organization. Different types or variations of the San Antonio Texas Gift Deed from Five Granters to One Grantee may include variations in the terms and conditions of the gift, specific instructions or restrictions on the use of the property, and any applicable state or local regulations. It is crucial to consult with a real estate attorney or legal professional to ensure that the gift deed is prepared accurately and complies with all relevant laws and regulations in San Antonio, Texas.