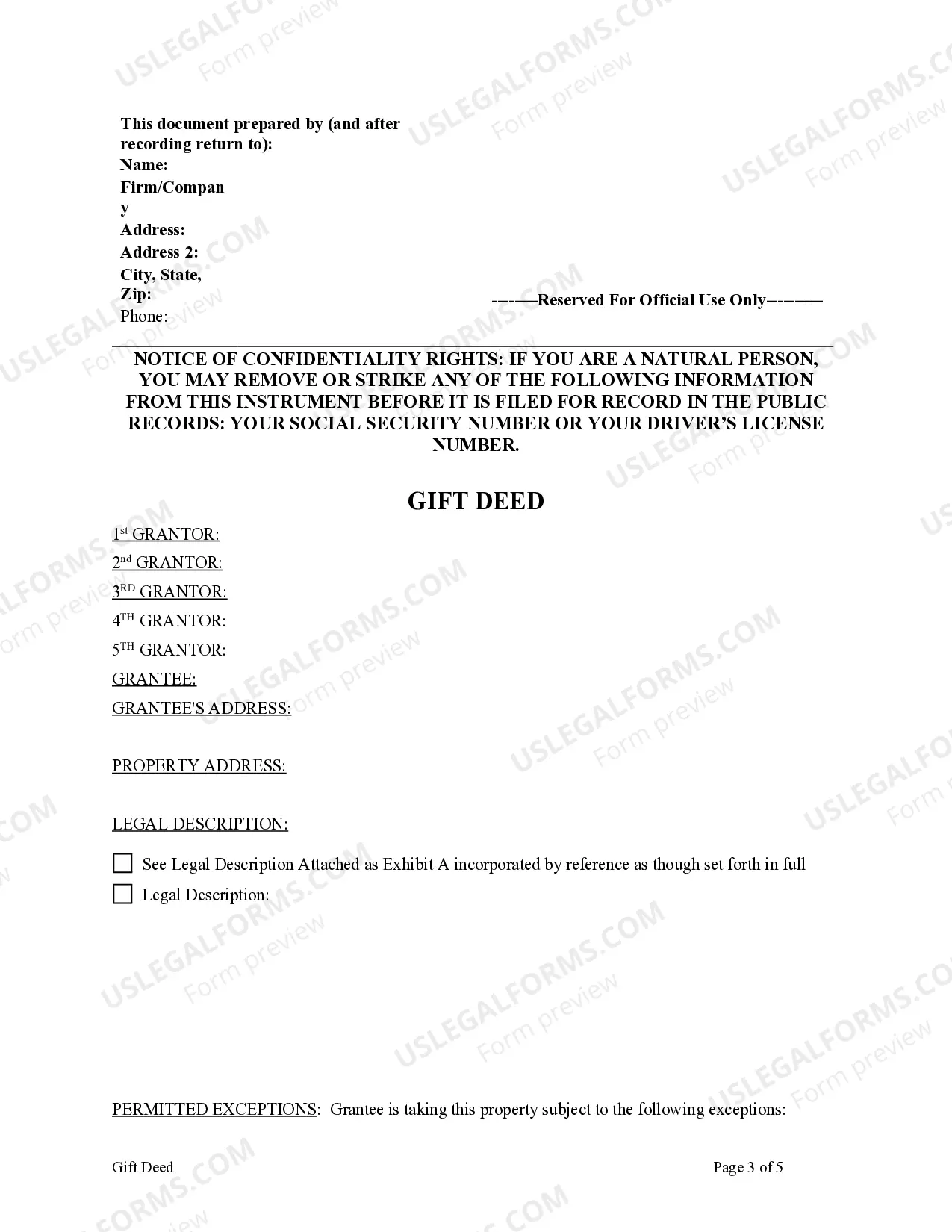

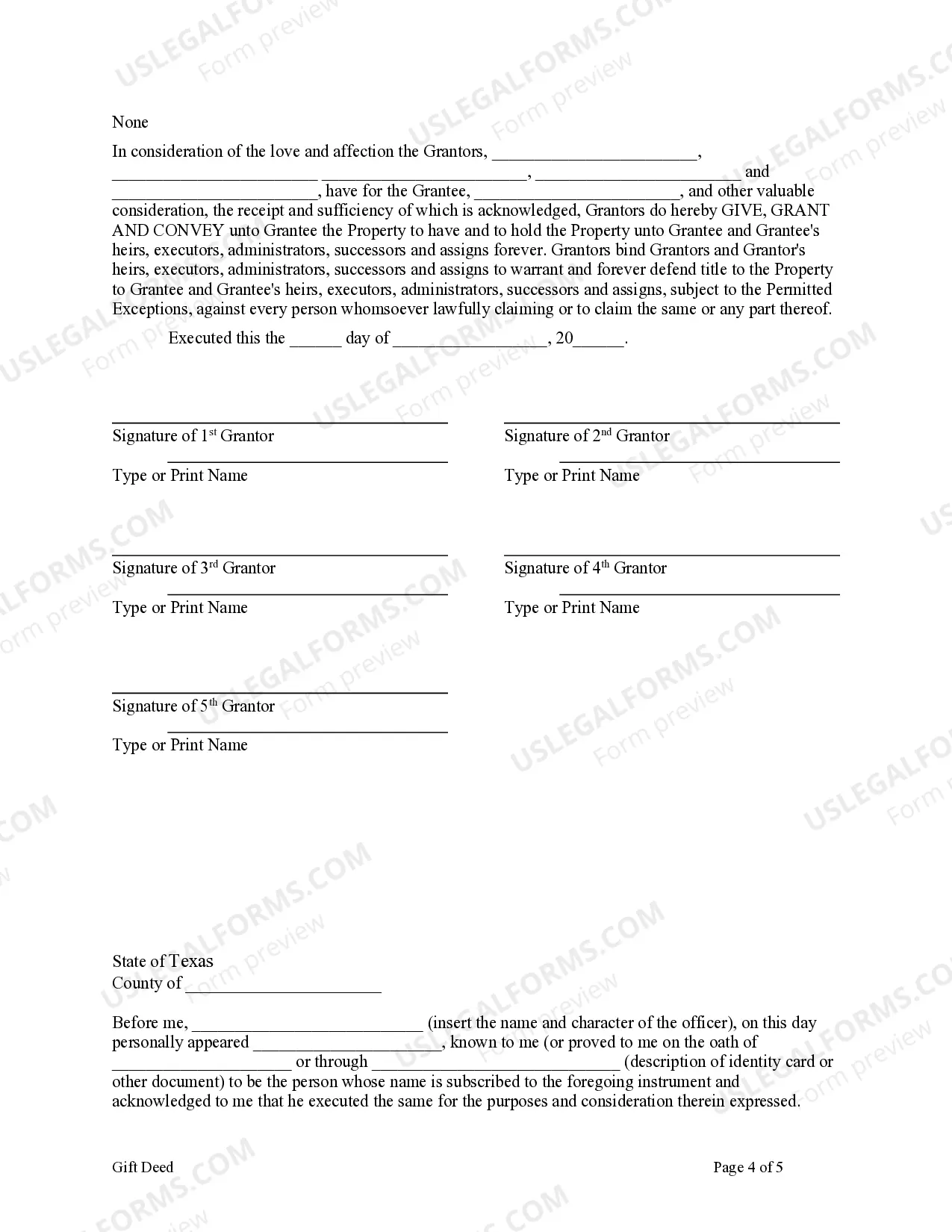

This form is a Gift Deed where the Grantors are five individuals and the Grantee is an individual. Grantors grant and convey the described property to Grantee. This deed complies with all state statutory laws.

A Sugar Land Texas Gift Deed is a legal document that signifies the transfer of real property as a gift from five different granters to one single grantee. This type of transaction typically involves the voluntary transfer of ownership without any financial consideration or compensation. A gift deed is a common method used to transfer property among family members, friends, or between individuals with a close relationship. In a typical Sugar Land Texas Gift Deed from Five Granters to One Grantee, the granters are the individuals or entities who own the property and wish to gift it to a specific recipient, known as the grantee. The granters can be siblings, parents, grandparents, friends, or any other combination of individuals. The gift deed is a legally binding document that must comply with all applicable laws and regulations in Sugar Land, Texas. The deed should specify the accurate legal description of the property, including the address, the lot of number, and the exact boundaries. It must also outline the granters' intent to gift the property to the grantee and the grantee's acceptance of the gift. There are various types of Sugar Land Texas Gift Deeds from Five Granters to One Grantee, each serving a specific purpose or meeting specific requirements: 1. Interfamily Gift Deed: This type of gift deed is commonly used among family members. For instance, parents gifting their property to their children or siblings transferring ownership to each other. 2. Intergenerational Gift Deed: This gift deed involves the transfer of property between different generations. For example, grandparents gifting their property to their grandchildren. 3. Friendship Gift Deed: In some cases, individuals who have a close friendship may choose to gift their property to each other through a gift deed. 4. Charitable Gift Deed: Granters can also use a gift deed to transfer property to a charitable organization or institution. This type of gift deed may have additional requirements, such as obtaining approval from the Internal Revenue Service (IRS) to ensure eligibility for tax benefits. It is important to consult with a qualified attorney or real estate professional when creating a Sugar Land Texas Gift Deed from Five Granters to One Grantee. They can provide guidance on the legal requirements, assist in preparing the necessary documentation and ensure a smooth transfer of property ownership.