This ia a Quitclaim Deed from Individual to Trust for the state of Texas. This is a Quitclaim deed in which the grantor is an individual and grantee is a trust. This form complies with all state statutory laws. This Quitclaim Deed must be signed in front of a Notary Public.

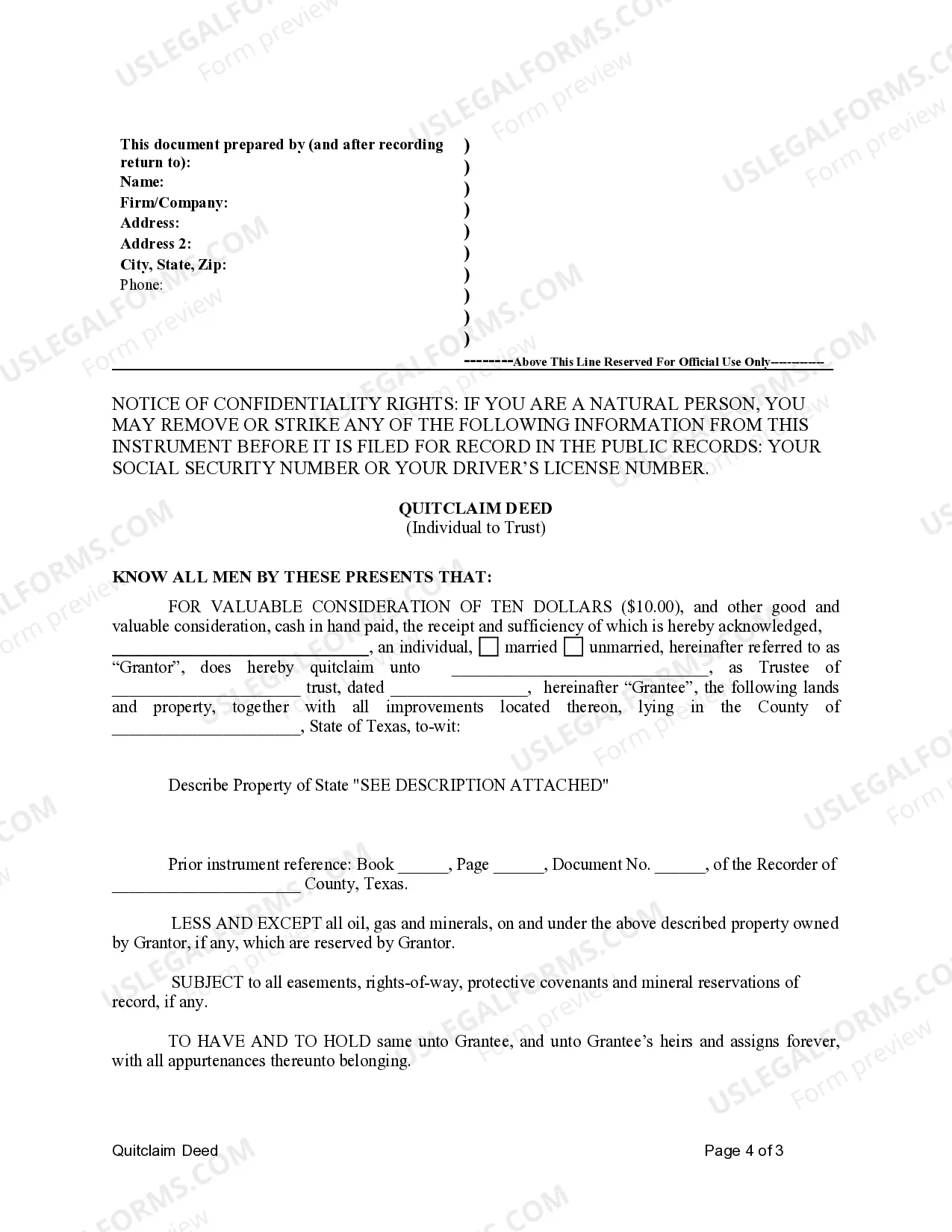

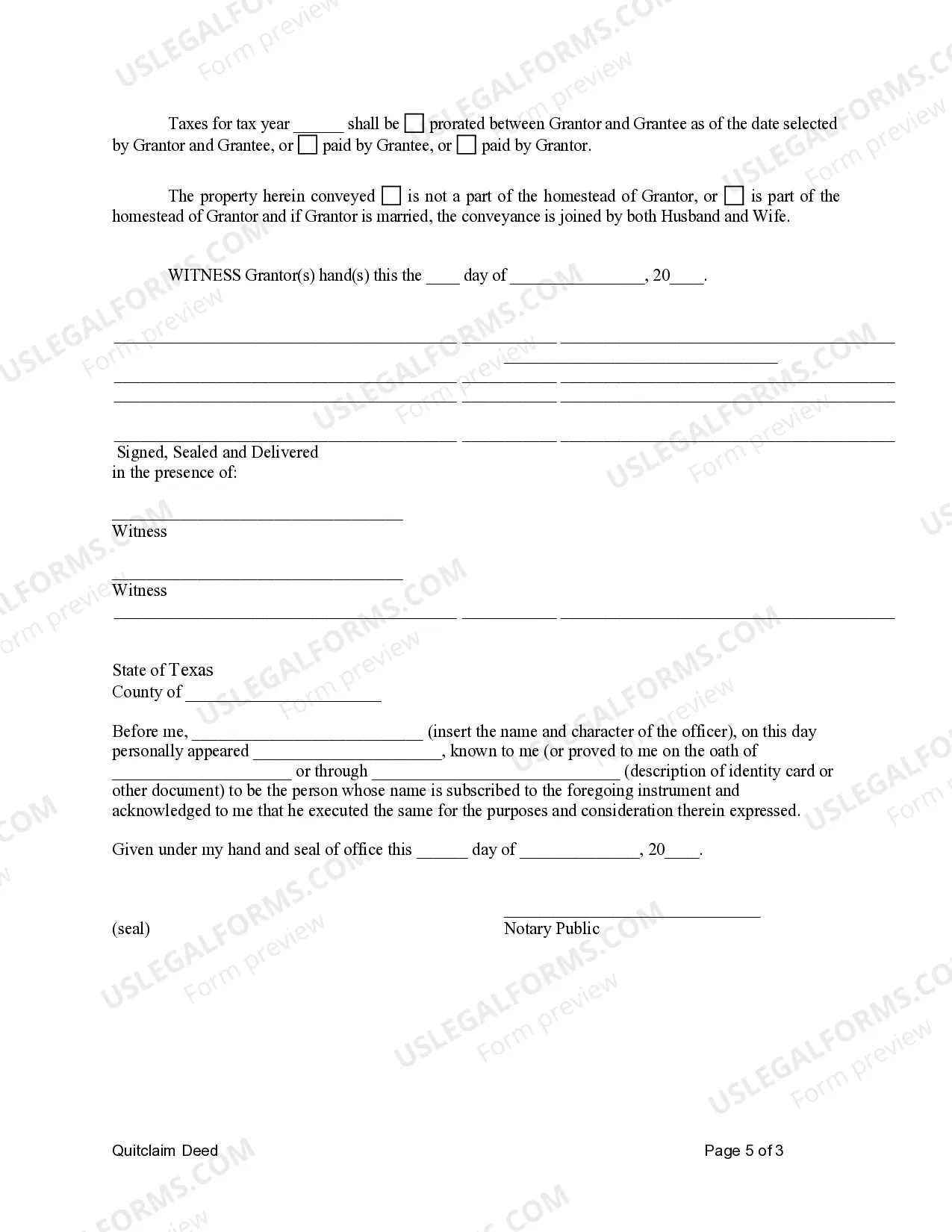

A Quitclaim Deed is a legal document used to transfer ownership of real property from one party to another, and in the context of Edinburg, Texas, it specifically refers to a transfer from an individual to a trust. This type of deed is commonly utilized when an individual wishes to transfer their property into a trust for various reasons, such as estate planning, asset protection, or tax advantages. The Edinburg Texas Quitclaim Deed from Individual to Trust is a vital legal instrument that ensures a smooth transfer of property rights, with specific terms and conditions agreed upon by both the granter (individual) and the grantee (trust). It should be noted that the process and requirements for executing a Quitclaim Deed vary from state to state, so it's crucial to adhere to the specific regulations in Edinburg, Texas. In Edinburg, Texas, there may be different types of Quitclaim Deeds from an individual to a trust, depending on the specific circumstances of the transfer. Some common variations may include: 1. Revocable Living Trust Quitclaim Deed: This type of deed is often used in estate planning to transfer ownership of real property to a revocable living trust. By doing so, the individual retains the ability to change or revoke the trust during their lifetime while ensuring a seamless transfer of assets upon their death. 2. Irrevocable Trust Quitclaim Deed: In some cases, individuals may choose to transfer their property to an irrevocable trust, which cannot be altered or revoked after it has been established. This trust type is commonly used for asset protection or Medicaid planning purposes. 3. Family Trust Quitclaim Deed: When transferring ownership of property within a family, individuals may choose to execute a Quitclaim Deed to a family trust. This arrangement can help simplify the transfer process and provide benefits such as tax planning or protection of family assets. Regardless of the specific type of Edinburg Texas Quitclaim Deed from Individual to Trust, certain key components should be included within the document. These components typically include a legal description of the property, details of the granter and grantee, the transferor's warranty of title, and the acknowledgement and recording sections to make the transfer official. It is recommended to seek legal counsel from a qualified attorney or real estate professional familiar with Edinburg, Texas laws and regulations when preparing and executing a Quitclaim Deed from an individual to a trust. This will ensure compliance with local requirements and help protect the interests of both the granter and grantee involved in the transfer of property.