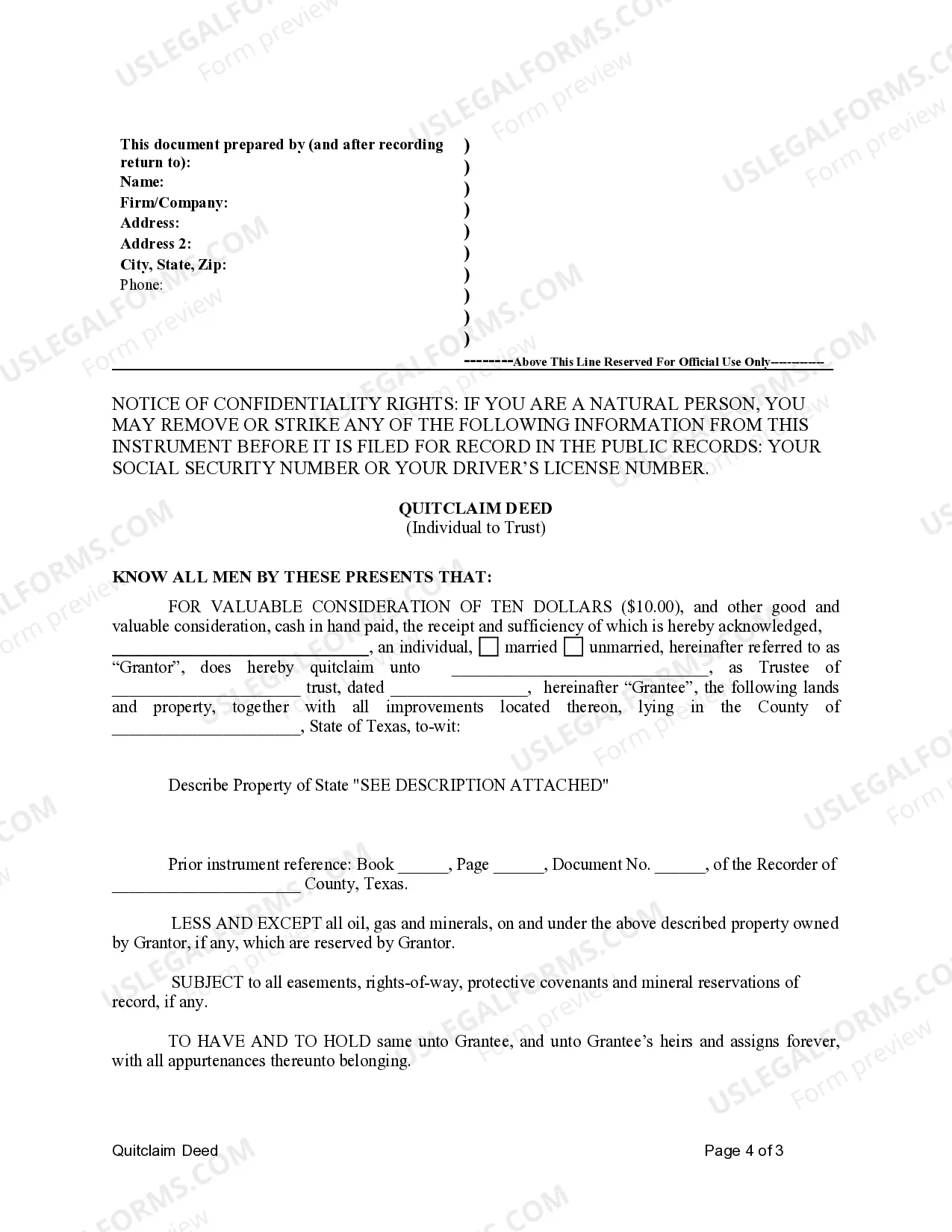

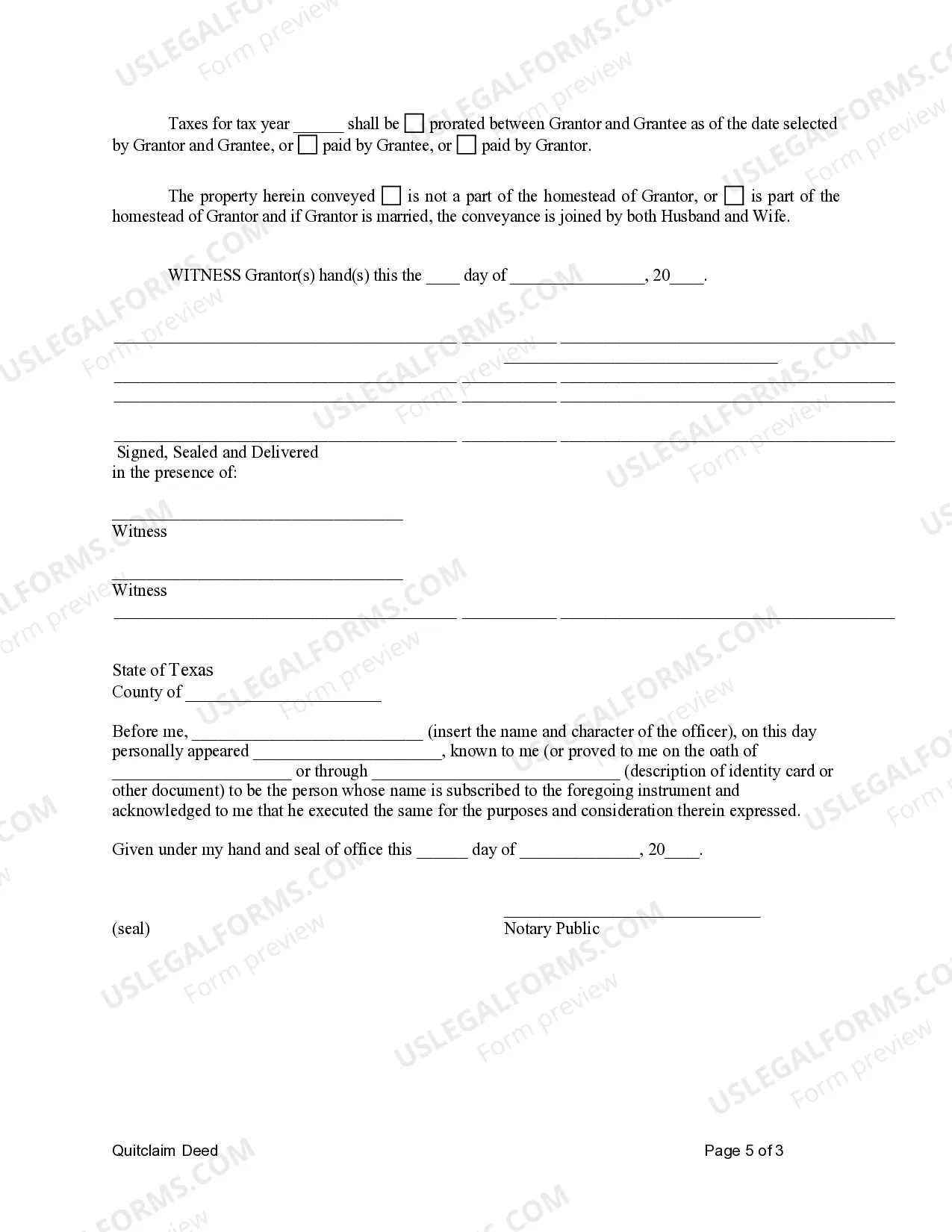

This ia a Quitclaim Deed from Individual to Trust for the state of Texas. This is a Quitclaim deed in which the grantor is an individual and grantee is a trust. This form complies with all state statutory laws. This Quitclaim Deed must be signed in front of a Notary Public.

A Harris Texas Quitclaim Deed from Individual to Trust is a legal document used to transfer ownership of real estate property from an individual to a trust. This type of deed is commonly used in estate planning and asset protection strategies. The Harris County, Texas jurisdiction ensures that the transfer of property is done in accordance with state laws. A quitclaim deed is a straightforward method of transferring property ownership without providing any guarantee or warranty of the title status. It simply transfers whatever interest the individual holds in the property to a trust. By executing a Harris Texas Quitclaim Deed from Individual to Trust, the individual, known as the granter, legally conveys all rights, title, and interest they have in the property to the trust, called the grantee. This transfer allows for seamless management and protection of the property by the trust, ensuring its availability for future generations or fulfilling specific estate planning goals. There are various types of Harris Texas Quitclaim Deeds from Individual to Trust that may be utilized, depending on specific circumstances: 1. Revocable Living Trust Quitclaim Deed: This type of deed transfers property to a revocable living trust, which is a common estate planning tool. It allows the individual to maintain control over the property during their lifetime while providing for a smooth transition upon their death. 2. Irrevocable Trust Quitclaim Deed: In this case, the individual transfers property to an irrevocable trust, which is not amendable or revocable without the consent of all involved parties. It is often used for long-term asset protection purposes or to minimize estate taxes. 3. Special Needs Trust Quitclaim Deed: This type of trust caters to the needs of individuals with disabilities and aims to protect their eligibility for government assistance programs. The quitclaim deed transfers property to the special needs trust, ensuring its proper management for the beneficiary's benefit. The Harris Texas Quitclaim Deed from Individual to Trust is a crucial legal tool for individuals seeking to transfer property to a trust entity. It offers flexibility and control over property ownership, allowing for efficient estate planning, asset protection, and management of real estate assets. It is essential to consult with a qualified attorney experienced in Texas real estate law to ensure compliance with all relevant regulations and to meet individual estate planning objectives.A Harris Texas Quitclaim Deed from Individual to Trust is a legal document used to transfer ownership of real estate property from an individual to a trust. This type of deed is commonly used in estate planning and asset protection strategies. The Harris County, Texas jurisdiction ensures that the transfer of property is done in accordance with state laws. A quitclaim deed is a straightforward method of transferring property ownership without providing any guarantee or warranty of the title status. It simply transfers whatever interest the individual holds in the property to a trust. By executing a Harris Texas Quitclaim Deed from Individual to Trust, the individual, known as the granter, legally conveys all rights, title, and interest they have in the property to the trust, called the grantee. This transfer allows for seamless management and protection of the property by the trust, ensuring its availability for future generations or fulfilling specific estate planning goals. There are various types of Harris Texas Quitclaim Deeds from Individual to Trust that may be utilized, depending on specific circumstances: 1. Revocable Living Trust Quitclaim Deed: This type of deed transfers property to a revocable living trust, which is a common estate planning tool. It allows the individual to maintain control over the property during their lifetime while providing for a smooth transition upon their death. 2. Irrevocable Trust Quitclaim Deed: In this case, the individual transfers property to an irrevocable trust, which is not amendable or revocable without the consent of all involved parties. It is often used for long-term asset protection purposes or to minimize estate taxes. 3. Special Needs Trust Quitclaim Deed: This type of trust caters to the needs of individuals with disabilities and aims to protect their eligibility for government assistance programs. The quitclaim deed transfers property to the special needs trust, ensuring its proper management for the beneficiary's benefit. The Harris Texas Quitclaim Deed from Individual to Trust is a crucial legal tool for individuals seeking to transfer property to a trust entity. It offers flexibility and control over property ownership, allowing for efficient estate planning, asset protection, and management of real estate assets. It is essential to consult with a qualified attorney experienced in Texas real estate law to ensure compliance with all relevant regulations and to meet individual estate planning objectives.