This ia a Quitclaim Deed from Individual to Trust for the state of Texas. This is a Quitclaim deed in which the grantor is an individual and grantee is a trust. This form complies with all state statutory laws. This Quitclaim Deed must be signed in front of a Notary Public.

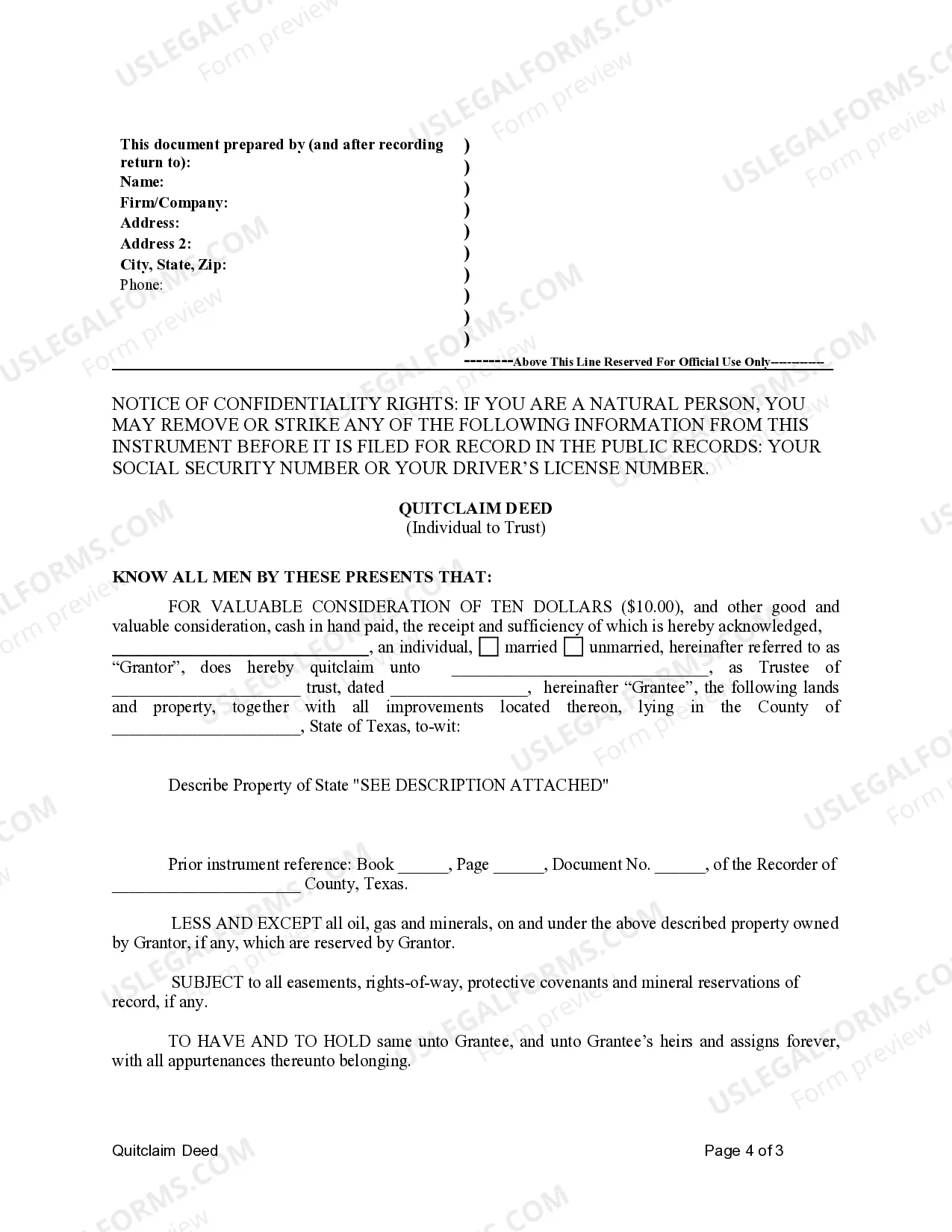

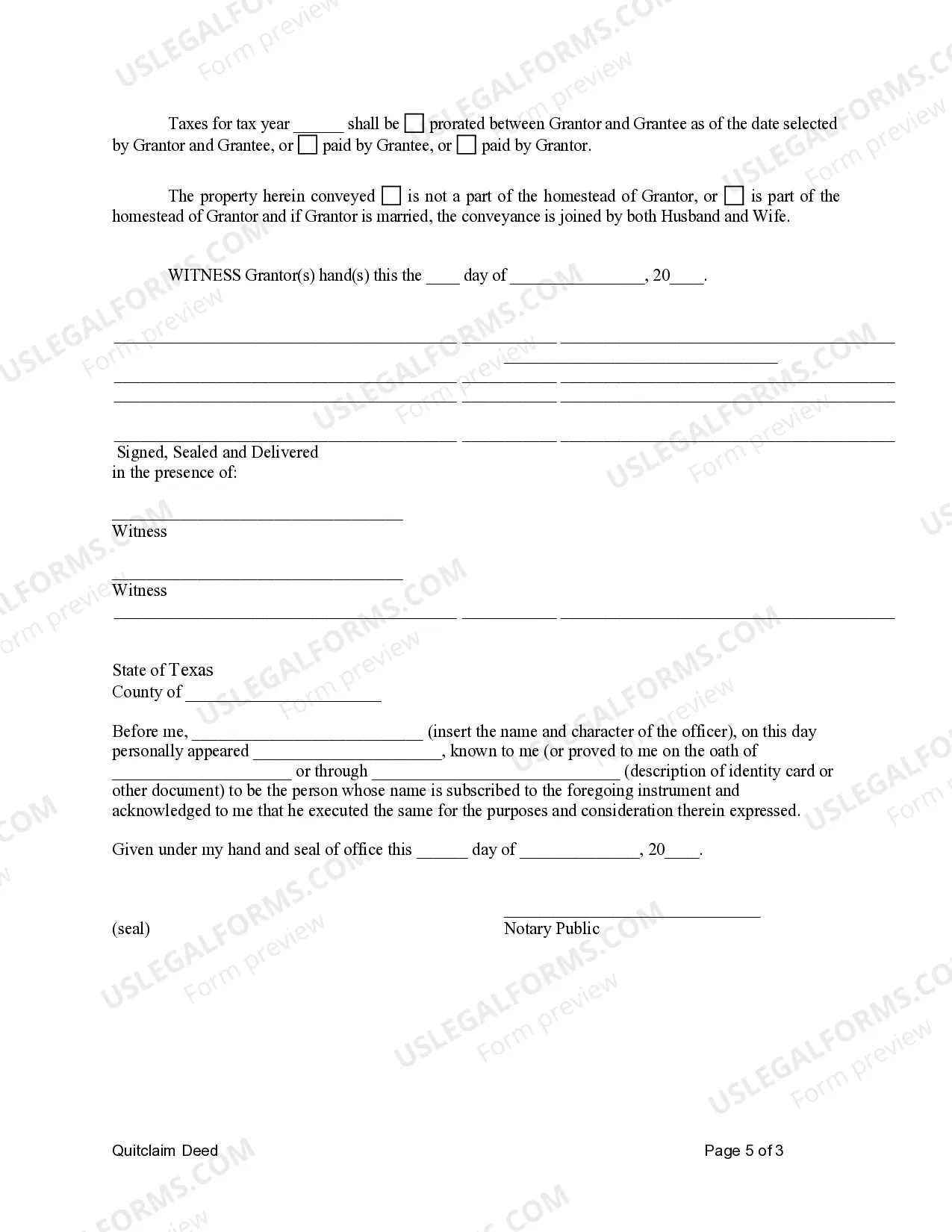

Title: Pearland Texas Quitclaim Deed from Individual to Trust: A Comprehensive Guide Introduction: A Pearland Texas Quitclaim Deed from Individual to Trust refers to the legal document used to transfer real estate ownership from an individual to a trust in Pearland, Texas. This process provides a seamless transfer of property rights and ensures the property is protected within the trust framework. In this article, we will explore the importance, process, and different types of Pearland Texas Quitclaim Deed from Individual to Trust. 1. Importance of Pearland Texas Quitclaim Deed from Individual to Trust: — Secure Asset Protection: Transferring property from an individual to a trust safeguards the asset from potential creditors or legal issues. — Estate Planning: By maintaining property ownership within a trust, individuals ensure efficient distribution upon their demise, avoiding probate complications. — Streamlined Succession Planning: Transferring property ownership via a quitclaim deed simplifies the transfer process, especially when multiple beneficiaries are involved. 2. Process of Executing a Pearland Texas Quitclaim Deed from Individual to Trust: a. Gather Essential Information: — Trust Details: Gather all necessary information about the trust, including its legal name, date of creation, and relevant trustee details. — Property Information: Provide precise information regarding the property being transferred, including address, legal description, and tax identification number. b. Drafting the Quitclaim Deed: — Engage an Attorney: Consult a real estate attorney to ensure the deed complies with Texas laws and accurately reflects the transfer intentions. — Include Key Clauses: The deed should specify the transfer from an individual to the trust, the legal names of the parties involved, and a clear description of the property. c. Record the Quitclaim Deed: — County Clerk's Office: Submit the executed quitclaim deed to the Brazoria County Clerk's Office for recording within the designated time frame. — Recording Fees: Pay the required county recording fees, which vary based on the number of pages and additional documents. 3. Different Types of Pearland Texas Quitclaim Deed from Individual to Trust: a. Individual to Revocable Living Trust: This type of transfer establishes a revocable living trust, allowing individuals to maintain control and make changes while alive. It ensures a smooth transition of ownership upon incapacity or death. b. Individual to Irrevocable Trust: This type of transfer creates an irrevocable trust, where the individual relinquishes all control and ownership rights over the property. It is commonly used for tax planning purposes or protecting assets from Medicaid eligibility. c. Individual to Testamentary Trust: Testamentary trusts are established through a will and do not become effective until the individual's death. This transfer ensures that the property is distributed according to the individual's specified wishes. Conclusion: Executing a Pearland Texas Quitclaim Deed from Individual to Trust is a crucial step towards asset protection, efficient succession planning, and avoiding probate complications. By understanding the process and various types of deeds applicable, individuals can make informed decisions to safeguard their property and ensure the seamless transfer of assets to their intended beneficiaries. Consultation with a qualified attorney is highly recommended ensuring compliance with specific Texas laws and individual circumstances.Title: Pearland Texas Quitclaim Deed from Individual to Trust: A Comprehensive Guide Introduction: A Pearland Texas Quitclaim Deed from Individual to Trust refers to the legal document used to transfer real estate ownership from an individual to a trust in Pearland, Texas. This process provides a seamless transfer of property rights and ensures the property is protected within the trust framework. In this article, we will explore the importance, process, and different types of Pearland Texas Quitclaim Deed from Individual to Trust. 1. Importance of Pearland Texas Quitclaim Deed from Individual to Trust: — Secure Asset Protection: Transferring property from an individual to a trust safeguards the asset from potential creditors or legal issues. — Estate Planning: By maintaining property ownership within a trust, individuals ensure efficient distribution upon their demise, avoiding probate complications. — Streamlined Succession Planning: Transferring property ownership via a quitclaim deed simplifies the transfer process, especially when multiple beneficiaries are involved. 2. Process of Executing a Pearland Texas Quitclaim Deed from Individual to Trust: a. Gather Essential Information: — Trust Details: Gather all necessary information about the trust, including its legal name, date of creation, and relevant trustee details. — Property Information: Provide precise information regarding the property being transferred, including address, legal description, and tax identification number. b. Drafting the Quitclaim Deed: — Engage an Attorney: Consult a real estate attorney to ensure the deed complies with Texas laws and accurately reflects the transfer intentions. — Include Key Clauses: The deed should specify the transfer from an individual to the trust, the legal names of the parties involved, and a clear description of the property. c. Record the Quitclaim Deed: — County Clerk's Office: Submit the executed quitclaim deed to the Brazoria County Clerk's Office for recording within the designated time frame. — Recording Fees: Pay the required county recording fees, which vary based on the number of pages and additional documents. 3. Different Types of Pearland Texas Quitclaim Deed from Individual to Trust: a. Individual to Revocable Living Trust: This type of transfer establishes a revocable living trust, allowing individuals to maintain control and make changes while alive. It ensures a smooth transition of ownership upon incapacity or death. b. Individual to Irrevocable Trust: This type of transfer creates an irrevocable trust, where the individual relinquishes all control and ownership rights over the property. It is commonly used for tax planning purposes or protecting assets from Medicaid eligibility. c. Individual to Testamentary Trust: Testamentary trusts are established through a will and do not become effective until the individual's death. This transfer ensures that the property is distributed according to the individual's specified wishes. Conclusion: Executing a Pearland Texas Quitclaim Deed from Individual to Trust is a crucial step towards asset protection, efficient succession planning, and avoiding probate complications. By understanding the process and various types of deeds applicable, individuals can make informed decisions to safeguard their property and ensure the seamless transfer of assets to their intended beneficiaries. Consultation with a qualified attorney is highly recommended ensuring compliance with specific Texas laws and individual circumstances.