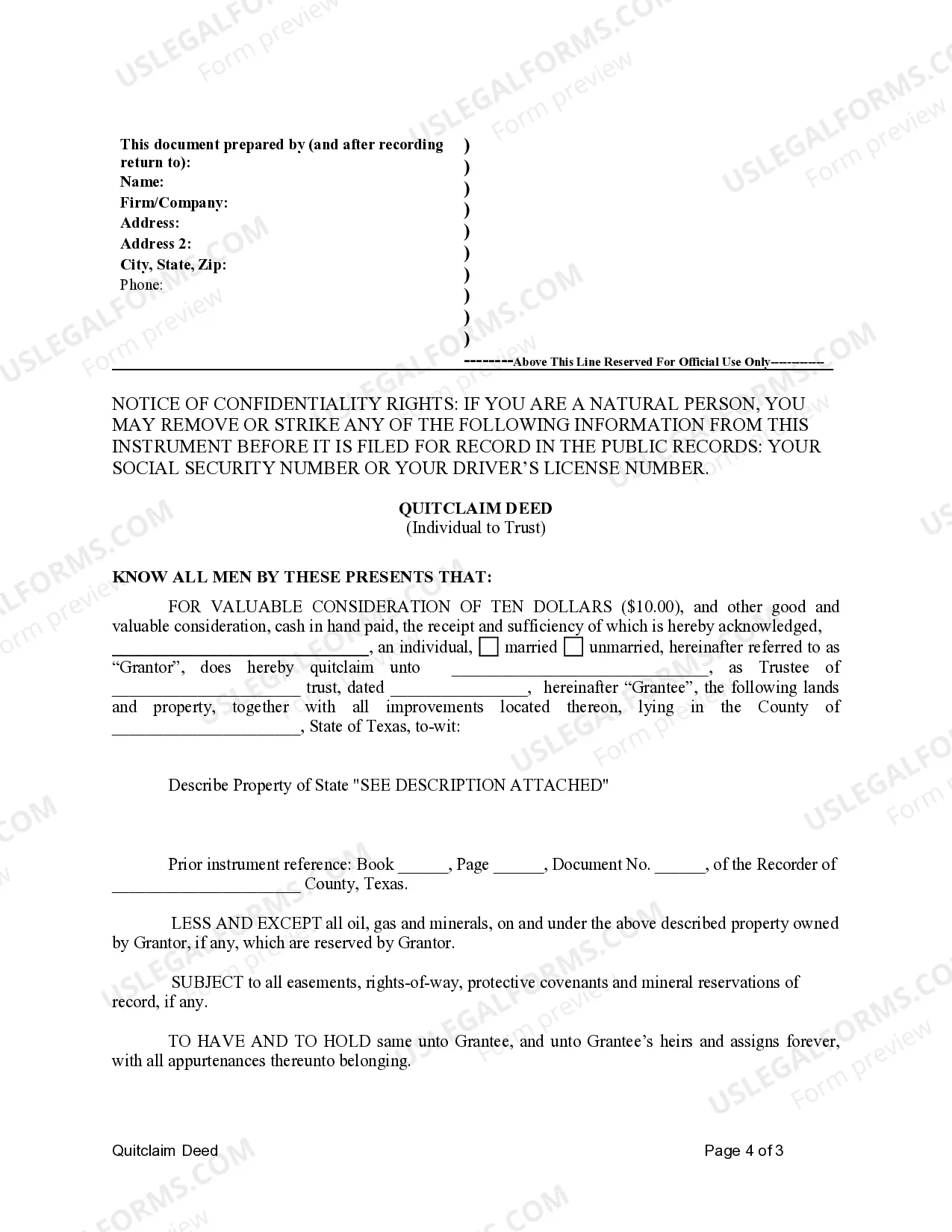

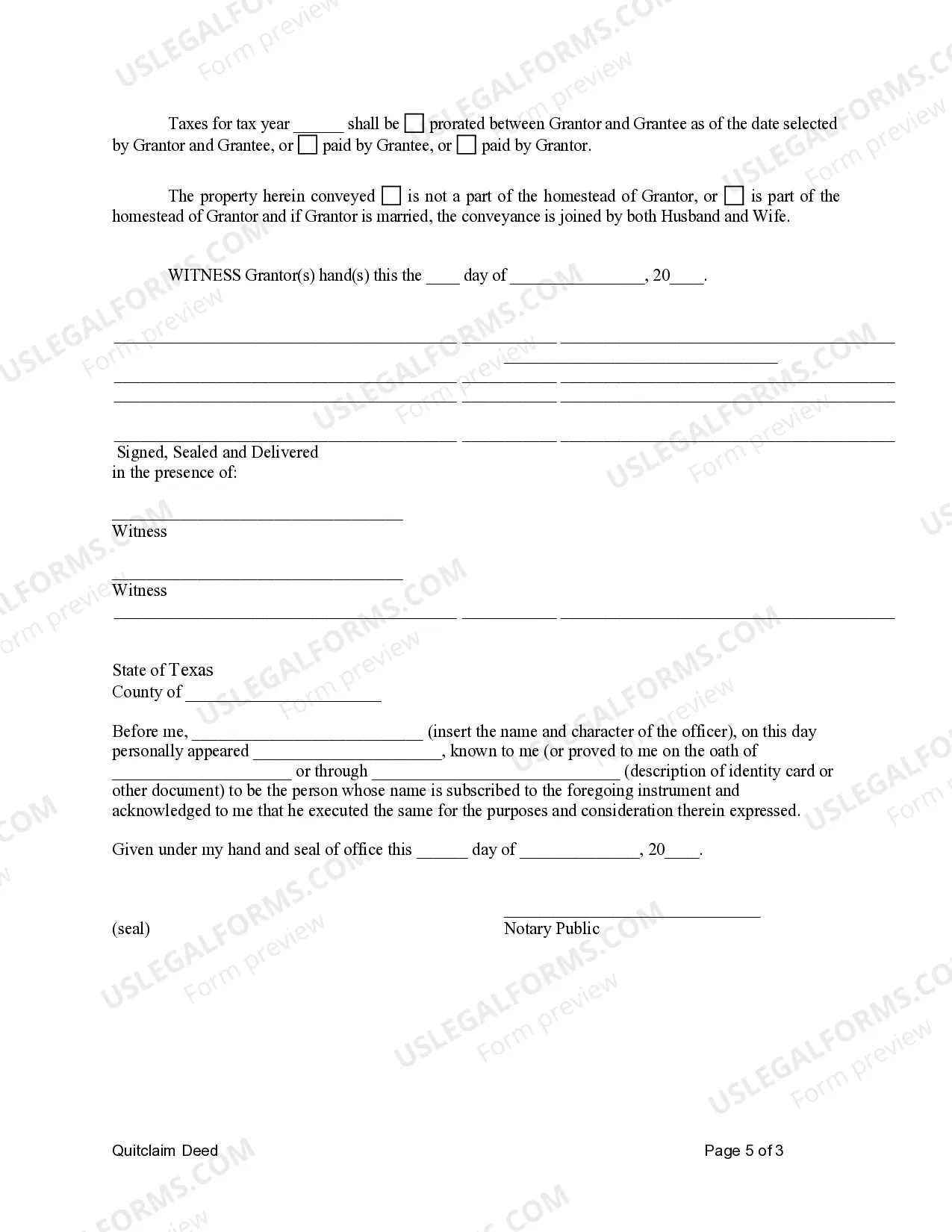

This ia a Quitclaim Deed from Individual to Trust for the state of Texas. This is a Quitclaim deed in which the grantor is an individual and grantee is a trust. This form complies with all state statutory laws. This Quitclaim Deed must be signed in front of a Notary Public.

A Sugar Land Texas Quitclaim Deed from Individual to Trust is a legal document that facilitates the transfer of ownership of real property from an individual to a trust entity. This type of deed is commonly used when an individual wants to transfer their property to a trust they have established. A quitclaim deed is often used when there is an existing relationship between the individual and the trust, such as in the case of estate planning or asset protection. The deed transfers the individual's ownership rights, interests, and claims to the property to the trust, ensuring that it becomes a part of the trust's assets. In Sugar Land, Texas, there are different types of quitclaim deeds from individuals to trusts that can be used for various purposes. These may include: 1. Revocable Living Trust Quitclaim Deed: This type of deed is commonly used in estate planning to transfer ownership of property from an individual to a revocable living trust. The revocable nature of the trust allows the individual to maintain control and make changes to the trust during their lifetime. 2. Irrevocable Trust Quitclaim Deed: An irrevocable trust quitclaim deed is used when an individual wants to transfer property ownership to an irrevocable trust. Unlike a revocable trust, an irrevocable trust cannot be altered or revoked once established, making it a suitable option for asset protection or charitable giving purposes. 3. Special Needs Trust Quitclaim Deed: This type of quitclaim deed is utilized when an individual wishes to transfer property to a special needs trust. A special needs trust is designed to provide financial support and care to individuals with disabilities without affecting their eligibility for government assistance programs. 4. Charitable Trust Quitclaim Deed: This quitclaim deed is used to transfer ownership of property to a charitable trust. Charitable trusts are established to support nonprofit organizations or charitable causes, allowing individuals to contribute their property for the greater good. It is important to note that while a quitclaim deed transfers the individual's ownership rights, it does not provide any guarantee or warranty regarding the title's validity or clear legal status. It is prudent to consult with a legal professional familiar with Sugar Land, Texas laws to ensure compliance and understanding of the specific requirements for executing a quitclaim deed in the area.A Sugar Land Texas Quitclaim Deed from Individual to Trust is a legal document that facilitates the transfer of ownership of real property from an individual to a trust entity. This type of deed is commonly used when an individual wants to transfer their property to a trust they have established. A quitclaim deed is often used when there is an existing relationship between the individual and the trust, such as in the case of estate planning or asset protection. The deed transfers the individual's ownership rights, interests, and claims to the property to the trust, ensuring that it becomes a part of the trust's assets. In Sugar Land, Texas, there are different types of quitclaim deeds from individuals to trusts that can be used for various purposes. These may include: 1. Revocable Living Trust Quitclaim Deed: This type of deed is commonly used in estate planning to transfer ownership of property from an individual to a revocable living trust. The revocable nature of the trust allows the individual to maintain control and make changes to the trust during their lifetime. 2. Irrevocable Trust Quitclaim Deed: An irrevocable trust quitclaim deed is used when an individual wants to transfer property ownership to an irrevocable trust. Unlike a revocable trust, an irrevocable trust cannot be altered or revoked once established, making it a suitable option for asset protection or charitable giving purposes. 3. Special Needs Trust Quitclaim Deed: This type of quitclaim deed is utilized when an individual wishes to transfer property to a special needs trust. A special needs trust is designed to provide financial support and care to individuals with disabilities without affecting their eligibility for government assistance programs. 4. Charitable Trust Quitclaim Deed: This quitclaim deed is used to transfer ownership of property to a charitable trust. Charitable trusts are established to support nonprofit organizations or charitable causes, allowing individuals to contribute their property for the greater good. It is important to note that while a quitclaim deed transfers the individual's ownership rights, it does not provide any guarantee or warranty regarding the title's validity or clear legal status. It is prudent to consult with a legal professional familiar with Sugar Land, Texas laws to ensure compliance and understanding of the specific requirements for executing a quitclaim deed in the area.