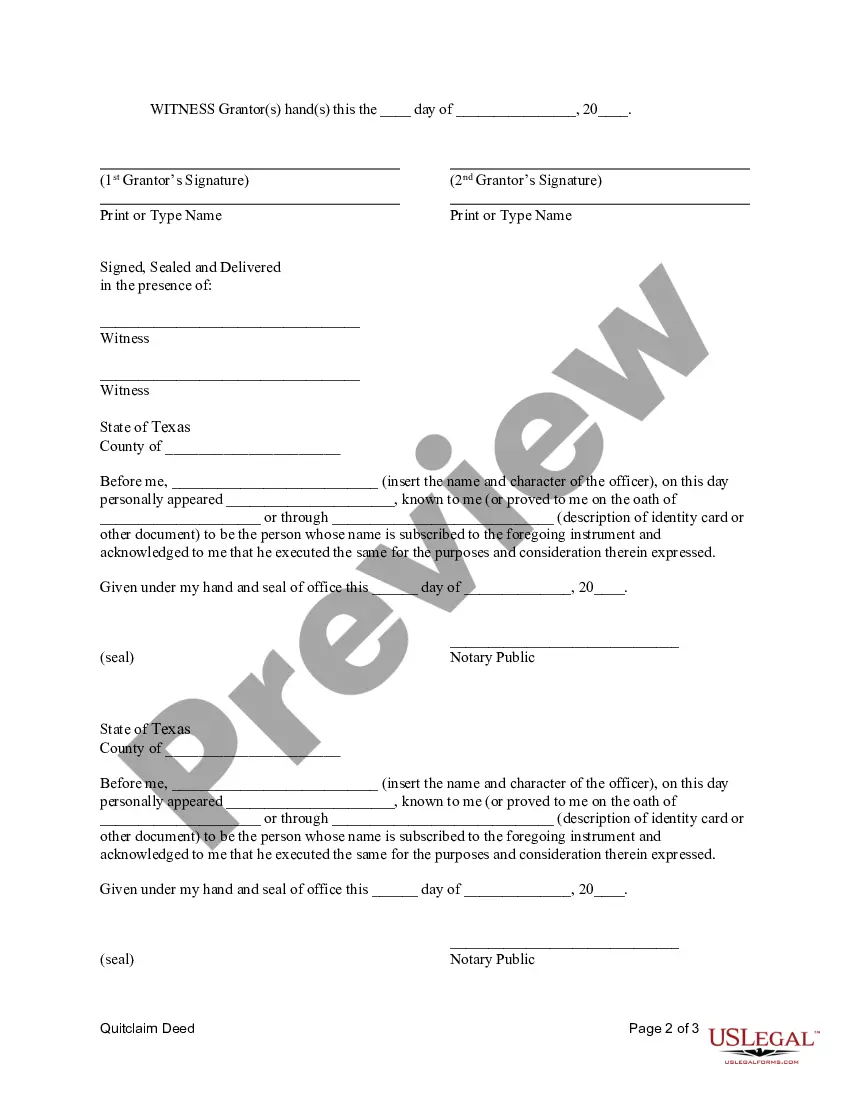

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Brownsville Texas Quitclaim Deed from Husband and Wife to Corporation is a legal document utilized when a couple wishes to transfer ownership of their property to a corporation through a quitclaim deed. This type of deed allows the spouses to release their rights and interests in the property to the corporation, without providing any guarantees or warranties regarding the property's title. The Brownsville Texas Quitclaim Deed from Husband and Wife to Corporation is commonly used in various scenarios, such as when a couple wants to incorporate their property within a business entity, transfer property ownership to an existing corporation, or facilitate estate planning strategies. This deed acts as a legal instrument to effectuate the transfer of ownership rights from the spouses to the corporation. It is important to note that there are different types of Brownsville Texas Quitclaim Deeds from Husband and Wife to Corporation, each serving distinct purposes. Some common types include: 1. Traditional Brownsville Texas Quitclaim Deed: This is the standard document used to transfer property ownership from a married couple to a corporation. It outlines the spouses as granters (relinquishing their rights) and the corporation as the grantee (receiving the rights). 2. Brownsville Texas Quitclaim Deed with Consideration: In this variation, the spouses may include a monetary consideration for the transfer of ownership, usually to satisfy legal requirements or for tax purposes. The consideration amount is typically mentioned in the deed. 3. Brownsville Texas Quitclaim Deed with Life Estate: This type of deed enables the married couple to transfer their property rights to the corporation while retaining life estate rights, which means they can continue to live on and use the property until their death. Upon their demise, the corporation automatically assumes full ownership. 4. Brownsville Texas Quitclaim Deed with Restrictive Covenant: In certain cases, the spouses may impose restrictive covenants or conditions on the use of the property by the corporation. This may include limitations on development, usage restrictions, or specific requirements that the corporation must abide by when utilizing the property. It is crucial to consult with an experienced attorney or legal professional while preparing a Brownsville Texas Quitclaim Deed from Husband and Wife to Corporation to ensure compliance with local laws and adequately address any specific requirements or circumstances. In conclusion, a Brownsville Texas Quitclaim Deed from Husband and Wife to Corporation is a legal instrument used to transfer property ownership rights from a married couple to a corporation. Various types of these deeds exist to cater to different scenarios, including those with consideration, life estate rights, or restrictive covenants. Seeking legal guidance is crucial to ensure the proper execution of such deeds.A Brownsville Texas Quitclaim Deed from Husband and Wife to Corporation is a legal document utilized when a couple wishes to transfer ownership of their property to a corporation through a quitclaim deed. This type of deed allows the spouses to release their rights and interests in the property to the corporation, without providing any guarantees or warranties regarding the property's title. The Brownsville Texas Quitclaim Deed from Husband and Wife to Corporation is commonly used in various scenarios, such as when a couple wants to incorporate their property within a business entity, transfer property ownership to an existing corporation, or facilitate estate planning strategies. This deed acts as a legal instrument to effectuate the transfer of ownership rights from the spouses to the corporation. It is important to note that there are different types of Brownsville Texas Quitclaim Deeds from Husband and Wife to Corporation, each serving distinct purposes. Some common types include: 1. Traditional Brownsville Texas Quitclaim Deed: This is the standard document used to transfer property ownership from a married couple to a corporation. It outlines the spouses as granters (relinquishing their rights) and the corporation as the grantee (receiving the rights). 2. Brownsville Texas Quitclaim Deed with Consideration: In this variation, the spouses may include a monetary consideration for the transfer of ownership, usually to satisfy legal requirements or for tax purposes. The consideration amount is typically mentioned in the deed. 3. Brownsville Texas Quitclaim Deed with Life Estate: This type of deed enables the married couple to transfer their property rights to the corporation while retaining life estate rights, which means they can continue to live on and use the property until their death. Upon their demise, the corporation automatically assumes full ownership. 4. Brownsville Texas Quitclaim Deed with Restrictive Covenant: In certain cases, the spouses may impose restrictive covenants or conditions on the use of the property by the corporation. This may include limitations on development, usage restrictions, or specific requirements that the corporation must abide by when utilizing the property. It is crucial to consult with an experienced attorney or legal professional while preparing a Brownsville Texas Quitclaim Deed from Husband and Wife to Corporation to ensure compliance with local laws and adequately address any specific requirements or circumstances. In conclusion, a Brownsville Texas Quitclaim Deed from Husband and Wife to Corporation is a legal instrument used to transfer property ownership rights from a married couple to a corporation. Various types of these deeds exist to cater to different scenarios, including those with consideration, life estate rights, or restrictive covenants. Seeking legal guidance is crucial to ensure the proper execution of such deeds.