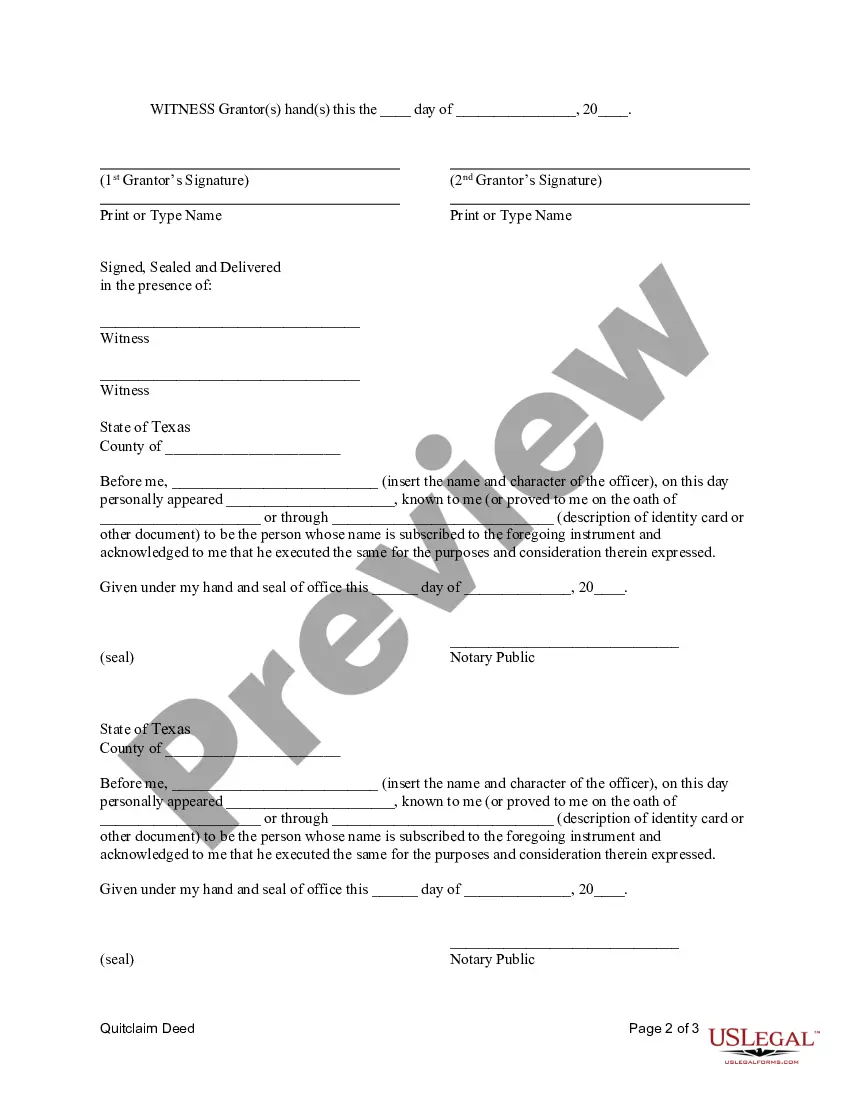

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

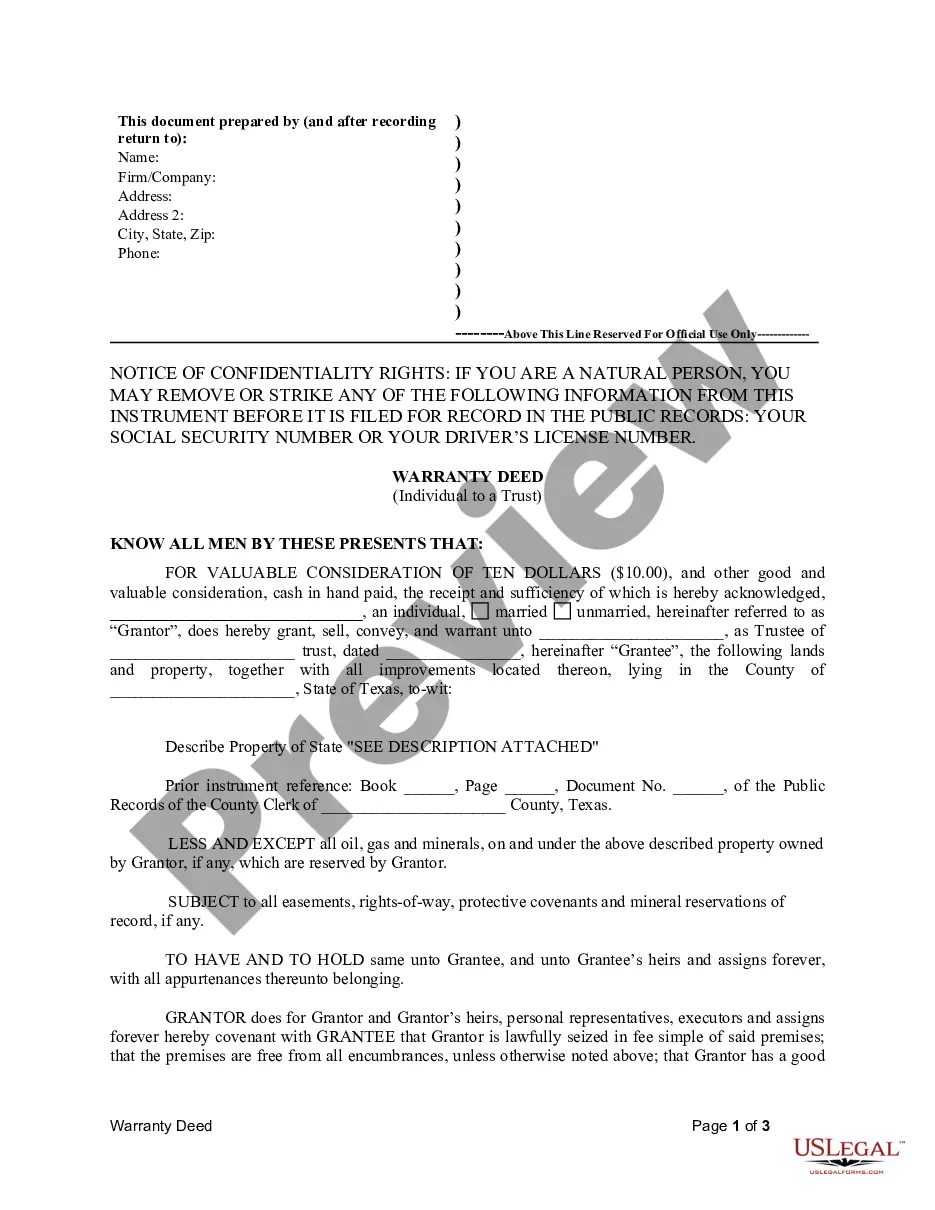

A Carrollton Texas Quitclaim Deed from Husband and Wife to Corporation refers to a legal document that facilitates the transfer of property ownership between married individuals and a corporate entity. This type of deed is commonly used when a couple intends to transfer their jointly owned property to a corporation for various reasons, such as asset protection, tax benefits, or business purposes. The Carrollton Texas Quitclaim Deed from Husband and Wife to Corporation involves the relinquishment of all rights, claims, and interests the couple holds in the property. It signifies that the husband and wife are willing to transfer their ownership rights in the property to the named corporation, without offering any warranty or guarantee about the property's title or condition. It is crucial to note that quitclaim deeds do not necessarily indicate a sale but rather a transfer of ownership interest. There are certain types of Carrollton Texas Quitclaim Deeds from Husband and Wife to Corporation that can be identified based on specific circumstances. Some examples include: 1. Voluntary Quitclaim Deed: This type of quitclaim deed is executed by the husband and wife voluntarily, with both parties willingly agreeing to transfer their ownership interests to the corporation. It usually occurs when the couple decides to incorporate their jointly-owned property for business or investment purposes. 2. Divorce Quitclaim Deed: In cases of divorce, where the property was jointly owned by the husband and wife, a quitclaim deed may be used to transfer the property to a corporation. This type of quitclaim deed serves to clarify the property division and ensures a smooth transfer of ownership rights while finalizing the divorce proceedings. 3. Estate Planning Quitclaim Deed: This quitclaim deed becomes relevant when a couple wants to incorporate their property as part of their estate planning strategy. By transferring property ownership to a corporation, they can potentially mitigate estate taxes or protect the property from probate processes. 4. Tax Planning Quitclaim Deed: A quitclaim deed involving a transfer of property to a corporation can be utilized for tax planning purposes. By transferring ownership to a corporation, the couple might benefit from certain tax advantages, such as depreciation deductions or lower tax rates applicable to corporate entities. When executing a Carrollton Texas Quitclaim Deed from Husband and Wife to Corporation, it is crucial to consult a qualified attorney or legal professional to ensure compliance with local laws and regulations. This ensures that the deed accurately represents the intentions of the parties involved and provides legal protection for all parties involved in the transfer of property ownership.A Carrollton Texas Quitclaim Deed from Husband and Wife to Corporation refers to a legal document that facilitates the transfer of property ownership between married individuals and a corporate entity. This type of deed is commonly used when a couple intends to transfer their jointly owned property to a corporation for various reasons, such as asset protection, tax benefits, or business purposes. The Carrollton Texas Quitclaim Deed from Husband and Wife to Corporation involves the relinquishment of all rights, claims, and interests the couple holds in the property. It signifies that the husband and wife are willing to transfer their ownership rights in the property to the named corporation, without offering any warranty or guarantee about the property's title or condition. It is crucial to note that quitclaim deeds do not necessarily indicate a sale but rather a transfer of ownership interest. There are certain types of Carrollton Texas Quitclaim Deeds from Husband and Wife to Corporation that can be identified based on specific circumstances. Some examples include: 1. Voluntary Quitclaim Deed: This type of quitclaim deed is executed by the husband and wife voluntarily, with both parties willingly agreeing to transfer their ownership interests to the corporation. It usually occurs when the couple decides to incorporate their jointly-owned property for business or investment purposes. 2. Divorce Quitclaim Deed: In cases of divorce, where the property was jointly owned by the husband and wife, a quitclaim deed may be used to transfer the property to a corporation. This type of quitclaim deed serves to clarify the property division and ensures a smooth transfer of ownership rights while finalizing the divorce proceedings. 3. Estate Planning Quitclaim Deed: This quitclaim deed becomes relevant when a couple wants to incorporate their property as part of their estate planning strategy. By transferring property ownership to a corporation, they can potentially mitigate estate taxes or protect the property from probate processes. 4. Tax Planning Quitclaim Deed: A quitclaim deed involving a transfer of property to a corporation can be utilized for tax planning purposes. By transferring ownership to a corporation, the couple might benefit from certain tax advantages, such as depreciation deductions or lower tax rates applicable to corporate entities. When executing a Carrollton Texas Quitclaim Deed from Husband and Wife to Corporation, it is crucial to consult a qualified attorney or legal professional to ensure compliance with local laws and regulations. This ensures that the deed accurately represents the intentions of the parties involved and provides legal protection for all parties involved in the transfer of property ownership.