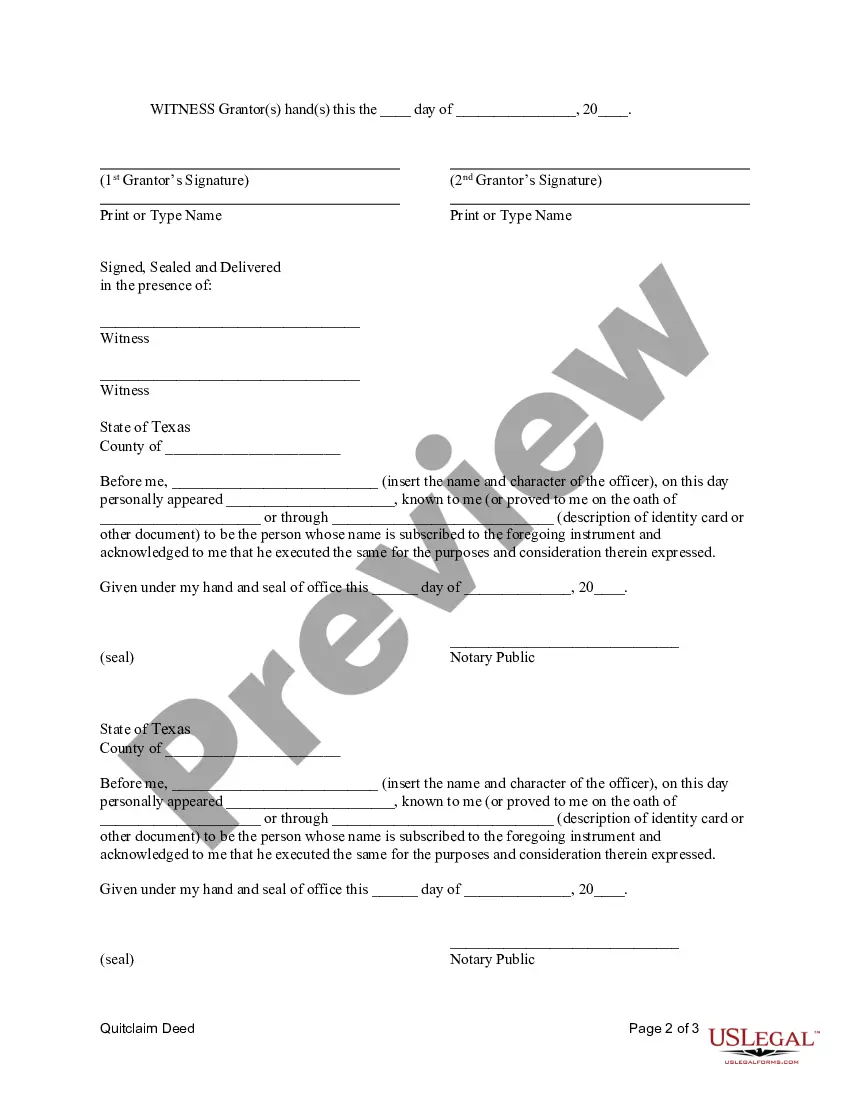

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A College Stations Texas Quitclaim Deed from Husband and Wife to Corporation is a legal document that signifies the transfer of real property ownership from a married couple to a corporation without any guarantees regarding the property's title. This type of deed can be used in various situations, such as business restructuring, estate planning, or asset protection. It is important to note that there can be different variations of this deed, including: 1. Standard College Station Texas Quitclaim Deed from Husband and Wife to Corporation: This type of Quitclaim Deed is the most common transfer method. It involves the husband and wife willingly relinquishing any ownership rights they have over the property to the corporation. 2. College Station Texas Corporate Entity Formation Quitclaim Deed: This deed variation refers specifically to the transfer of ownership when a corporation is being formed for the purpose of holding the property. It involves legally establishing the corporation and then transferring the property title to it via a Quitclaim Deed. 3. College Station Texas Quitclaim Deed with Specific Restrictions/Clauses: In some cases, additional clauses or restrictions may be included in the Quitclaim Deed from Husband and Wife to Corporation. These clauses could address specific conditions for the use of the property, restrictions on transfer or sale, or provisions related to future disputes or liabilities. 4. College Station Texas Quitclaim Deed with Conveyance of Rights and Easements: This type of Quitclaim Deed may transfer not only the property but also any rights or easements associated with it. For example, if the property has utility easements, access rights, or any shared common areas, those can be included in the deed transfer to ensure the full transfer of ownership rights. It is essential to consult with an attorney or a real estate professional experienced in College Station Texas real estate laws when preparing a Quitclaim Deed from Husband and Wife to Corporation. They can guide you through the process, ensure all legal requirements are met, and verify that the deed accurately reflects the intended transfer of ownership rights.A College Stations Texas Quitclaim Deed from Husband and Wife to Corporation is a legal document that signifies the transfer of real property ownership from a married couple to a corporation without any guarantees regarding the property's title. This type of deed can be used in various situations, such as business restructuring, estate planning, or asset protection. It is important to note that there can be different variations of this deed, including: 1. Standard College Station Texas Quitclaim Deed from Husband and Wife to Corporation: This type of Quitclaim Deed is the most common transfer method. It involves the husband and wife willingly relinquishing any ownership rights they have over the property to the corporation. 2. College Station Texas Corporate Entity Formation Quitclaim Deed: This deed variation refers specifically to the transfer of ownership when a corporation is being formed for the purpose of holding the property. It involves legally establishing the corporation and then transferring the property title to it via a Quitclaim Deed. 3. College Station Texas Quitclaim Deed with Specific Restrictions/Clauses: In some cases, additional clauses or restrictions may be included in the Quitclaim Deed from Husband and Wife to Corporation. These clauses could address specific conditions for the use of the property, restrictions on transfer or sale, or provisions related to future disputes or liabilities. 4. College Station Texas Quitclaim Deed with Conveyance of Rights and Easements: This type of Quitclaim Deed may transfer not only the property but also any rights or easements associated with it. For example, if the property has utility easements, access rights, or any shared common areas, those can be included in the deed transfer to ensure the full transfer of ownership rights. It is essential to consult with an attorney or a real estate professional experienced in College Station Texas real estate laws when preparing a Quitclaim Deed from Husband and Wife to Corporation. They can guide you through the process, ensure all legal requirements are met, and verify that the deed accurately reflects the intended transfer of ownership rights.