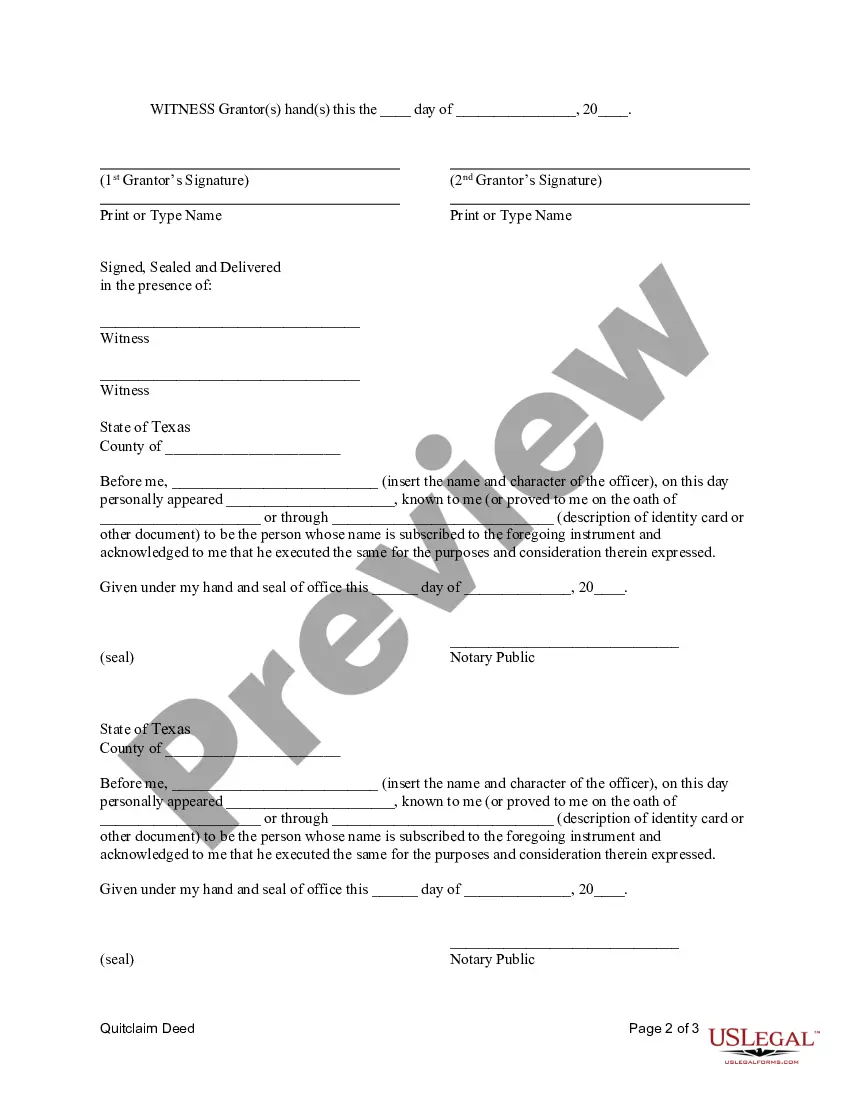

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Collin Texas Quitclaim Deed from Husband and Wife to Corporation is a legal document that allows a married couple to transfer their interest in a property to a corporation through a quitclaim deed. This transfer effectively removes their ownership rights and vests them in the corporation instead. This type of deed is commonly used when a couple wants to transfer ownership of their property to a corporation for various reasons such as tax planning, liability protection, or to facilitate future business endeavors. It is important to note that a quitclaim deed does not provide any guarantees or warranties regarding the property's title, and it only transfers the interest that the granter has at the time of the transfer. There are several types of Collin Texas Quitclaim Deeds from Husband and Wife to Corporation, each designed to address specific circumstances or requirements: 1. General Collin Texas Quitclaim Deed from Husband and Wife to Corporation: This is the most commonly used type of quitclaim deed. It allows the husband and wife to transfer their entire ownership interest in the property to the corporation, without specifying any restrictions or limitations on the transfer. 2. Restricted Collin Texas Quitclaim Deed from Husband and Wife to Corporation: In some cases, the husband and wife may want to transfer their ownership interest to the corporation but retain certain restrictions or limitations. This type of quitclaim deed allows the couple to define specific terms or conditions under which the property can be used or transferred by the corporation. 3. Life Estate Collin Texas Quitclaim Deed from Husband and Wife to Corporation: A life estate quitclaim deed enables the husband and wife to transfer their current ownership interest to the corporation but retain the right to occupy or use the property until their deaths. Once they pass away, the corporation gains full ownership of the property. 4. Partial Collin Texas Quitclaim Deed from Husband and Wife to Corporation: When the husband and wife only want to transfer a portion of their ownership interest to the corporation, a partial quitclaim deed can be used. This allows them to specify the exact percentage or fraction of their interest being transferred. Overall, a Collin Texas Quitclaim Deed from Husband and Wife to Corporation is a legal mechanism that enables married couples to transfer their property ownership to a corporation. However, it is crucial to consult with an experienced real estate attorney to ensure the document is prepared correctly, considering the specific legal requirements and implications involved in such a transfer. Keywords: Collin Texas, Quitclaim Deed, Husband and Wife, Corporation, transfer, ownership rights, property, legal document, tax planning, liability protection, business endeavors, guarantees, warranties, restrictions, limitations, General Quitclaim Deed, Restricted Quitclaim Deed, Life Estate Quitclaim Deed, Partial Quitclaim Deed, real estate attorney.A Collin Texas Quitclaim Deed from Husband and Wife to Corporation is a legal document that allows a married couple to transfer their interest in a property to a corporation through a quitclaim deed. This transfer effectively removes their ownership rights and vests them in the corporation instead. This type of deed is commonly used when a couple wants to transfer ownership of their property to a corporation for various reasons such as tax planning, liability protection, or to facilitate future business endeavors. It is important to note that a quitclaim deed does not provide any guarantees or warranties regarding the property's title, and it only transfers the interest that the granter has at the time of the transfer. There are several types of Collin Texas Quitclaim Deeds from Husband and Wife to Corporation, each designed to address specific circumstances or requirements: 1. General Collin Texas Quitclaim Deed from Husband and Wife to Corporation: This is the most commonly used type of quitclaim deed. It allows the husband and wife to transfer their entire ownership interest in the property to the corporation, without specifying any restrictions or limitations on the transfer. 2. Restricted Collin Texas Quitclaim Deed from Husband and Wife to Corporation: In some cases, the husband and wife may want to transfer their ownership interest to the corporation but retain certain restrictions or limitations. This type of quitclaim deed allows the couple to define specific terms or conditions under which the property can be used or transferred by the corporation. 3. Life Estate Collin Texas Quitclaim Deed from Husband and Wife to Corporation: A life estate quitclaim deed enables the husband and wife to transfer their current ownership interest to the corporation but retain the right to occupy or use the property until their deaths. Once they pass away, the corporation gains full ownership of the property. 4. Partial Collin Texas Quitclaim Deed from Husband and Wife to Corporation: When the husband and wife only want to transfer a portion of their ownership interest to the corporation, a partial quitclaim deed can be used. This allows them to specify the exact percentage or fraction of their interest being transferred. Overall, a Collin Texas Quitclaim Deed from Husband and Wife to Corporation is a legal mechanism that enables married couples to transfer their property ownership to a corporation. However, it is crucial to consult with an experienced real estate attorney to ensure the document is prepared correctly, considering the specific legal requirements and implications involved in such a transfer. Keywords: Collin Texas, Quitclaim Deed, Husband and Wife, Corporation, transfer, ownership rights, property, legal document, tax planning, liability protection, business endeavors, guarantees, warranties, restrictions, limitations, General Quitclaim Deed, Restricted Quitclaim Deed, Life Estate Quitclaim Deed, Partial Quitclaim Deed, real estate attorney.