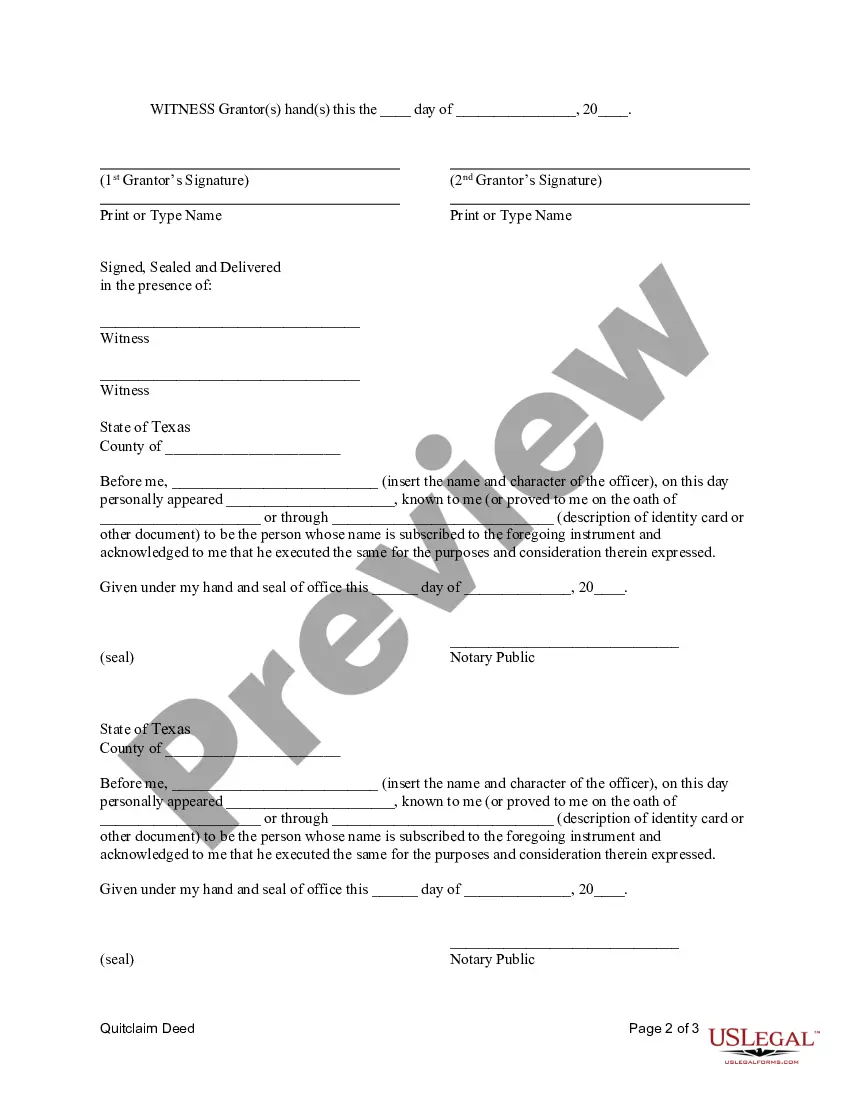

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

Edinburg Texas Quitclaim Deed from Husband and Wife to Corporation is a legal document that transfers all ownership rights of a property from a husband and wife to a corporation. This type of deed is commonly used when a married couple wants to transfer their property to a corporation that they own or establish, for various purposes such as asset protection, tax planning, or business expansion. The deed effectively "quits" any claims or interests the husband and wife have on the property, and transfers them to the corporation. There are several types of Edinburg Texas Quitclaim Deeds from Husband and Wife to Corporation, each serving a specific purpose: 1. Standard Edinburg Texas Quitclaim Deed from Husband and Wife to Corporation: This is the most commonly used type of deed and simply transfers the property ownership from the husband and wife to the corporation. It outlines the legal description of the property, identifies the parties involved, and contains acknowledgment and signature sections. 2. Edinburg Texas Quitclaim Deed with Reservation: In some cases, the husband and wife may want to retain certain rights or interests in the property being transferred to the corporation. This type of deed allows them to transfer most of the ownership rights but keeps specific rights, such as the right to reside in the property for a specified period or to receive rental income. 3. Edinburg Texas Quitclaim Deed without Warranty: With this type of deed, the husband and wife transfer the property to the corporation without providing any warranties or guarantees regarding the property's title or condition. The corporation accepts the property as-is, assuming any potential risks or issues. 4. Edinburg Texas Quitclaim Deed with Covenants: This type of deed includes certain covenants, which are legally binding promises made by the husband and wife to defend the corporation's title against any future claims. It provides the corporation with additional protection and assurance regarding the property's ownership. 5. Edinburg Texas Quitclaim Deed for Specific Purposes: In some cases, the husband and wife may use a quitclaim deed to transfer specific types of property or interests to the corporation, such as mineral rights, easements, or water rights. These deeds are specialized and have additional provisions to address the specific nature of the transferred rights. It is important to consult with a qualified real estate attorney when preparing an Edinburg Texas Quitclaim Deed from Husband and Wife to Corporation to ensure compliance with local laws and to address any individual circumstances or requirements.Edinburg Texas Quitclaim Deed from Husband and Wife to Corporation is a legal document that transfers all ownership rights of a property from a husband and wife to a corporation. This type of deed is commonly used when a married couple wants to transfer their property to a corporation that they own or establish, for various purposes such as asset protection, tax planning, or business expansion. The deed effectively "quits" any claims or interests the husband and wife have on the property, and transfers them to the corporation. There are several types of Edinburg Texas Quitclaim Deeds from Husband and Wife to Corporation, each serving a specific purpose: 1. Standard Edinburg Texas Quitclaim Deed from Husband and Wife to Corporation: This is the most commonly used type of deed and simply transfers the property ownership from the husband and wife to the corporation. It outlines the legal description of the property, identifies the parties involved, and contains acknowledgment and signature sections. 2. Edinburg Texas Quitclaim Deed with Reservation: In some cases, the husband and wife may want to retain certain rights or interests in the property being transferred to the corporation. This type of deed allows them to transfer most of the ownership rights but keeps specific rights, such as the right to reside in the property for a specified period or to receive rental income. 3. Edinburg Texas Quitclaim Deed without Warranty: With this type of deed, the husband and wife transfer the property to the corporation without providing any warranties or guarantees regarding the property's title or condition. The corporation accepts the property as-is, assuming any potential risks or issues. 4. Edinburg Texas Quitclaim Deed with Covenants: This type of deed includes certain covenants, which are legally binding promises made by the husband and wife to defend the corporation's title against any future claims. It provides the corporation with additional protection and assurance regarding the property's ownership. 5. Edinburg Texas Quitclaim Deed for Specific Purposes: In some cases, the husband and wife may use a quitclaim deed to transfer specific types of property or interests to the corporation, such as mineral rights, easements, or water rights. These deeds are specialized and have additional provisions to address the specific nature of the transferred rights. It is important to consult with a qualified real estate attorney when preparing an Edinburg Texas Quitclaim Deed from Husband and Wife to Corporation to ensure compliance with local laws and to address any individual circumstances or requirements.