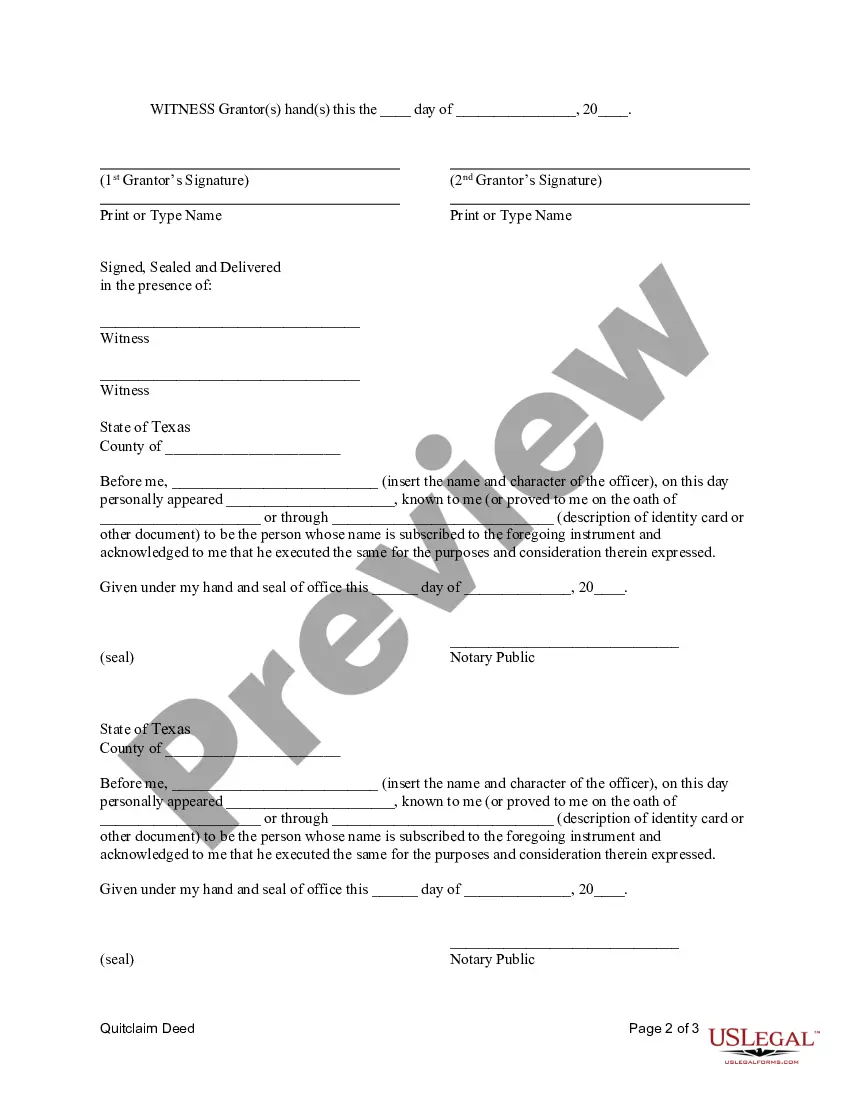

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Grand Prairie Texas Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer ownership of real property from a married couple to a corporation. This type of deed is commonly utilized when the couple wishes to transfer the property to a business entity owned by them, such as a corporation, for various reasons such as liability protection, tax advantages, or business restructuring. The Quitclaim Deed serves as a means of conveying all rights, title, and interest in the property from the husband and wife, acting as granters, to the corporation, acting as the grantee. It is important to note that a Quitclaim Deed does not guarantee or assure clear title to the property, but rather transfers whatever interest or claim the husband and wife may have on the property at the time of the transfer. There are several types of Grand Prairie Texas Quitclaim Deeds from Husband and Wife to Corporation, including: 1. General Quitclaim Deed: This is the most common type of Quitclaim Deed used in Grand Prairie, Texas. It outlines the transfer of ownership of the property from the spouses to the corporation, without any warranties or guarantees. 2. Warranty Quitclaim Deed: Unlike the general Quitclaim Deed, this type of deed provides limited warranties to the grantee. It assures the grantee that the spouse transferring the property has the legal right to do so, but does not protect against any prior claims or encumbrances on the property. 3. Special Purpose Quitclaim Deed: This type of deed is used when specific conditions or circumstances exist that necessitate a tailored transfer of property rights. For example, if the couple wishes to transfer ownership of only a portion of their property to the corporation, a Special Purpose Quitclaim Deed would be executed. It is important to consult with a qualified real estate attorney or legal professional when executing a Grand Prairie Texas Quitclaim Deed from Husband and Wife to Corporation to ensure compliance with all applicable laws and requirements. Additionally, conducting a thorough title search and obtaining title insurance is recommended to safeguard against any potential issues or claims on the property.A Grand Prairie Texas Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer ownership of real property from a married couple to a corporation. This type of deed is commonly utilized when the couple wishes to transfer the property to a business entity owned by them, such as a corporation, for various reasons such as liability protection, tax advantages, or business restructuring. The Quitclaim Deed serves as a means of conveying all rights, title, and interest in the property from the husband and wife, acting as granters, to the corporation, acting as the grantee. It is important to note that a Quitclaim Deed does not guarantee or assure clear title to the property, but rather transfers whatever interest or claim the husband and wife may have on the property at the time of the transfer. There are several types of Grand Prairie Texas Quitclaim Deeds from Husband and Wife to Corporation, including: 1. General Quitclaim Deed: This is the most common type of Quitclaim Deed used in Grand Prairie, Texas. It outlines the transfer of ownership of the property from the spouses to the corporation, without any warranties or guarantees. 2. Warranty Quitclaim Deed: Unlike the general Quitclaim Deed, this type of deed provides limited warranties to the grantee. It assures the grantee that the spouse transferring the property has the legal right to do so, but does not protect against any prior claims or encumbrances on the property. 3. Special Purpose Quitclaim Deed: This type of deed is used when specific conditions or circumstances exist that necessitate a tailored transfer of property rights. For example, if the couple wishes to transfer ownership of only a portion of their property to the corporation, a Special Purpose Quitclaim Deed would be executed. It is important to consult with a qualified real estate attorney or legal professional when executing a Grand Prairie Texas Quitclaim Deed from Husband and Wife to Corporation to ensure compliance with all applicable laws and requirements. Additionally, conducting a thorough title search and obtaining title insurance is recommended to safeguard against any potential issues or claims on the property.