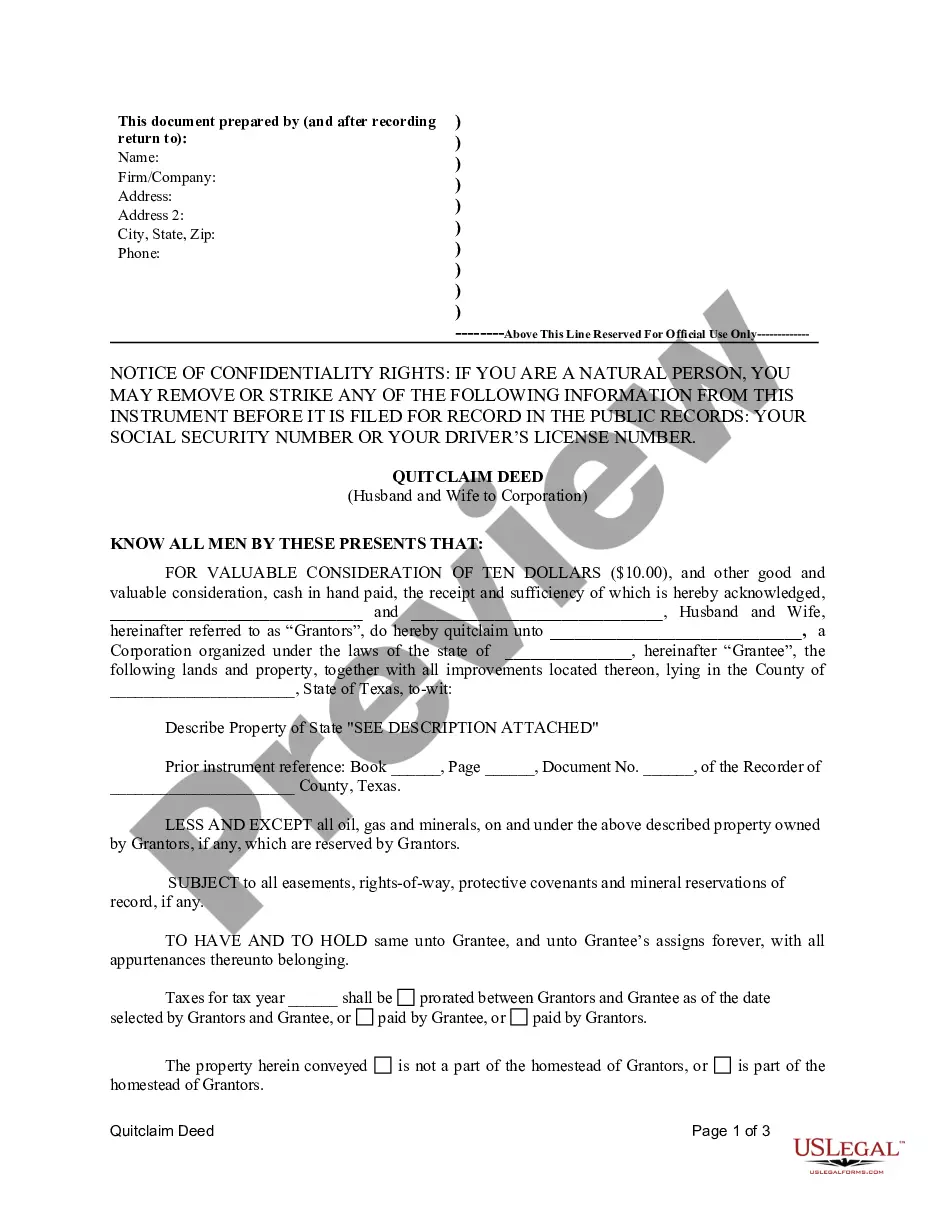

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

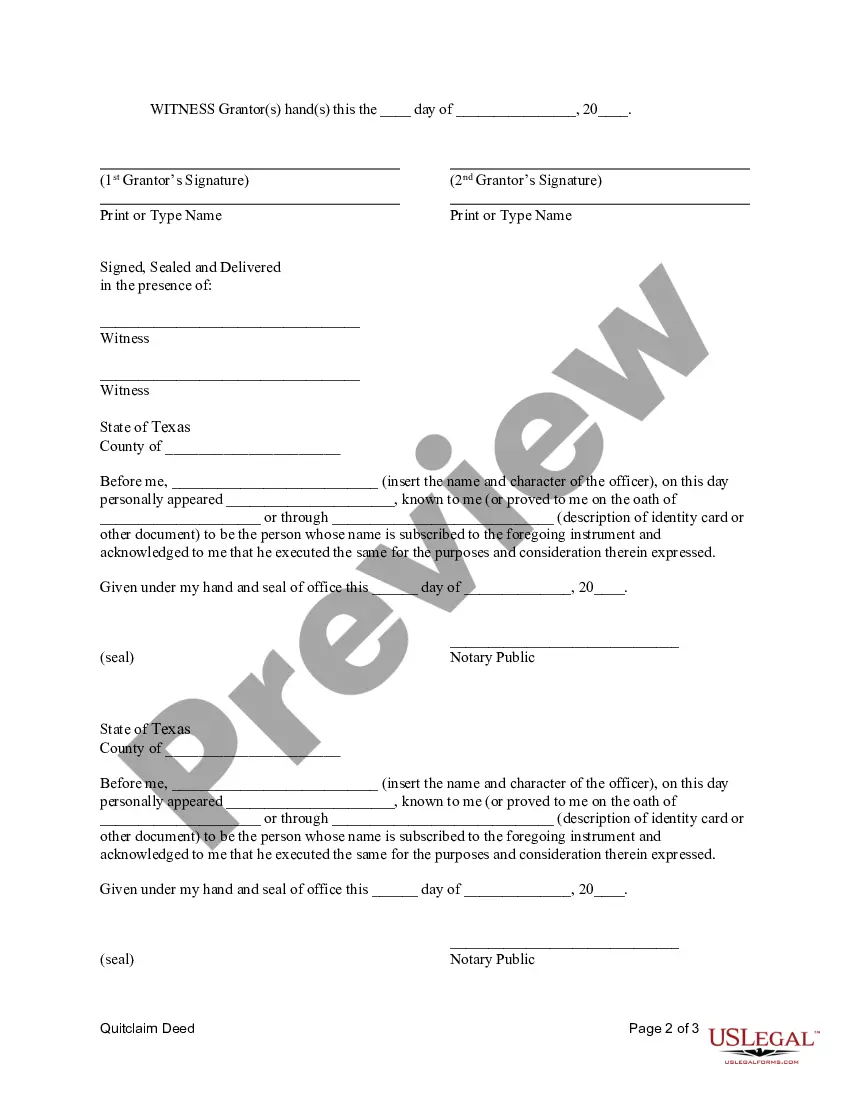

A Harris Texas Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer ownership of property from a married couple to a corporation. This type of deed is commonly used in situations where the couple wants to transfer the property to their corporation for various reasons, such as asset protection or tax benefits. The Harris Texas Quitclaim Deed from Husband and Wife to Corporation is a binding agreement that entails the transfer of both spouses' interest in the property to the corporation. The deed serves as evidence of the transfer and should include detailed information about the property, as well as the names and signatures of the husband, wife, and the corporation. There are several types of Harris Texas Quitclaim Deeds that can be used in different circumstances: 1. General Harris Texas Quitclaim Deed: This type of deed transfers the property from the husband and wife to the corporation without any guarantees or warranties regarding the property's title. It simply transfers the ownership interest without making any claims about the property's history or any potential liens or encumbrances. 2. Special Warranty Harris Texas Quitclaim Deed: This deed type provides a limited warranty, stating that the husband and wife warrant that they have not done anything to harm the property's title during their ownership. It offers some level of protection to the corporation against potential claims or disputes arising from the couple's ownership. 3. Lady Bird Harris Texas Quitclaim Deed: Named after Lady Bird Johnson, this type of deed is a special form of quitclaim deed that includes a reserved life estate for the husband and wife. It allows them to retain the right to live on or use the property until their death, after which full ownership automatically transfers to the corporation without probate or additional legal proceedings. 4. Corporate Assignment Harris Texas Quitclaim Deed: This deed transfers the property from the husband and wife to the corporation when the property is already owned by either the husband or the wife in their individual capacity. This type of deed is usually used when the couple wants to consolidate their property under the corporation's ownership. It is important to consult with a qualified real estate attorney to ensure the correct type of Harris Texas Quitclaim Deed is used in a specific situation. Additionally, it is crucial to comply with all legal requirements and properly record the deed with the appropriate county clerk's office in Harris County, Texas.A Harris Texas Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer ownership of property from a married couple to a corporation. This type of deed is commonly used in situations where the couple wants to transfer the property to their corporation for various reasons, such as asset protection or tax benefits. The Harris Texas Quitclaim Deed from Husband and Wife to Corporation is a binding agreement that entails the transfer of both spouses' interest in the property to the corporation. The deed serves as evidence of the transfer and should include detailed information about the property, as well as the names and signatures of the husband, wife, and the corporation. There are several types of Harris Texas Quitclaim Deeds that can be used in different circumstances: 1. General Harris Texas Quitclaim Deed: This type of deed transfers the property from the husband and wife to the corporation without any guarantees or warranties regarding the property's title. It simply transfers the ownership interest without making any claims about the property's history or any potential liens or encumbrances. 2. Special Warranty Harris Texas Quitclaim Deed: This deed type provides a limited warranty, stating that the husband and wife warrant that they have not done anything to harm the property's title during their ownership. It offers some level of protection to the corporation against potential claims or disputes arising from the couple's ownership. 3. Lady Bird Harris Texas Quitclaim Deed: Named after Lady Bird Johnson, this type of deed is a special form of quitclaim deed that includes a reserved life estate for the husband and wife. It allows them to retain the right to live on or use the property until their death, after which full ownership automatically transfers to the corporation without probate or additional legal proceedings. 4. Corporate Assignment Harris Texas Quitclaim Deed: This deed transfers the property from the husband and wife to the corporation when the property is already owned by either the husband or the wife in their individual capacity. This type of deed is usually used when the couple wants to consolidate their property under the corporation's ownership. It is important to consult with a qualified real estate attorney to ensure the correct type of Harris Texas Quitclaim Deed is used in a specific situation. Additionally, it is crucial to comply with all legal requirements and properly record the deed with the appropriate county clerk's office in Harris County, Texas.