This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

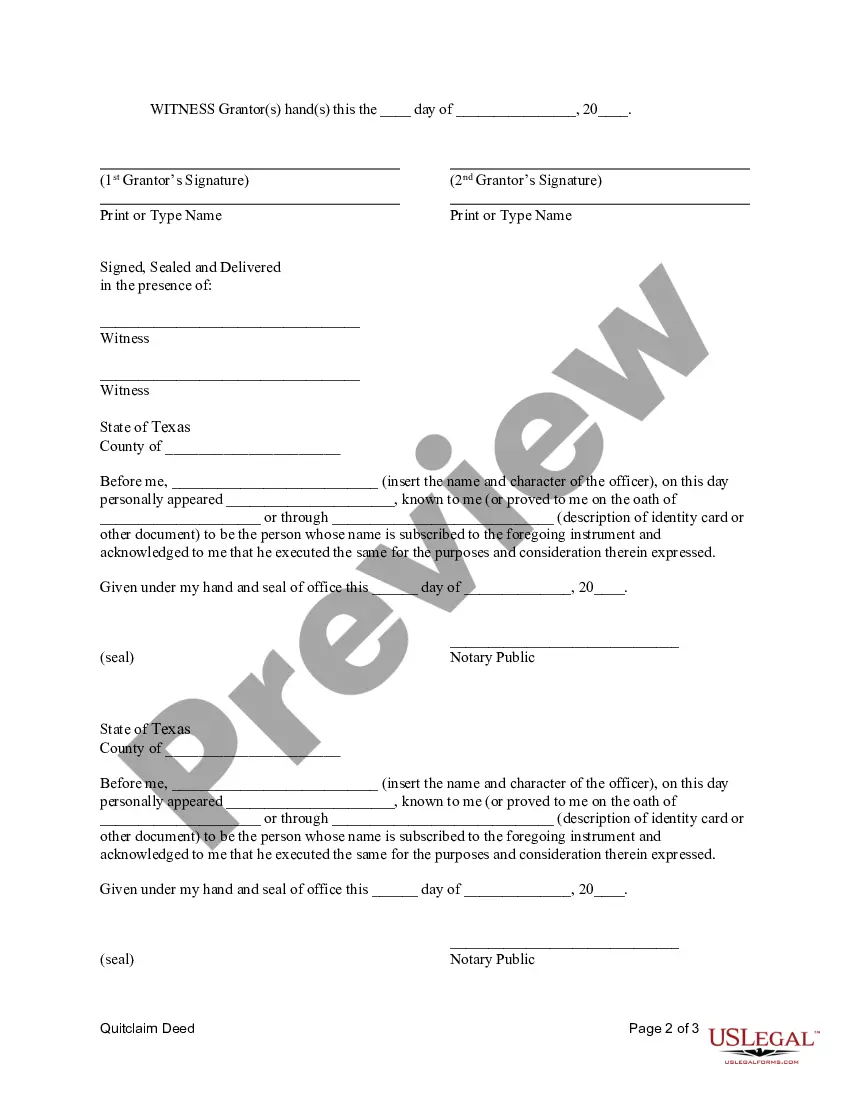

Title: Understanding McKinney Texas Quitclaim Deed from Husband and Wife to Corporation: Types and Detailed Explanation Keywords: McKinney Texas Quitclaim Deed, Husband and Wife, Corporation, Types, Detailed Explanation Introduction: A McKinney Texas Quitclaim Deed is a legal document that allows a husband and wife to transfer their ownership interests in a property to a corporation. This deed ensures a smooth transfer of ownership rights, and its execution should follow specific legal requirements. In this article, we will provide a detailed description of what a McKinney Texas Quitclaim Deed from Husband and Wife to Corporation entails, as well as discuss different types that exist. 1. General Explanation of McKinney Texas Quitclaim Deed from Husband and Wife to Corporation: A McKinney Texas Quitclaim Deed from Husband and Wife to Corporation is a legally binding document that legally transfers ownership interests from a married couple to a corporation. It is often used when the couple wishes to transfer property to their corporation for various purposes such as asset protection, business reorganization, or estate planning. 2. Process of Executing McKinney Texas Quitclaim Deed from Husband and Wife to Corporation: a. Drafting the Deed: It is advisable to seek the assistance of a qualified attorney experienced in real estate law to draft the McKinney Texas Quitclaim Deed accurately. The deed should state the husband and wife's intention to transfer their property as joint tenants to the corporation. b. Notarization: The deed must be signed by both spouses in the presence of a notary public, who signs and seals the document to authenticate it. c. Filing the Deed: The executed deed should be filed with the county clerk's office in McKinney, Texas, to officially transfer ownership rights from the couple to the corporation. Types of McKinney Texas Quitclaim Deed from Husband and Wife to Corporation: 1. McKinney Texas Quitclaim Deed with Reserved Rights: In this type of deed, the husband and wife transfer their ownership interests to the corporation while retaining certain rights, such as the right to live on the property or receive income generated from it. 2. McKinney Texas Conditional Quitclaim Deed from Husband and Wife to Corporation: This type of deed includes specific conditions that must be met before the transfer of ownership is complete. Conditions could include the corporation meeting certain performance criteria or fulfilling obligations outlined in the deed. 3. McKinney Texas Absolute Quitclaim Deed from Husband and Wife to Corporation: In an absolute quitclaim deed, the husband and wife relinquish all ownership rights and have no further claim to the property. This type of deed is commonly used when transferring property as a gift or as part of a business transition. Conclusion: A McKinney Texas Quitclaim Deed from Husband and Wife to Corporation allows a couple to transfer their ownership interests in a property to a corporation. It is crucial to consult with a qualified attorney to ensure the legal validity of the deed. With different types such as those mentioned above, choosing the appropriate quitclaim deed type depends on the particular circumstances and objectives of the property transfer.Title: Understanding McKinney Texas Quitclaim Deed from Husband and Wife to Corporation: Types and Detailed Explanation Keywords: McKinney Texas Quitclaim Deed, Husband and Wife, Corporation, Types, Detailed Explanation Introduction: A McKinney Texas Quitclaim Deed is a legal document that allows a husband and wife to transfer their ownership interests in a property to a corporation. This deed ensures a smooth transfer of ownership rights, and its execution should follow specific legal requirements. In this article, we will provide a detailed description of what a McKinney Texas Quitclaim Deed from Husband and Wife to Corporation entails, as well as discuss different types that exist. 1. General Explanation of McKinney Texas Quitclaim Deed from Husband and Wife to Corporation: A McKinney Texas Quitclaim Deed from Husband and Wife to Corporation is a legally binding document that legally transfers ownership interests from a married couple to a corporation. It is often used when the couple wishes to transfer property to their corporation for various purposes such as asset protection, business reorganization, or estate planning. 2. Process of Executing McKinney Texas Quitclaim Deed from Husband and Wife to Corporation: a. Drafting the Deed: It is advisable to seek the assistance of a qualified attorney experienced in real estate law to draft the McKinney Texas Quitclaim Deed accurately. The deed should state the husband and wife's intention to transfer their property as joint tenants to the corporation. b. Notarization: The deed must be signed by both spouses in the presence of a notary public, who signs and seals the document to authenticate it. c. Filing the Deed: The executed deed should be filed with the county clerk's office in McKinney, Texas, to officially transfer ownership rights from the couple to the corporation. Types of McKinney Texas Quitclaim Deed from Husband and Wife to Corporation: 1. McKinney Texas Quitclaim Deed with Reserved Rights: In this type of deed, the husband and wife transfer their ownership interests to the corporation while retaining certain rights, such as the right to live on the property or receive income generated from it. 2. McKinney Texas Conditional Quitclaim Deed from Husband and Wife to Corporation: This type of deed includes specific conditions that must be met before the transfer of ownership is complete. Conditions could include the corporation meeting certain performance criteria or fulfilling obligations outlined in the deed. 3. McKinney Texas Absolute Quitclaim Deed from Husband and Wife to Corporation: In an absolute quitclaim deed, the husband and wife relinquish all ownership rights and have no further claim to the property. This type of deed is commonly used when transferring property as a gift or as part of a business transition. Conclusion: A McKinney Texas Quitclaim Deed from Husband and Wife to Corporation allows a couple to transfer their ownership interests in a property to a corporation. It is crucial to consult with a qualified attorney to ensure the legal validity of the deed. With different types such as those mentioned above, choosing the appropriate quitclaim deed type depends on the particular circumstances and objectives of the property transfer.