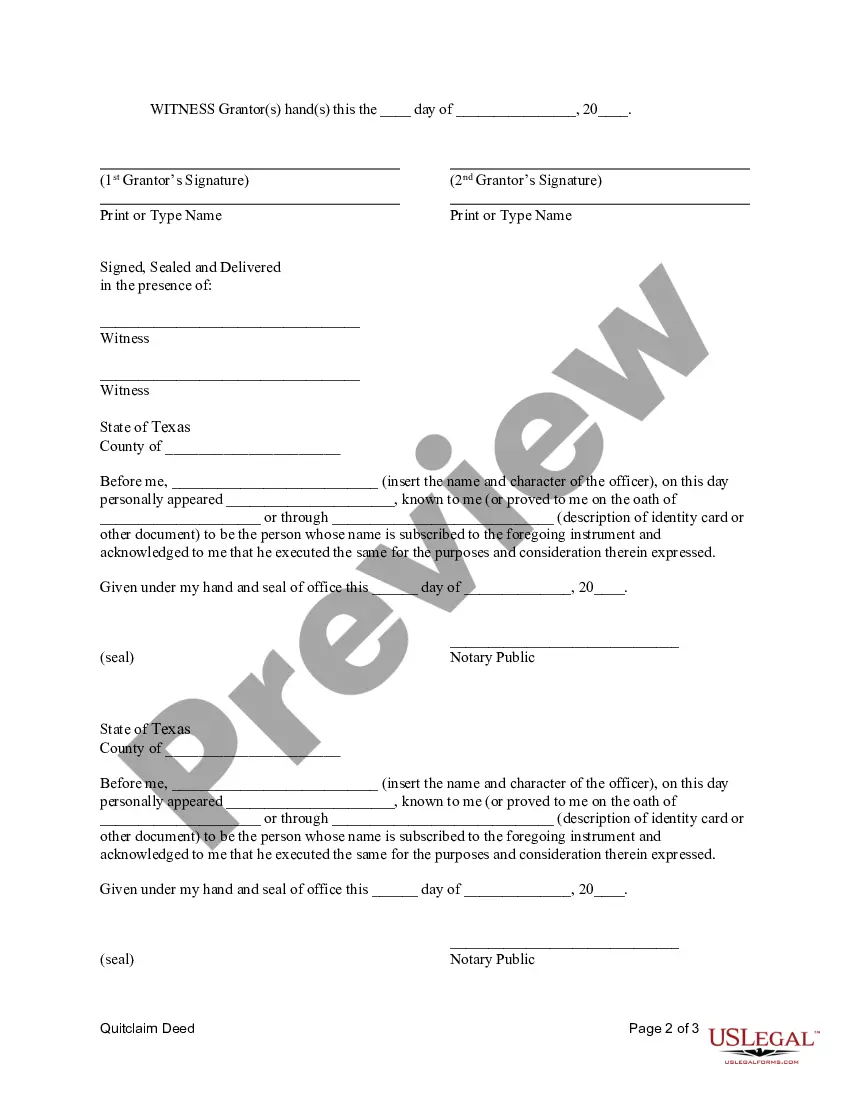

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Mesquite Texas Quitclaim Deed from Husband and Wife to Corporation is a legal document that transfers ownership of real property from a married couple (the granters) to a corporation (the grantee). This type of deed is commonly used when a married couple wants to transfer property they jointly own to a corporation for various reasons, such as asset protection or business purposes. The Mesquite Texas Quitclaim Deed from Husband and Wife to Corporation is governed by Texas state laws and must adhere to specific requirements to ensure its validity. It is essential to consult with a qualified attorney or a real estate professional when preparing and executing this deed to ensure compliance with all legal requirements. One type of Mesquite Texas Quitclaim Deed from Husband and Wife to Corporation is the general form of the quitclaim deed. It includes various components and information that need to be accurately filled out, including the names of the granters (husband and wife), the name of the corporation as the grantee, a detailed legal description of the property being transferred, and the consideration exchanged for the transfer. Another type of Mesquite Texas Quitclaim Deed from Husband and Wife to Corporation is the special form of the quitclaim deed. This type of deed includes additional provisions and conditions that may be specific to the circumstance of the property transfer. For example, it may include indemnity clauses, covenants, or restrictions that the granters want to impose on the property being transferred. Some relevant keywords for a Mesquite Texas Quitclaim Deed from Husband and Wife to Corporation include: 1. Mesquite Texas: Referring to the specific city and location where the property is situated. 2. Quitclaim Deed: A legal document used to transfer ownership of real property. 3. Husband and Wife: The joint owners of the property who are transferring it. 4. Corporation: The entity that will become the new owner of the property. 5. Transfer of Ownership: The process of changing property ownership from individuals to a corporation. 6. Real Estate: Referring to the type of property being transferred. 7. Legal Requirements: The specific rules and regulations that must be followed to ensure a valid deed. 8. Property Description: The detailed information about the property being transferred, including its boundaries, lot number, and street address. 9. Consideration: The amount or form of payment exchanged for the transfer of the property. 10. Special Provisions: Additional conditions or restrictions that may be included in the deed. Remember, it is crucial to consult with professionals well-versed in real estate and legal matters to ensure the accuracy and validity of any Mesquite Texas Quitclaim Deed from Husband and Wife to Corporation.A Mesquite Texas Quitclaim Deed from Husband and Wife to Corporation is a legal document that transfers ownership of real property from a married couple (the granters) to a corporation (the grantee). This type of deed is commonly used when a married couple wants to transfer property they jointly own to a corporation for various reasons, such as asset protection or business purposes. The Mesquite Texas Quitclaim Deed from Husband and Wife to Corporation is governed by Texas state laws and must adhere to specific requirements to ensure its validity. It is essential to consult with a qualified attorney or a real estate professional when preparing and executing this deed to ensure compliance with all legal requirements. One type of Mesquite Texas Quitclaim Deed from Husband and Wife to Corporation is the general form of the quitclaim deed. It includes various components and information that need to be accurately filled out, including the names of the granters (husband and wife), the name of the corporation as the grantee, a detailed legal description of the property being transferred, and the consideration exchanged for the transfer. Another type of Mesquite Texas Quitclaim Deed from Husband and Wife to Corporation is the special form of the quitclaim deed. This type of deed includes additional provisions and conditions that may be specific to the circumstance of the property transfer. For example, it may include indemnity clauses, covenants, or restrictions that the granters want to impose on the property being transferred. Some relevant keywords for a Mesquite Texas Quitclaim Deed from Husband and Wife to Corporation include: 1. Mesquite Texas: Referring to the specific city and location where the property is situated. 2. Quitclaim Deed: A legal document used to transfer ownership of real property. 3. Husband and Wife: The joint owners of the property who are transferring it. 4. Corporation: The entity that will become the new owner of the property. 5. Transfer of Ownership: The process of changing property ownership from individuals to a corporation. 6. Real Estate: Referring to the type of property being transferred. 7. Legal Requirements: The specific rules and regulations that must be followed to ensure a valid deed. 8. Property Description: The detailed information about the property being transferred, including its boundaries, lot number, and street address. 9. Consideration: The amount or form of payment exchanged for the transfer of the property. 10. Special Provisions: Additional conditions or restrictions that may be included in the deed. Remember, it is crucial to consult with professionals well-versed in real estate and legal matters to ensure the accuracy and validity of any Mesquite Texas Quitclaim Deed from Husband and Wife to Corporation.