This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

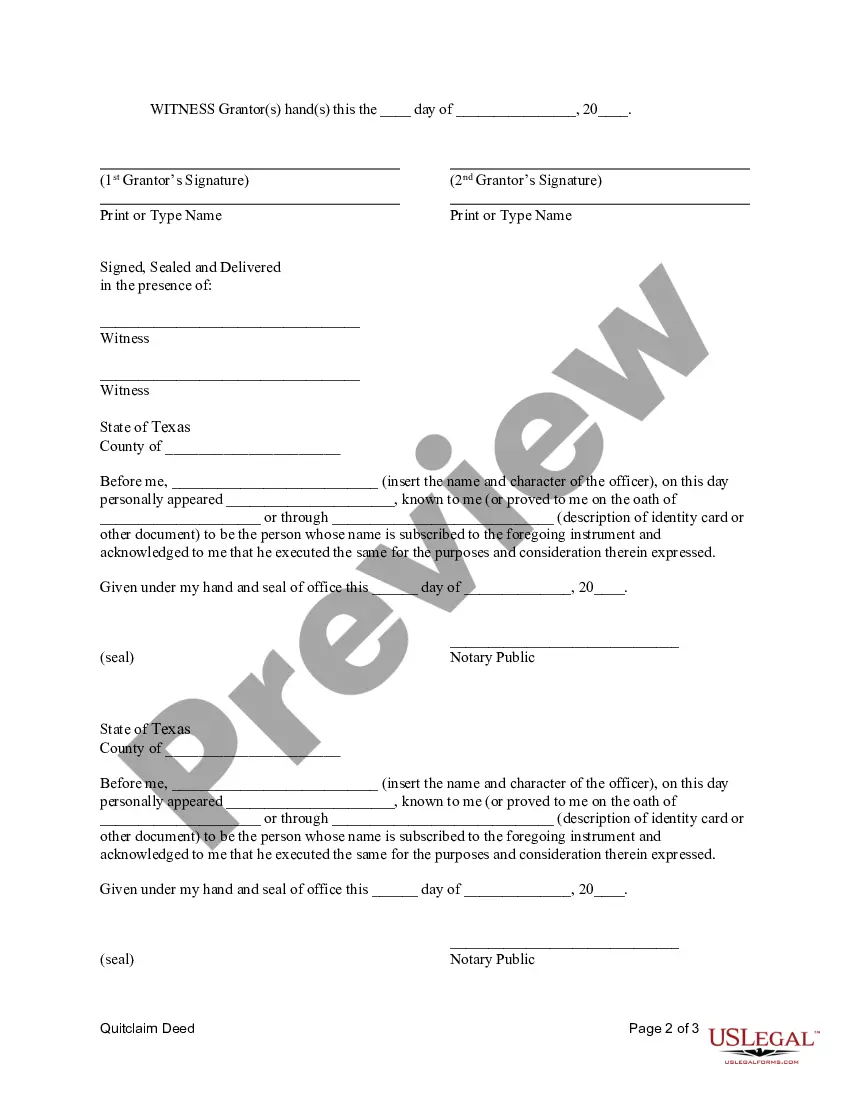

In Odessa, Texas, a Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer the ownership of a property from a married couple to a corporation. This type of deed is commonly employed when the couple wants to transfer their interest in a property to a corporation they own or are establishing, while concurrently extinguishing any claims or potential disputes regarding the property ownership. The Odessa Texas Quitclaim Deed from Husband and Wife to Corporation is a straightforward and effective method to ensure a smooth transfer of property rights. By executing this deed, the couple agrees to release and convey any interest they have in the property to the corporation without making any guarantees or warranties as to the property's title. The process of creating a Quitclaim Deed from Husband and Wife to Corporation in Odessa, Texas involves several important steps. First, the couple must draft the deed, which should include accurate legal descriptions of the property, the granters (husband and wife), and the grantee (the corporation). Additionally, the deed should clearly state the purpose of the transfer and the consideration involved, such as monetary payment or ownership stake in the corporation. Different types of Odessa Texas Quitclaim Deed from Husband and Wife to Corporation may include: 1. General Quitclaim Deed from Husband and Wife to Corporation: This is the most common type of deed, typically used when the property transfer is straightforward, and there are no additional terms or conditions attached to the transfer. 2. Special Quitclaim Deed from Husband and Wife to Corporation: This type of deed is employed when there are specific conditions or terms attached to the transfer. For example, the deed may specify that the corporation assumes certain liabilities or obligations associated with the property. 3. Limited Liability Quitclaim Deed from Husband and Wife to Corporation: This deed is utilized when the couple wishes to limit or minimize potential liability associated with the property. By transferring the property to the corporation, they aim to shield their personal assets from any future claims or lawsuits related to the property. In conclusion, an Odessa Texas Quitclaim Deed from Husband and Wife to Corporation is a legal instrument used to transfer ownership of property from a married couple to a corporation. It offers a straightforward method to ensure the smooth transfer of property rights while releasing any claims or disputes. Different types of deeds, such as General, Special, or Limited Liability Quitclaim Deeds, may be used depending on the specific circumstances and requirements of the property transfer.