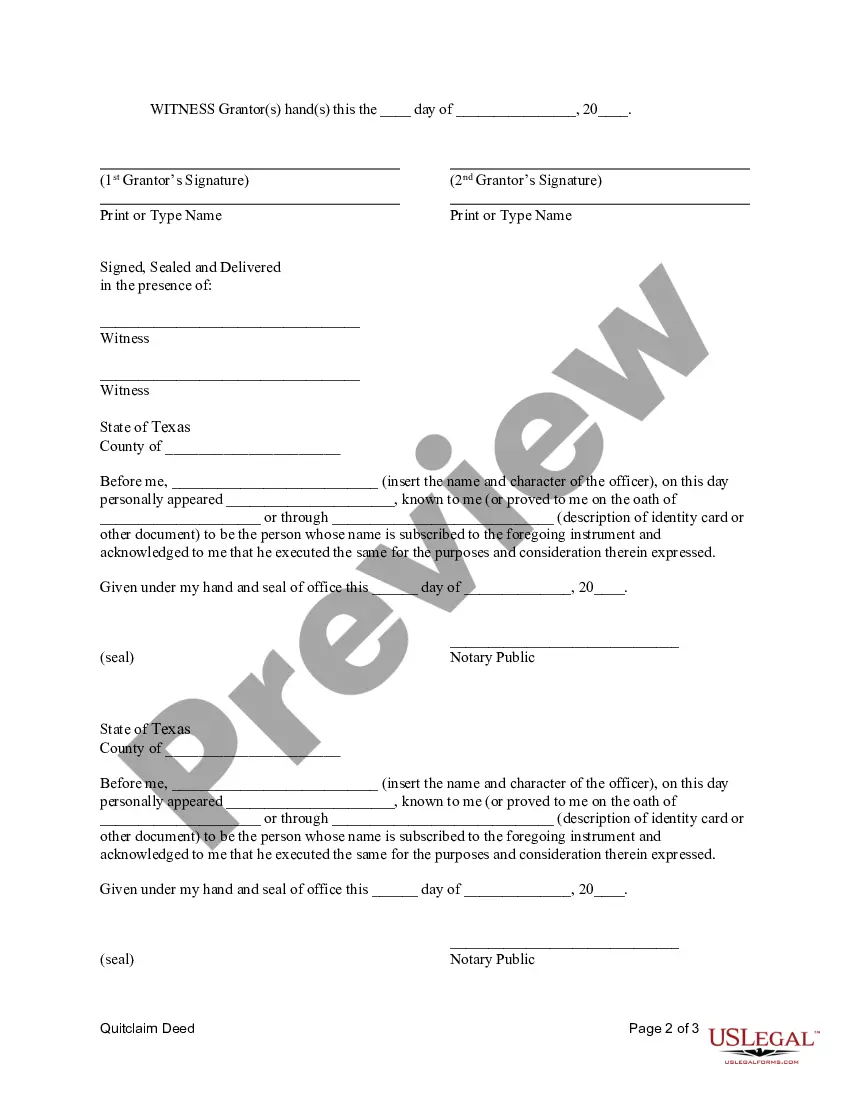

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Pasadena Texas Quitclaim Deed from Husband and Wife to Corporation is a legal document that transfers the ownership interest in a property from a married couple to a corporation located in Pasadena, Texas. This type of deed is commonly used when individuals want to transfer their property ownership to a corporate entity, which can provide various benefits such as liability protection and tax advantages. The Pasadena Texas Quitclaim Deed from Husband and Wife to Corporation serves as evidence of the transfer and ensures that the corporation becomes the new legal owner of the property. It should be noted that a quitclaim deed only transfers the interest that the couple has in the property, without guaranteeing a clear title or providing any warranties regarding the property's condition or other ownership claims. It is therefore crucial for all parties involved to seek legal advice before proceeding with the transfer. Different types of Pasadena Texas Quitclaim Deed from Husband and Wife to Corporation may include: 1. Simple Pasadena Texas Quitclaim Deed from Husband and Wife to Corporation: This is a basic form that outlines the transfer of property ownership from a married couple to a corporation without any additional clauses or conditions. 2. Pasadena Texas Quitclaim Deed with Consideration from Husband and Wife to Corporation: In this type of deed, the property transfer involves a monetary consideration or exchange between the couple and the corporation. This consideration can be a specific amount of money, shares of the corporation's stock, or any other agreed-upon value. 3. Pasadena Texas Quitclaim Deed with Lien Waiver from Husband and Wife to Corporation: If there are any outstanding liens or encumbrances on the property, the couple may include a lien waiver clause in the deed. This ensures that the corporation becomes responsible for any existing liens on the property after the transfer. 4. Pasadena Texas Quitclaim Deed with Restrictive Covenants from Husband and Wife to Corporation: This type of deed includes additional clauses that impose restrictions or conditions on the property's use. For example, the couple may outline specific zoning requirements, usage limitations, or architectural guidelines that the corporation must adhere to. It is essential to consult with a qualified attorney or real estate professional when drafting or executing a Pasadena Texas Quitclaim Deed from Husband and Wife to Corporation. They can provide guidance on the specific requirements, legal implications, and potential tax consequences associated with this type of transfer.A Pasadena Texas Quitclaim Deed from Husband and Wife to Corporation is a legal document that transfers the ownership interest in a property from a married couple to a corporation located in Pasadena, Texas. This type of deed is commonly used when individuals want to transfer their property ownership to a corporate entity, which can provide various benefits such as liability protection and tax advantages. The Pasadena Texas Quitclaim Deed from Husband and Wife to Corporation serves as evidence of the transfer and ensures that the corporation becomes the new legal owner of the property. It should be noted that a quitclaim deed only transfers the interest that the couple has in the property, without guaranteeing a clear title or providing any warranties regarding the property's condition or other ownership claims. It is therefore crucial for all parties involved to seek legal advice before proceeding with the transfer. Different types of Pasadena Texas Quitclaim Deed from Husband and Wife to Corporation may include: 1. Simple Pasadena Texas Quitclaim Deed from Husband and Wife to Corporation: This is a basic form that outlines the transfer of property ownership from a married couple to a corporation without any additional clauses or conditions. 2. Pasadena Texas Quitclaim Deed with Consideration from Husband and Wife to Corporation: In this type of deed, the property transfer involves a monetary consideration or exchange between the couple and the corporation. This consideration can be a specific amount of money, shares of the corporation's stock, or any other agreed-upon value. 3. Pasadena Texas Quitclaim Deed with Lien Waiver from Husband and Wife to Corporation: If there are any outstanding liens or encumbrances on the property, the couple may include a lien waiver clause in the deed. This ensures that the corporation becomes responsible for any existing liens on the property after the transfer. 4. Pasadena Texas Quitclaim Deed with Restrictive Covenants from Husband and Wife to Corporation: This type of deed includes additional clauses that impose restrictions or conditions on the property's use. For example, the couple may outline specific zoning requirements, usage limitations, or architectural guidelines that the corporation must adhere to. It is essential to consult with a qualified attorney or real estate professional when drafting or executing a Pasadena Texas Quitclaim Deed from Husband and Wife to Corporation. They can provide guidance on the specific requirements, legal implications, and potential tax consequences associated with this type of transfer.