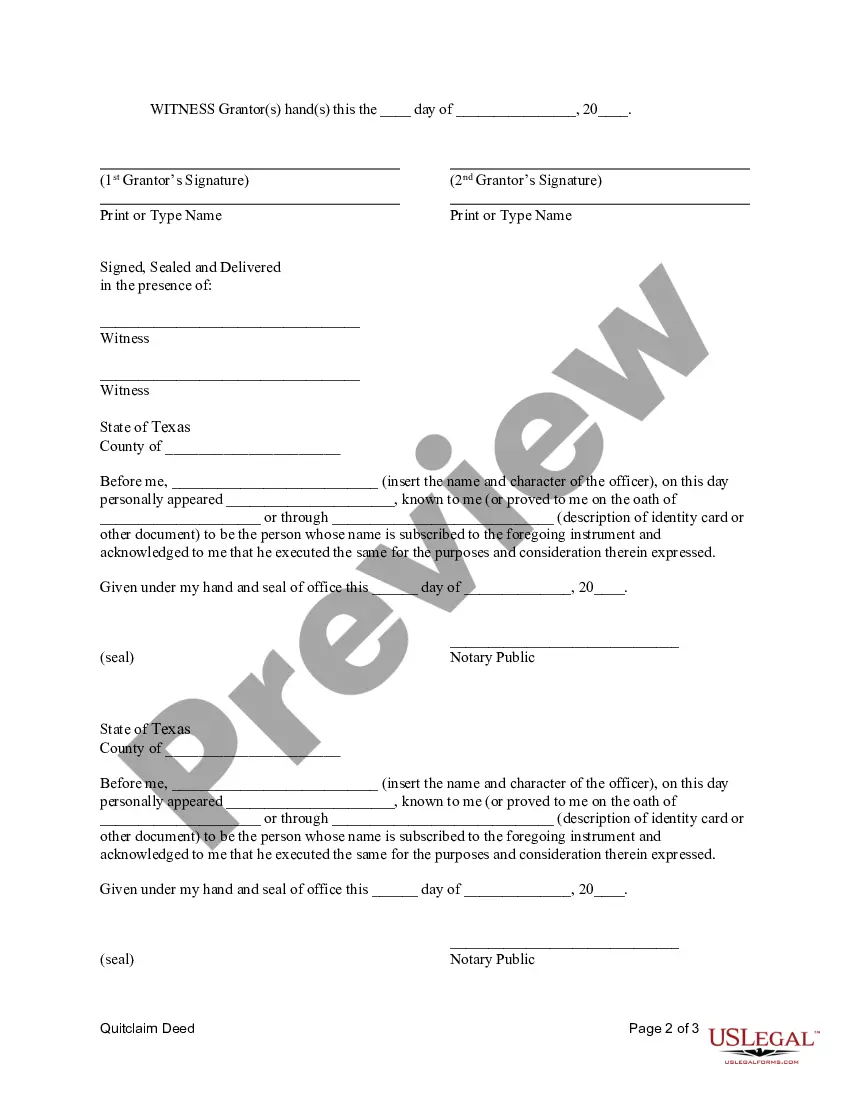

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Pearland Texas Quitclaim Deed from Husband and Wife to Corporation is a legal document that transfers the ownership interest of a property from a married couple to a corporation. This type of deed is commonly used when the couple wants to transfer their property to a business entity they own or establish, such as a corporation, LLC, or partnership. It is essential to understand the different types of quitclaim deeds available for this purpose: 1. General Pearland Texas Quitclaim Deed from Husband and Wife to Corporation: This is the most typical type of quitclaim deed used to transfer property ownership from a married couple to a corporation. It involves the transfer of the couple's entire interest in the property to the corporation, ensuring the corporation becomes the sole owner. 2. Partial Pearland Texas Quitclaim Deed from Husband and Wife to Corporation: In some cases, a married couple may want to transfer only a portion of their interest in the property to a corporation. This type of deed allows for the transfer of a specified percentage or fraction of the property ownership to the corporation, while the couple retains their remaining share. 3. Conditional Pearland Texas Quitclaim Deed from Husband and Wife to Corporation: A conditional quitclaim deed involves the transfer of property ownership to a corporation, but with specific conditions attached. For example, the transfer may be contingent upon the corporation's completion of certain obligations or the fulfillment of legal requirements. 4. Limited Pearland Texas Quitclaim Deed from Husband and Wife to Corporation: Sometimes, a married couple may wish to transfer ownership rights to a corporation with specific restrictions. A limited quitclaim deed allows for the transfer of ownership under specific terms and limitations defined by the couple. 5. Revocable Pearland Texas Quitclaim Deed from Husband and Wife to Corporation: A revocable quitclaim deed grants the married couple the ability to revoke the transfer of property ownership from themselves to the corporation at a later date. This type of deed provides flexibility and can be useful in situations where the couple wants to maintain control over the property in the long term. When preparing a Pearland Texas Quitclaim Deed from Husband and Wife to Corporation, it is crucial to consult with a qualified attorney familiar with Texas real estate laws to ensure the deed complies with all legal requirements. Additionally, it is essential to fill out the deed accurately, including the property description, names of individuals involved, and any stipulations or conditions that may apply to the transfer.A Pearland Texas Quitclaim Deed from Husband and Wife to Corporation is a legal document that transfers the ownership interest of a property from a married couple to a corporation. This type of deed is commonly used when the couple wants to transfer their property to a business entity they own or establish, such as a corporation, LLC, or partnership. It is essential to understand the different types of quitclaim deeds available for this purpose: 1. General Pearland Texas Quitclaim Deed from Husband and Wife to Corporation: This is the most typical type of quitclaim deed used to transfer property ownership from a married couple to a corporation. It involves the transfer of the couple's entire interest in the property to the corporation, ensuring the corporation becomes the sole owner. 2. Partial Pearland Texas Quitclaim Deed from Husband and Wife to Corporation: In some cases, a married couple may want to transfer only a portion of their interest in the property to a corporation. This type of deed allows for the transfer of a specified percentage or fraction of the property ownership to the corporation, while the couple retains their remaining share. 3. Conditional Pearland Texas Quitclaim Deed from Husband and Wife to Corporation: A conditional quitclaim deed involves the transfer of property ownership to a corporation, but with specific conditions attached. For example, the transfer may be contingent upon the corporation's completion of certain obligations or the fulfillment of legal requirements. 4. Limited Pearland Texas Quitclaim Deed from Husband and Wife to Corporation: Sometimes, a married couple may wish to transfer ownership rights to a corporation with specific restrictions. A limited quitclaim deed allows for the transfer of ownership under specific terms and limitations defined by the couple. 5. Revocable Pearland Texas Quitclaim Deed from Husband and Wife to Corporation: A revocable quitclaim deed grants the married couple the ability to revoke the transfer of property ownership from themselves to the corporation at a later date. This type of deed provides flexibility and can be useful in situations where the couple wants to maintain control over the property in the long term. When preparing a Pearland Texas Quitclaim Deed from Husband and Wife to Corporation, it is crucial to consult with a qualified attorney familiar with Texas real estate laws to ensure the deed complies with all legal requirements. Additionally, it is essential to fill out the deed accurately, including the property description, names of individuals involved, and any stipulations or conditions that may apply to the transfer.