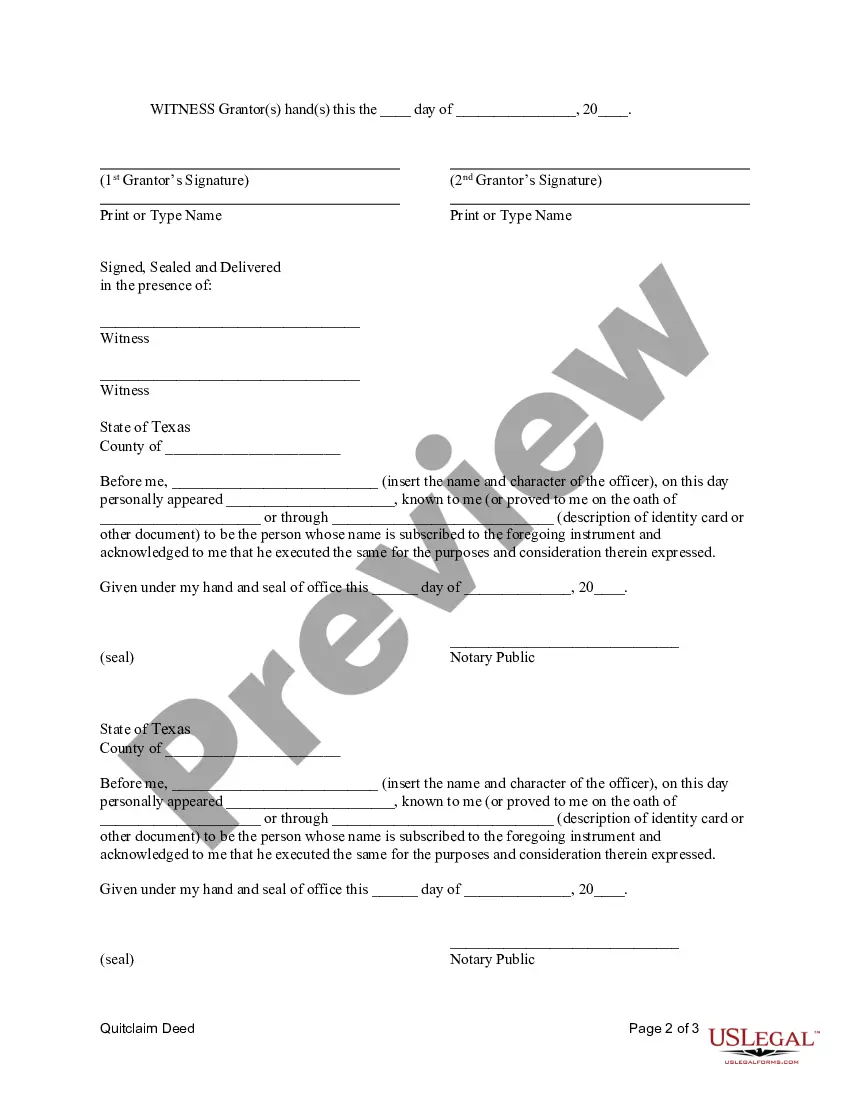

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Round Rock Texas Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer property ownership from a married couple to a corporation in Round Rock, Texas. This type of deed is commonly used when a married couple wants to transfer property they jointly own to a corporation they own or are forming. The Round Rock Texas Quitclaim Deed from Husband and Wife to Corporation involves the transfer of ownership without making any warranties or guarantees regarding the property title. Essentially, the couple gives up any interest or claim they have on the property, and the corporation assumes full ownership rights and responsibilities. There are different types of Round Rock Texas Quitclaim Deeds from Husband and Wife to Corporation, including: 1. General Round Rock Texas Quitclaim Deed: This type of deed is used to transfer property ownership from a husband and wife to a corporation without any special conditions or restrictions. It's a straightforward transfer of ownership. 2. Round Rock Texas Quitclaim Deed with Specific Terms: In some cases, the husband and wife may include specific terms or conditions in the deed. These terms could outline any restrictions or limitations on the use of the property by the corporation. 3. Round Rock Texas Quitclaim Deed with Consideration: This type of deed includes a consideration clause, which means that the corporation is paying the husband and wife a specified amount of money or some other form of compensation for the property transfer. This clause ensures that there is a legal contract established between the parties involved. When creating a Round Rock Texas Quitclaim Deed from Husband and Wife to Corporation, it is essential to include accurate, specific and detailed information about the property, parties involved, and any additional terms or conditions. It is recommended to consult with a qualified real estate attorney or professional to ensure the deed complies with all legal requirements and is properly executed. Using a professional will help ensure the process is carried out smoothly and protect the rights and interests of all parties involved. In summary, a Round Rock Texas Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer property ownership from a married couple to a corporation in Round Rock, Texas. It is crucial to choose the appropriate type of deed based on the specific circumstances of the transfer and consult with professionals for guidance throughout the process.A Round Rock Texas Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer property ownership from a married couple to a corporation in Round Rock, Texas. This type of deed is commonly used when a married couple wants to transfer property they jointly own to a corporation they own or are forming. The Round Rock Texas Quitclaim Deed from Husband and Wife to Corporation involves the transfer of ownership without making any warranties or guarantees regarding the property title. Essentially, the couple gives up any interest or claim they have on the property, and the corporation assumes full ownership rights and responsibilities. There are different types of Round Rock Texas Quitclaim Deeds from Husband and Wife to Corporation, including: 1. General Round Rock Texas Quitclaim Deed: This type of deed is used to transfer property ownership from a husband and wife to a corporation without any special conditions or restrictions. It's a straightforward transfer of ownership. 2. Round Rock Texas Quitclaim Deed with Specific Terms: In some cases, the husband and wife may include specific terms or conditions in the deed. These terms could outline any restrictions or limitations on the use of the property by the corporation. 3. Round Rock Texas Quitclaim Deed with Consideration: This type of deed includes a consideration clause, which means that the corporation is paying the husband and wife a specified amount of money or some other form of compensation for the property transfer. This clause ensures that there is a legal contract established between the parties involved. When creating a Round Rock Texas Quitclaim Deed from Husband and Wife to Corporation, it is essential to include accurate, specific and detailed information about the property, parties involved, and any additional terms or conditions. It is recommended to consult with a qualified real estate attorney or professional to ensure the deed complies with all legal requirements and is properly executed. Using a professional will help ensure the process is carried out smoothly and protect the rights and interests of all parties involved. In summary, a Round Rock Texas Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer property ownership from a married couple to a corporation in Round Rock, Texas. It is crucial to choose the appropriate type of deed based on the specific circumstances of the transfer and consult with professionals for guidance throughout the process.