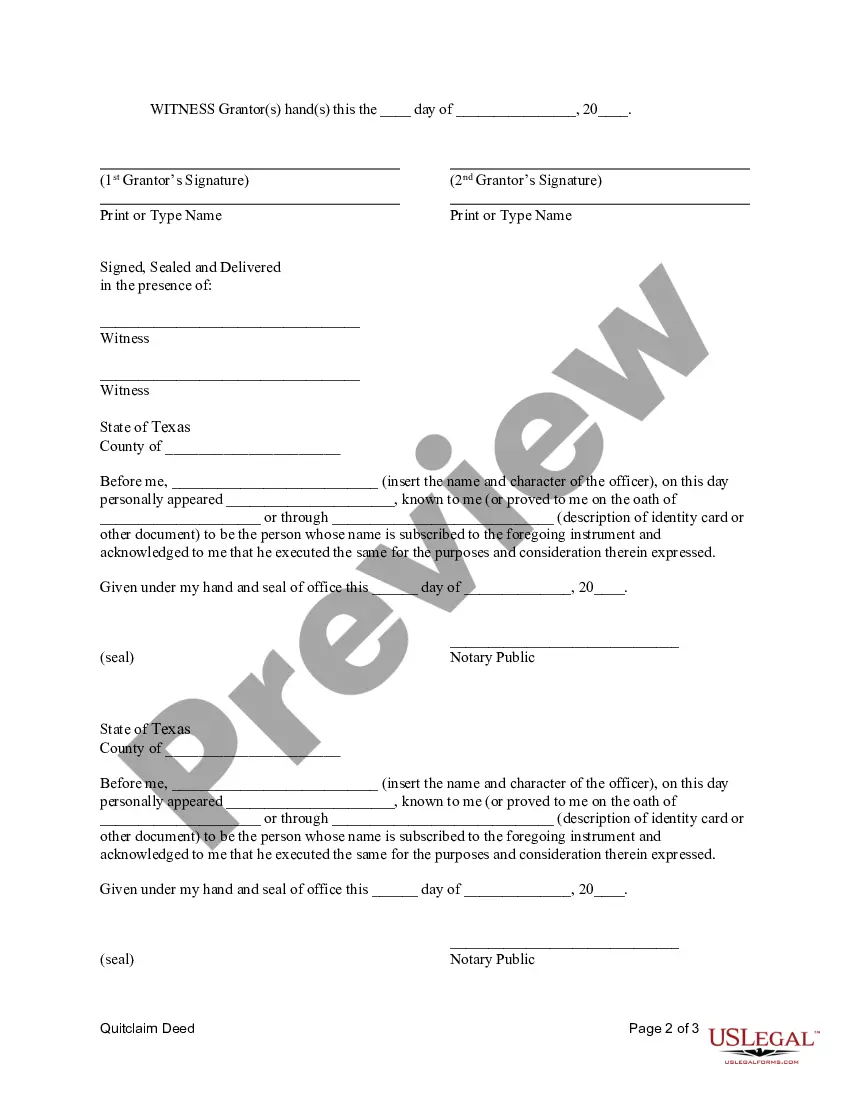

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Sugar Land Texas Quitclaim Deed from Husband and Wife to Corporation refers to a legal document that transfers the ownership of a property from a married couple to a corporation, relinquishing any rights or claims they may have on the said property. This type of deed is commonly used when a couple wishes to transfer their personal property into a corporate entity, typically for business or tax purposes. It is essential to understand the different types of Quitclaim Deeds available in Sugar Land, Texas, as follows: 1. General Quitclaim Deed: This is the most common type of Quitclaim Deed used in Sugar Land, Texas. It transfers the property rights from the husband and wife to the corporation without any warranties or guarantees. By signing this deed, the couple simply transfers whatever interest they possess, without any assurance of the property's title. 2. Special Purpose Quitclaim Deed: This type of deed is used when the transfer of ownership is subject to specific conditions or restrictions. For example, the husband and wife may stipulate that the property can only be used for specific purposes or that certain portions of the property are excluded from the transfer. 3. Joint Tenancy Quitclaim Deed: If the property is jointly owned by the husband and wife as joint tenants, they can use this deed to transfer their interest to the corporation. Joint tenancy often includes the right of survivorship, where if one spouse passes away, the property automatically goes to the surviving spouse. By using a Joint Tenancy Quitclaim Deed, the surviving spouse can transfer their joint interest to the corporation. 4. Tenancy in Common Quitclaim Deed: If the property is owned by the husband and wife as tenants in common, they can use this type of deed to transfer their respective shares to the corporation. Unlike joint tenancy, tenants in common have separate and distinct portions of ownership, which they can individually convey to the corporation. It's crucial for the husband and wife, as well as the corporation, to consult an attorney specializing in real estate law to draft, review, and execute the Quitclaim Deed accurately. They should also ensure that all legal requirements, such as notarization and recording with the appropriate Sugar Land County authority, are fulfilled. This will help ensure a smooth transfer of ownership and protect the interests of all parties involved in the transaction.