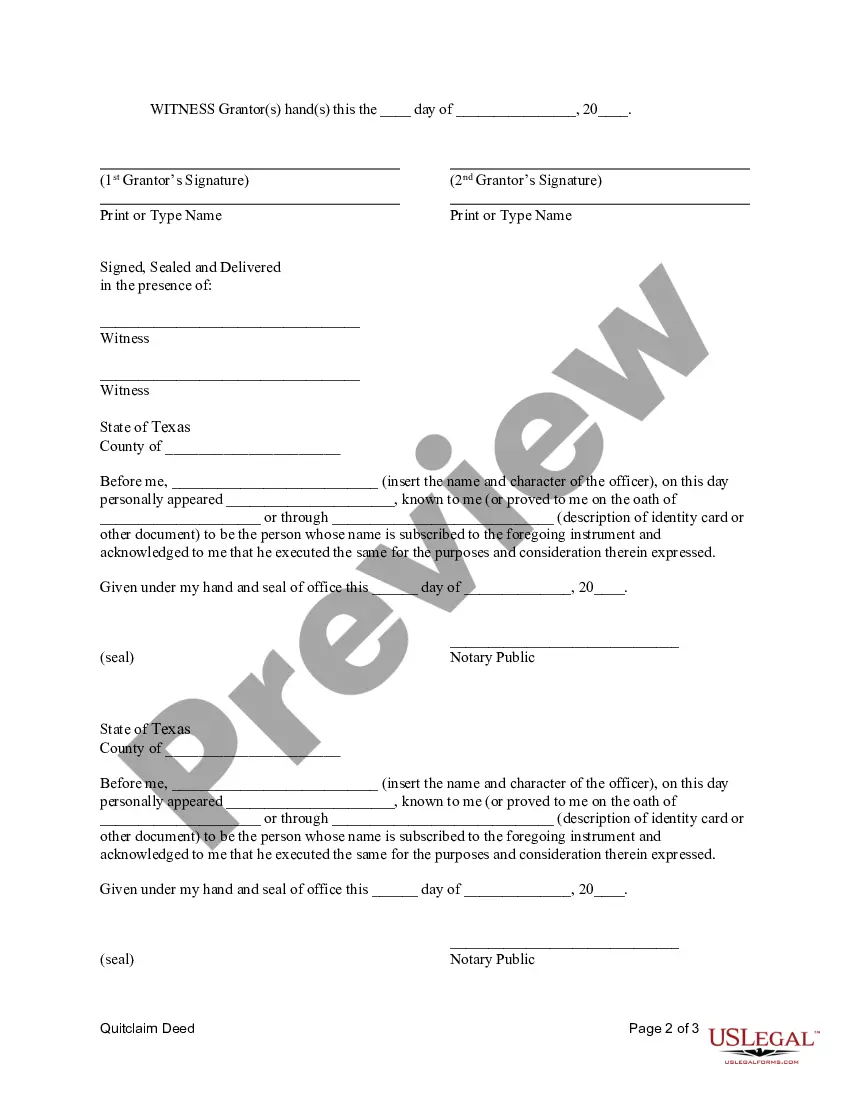

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Travis Texas Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer ownership of real estate property in Travis County, Texas, from a married couple to a corporation. This type of transfer is typically executed when the couple, as owners of the property, decide to establish a corporate entity to hold the property title. The quitclaim deed is commonly used for transfers between parties who have an existing relationship, such as a marital relationship or business partnership, where there is an understanding and agreement about the property transfer. It guarantees that the spouses, as granters, are relinquishing any claims or interests they may have in the property, effectively conveying their entire ownership to the corporation, the grantee. In Travis County, Texas, there are several variations of the Quitclaim Deed from Husband and Wife to Corporation, each addressing specific circumstances: 1. Regular/Standard Quitclaim Deed: This is the most common type of quitclaim deed used for transferring property in Travis County, Texas. It outlines the names of the husband and wife as granters, along with their marital status. The deed should clearly identify the corporation as the grantee and provide its legal name and address. Additionally, it includes a legal description of the property being transferred and any relevant details, such as the tax identification number. 2. Quitclaim Deed with Right of Survivorship: In some cases, a married couple may choose to include a right of survivorship clause in the quitclaim deed. This clause ensures that if one spouse passes away, the surviving spouse automatically becomes the full owner of the property, bypassing the probate process. If this option is desired, it must be clearly stated in the deed along with both spouses' consent. 3. Special Warranty Deed: While a quitclaim deed is commonly used for transferring property, some couples may opt for a special warranty deed. This type of deed offers additional protection to the corporation by warranting that the granters have not done anything to encumber the property during their ownership period, except as otherwise stated in the deed. 4. Enhanced Life Estate Deed (Lady Bird Deed): This deed variation, often referred to as a Lady Bird Deed, allows a couple to retain control of the property during their lifetime while naming the corporation as the remainder beneficiary. It provides flexibility and the ability to sell, mortgage, or change beneficiaries without the corporation's consent. Upon the passing of the last surviving spouse, the property automatically transfers to the corporation without the need for probate. It is important to consult with a qualified attorney or real estate professional when preparing a Travis Texas Quitclaim Deed from Husband and Wife to Corporation to ensure all legal requirements and specific circumstances are accurately addressed.A Travis Texas Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer ownership of real estate property in Travis County, Texas, from a married couple to a corporation. This type of transfer is typically executed when the couple, as owners of the property, decide to establish a corporate entity to hold the property title. The quitclaim deed is commonly used for transfers between parties who have an existing relationship, such as a marital relationship or business partnership, where there is an understanding and agreement about the property transfer. It guarantees that the spouses, as granters, are relinquishing any claims or interests they may have in the property, effectively conveying their entire ownership to the corporation, the grantee. In Travis County, Texas, there are several variations of the Quitclaim Deed from Husband and Wife to Corporation, each addressing specific circumstances: 1. Regular/Standard Quitclaim Deed: This is the most common type of quitclaim deed used for transferring property in Travis County, Texas. It outlines the names of the husband and wife as granters, along with their marital status. The deed should clearly identify the corporation as the grantee and provide its legal name and address. Additionally, it includes a legal description of the property being transferred and any relevant details, such as the tax identification number. 2. Quitclaim Deed with Right of Survivorship: In some cases, a married couple may choose to include a right of survivorship clause in the quitclaim deed. This clause ensures that if one spouse passes away, the surviving spouse automatically becomes the full owner of the property, bypassing the probate process. If this option is desired, it must be clearly stated in the deed along with both spouses' consent. 3. Special Warranty Deed: While a quitclaim deed is commonly used for transferring property, some couples may opt for a special warranty deed. This type of deed offers additional protection to the corporation by warranting that the granters have not done anything to encumber the property during their ownership period, except as otherwise stated in the deed. 4. Enhanced Life Estate Deed (Lady Bird Deed): This deed variation, often referred to as a Lady Bird Deed, allows a couple to retain control of the property during their lifetime while naming the corporation as the remainder beneficiary. It provides flexibility and the ability to sell, mortgage, or change beneficiaries without the corporation's consent. Upon the passing of the last surviving spouse, the property automatically transfers to the corporation without the need for probate. It is important to consult with a qualified attorney or real estate professional when preparing a Travis Texas Quitclaim Deed from Husband and Wife to Corporation to ensure all legal requirements and specific circumstances are accurately addressed.