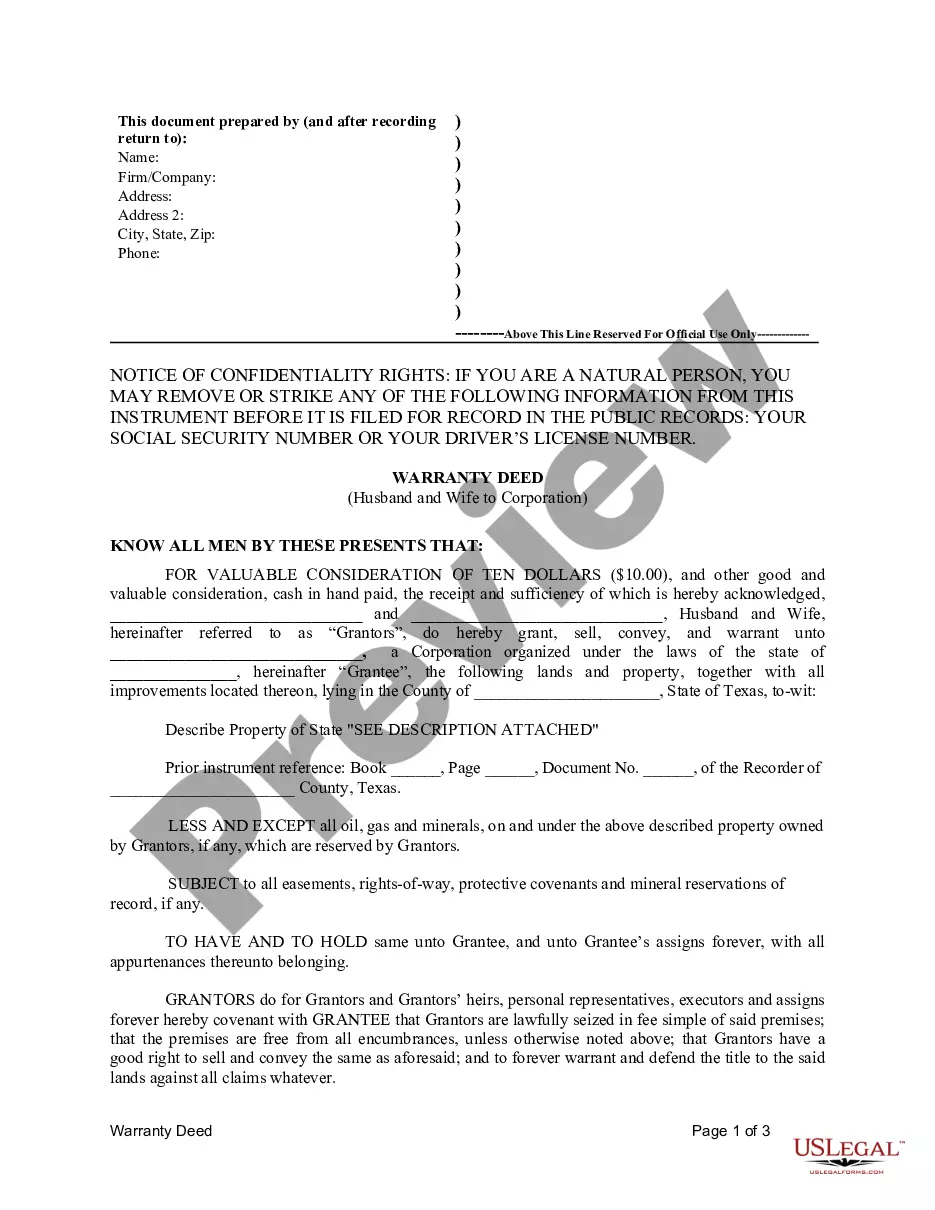

This Warranty Deed from Husband and Wife to Corporation form is a Warranty Deed where the grantors are husband and wife and the grantee is a corporation. Grantors warrant and convey the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

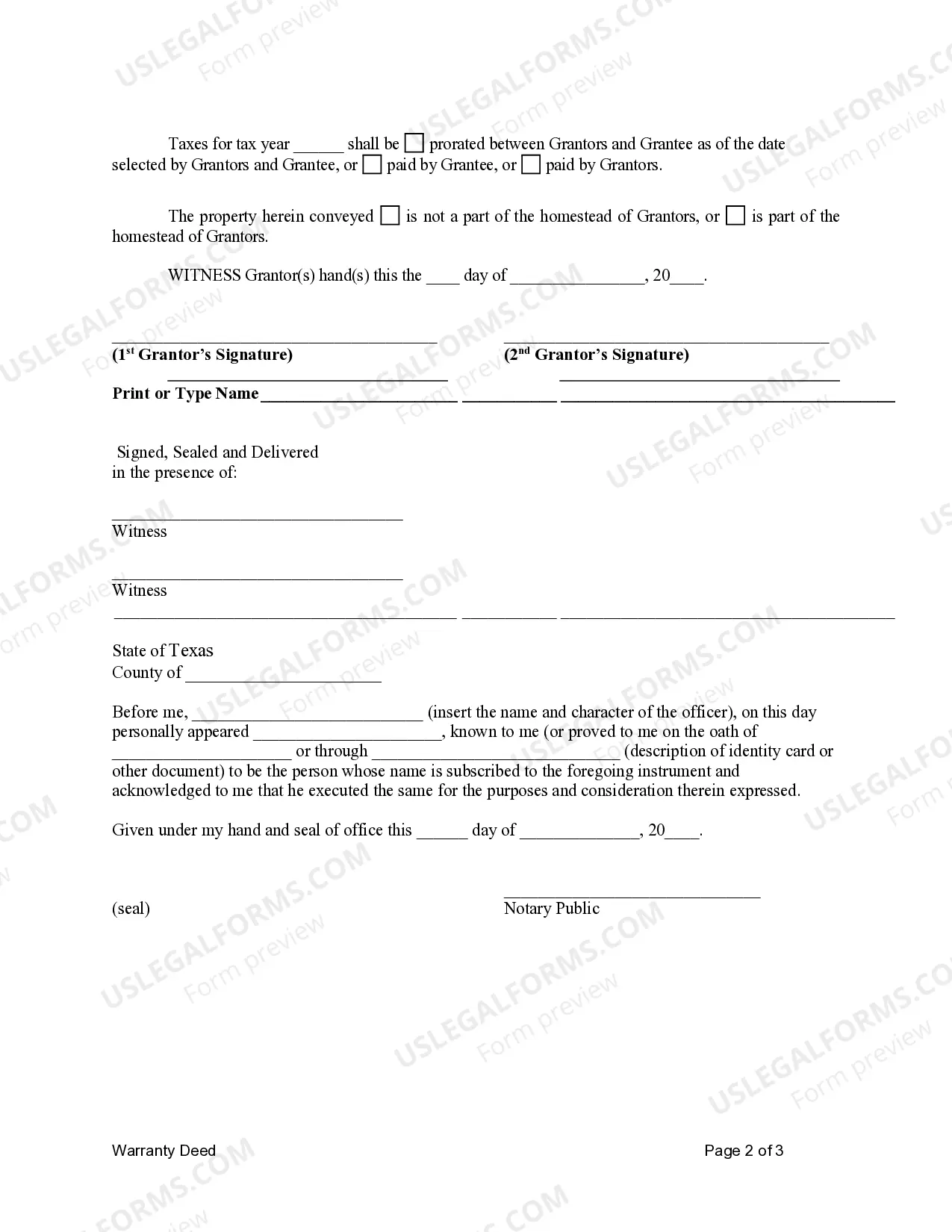

A Frisco Texas Warranty Deed from Husband and Wife to Corporation is a legal document that transfers ownership of real estate property from a married couple to a corporation based in Frisco, Texas. This type of deed provides a warranty or guarantee that the property title is free from any encumbrances or defects, ensuring a clean transfer of ownership. When drafting this deed, it is important to clearly state the full legal names of both the husband and wife as granters, along with their current address. Likewise, the corporation's complete legal name, registered address, and relevant identifying details should be provided as the grantee. The Frisco Texas Warranty Deed from Husband and Wife to Corporation typically includes the following crucial information: 1. Property Description: A detailed description of the property being transferred should be included. This may involve the official legal description from the property's title, including boundaries, lot numbers, or survey information. Enclose any relevant documentation that aids in identifying the property accurately, such as tax parcel numbers or street addresses. 2. Consideration: The consideration section outlines the value exchanged for the transfer of the property. Specify monetary compensation, if any, or a mention that the property is being transferred solely for corporate purposes, without any exchange of funds. 3. Warranties: Clearly state the warranties being provided by the husband and wife as granters. This includes affirming that they are the rightful owners of the property, holding the power to sell it, and that the property title is clear, free from any liens, encumbrances, or claims. 4. Granting Clause: Include a granting clause that declares the intention of the husband and wife to transfer the property with a warranty to the corporation. Ensure it emphasizes that the transfer is irrevocable and grants absolute ownership to the corporation. 5. Execution and Acknowledgment: The husband and wife must sign the warranty deed in the presence of a notary public. Their signatures should be notarized to authenticate the document. The date of execution should also be recorded. It is worth noting that there might be different variations of Frisco Texas Warranty Deeds from Husband and Wife to Corporation based on specific circumstances. These could include but are not limited to: 1. Joint Tenancy Warranty Deed: In cases where the husband and wife hold the property under joint tenancy, this type of warranty deed would transfer their interest to the corporation. 2. Tenancy in Common Warranty Deed: In circumstances where the husband and wife hold the property as tenants in common, this variation transfers their respective shares to the corporation. 3. Community Property Warranty Deed: In Texas, which follows community property laws, a warranty deed may be used to transfer the couple's community property interest to the corporation. 4. Transfer for Tax or Business Purposes: Warranty deeds can also be tailored to address specific tax or business considerations. For instance, if the transfer is solely for tax planning or reorganization purposes, the deed may detail the specific reasons behind the transfer. In conclusion, a Frisco Texas Warranty Deed from Husband and Wife to Corporation is a legally binding document that facilitates the transfer of property ownership from a married couple to a corporation. This deed serves to ensure title security by providing warranties that the property is free from any claims or encumbrances. Different variations of this deed exist to accommodate various ownership scenarios and specific legal requirements.A Frisco Texas Warranty Deed from Husband and Wife to Corporation is a legal document that transfers ownership of real estate property from a married couple to a corporation based in Frisco, Texas. This type of deed provides a warranty or guarantee that the property title is free from any encumbrances or defects, ensuring a clean transfer of ownership. When drafting this deed, it is important to clearly state the full legal names of both the husband and wife as granters, along with their current address. Likewise, the corporation's complete legal name, registered address, and relevant identifying details should be provided as the grantee. The Frisco Texas Warranty Deed from Husband and Wife to Corporation typically includes the following crucial information: 1. Property Description: A detailed description of the property being transferred should be included. This may involve the official legal description from the property's title, including boundaries, lot numbers, or survey information. Enclose any relevant documentation that aids in identifying the property accurately, such as tax parcel numbers or street addresses. 2. Consideration: The consideration section outlines the value exchanged for the transfer of the property. Specify monetary compensation, if any, or a mention that the property is being transferred solely for corporate purposes, without any exchange of funds. 3. Warranties: Clearly state the warranties being provided by the husband and wife as granters. This includes affirming that they are the rightful owners of the property, holding the power to sell it, and that the property title is clear, free from any liens, encumbrances, or claims. 4. Granting Clause: Include a granting clause that declares the intention of the husband and wife to transfer the property with a warranty to the corporation. Ensure it emphasizes that the transfer is irrevocable and grants absolute ownership to the corporation. 5. Execution and Acknowledgment: The husband and wife must sign the warranty deed in the presence of a notary public. Their signatures should be notarized to authenticate the document. The date of execution should also be recorded. It is worth noting that there might be different variations of Frisco Texas Warranty Deeds from Husband and Wife to Corporation based on specific circumstances. These could include but are not limited to: 1. Joint Tenancy Warranty Deed: In cases where the husband and wife hold the property under joint tenancy, this type of warranty deed would transfer their interest to the corporation. 2. Tenancy in Common Warranty Deed: In circumstances where the husband and wife hold the property as tenants in common, this variation transfers their respective shares to the corporation. 3. Community Property Warranty Deed: In Texas, which follows community property laws, a warranty deed may be used to transfer the couple's community property interest to the corporation. 4. Transfer for Tax or Business Purposes: Warranty deeds can also be tailored to address specific tax or business considerations. For instance, if the transfer is solely for tax planning or reorganization purposes, the deed may detail the specific reasons behind the transfer. In conclusion, a Frisco Texas Warranty Deed from Husband and Wife to Corporation is a legally binding document that facilitates the transfer of property ownership from a married couple to a corporation. This deed serves to ensure title security by providing warranties that the property is free from any claims or encumbrances. Different variations of this deed exist to accommodate various ownership scenarios and specific legal requirements.