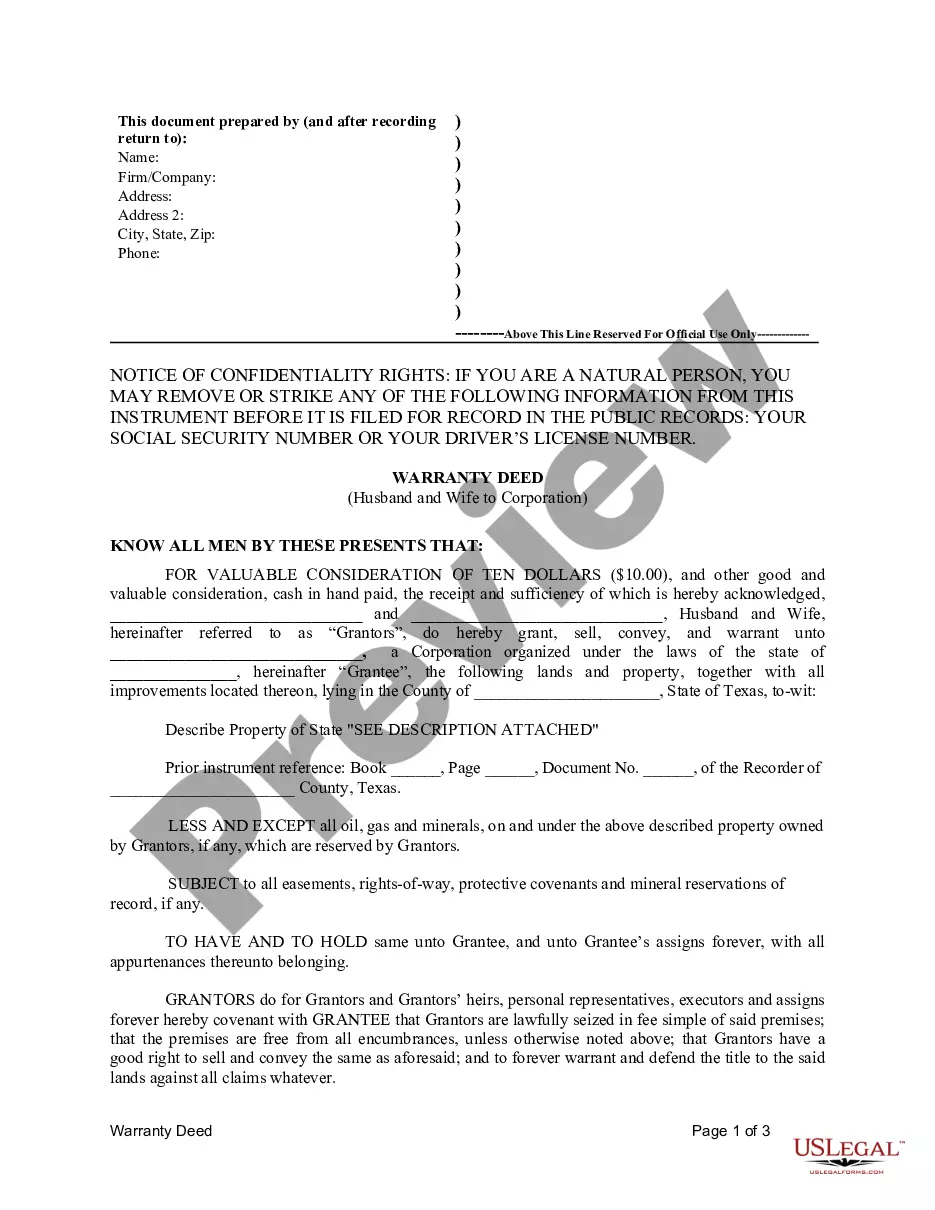

This Warranty Deed from Husband and Wife to Corporation form is a Warranty Deed where the grantors are husband and wife and the grantee is a corporation. Grantors warrant and convey the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

Houston Texas Warranty Deed from Husband and Wife to Corporation

Description

How to fill out Texas Warranty Deed From Husband And Wife To Corporation?

Utilize the US Legal Forms and gain immediate access to any form template you desire.

Our user-friendly website, with an extensive selection of templates, streamlines the process of locating and acquiring almost any document sample you require.

You can download, complete, and validate the Houston Texas Warranty Deed from Husband and Wife to Corporation in merely a few minutes, rather than spending countless hours searching the internet for a suitable template.

Using our collection is a fantastic method to enhance the security of your document submissions.

If you haven’t created an account yet, follow the steps outlined below.

Navigate to the page with the template you require. Ensure that it is the template you are seeking: verify its title and description, and utilize the Preview feature if available. If not, use the Search option to find the desired one.

- Our knowledgeable attorneys routinely examine all the files to guarantee that the forms are applicable for a specific state and comply with the latest laws and regulations.

- How can you obtain the Houston Texas Warranty Deed from Husband and Wife to Corporation.

- If you already possess an account, simply Log In to your profile.

- The Download button will be active on all the documents you view.

- Furthermore, you can access all previously saved documents in the My documents menu.

Form popularity

FAQ

Control and Ownership of Separate Property The signature of both spouses is required to convey Texas homestead, even if the property used as the marital home is actually owned by only one spouse.

All property deeds ? $195 Any Property Deed needed to transfer real estate in Texas. Prepared by an attorney licensed in the state of Texas.

A person cannot be passively removed from a deed. If the person is still living, you may ask them to remove themselves by signing a quitclaim, which is common after a divorce. The individual who signs and files a quitclaim is asking to have their name removed from the property deed.

How to Transfer Texas Real Estate Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor).Create a new deed.Sign and notarize the deed.File the documents in the county land records.

By default, the married couple will own the property as community property without rights of survivorship. If the couple wants to hold title as community property with right of survivorship, the couple must sign?in addition to the deed?a Community Property Survivorship Agreement.

The most common type of deed used in Texas is a general warranty deed. This type of deed guarantees the title comes without any liens, easements, or other title problems. A general warranty deed also assures the buyer that there will be no issues with the title.

Prices vary from county to county. Generally, the cost to record a deed runs from $15 to $40.

No, a warranty deed does not prove ownership. A title search is the best way to prove that a grantor rightfully owns a property. The warranty deed is a legal document that offers the buyer protection. In other words, the property title and warranty deed work in tandem together.

The most recognized form for a married couple is to own their home as Tenants by the Entirety. A tenancy by the entirety is ownership in real estate under the fictional assumption that a husband and wife are considered one person for legal purposes. This method of ownership conveys the property to them as one person.