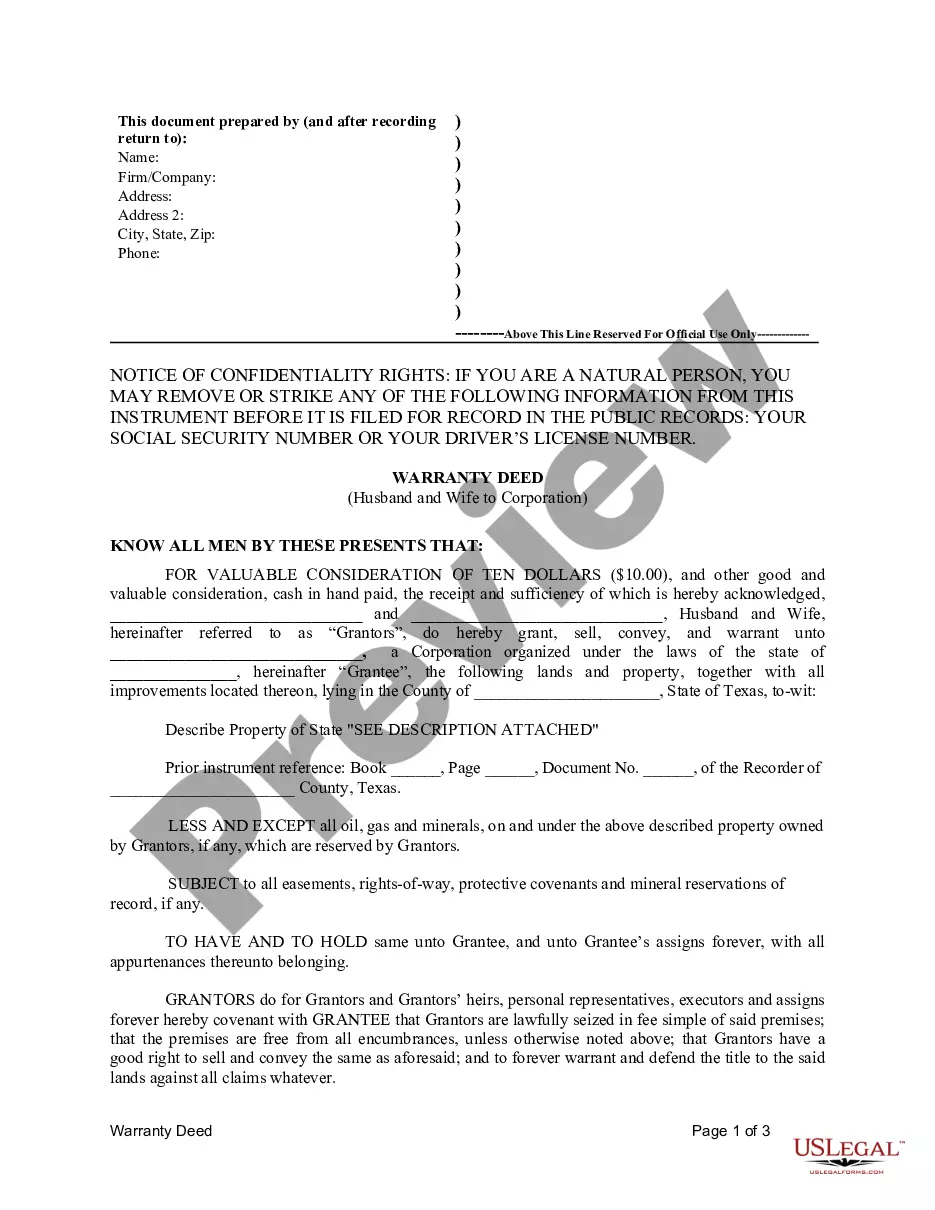

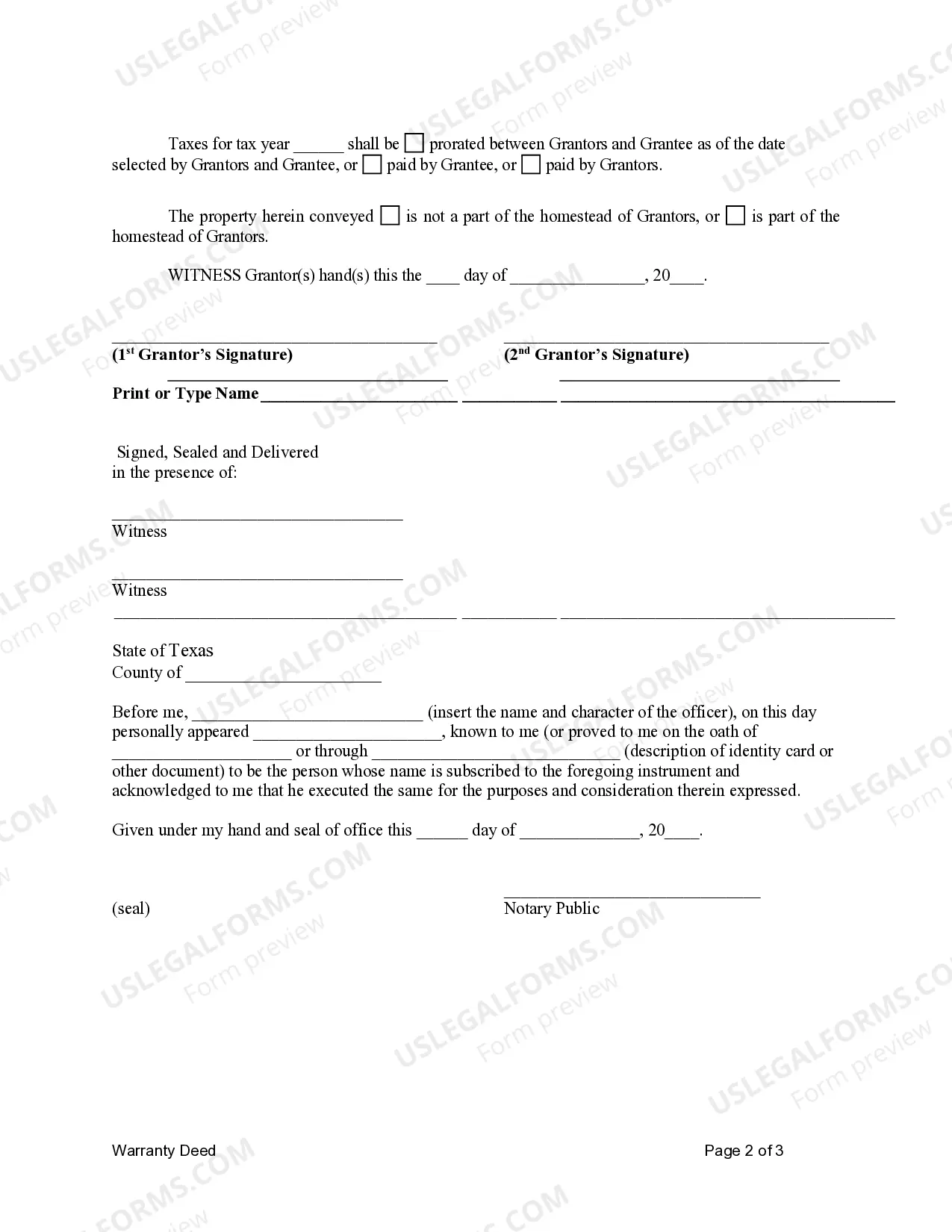

This Warranty Deed from Husband and Wife to Corporation form is a Warranty Deed where the grantors are husband and wife and the grantee is a corporation. Grantors warrant and convey the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Sugar Land Texas Warranty Deed from Husband and Wife to Corporation is a legally binding document that transfers the ownership rights of a property from a married couple to a corporation in Sugar Land, Texas. This deed provides a guarantee that the property is free from any encumbrances or defects in title, ensuring a smooth transfer of ownership. This type of warranty deed is commonly used when a married couple wishes to transfer property that they jointly own to a corporation. The deed serves as a legal protection for the corporation, assuring that the property is being transferred with a clean title and the sellers, as the husband and wife, have the legal authority to sell the property. There are different variations and specific types of Sugar Land Texas Warranty Deeds from Husband and Wife to Corporation, namely: 1. General Warranty Deed: This type of deed offers the highest level of protection and guarantees that the sellers, as the husband and wife, will defend the title against any claims or disputes that arose prior to the transfer. 2. Special Warranty Deed: Unlike the general warranty deed, a special warranty deed only guarantees that the sellers, as the husband and wife, will defend the title against any claims or disputes that arose during their ownership period. It does not provide protection against prior claims or defects. 3. Quitclaim Deed: This type of deed transfers the property rights without making any warranties or guarantees. It simply transfers the interest, if any, that the husband and wife have in the property to the corporation, without providing any legal protection against potential claims or defects. When executing a Sugar Land Texas Warranty Deed from Husband and Wife to Corporation, it is recommended to consult with a real estate attorney or a title company to ensure that all legal requirements are met, and the transfer is conducted correctly. This will help to protect the interests of both parties involved in the transaction and ensure a smooth transfer of property ownership.A Sugar Land Texas Warranty Deed from Husband and Wife to Corporation is a legally binding document that transfers the ownership rights of a property from a married couple to a corporation in Sugar Land, Texas. This deed provides a guarantee that the property is free from any encumbrances or defects in title, ensuring a smooth transfer of ownership. This type of warranty deed is commonly used when a married couple wishes to transfer property that they jointly own to a corporation. The deed serves as a legal protection for the corporation, assuring that the property is being transferred with a clean title and the sellers, as the husband and wife, have the legal authority to sell the property. There are different variations and specific types of Sugar Land Texas Warranty Deeds from Husband and Wife to Corporation, namely: 1. General Warranty Deed: This type of deed offers the highest level of protection and guarantees that the sellers, as the husband and wife, will defend the title against any claims or disputes that arose prior to the transfer. 2. Special Warranty Deed: Unlike the general warranty deed, a special warranty deed only guarantees that the sellers, as the husband and wife, will defend the title against any claims or disputes that arose during their ownership period. It does not provide protection against prior claims or defects. 3. Quitclaim Deed: This type of deed transfers the property rights without making any warranties or guarantees. It simply transfers the interest, if any, that the husband and wife have in the property to the corporation, without providing any legal protection against potential claims or defects. When executing a Sugar Land Texas Warranty Deed from Husband and Wife to Corporation, it is recommended to consult with a real estate attorney or a title company to ensure that all legal requirements are met, and the transfer is conducted correctly. This will help to protect the interests of both parties involved in the transaction and ensure a smooth transfer of property ownership.